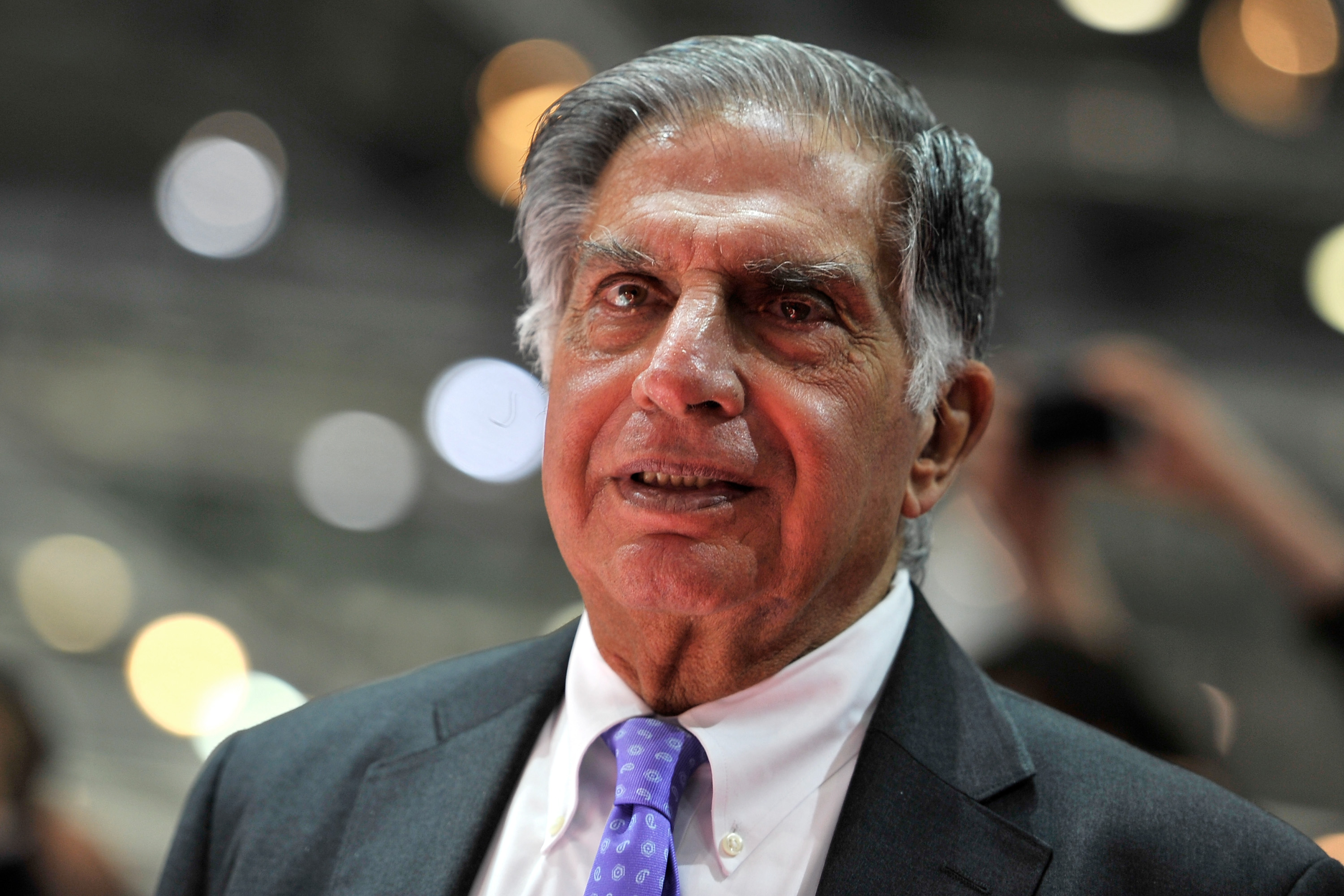

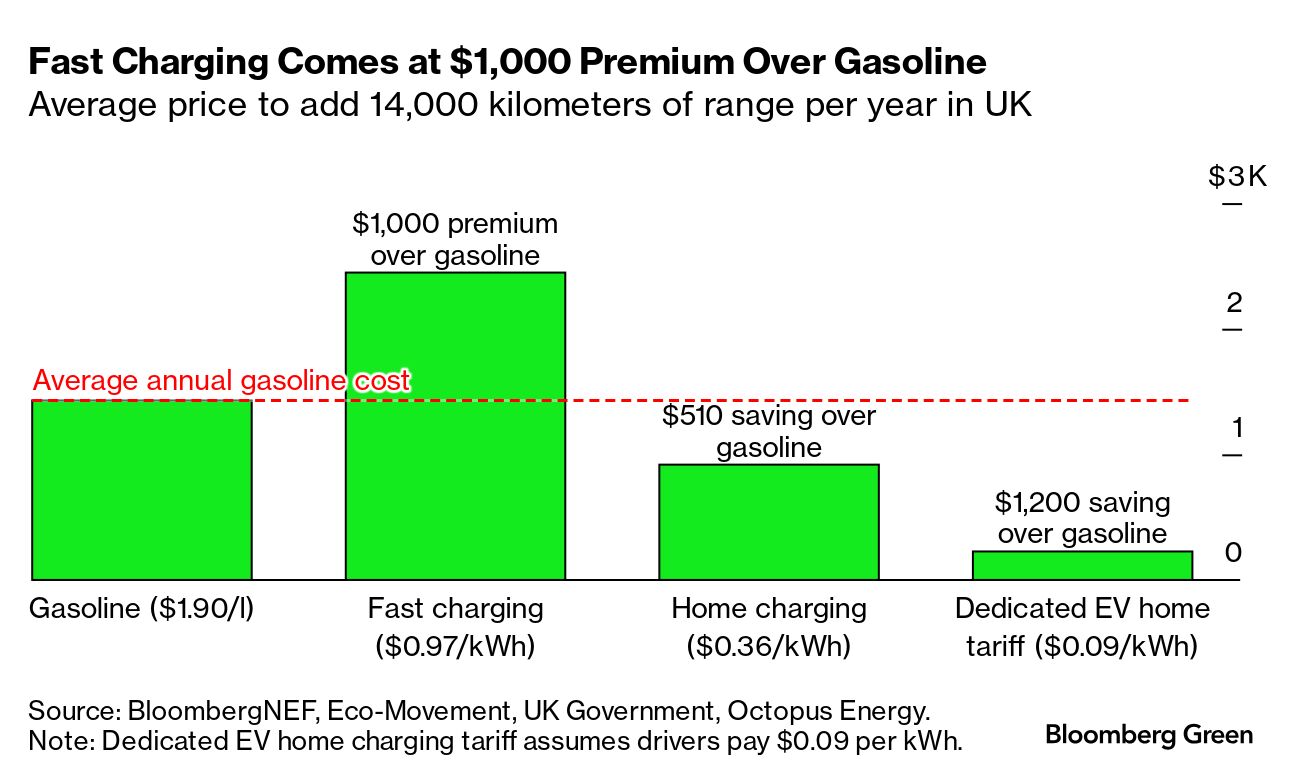

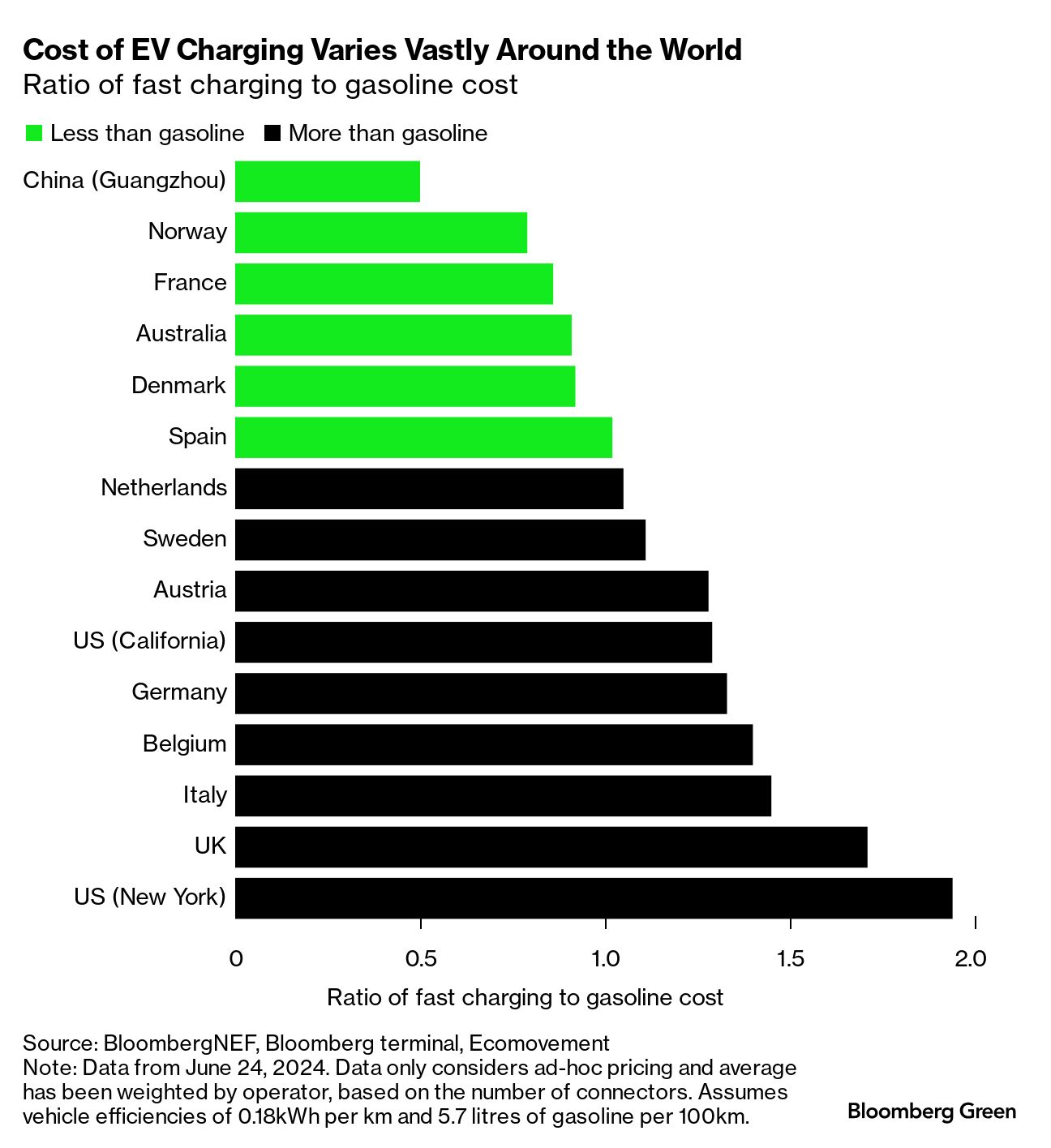

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Electric vehicle drivers are paying dramatically different prices to charge depending on where they plug in. In the UK, those with a home charger and special utility tariff can save $1,200 a year over gas — an amount that makes buying an EV increasingly attractive. However, for drivers exclusively fast-charging, they can expect to pay a $1,000 a year premium over gas. The 1.7-times cost multiple to fast-charge over fueling makes the UK one of the most expensive locations in the world for fast-charging that BloombergNEF assessed in its latest state of the industry report. Government incentives skewed toward biofuels and grid cost increases are part of the problem for UK charging operators. But there are bright spots in the world that suggest charging prices will come down as competition increases and the industry scales. BNEF expects electricity demand at UK fast chargers to grow sevenfold by 2030 and 13 times by 2035. Charging operators in the UK can lament the lack of carbon credits available. In California, Germany and the Netherlands, operators earn around $0.05 to 0.10 per kilowatt-hour from carbon credit programs. The UK's equivalent Renewable Transport Fuel Obligation program only supports biofuels, a contradictory stance considering electrification is the government's leading means for phasing out internal combustion engine vehicles by 2035. The influence of biofuels is weighing heavy on credit prices across programs, and governments are grappling with how to regulate them to meet their policy aims. The European Union is investigating complaints of a flood of unfairly priced and fraudulent biodiesel being imported into the bloc from China. Complainants suspect that palm oil are being mixed into the product rather than waste materials. Escalating grid costs are also causing problems for operators. Standing charges — the amount paid to cover grid costs, which increases depending on the size of the connection — have risen at some sites by tens of thousand of pounds a year recently in the UK. This has contributed to UK ultra-fast prices rising to $0.97 per kWh at the end of June, from around $0.56 per kWh two years ago. The lower density of charging compared to other countries and operators is also likely playing into higher prices. Despite record installations, the UK has fewer ultra-fast chargers per EV than other leading countries, with 170 per battery-electric vehicle at the end of 2023. That compares with around 100 in Norway, 77 in France and just 17 in China. Fast-charging in each of these countries now costs less than gasoline. Prices have been dropping in Norway and France as competition ramps up. To meet BloombergNEF's outlook, many more installations will be needed in the UK. We see the battery-electric vehicle fleet rocketing from around 1.3 million vehicles today, to 7 million by 2030 and more than 22 million by 2040. That size of fleet would require seven times more electricity by 2030 at ultra-fast chargers, reaching 4.9 TWh, plus more than 53,000 ultra-fast chargers, up from 8,300 today. Demand continues to rise by 2040, quadrupling to 20 TWh. The UK is highly unlikely to meet the 23,260 ultra-fast chargers in the outlook by 2025. Other major countries have pulled off what we expected. Germany, for example, already has surpassed this number. For operators struggling with rising costs, low demand, and challenges getting installations up and running, the outlook does show that the tide can turn quickly with respect to the business model. If EV sales gather momentum, the fleet can outgrow the number of chargers available, boosting utilization. This has been observed in the US, where competition is relatively low. Average utilization at EVgo's stations climbed to 19% in the second quarter, with 41% utilization at its top 15% of stations. This sounds great for operators, but with a fast-growing EV fleet, it signals potential challenges for drivers. The market is likely to follow a cyclical trend of growth, investor wariness, price wars and consolidation. Operators have a fine line to tread on pricing in order to avoid putting off potential EV drivers in the nascent period of this new industry.  Photographer: Bloomberg/Bloomberg Elon Musk went all-in to get robotaxis onto roads, sacrificing a widely anticipated cheaper car, gutting teams focused on other projects and downplaying Tesla's sales slowdown. So when Musk finally unveils autonomous taxi prototypes late Thursday, the CEO will have a lot to prove. - Read more on the stakes for Tesla's stock.

- Listen to the latest episode of Elon, Inc.

- Play along: get your robotaxi bingo card.

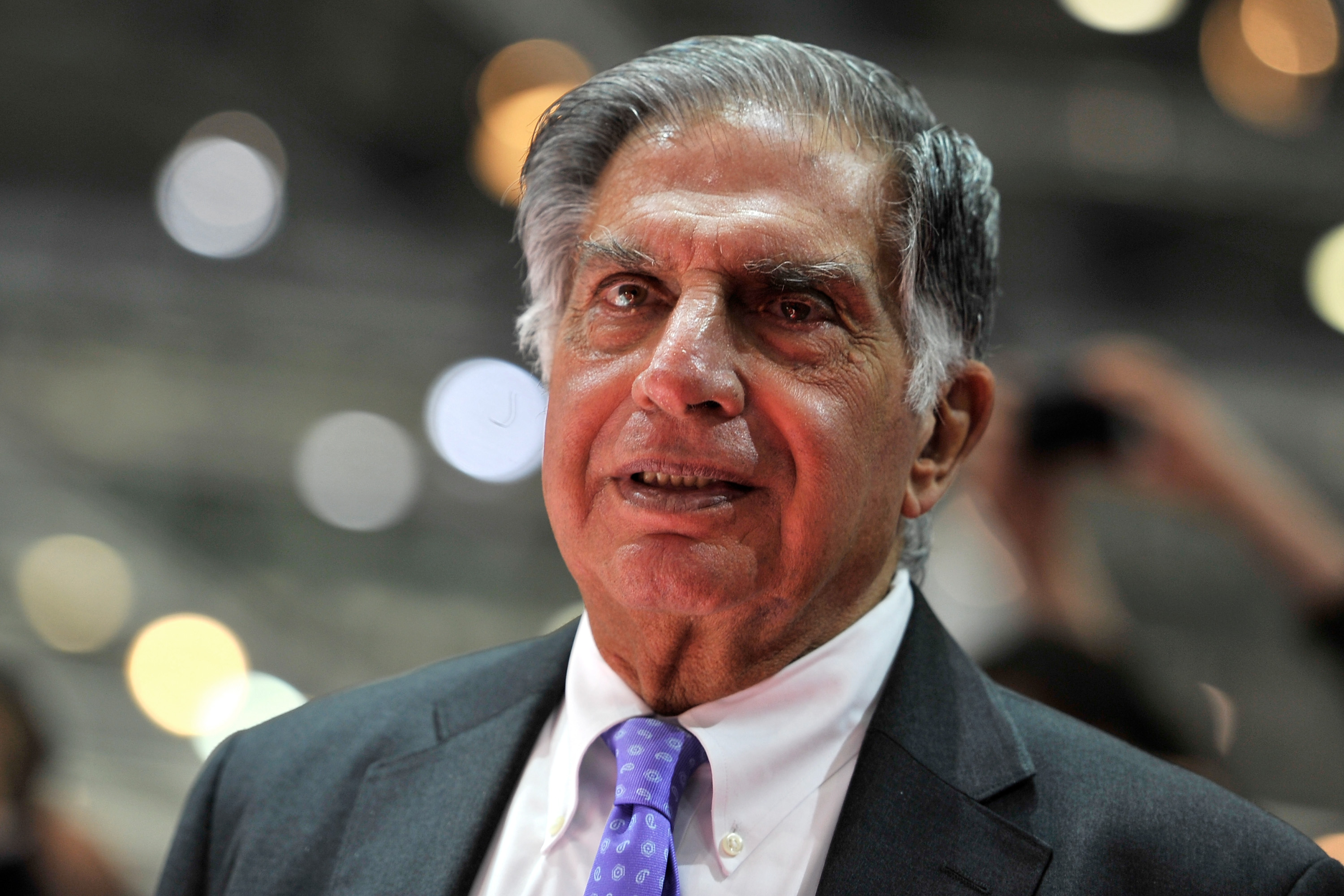

Photographer: Harold Cunningham/Getty Images Europe Ratan Tata, the businessman who inherited one of India's oldest conglomerates and transformed it into a global empire, has died at 86 years old. Tata Group embarked on an expansion drive under his leadership, snapping up iconic British assets including steelmaker Corus Group in 2007 and carmaker Jaguar Land Rover in 2008. He was "a truly uncommon leader whose immeasurable contributions have shaped not only the Tata Group, but also the very fabric of our nation," Chairman Natarajan Chandrasekaran said. |

No comments:

Post a Comment