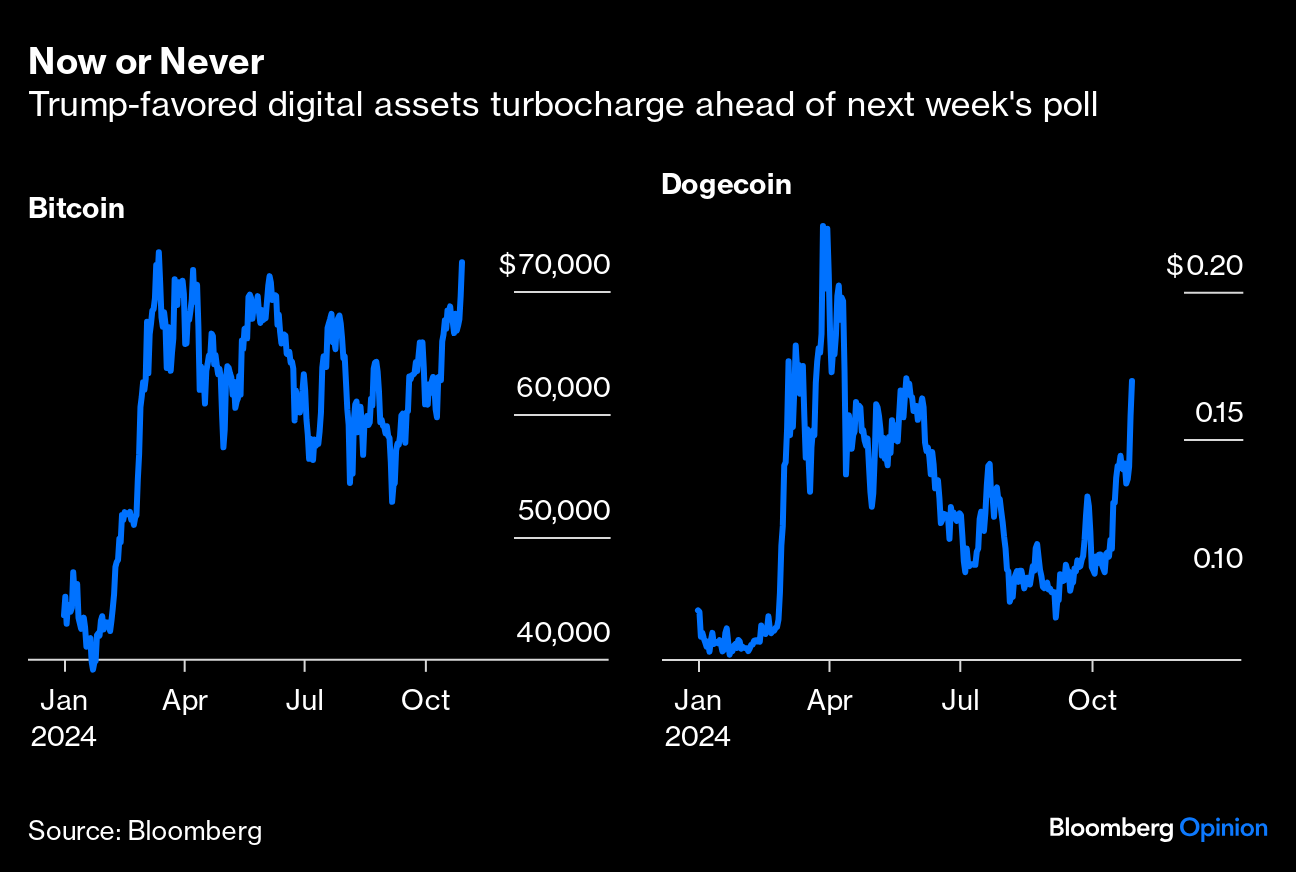

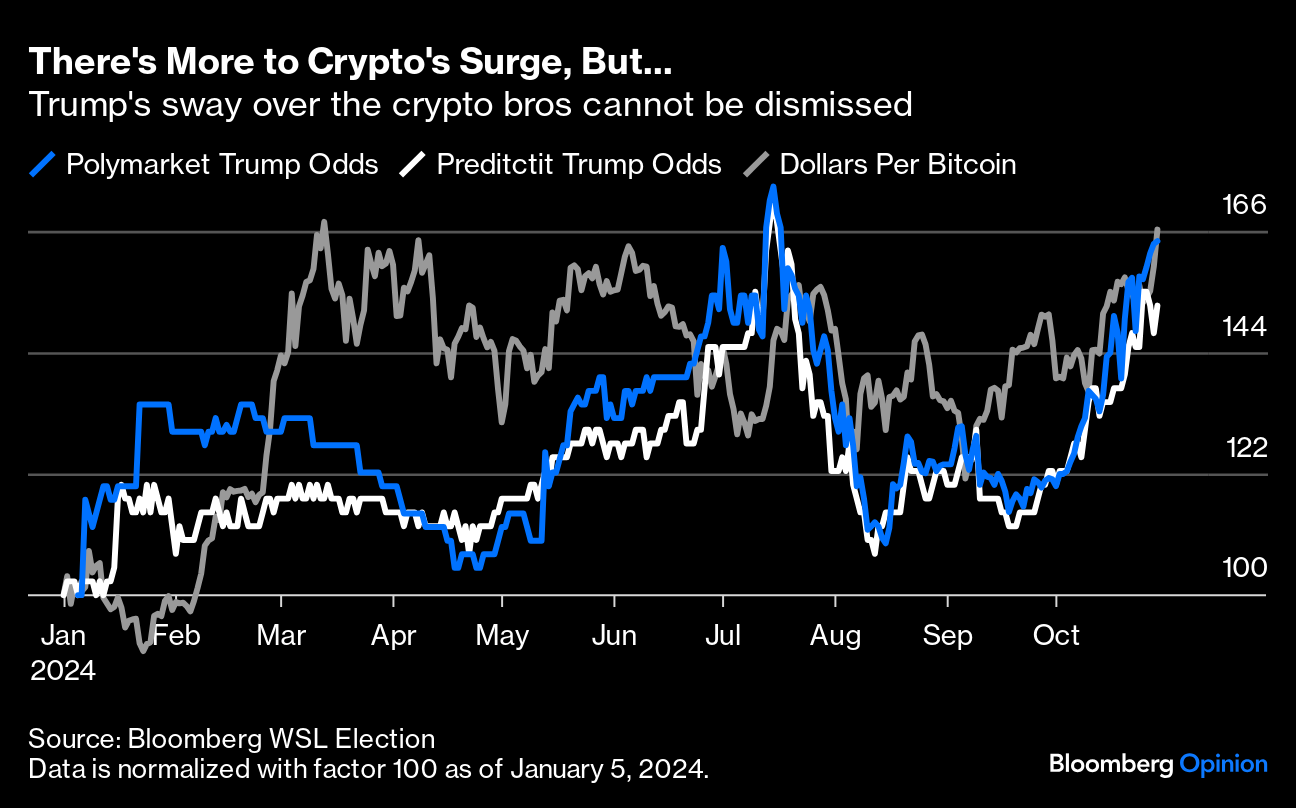

| Bitcoin's rally is known as the quintessential Trump trade for a reason, and it's moving to higher heights with barely a week to the US polls. Its March all-time high of about $73,160 is within arm's length after an astronomical 37.3% rise since the first week of September. The largest crypto asset has now topped $72,000 for the first time since April, turbocharged by inflows into dedicated exchange-traded funds and election speculation. That's up by about 71% this year. Spot Bitcoin ETFs have attracted some $3.6 billion in net inflows this month. Other crypto assets, notably Dogecoin (described by Elon Musk as a "hustle" on "Saturday Night Live" three years ago), are also rallying. Crypto's surge came after Donald Trump announced he would ask Musk to head a Department of Government Efficiency (or DOGE — no, you couldn't make this up) to cut government spending: Trump's about-face on crypto and his promises of a supportive regulatory regime have made him the darling of enthusiasts. Surprisingly, his chances in the White House race haven't always correlated strongly with Bitcoin. Prediction markets started turning toward a Trump victory before the recent crypto rally. But it does look as though crypto investors are putting their money where their mouths are. The way that Trump's odds have moved like Bitcoin for the year is hard to ignore: Where else might Bitcoin be drawing its inspiration? Frnt Financial's Stephane Ouellette argues that in the near-to-medium term, the election is merely contributing "noise": Ultimately, we believe the primary driving force behind Bitcoin at the moment is portfolio allocation decisions as interest rates decline and deficits are on course to greatly expand. We saw [billionaire hedge fund manager] Paul Tudor Jones last week say, "All I can see is inflation," so he is buying BTC, among other assets, as protection. As we've maintained, these moves in BTC tend to play out over time as entrants go from 0 or marginal allocations to including BTC in their portfolios as we go further down the path of this cycle.

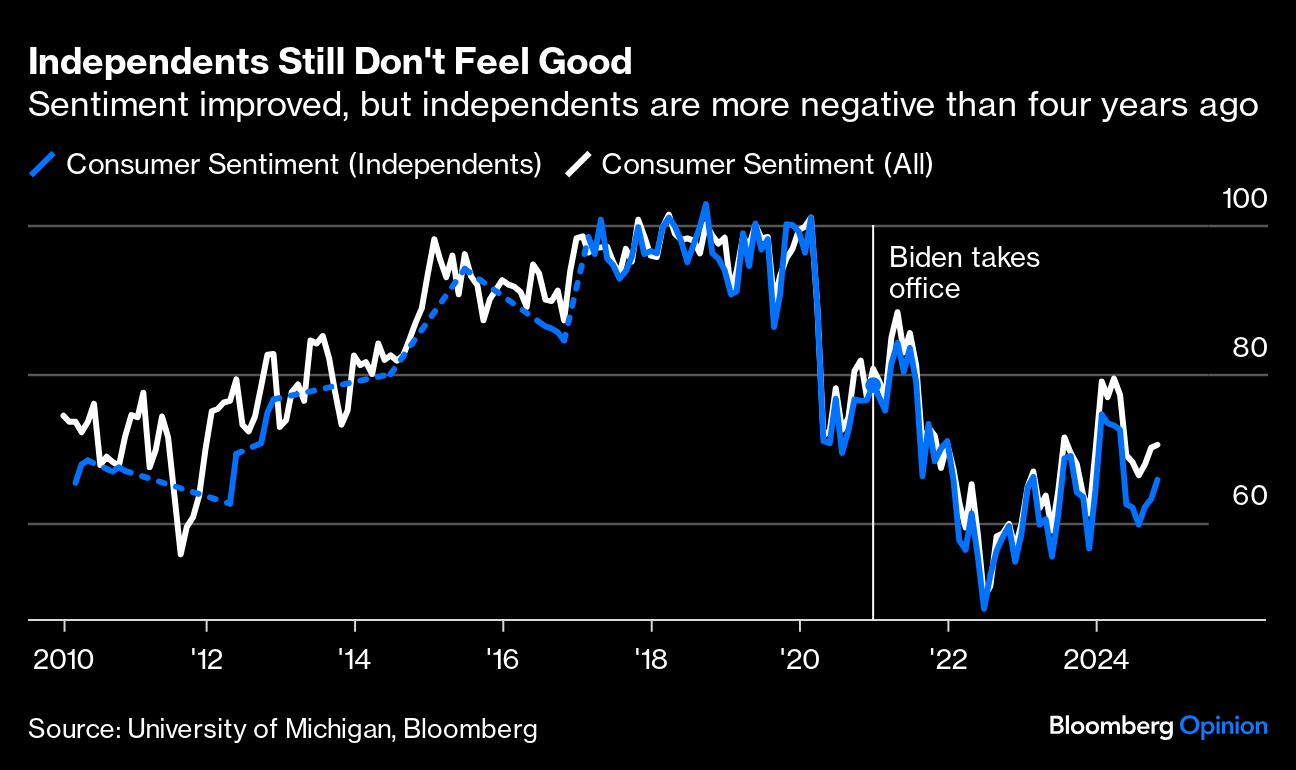

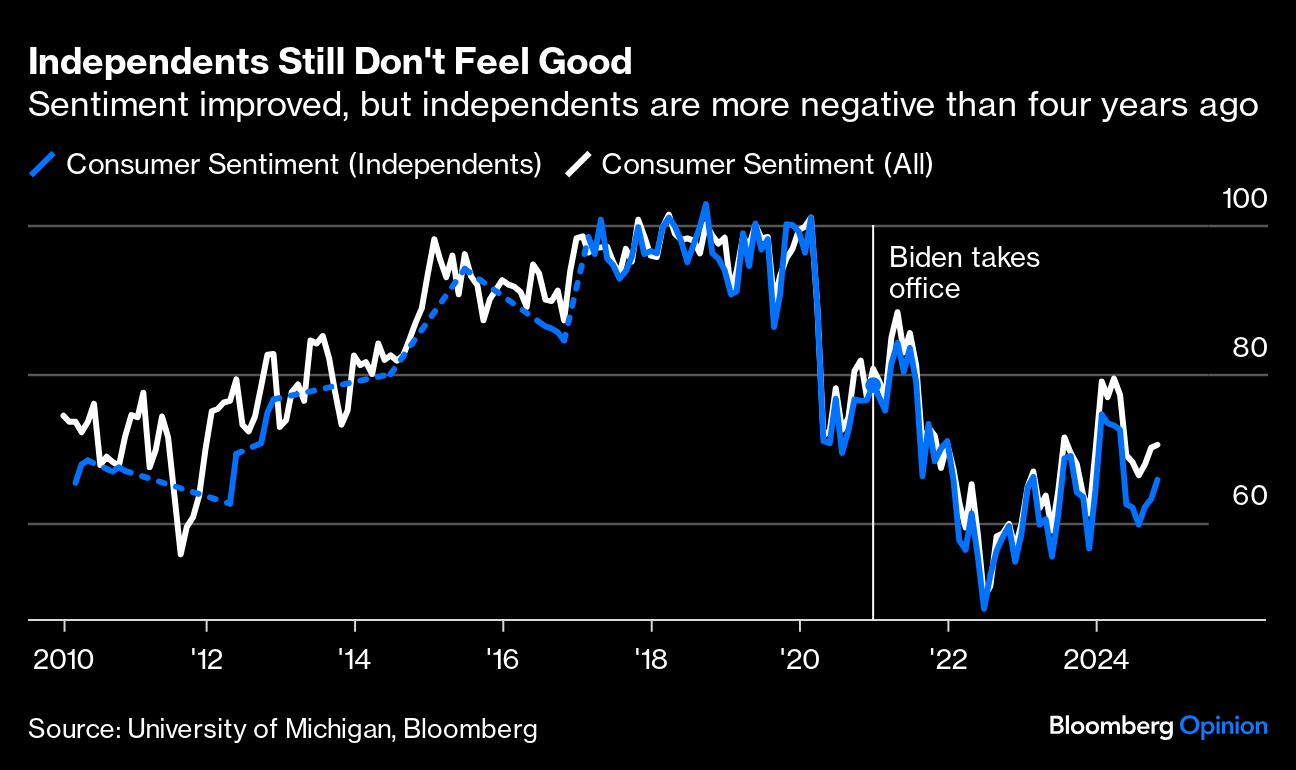

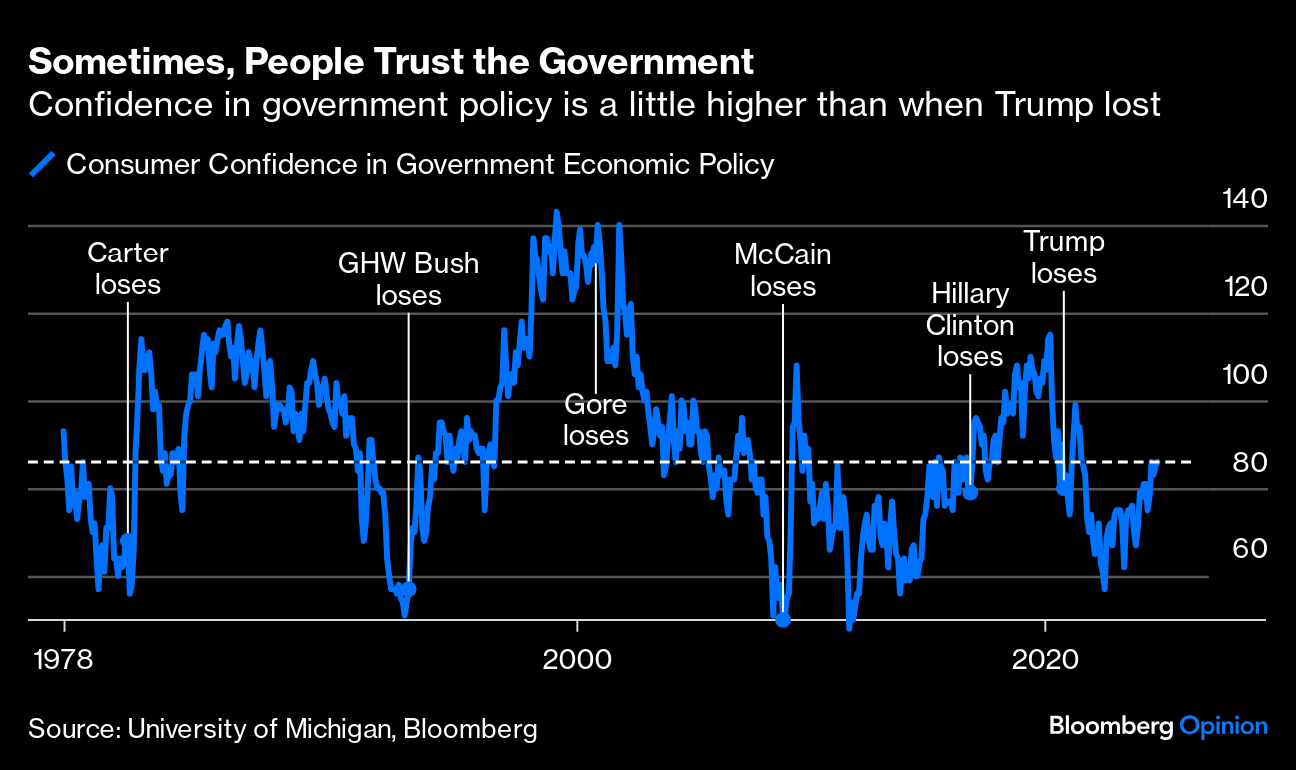

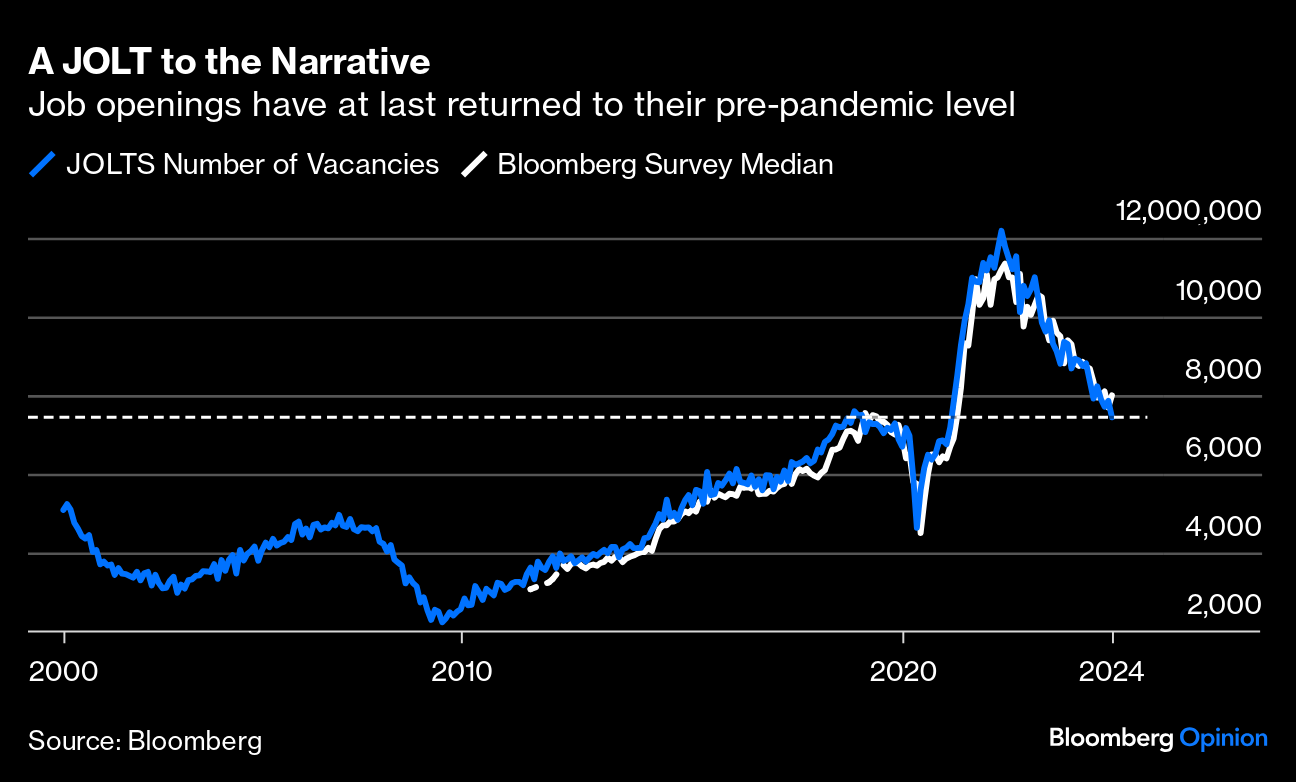

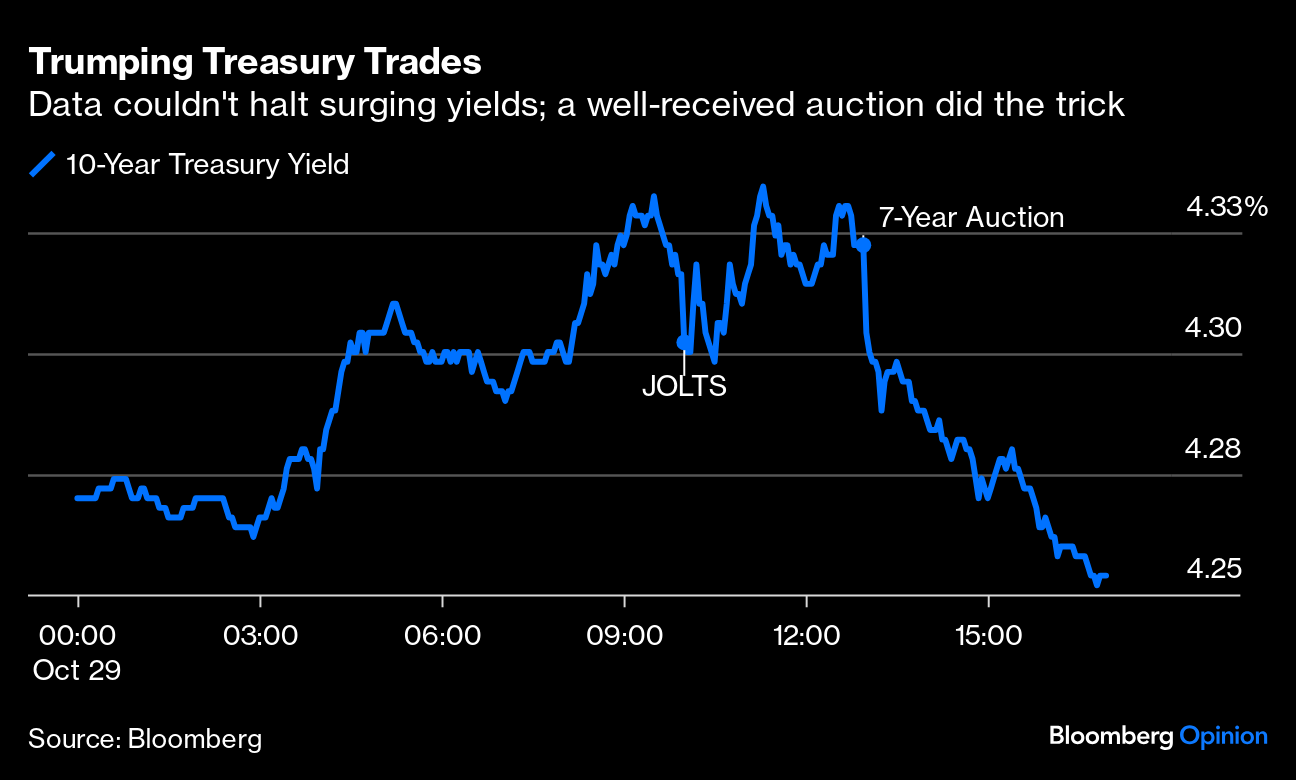

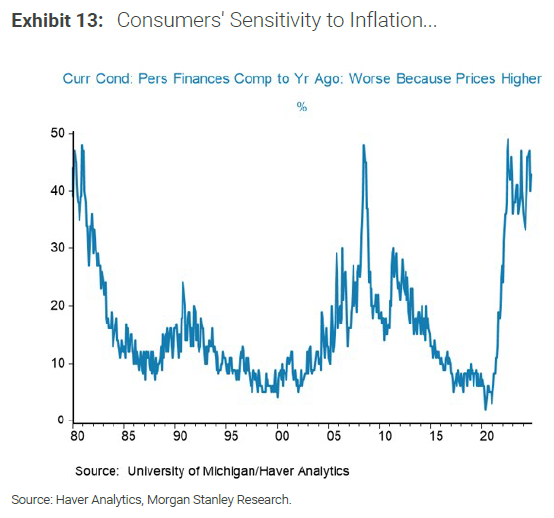

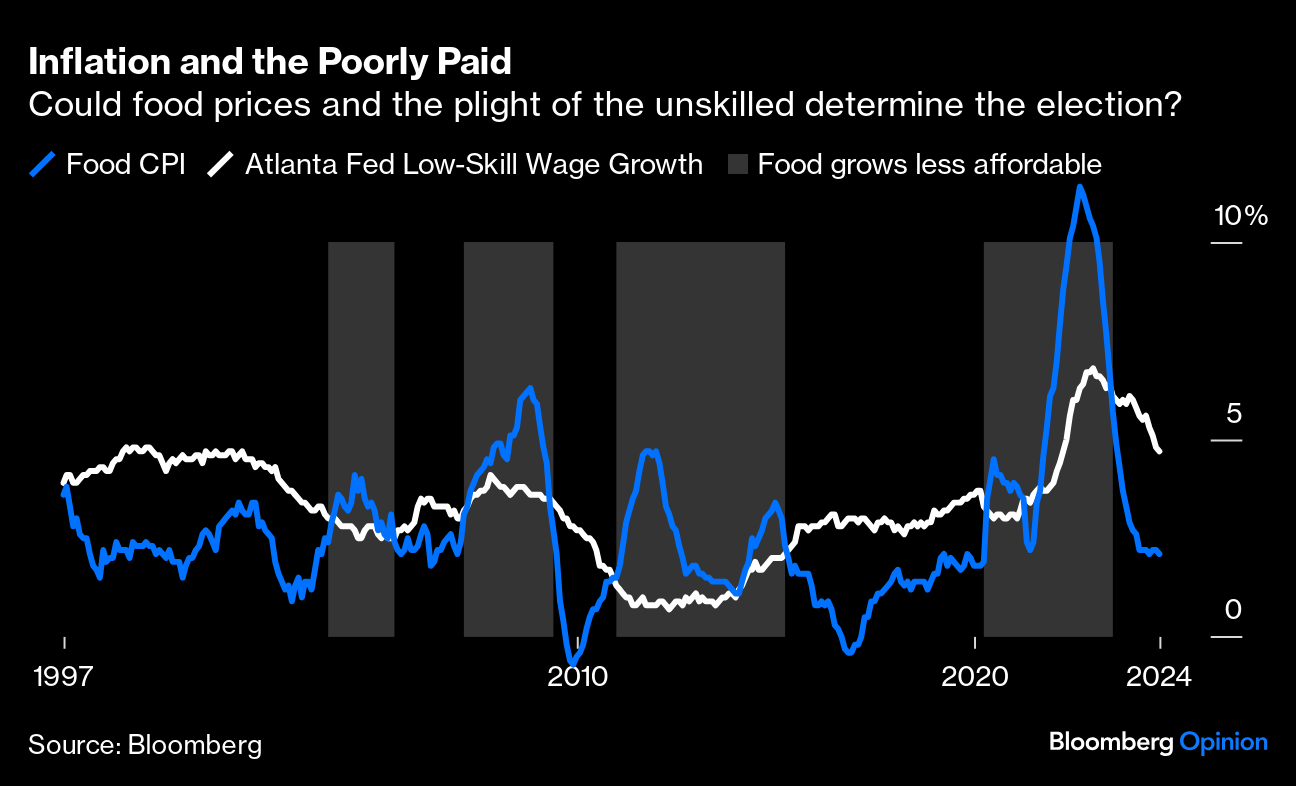

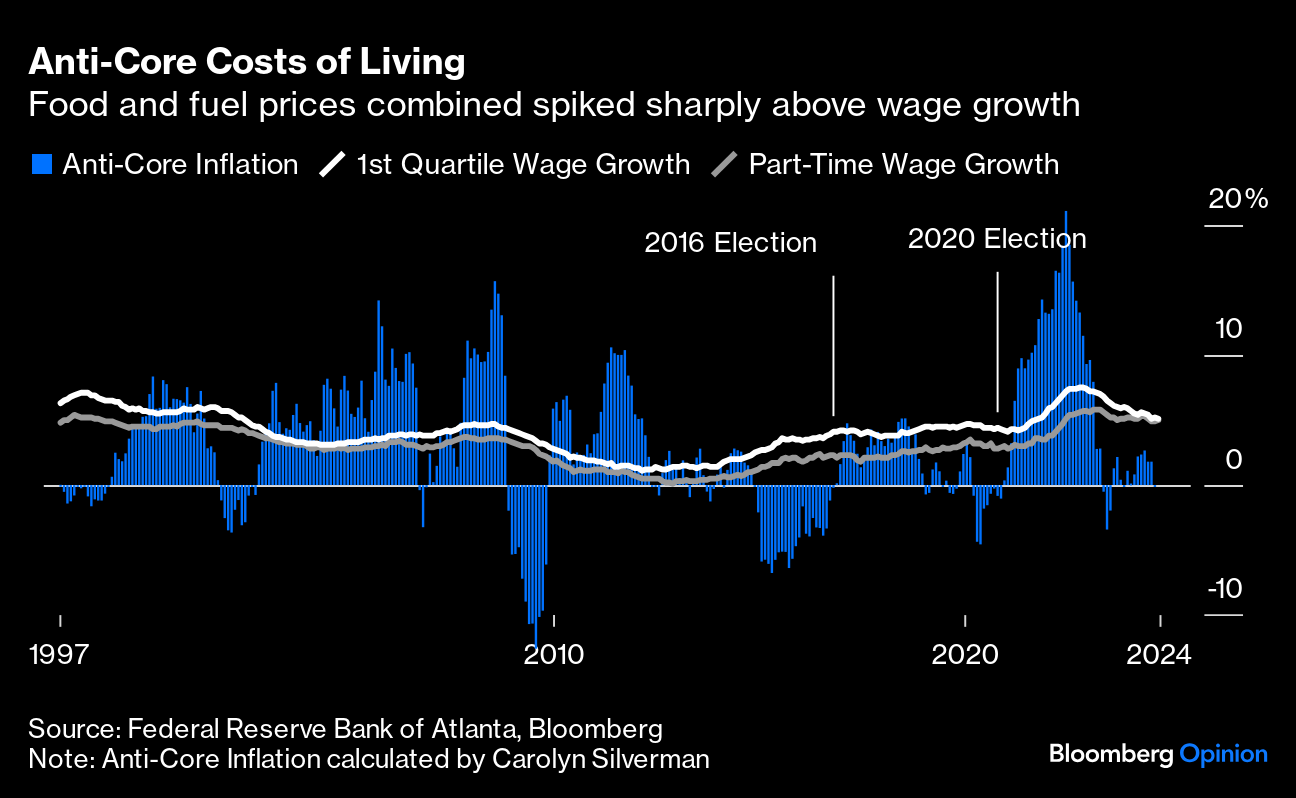

Note, however, that angst about returning inflation owes much to the belief that Trump will get another term. And Trump 2.0 would be a boon for crypto if the perceived antagonistic regulatory environment made way for a more market-friendly approach. Recently, a report of greater US scrutiny of Tether, a stablecoin that acts as a linchpin in crypto trading, weighed on Bitcoin. Ouellete argues that, outside of maybe a sell-the-news immediate reaction, it will make the market cycle speed up faster. In the event of a Kamala Harris victory, not much would change after some initial confusion. Where does Bitcoin go from here? It does appear to be as binary as the election itself. In a recent Bloomberg's MLIV Pulse Survey, respondents saw it surpassing the March record, and topping $80,000 by year-end if Trump wins, according to their median estimates. After a Harris win, the year-end prediction dropped to around $65,000. The survey also had a favorable forecast for gold — increasingly regarded as a Bitcoin cousin — which set another record Tuesday, climbing to almost $2,770 an ounce. However, the natural interpretation for this, given that gold is seen as an insurance against poor policy, is that gold investors don't like the prospect of Trump 2.0; they see the haven asset flourishing under Trump and foundering under Harris. —Richard Abbey Our minds run on narratives, and so do markets. Numbers matter, but what really helps us understand something is a story: "This is what's going on and why." It's natural and human, but leads to frequent narrative fallacies, a term associated with Nassim Nicolas Taleb, in which we fit all incoming data points to fit a preconceived story. The narrative running the table at present is that Trump has this election in the bag, even though his two previous outings came down to knife-edge margins in a few swing states, making the result essentially unpredictable. It has brought US stocks to successive records. Now, that narrative is in conflict with a flurry of economic data, while there's also the first glimmering of a counter-narrative for Harris. The University of Michigan's regular consumer sentiment survey was published Tuesday, and showed a surprising rise. For the two years since the spike in inflation peaked, the US economy has fared better than many had expected. It now appears to be registering. That might be bad news for the narrative that the nation thinks the inflation spike unforgivable, and long ago decided to punish Harris for it. Except that Michigan breaks down respondents by their party identification, which showed that the crucial independents are less confident than the overall population. They're also much less happy than when Joe Biden took over in 2021. So these facts still fit the Trump narrative:  Since 1978, Michigan has asked another question: Do consumers have confidence in government economic policy to deal with unemployment and inflation? Numbers above 100 indicate a majority are confident, and below it show that most are not convinced. Since the survey started, incumbent parties have been ejected from the White House six times. In three cases — Jimmy Carter for the Democrats in 1980, George H.W. Bush in 1992 and John McCain in 2008 for the Republicans — confidence in the government was on the floor. Democrat Al Gore's loss in 2000, when confidence in the Clinton administration's economic management was almost total, is a massive anomaly. That leaves the last two elections and the current one. In all three Octobers, the majority felt negative, but only by a narrow margin. People are a little more confident now than when Hillary Clinton and Trump lost (and much happier than when they reelected Barack Obama in 2012): The most natural explanation is that the economy is less important now to how people vote (and presumably cultural issues have gained in salience). Or, unless confidence is totally shot by financial crisis or recession, it never mattered as much as experts thought. The Trump narrative involves selling bonds, on the assumption that a growth-oriented administration will allow inflation to rise and force the Federal Reserve to abandon planned rate cuts. On that front, the JOLTS (Job Openings and Labor Turnover Survey) for August was interesting. The number of vacancies has dropped much more than expected, back to its (historically high) level before the pandemic: This is great news for the Fed, allowing it to go ahead with cutting rates, and should be a cue to buy bonds. On Tuesday, it was merely seen as a buying opportunity to put on another Trump trade. Yields had surged in early trading, and after a brief pause rallied again. However, plenty of institutions are happy to buy at these yields, and a well-received auction of seven-year Treasuries extinguished the day's excitement, sending the 10-year yield to 4.25% from 4.33%. The incident was a still a telling illustration of the power of the Trump narrative: As there's such confidence in a Trump victory, what evidence is there that inflation has been that painful? Morgan Stanley published this chart of the proportion of people who thought their personal finances worse than a year earlier who blamed inflation. It's not an issue that's gone away: The inflation spike was driven by everyday commodities that take the biggest bite from budgets of the less well-off. The Atlanta Fed publishes a wage tracker based on census data that monitors pay rises. If we compare average wage growth for the low-skilled with overall food inflation, food far outstripped pay in 2021 and 2022. That has now reversed. This comparison also helps explain Hillary Clinton's loss — because of acutely low wage growth, the pay of the low-skilled fell far behind grocery prices under Obama: For another version of this calculation, here are the Atlanta Fed's estimates of wage growth for the least-well-paid 25% of the population, and for part-time workers, against Bloomberg's measure of anti-core inflation, calculated by Opinion's data editor Carolyn Silverman and combining the official food and energy indexes. The Obama administration's failure to come through for the lowest-paid is again apparent, while the spike of 2022 looks even more extreme: This way of looking at it suggests that the problem is well and truly over. However, there's a key difference from the last inflation spike in 2008, which was followed by very significant anti-core disinflation. That hasn't happened this time, and that explains anger. Overall, does this defend the narrative — proposed by Points of Return and many others — that the inflation shock's effect on the lowest-paid meant that Harris was always dead in the water? That probably will be the tale if she loses, but the recovery of wage growth, and the way that anti-core inflation has exceeded wage growth many times in recent history, leaves it less than totally clear-cut. There's an emerging counter-narrative, and it concerns the narrative itself. It holds that the Madison Square Garden rally for Trump was the moment when his campaign grew too confident and overplayed its hand. Judging by the way Republicans have tried to talk down more embarrassing moments while Democrats have replayed them suggests this is the case.  Making the Garden grate again. Photographer: Adam Gray/Bloomberg There's a similar narrative from recent history. In 1992, British voters delivered a massive shock by returning the Conservatives under John Major with an overall majority. Only eight days earlier on "Red Wednesday," four separate polls had shown the opposition Labour Party ahead by more than the margin of error. Labour held a mega-rally that night and its genial leader, Neil Kinnock, came over as crassly triumphalist. Did it cost Labour the election? Kinnock argues that he had probably already lost. But turnout was very high. It's certainly consistent with the electorate confronting the growing likelihood of Labour in power and asking themselves how they really felt about it. If Trump somehow fails to pull this off, his jolly at Madison Square Garden will take much of the blame — along, perhaps with the prediction markets (not polls) that suggested he had it in the bag. Are the markets really over-confident? Consider that a Trump future will pay 50% if he wins, against 200% for a Harris future, and that narrative gets a little harder to dismiss. As Madison Square Garden has come in for some bad press of late, here is a reminder that it hosted Ali versus Frazier in the Fight of the Century in 1971, one of the greatest performances ever by Led Zeppelin two years later, and Queen, any number of performances by the Rolling Stones, and the occasional decent performance by the New York Knicks. And lots of Billy Joel.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Mohamed El-Erian: Bond Market Responds Oddly to the Fed's Move

- Marcus Ashworth: Weird Things Are Happening in the Bond Market

- Marc Rubinstein: Why Short Sellers Can't Even Get Along With Each Other

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment