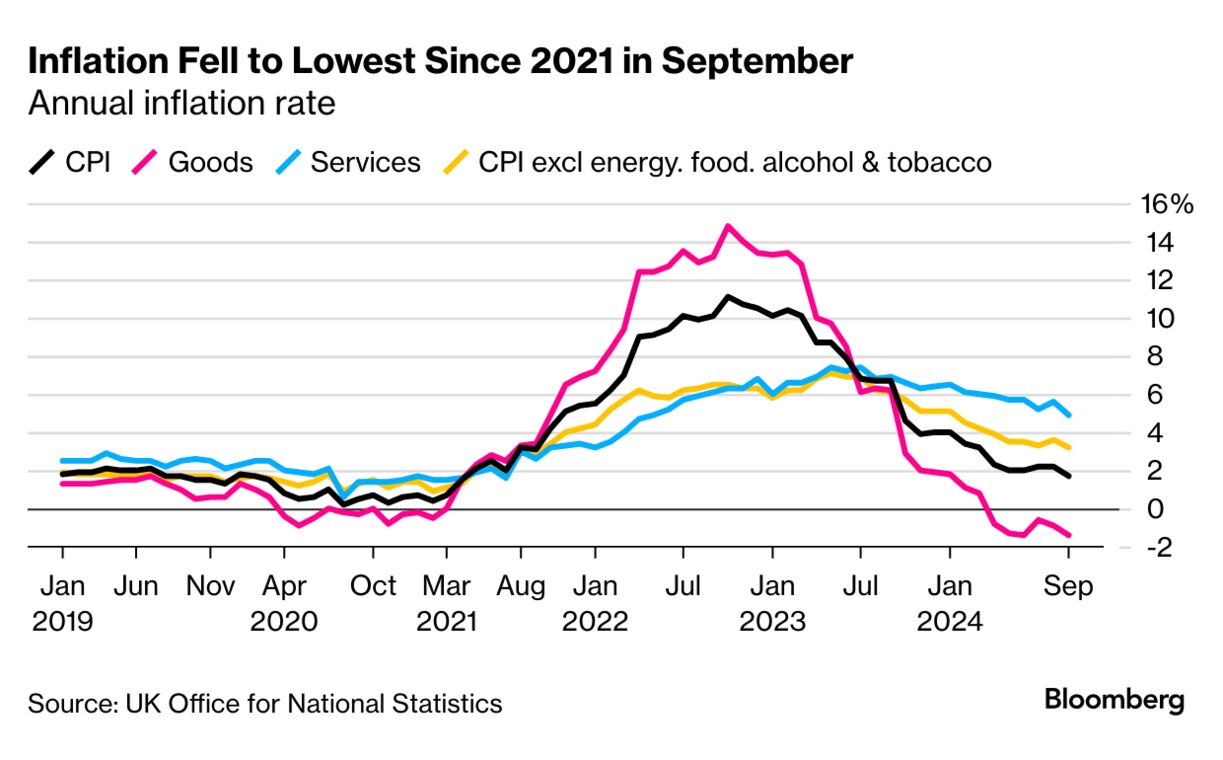

| Morning, I'm Louise Moon from Bloomberg UK's breaking news team, bringing you up to speed on today's top business stories. Can you hear the relief on Threadneedle Street? Lower prices at petrol pumps and cheaper air fares pulled inflation for September down to 1.7%. Importantly, stubborn services inflation has eased off. That is a triple threat of: - lower than expectations (of 1.9% by economists and 2.1% by the Bank of England in August).

- the lowest since 2021.

- below the Bank of England's 2% target.

It boosts the case for a possible second interest rate cut next month. A drop in the pound after the figures were released suggest traders are anticipating as much. But it is a delicate balance: Inflation is expected to pick up again over the coming months, and rate-setters will need to be fully confident that price pressures are contained if borrowing costs are to come down at a quicker pace. Markets Today's Morwenna Coniam gives her take on the figures below. What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment