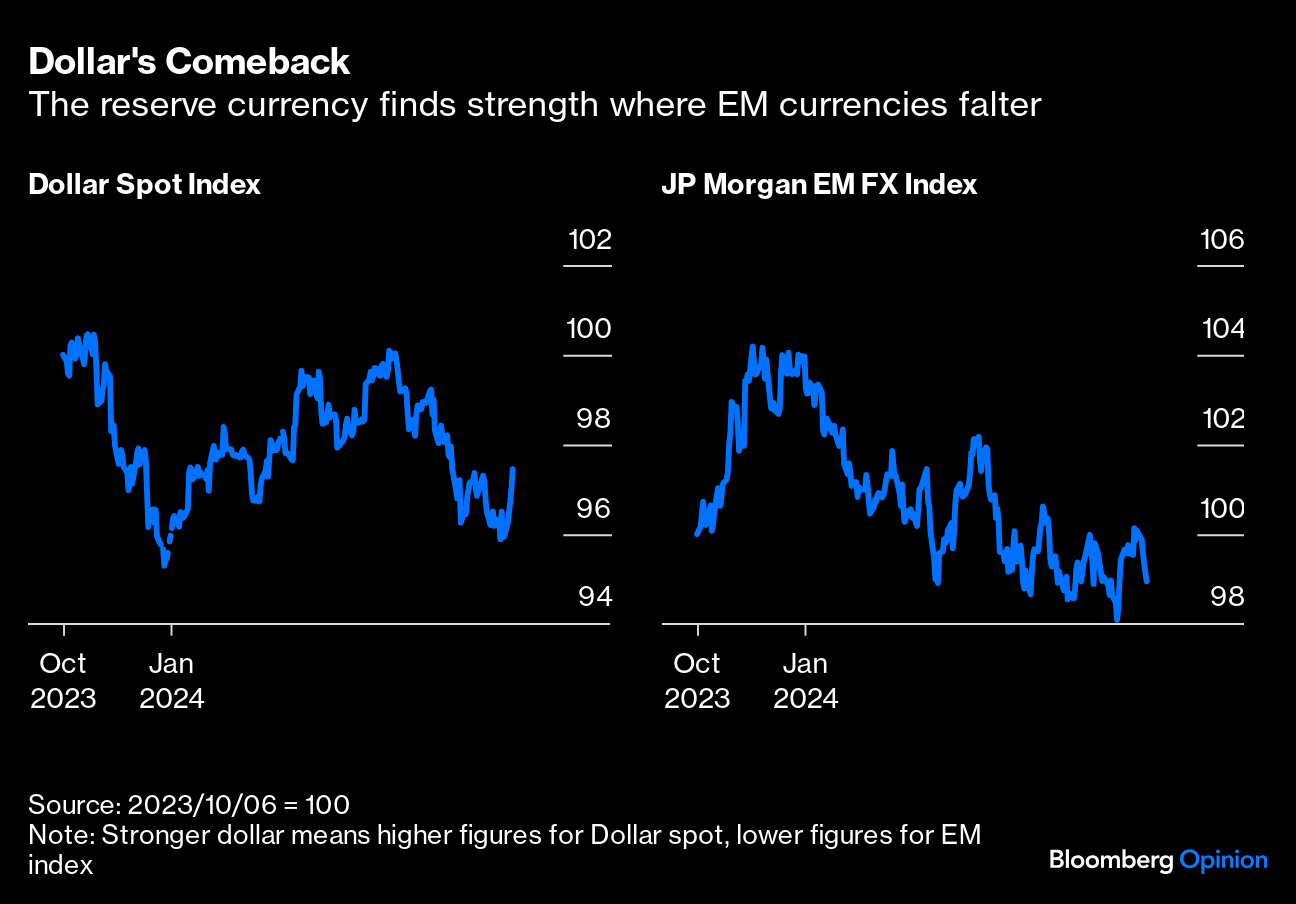

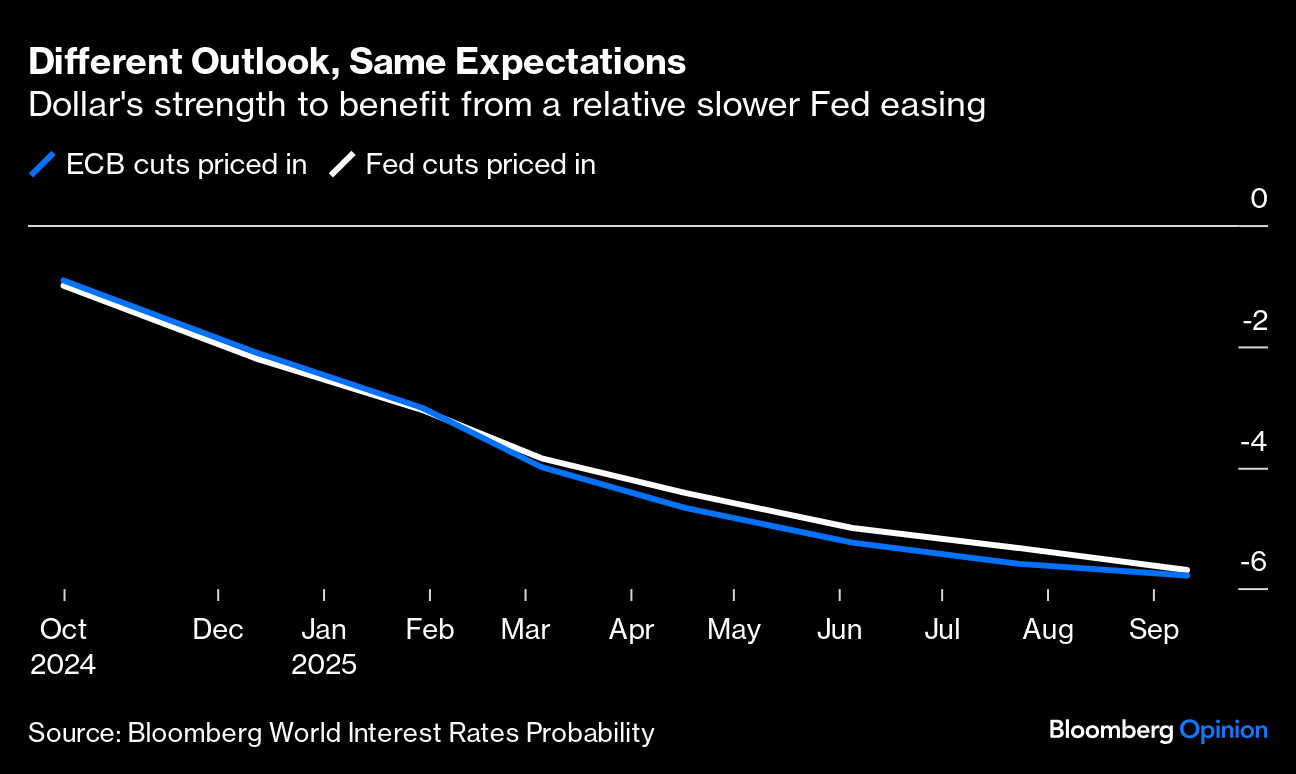

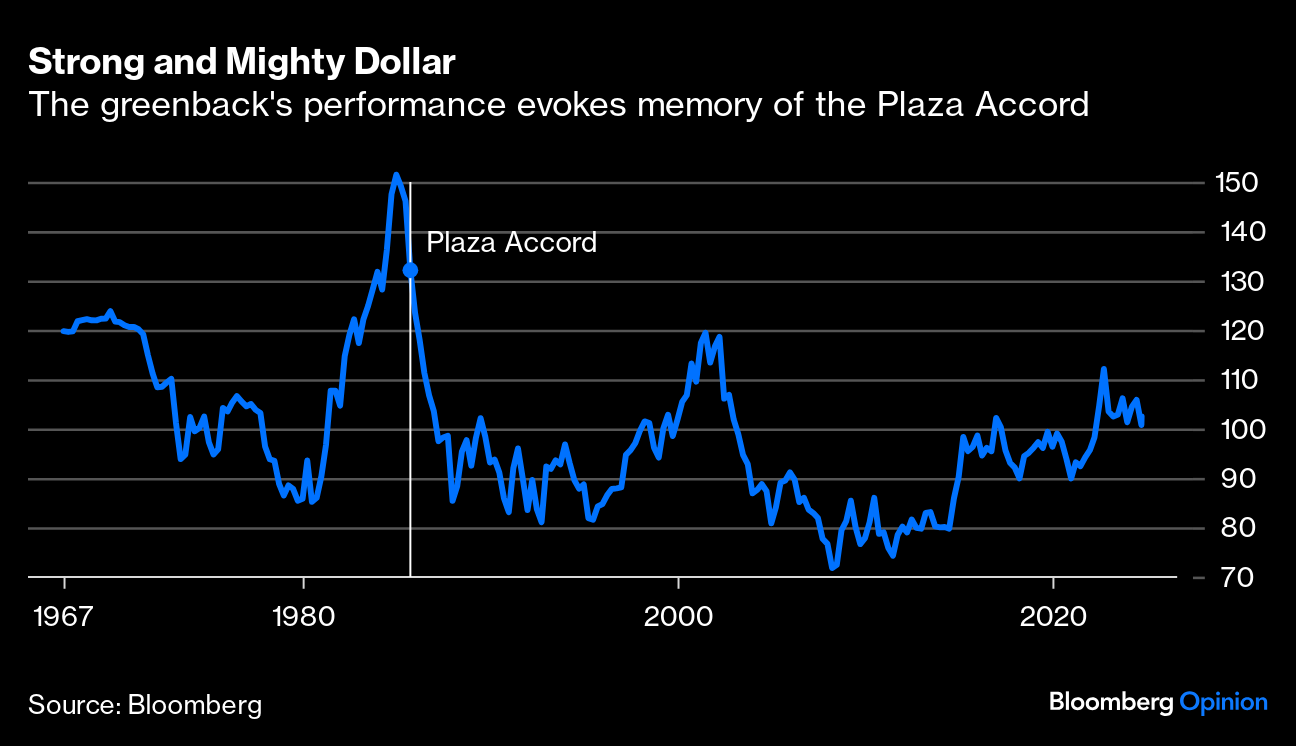

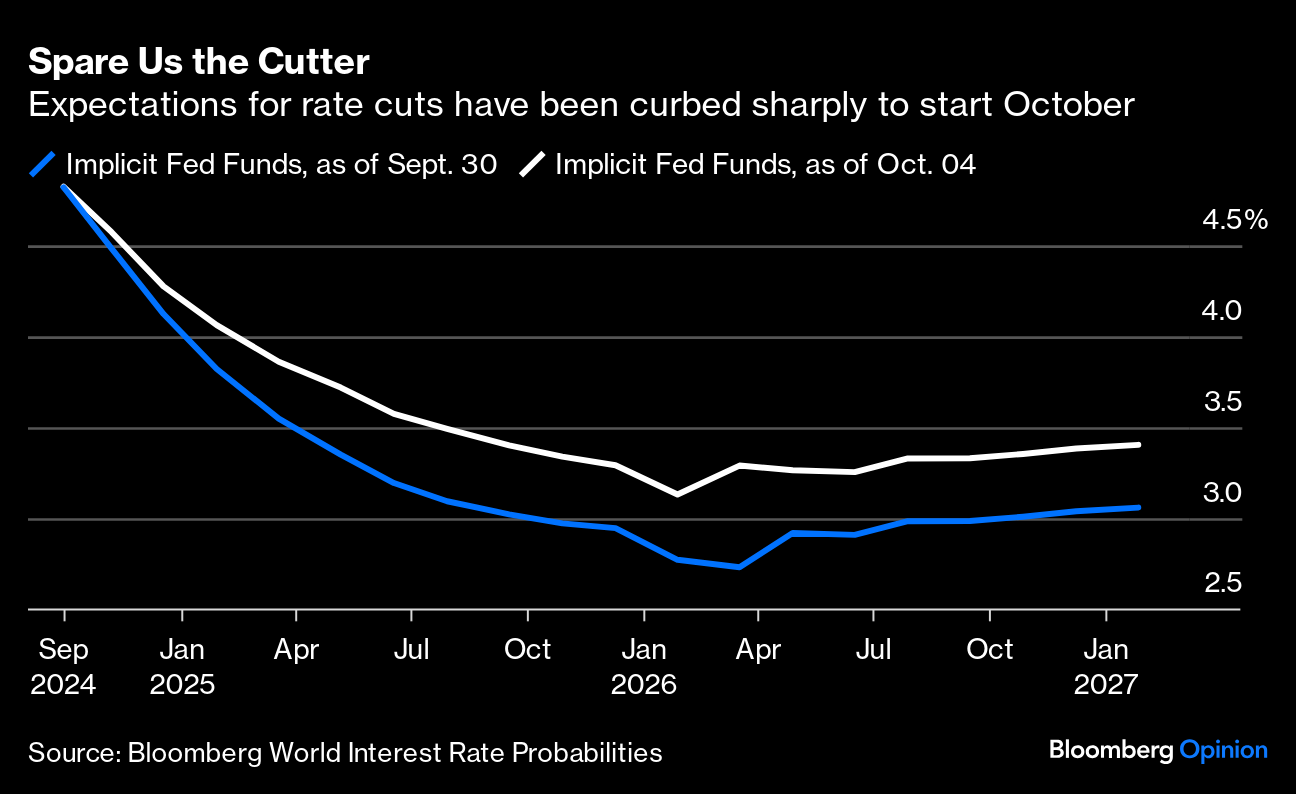

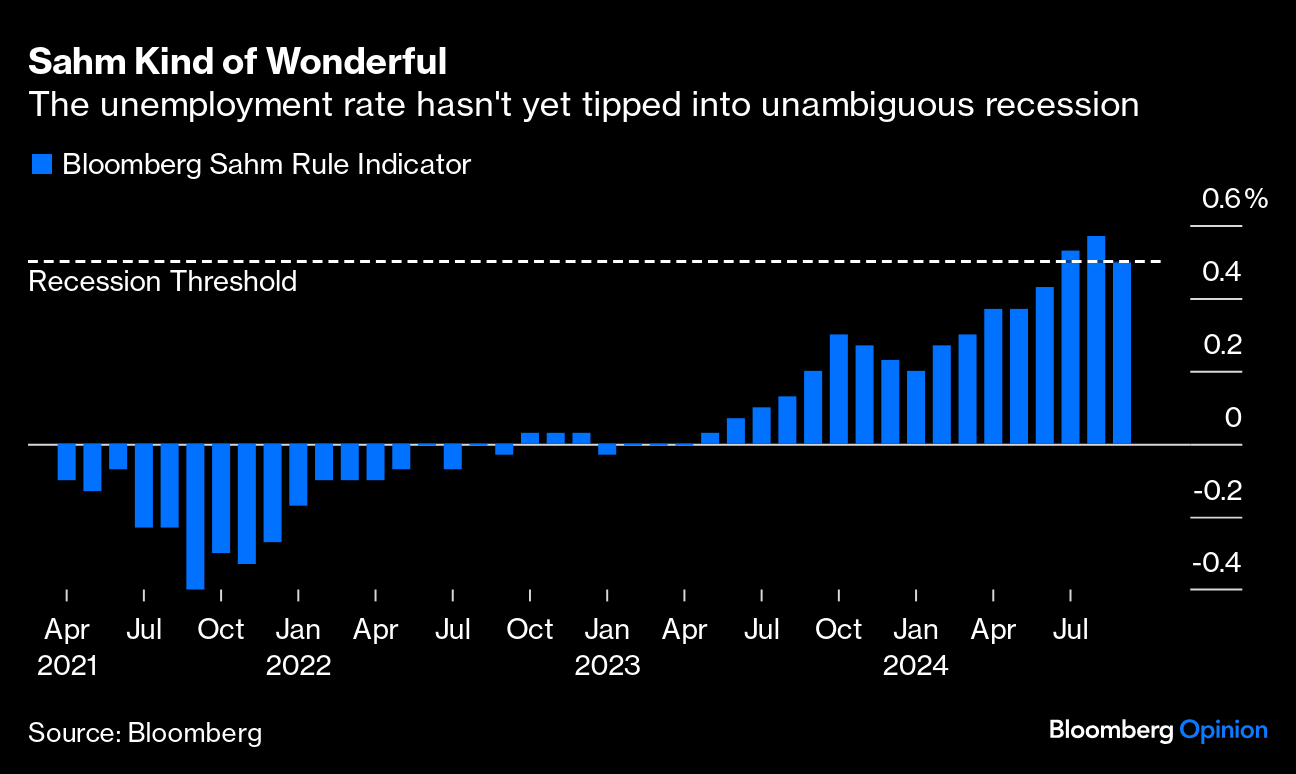

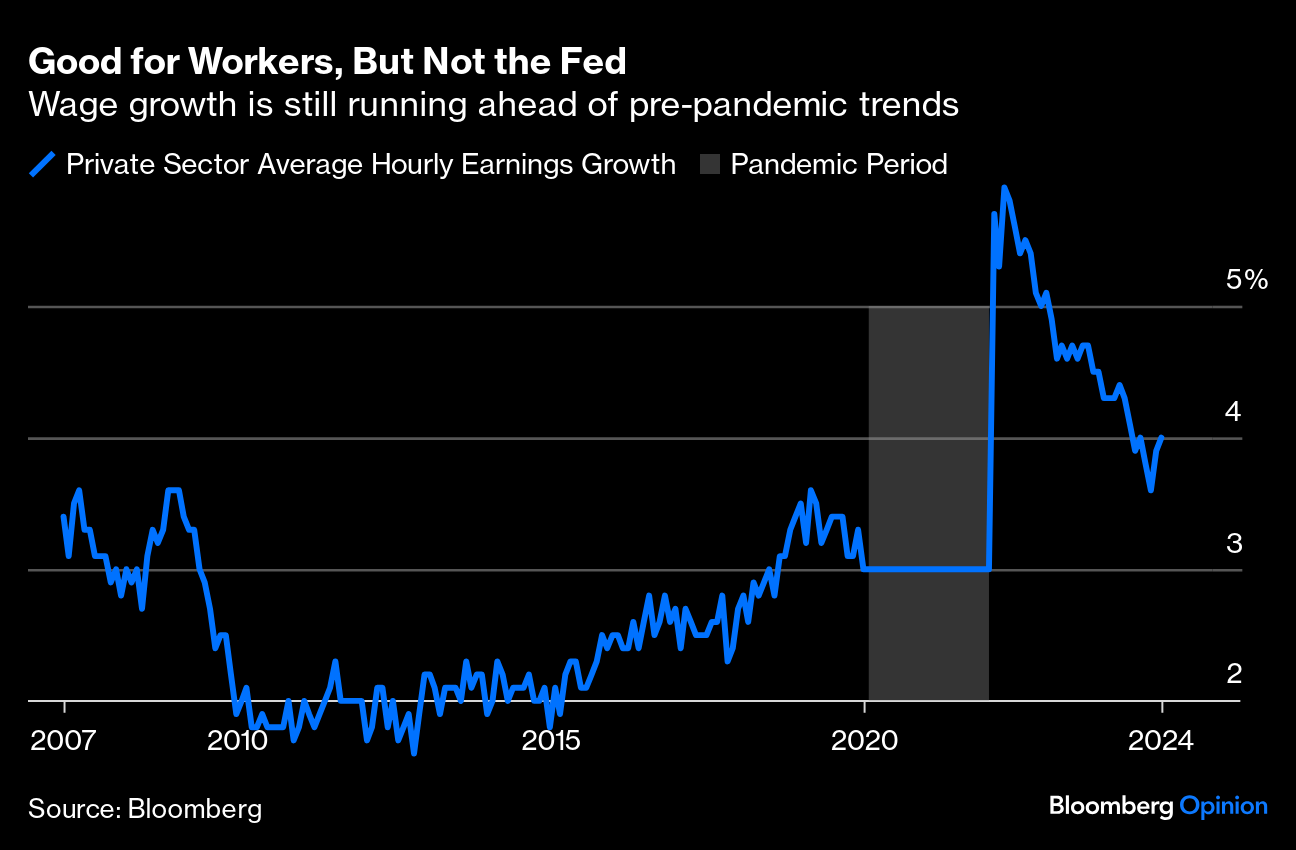

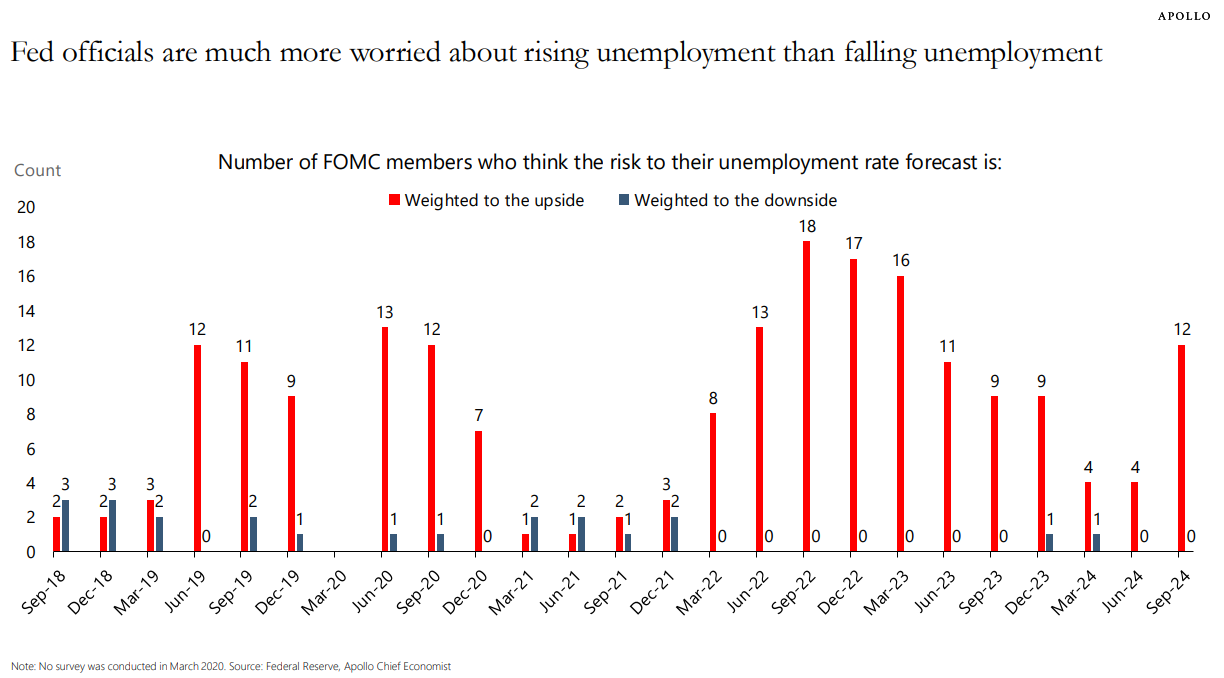

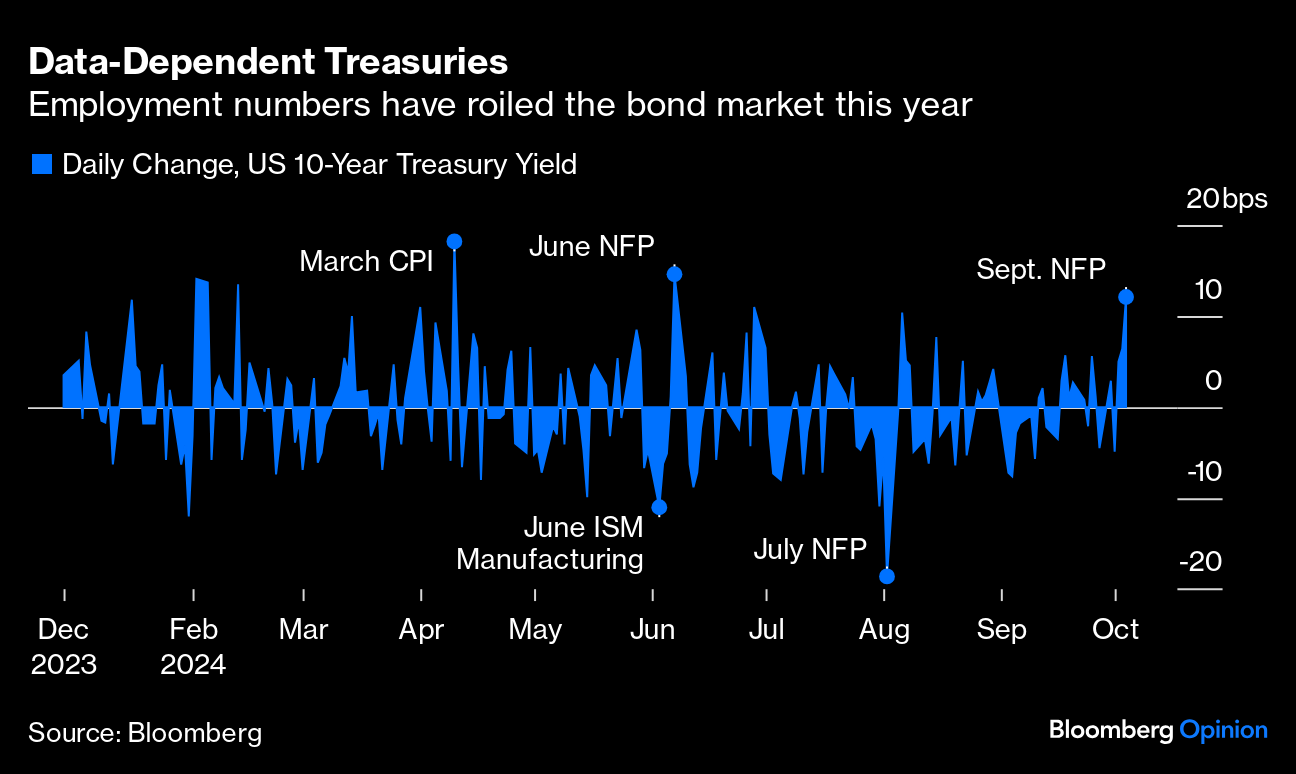

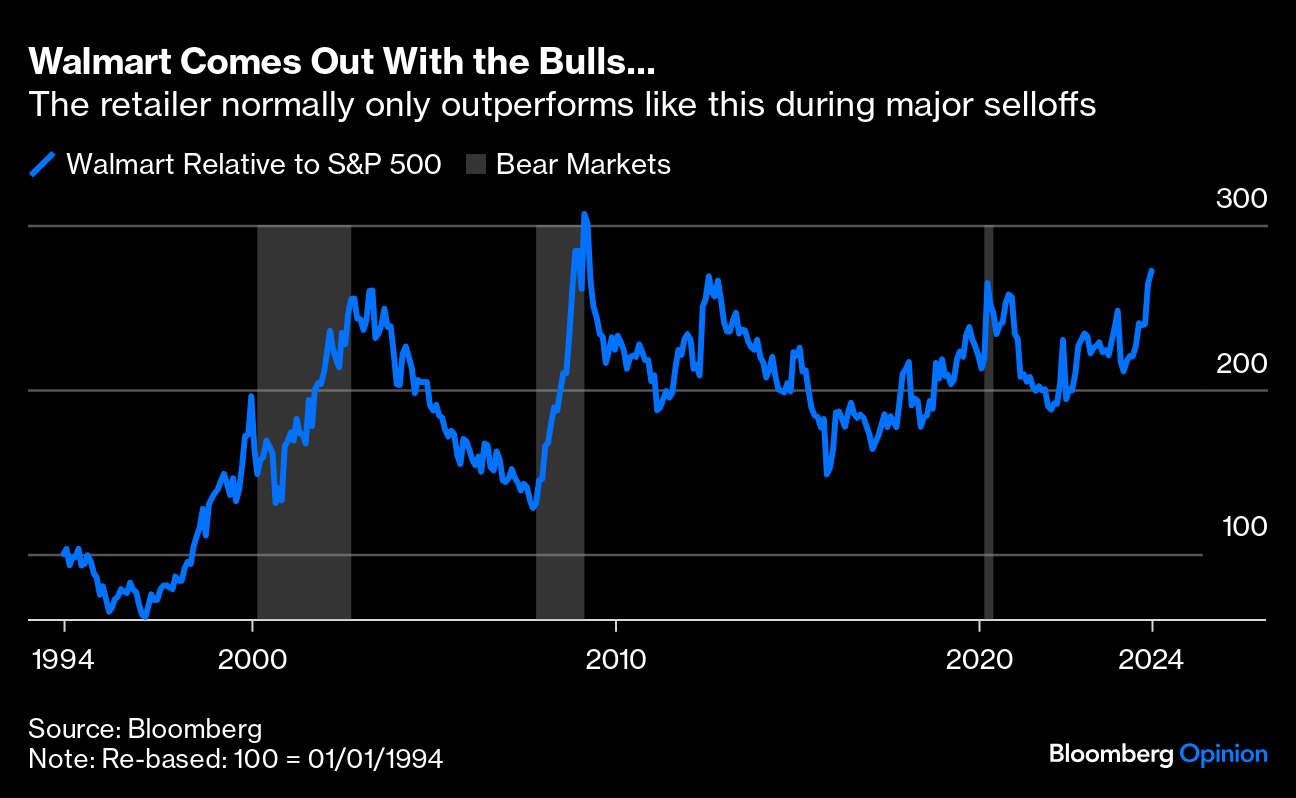

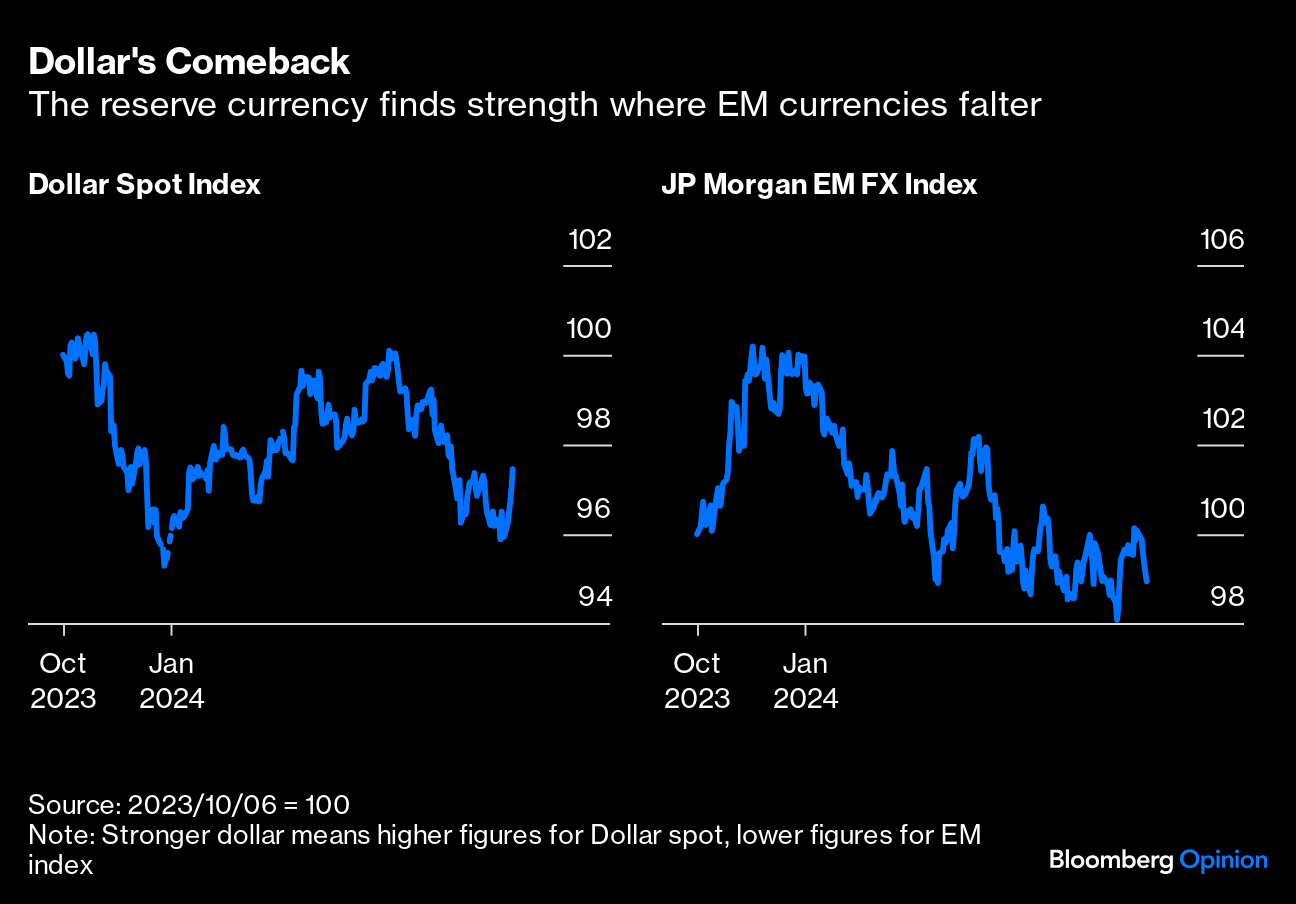

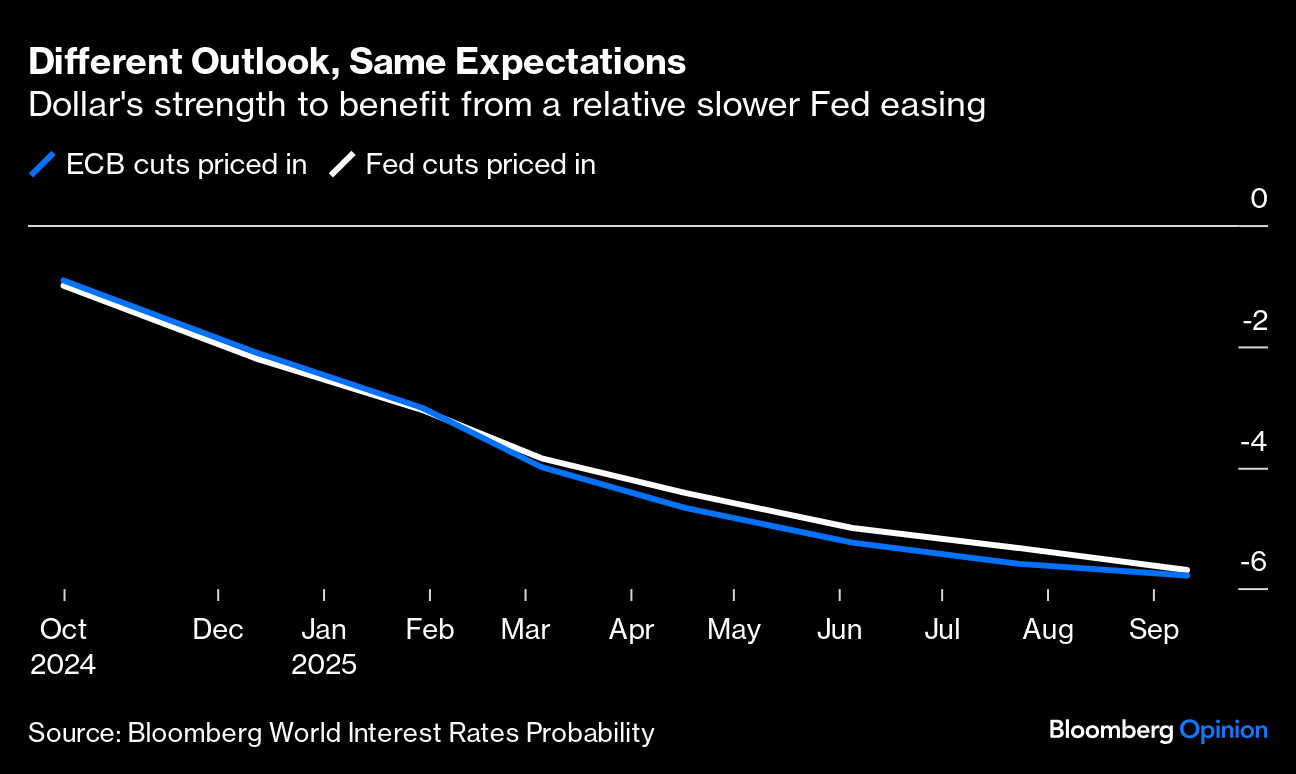

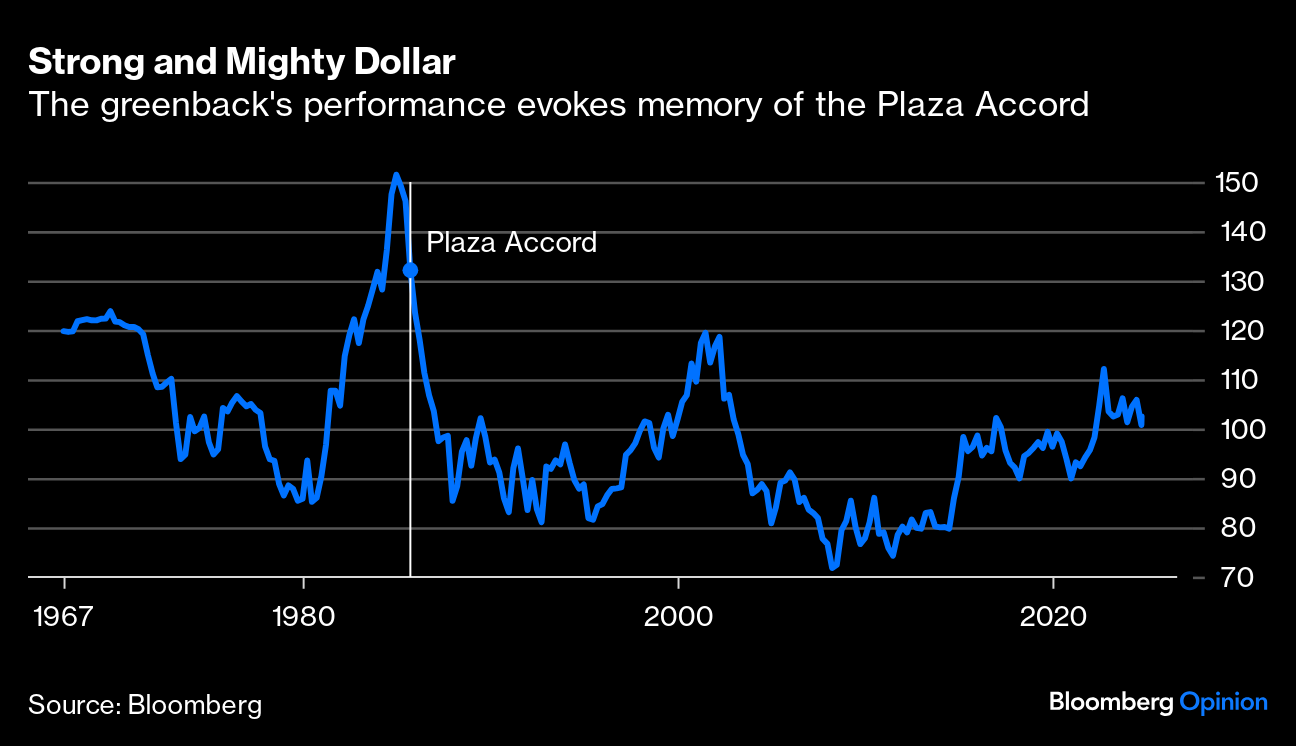

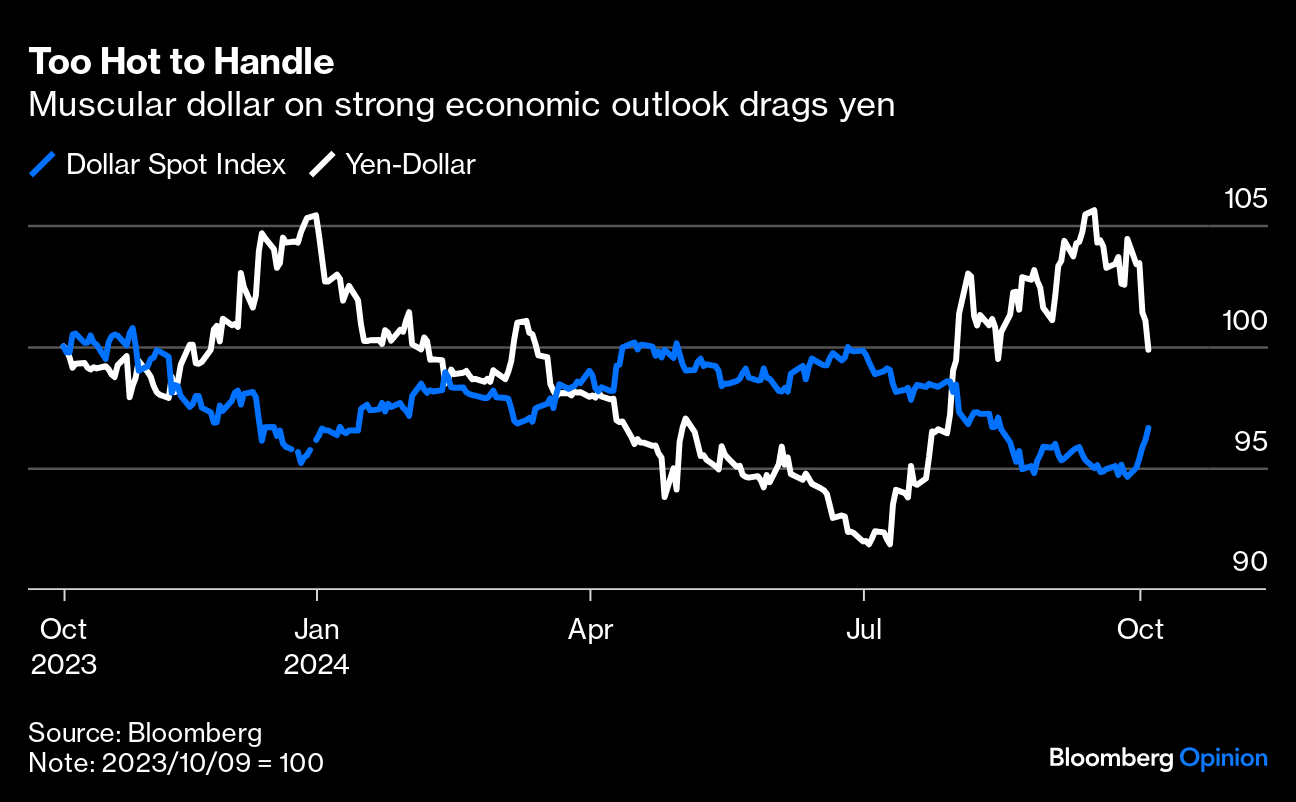

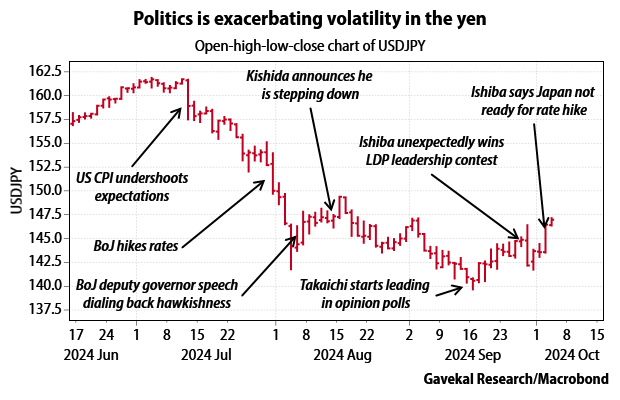

| Data-dependency is exhausting. August and September opened with big market selloffs in response to US data. October's numbers have had the opposite effect. The long ascendancy of stocks over bonds, proxied by the biggest exchange-traded funds covering them, has been reasserted: Stocks are still not back to their high relative to bonds, but the major corrections of the last two months have been reversed, and the upward trend reinstated. That's largely thanks to the current obsession with the short-term outlook for the fed funds rate. Hopes had remained high that the next meeting of the Federal Open Market Committee, due two days after the presidential election, would repeat September's cut of 50 basis points. The data now look far too strong to permit that, and the chance of a jumbo cut has been written down to zero in fed funds futures. This is how those odds have moved since the last FOMC: While the focus remains on the very near term, the last week has seen a big readjustment of the Fed's projected flight path over the next two years. This chart shows the implicit course of fed funds at the beginning and end of last week: Why such a strong reaction? Perhaps the single biggest psychological impact came from the fall in the unemployment rate, which regressed to 4.1%. This matters because unemployment tends to grow steadily and then accelerate higher, making rising jobless rates a good recession signal. The Sahm Rule, named for Bloomberg Opinion colleague and former Fed economist Claudia Sahm, holds that a slowdown will result if the unemployment rate rises by 0.5 percentage points above its low for the previous 12 months. The big August selloff was driven in part by the triggering of the Sahm Rule. Two months later, we're back to the 0.5% threshold; it's still not at all clear that the economy is tipping into recession: The other big blow for those banking on rate cuts came from earnings growth. Private sector wage growth ticked back up to 4% in constant dollars, which is great news for living standards, but not so great for central bankers hoping to squeeze inflationary psychology out of the system: It's more or less a constant that the Fed is more worried about unemployment coming in too high than too low. This shows up in their economic projections, summarized here by Torsten Slok of Apollo Management, and led to the market's confidence that the central bank would err on the side of cutting rates too much, rather than too little: As the year has proceeded, the Fed has messaged, and the market has believed, that unemployment now matters as much as inflation to the central bank, if not more. That is now in question. The September non-farm payrolls prompted a rise of 12 basis points in the 10-year yield, its biggest since the June employment data. As the chart shows, Treasuries have lurched violently in both directions in response to new data throughout the year, with jobs now in the driver's seat. After August's recession scare, we're back to worries about overheating and inflation: There is inflation data on Thursday, which will matter as always. It's hard to see how it can create a surprise to counteract what has just come from the payrolls. In conjunction with China's stimulus, this economic cycle looks likely to carry on for longer. That means stocks can continue to beat bonds. As for the Fed, we can pencil in a 25-basis-point cut for next month, and concentrate on worrying about the election. Let's assume for now that the US isn't slipping into recession, that the neutral rate is higher than thought, and that there won't be many more rate cuts. If so, that stands to have a strange effect on a stock market that has been subtly positioning for a slowdown, even if this was masked by the extraordinary success of the technology sector. Utilities and consumer staples both tend to benefit from low rates and a slow economy. They've had an awful time of it for most of this decade, but had recently perked up and started to beat the market once more:  One fascinating specific example is Walmart Inc. The biggest US brick-and-mortar retailer, and biggest private sector employer, has over the last quarter-century tended to beat the benchmark only when the overall market is selling off; indeed it was the only major company whose share price rose during the massive selloff from October 2007 to March 2009. The extent of its outperformance this year is something that typically only happens when everything else is falling apart. Confidence in Walmart looks extraordinary: It's also, somehow or other, outperformed Amazon.com Inc. this decade: Turning to valuation, Walmart is now trading at a price-to-sales ratio of almost exactly one. In other words, its market cap is now up to one year's worth of revenue. This is a very big deal for a company that turns over its inventory as fast as Walmart attempts to do. Its rally in the last year is built entirely upon its valuation surging above a ceiling of 0.75 times sales that had held since 2002. It hasn't been higher than this since the madness at the top of the market in 2000: Larry McDonald of the BearTraps Report points out on LinkedIn that Walmart stock is now more than 30% above its 200-day moving average. Historically, it has never managed to stay this far ahead of the trend for long. "The probability of a hot inflation bounce is high," he says. "This is the worst possible outcome for staples and utilities." Quietly, some most unfashionable stocks have been creeping back into fashion. If the macro optimism endures, don't expect that to last. One big corollary of the strong US data has been the return of the dollar. The Bloomberg Dollar Spot Index in Friday's trading surged to its highest since mid-August. Only two weeks ago, it had nearly erased its gain for the year. The Federal Reserve's outsized cut and hopes for a faster easing cycle piled on that grim forecast. All of that is up for grabs again. Beyond the September jobs data and the elimination of hopes for another 50-basis-point cut next month, other factors conspired to help the dollar. They included strong Institute of Supply Management surveys, dovish signals from the European Central Bank and the Bank of England, and the escalation of hostilities in the Middle East that has enhanced the dollar's safe-haven appeal. The strong run for the reserve currency has been mirrored by a selloff in emerging markets. JPMorgan's measure of EM foreign exchange is on a six-day losing streak:  The rally has been helped on its way by a weak outlook for Europe. Despite widely different sentiment toward Europe and the US, Capital Economics' Jonas Goltermann notes that the pace of rate cuts discounted in money markets is still roughly similar for the Fed and the ECB (and slightly slower for the BOE). Why does this matter? If anything, with the US economy looking much stronger, relative interest rates are unlikely to shift against the dollar in the near term. The Bloomberg World Interest Rates Probability function of implied interest rates, derived from overnight index swaps, shows that the market currently expects the two central banks to take exactly the same course over the next 12 months:  The dollar's strength furthers its upward trajectory, which has endured for almost two decades. This ultimately flows from the strong US economy. Does this back assertions — made strenuously during the campaign by Donald Trump — that the currency is overvalued? Probably. An overpriced currency makes exports expensive while making imports cheaper. This imbalance weighs on the country's manufacturing sector, potentially impacting jobs. While the currency may not be at the heights that necessitated the Plaza Accord nearly 40 years ago, which coordinated efforts to weaken the dollar, it strengthens the concerns of proponents of import tariffs like Trump:  The dollar's blistering start to the quarter is nearly the opposite of the Japanese yen. Politics is a key factor in its troubles after new Prime Minister Shigeru Ishiba, previously regarded as a relative hawk, opposed the Bank of Japan's plans to normalize monetary policy. That prompted a renewed surge in speculation against the yen. As shown in the chart, the two currencies have reversed the trajectories seen in early August, when fears of a US recession and a rare BOJ rate hike led to a collapse in the yen carry trade: It's been a dramatic summer for the yen. This Gavekal Research chart captures the events that have driven its movements since June:

Among the explanations for Ishiba's sudden shift, Gavekal's Udith Sikand says that the yen's latest headwind stems from the possibility of the new premier positioning for a "Mar-a-Lago accord" — similar to the Plaza Accord. That would be premised on a Trump victory; he favors a weaker dollar, and also backs increased tariffs that would tend to drive it higher. Trump could need to strike a grand bargain with countries including Japan:

In this event, it makes sense for Japan to come to the negotiating table with a yen that is still deeply undervalued. That would then allow it to strike a hard bargain for issues that are close to Ishiba's heart, such as revising the treaties that bind Japan and the US into an unequal alliance. The underlying point stemming from these potential explanations is that while Ishiba has big goals in foreign policy, his domestic economic agenda is vague.

As Ishiba settles into office, he'll keep tabs on US rate expectations and, of course, the election. For now, the retreat from hopes of big Fed easing buoys the US currency. For the next month, politics matters more. Bannockburn Global's Marc Chandler says the dollar's trajectory, which he describes as a correction, will likely persist for a few weeks. What happens after that should be clearer once the dust settles after Nov. 5. — Richard Abbey It's Oct. 7, a date that has taken its place with Sept. 11 and Jan. 6 as one that needs no explanation. Twelve months ago I greeted the news in this space with a setting of Sim Shalom ("Grant Peace" in Hebrew). It didn't help. Let's try Daniel Barenboim and the West-Eastern Divan Orchestra, playing Beethoven's Ninth Symphony, a hymn to brotherhood, in Berlin. The orchestra includes both Israelis and Palestinians. Relations between Germans and Jews have somehow been resurrected; maybe the same is possible for Israelis and Palestinians? I'm grasping at straws, but it's beautiful music, and the climax of Friedrich Schiller's "Ode to Joy" moves the conductor to sing along with the essential line, "Alle Menschen werden Brüder" — all people will become brothers. Have a good week everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment