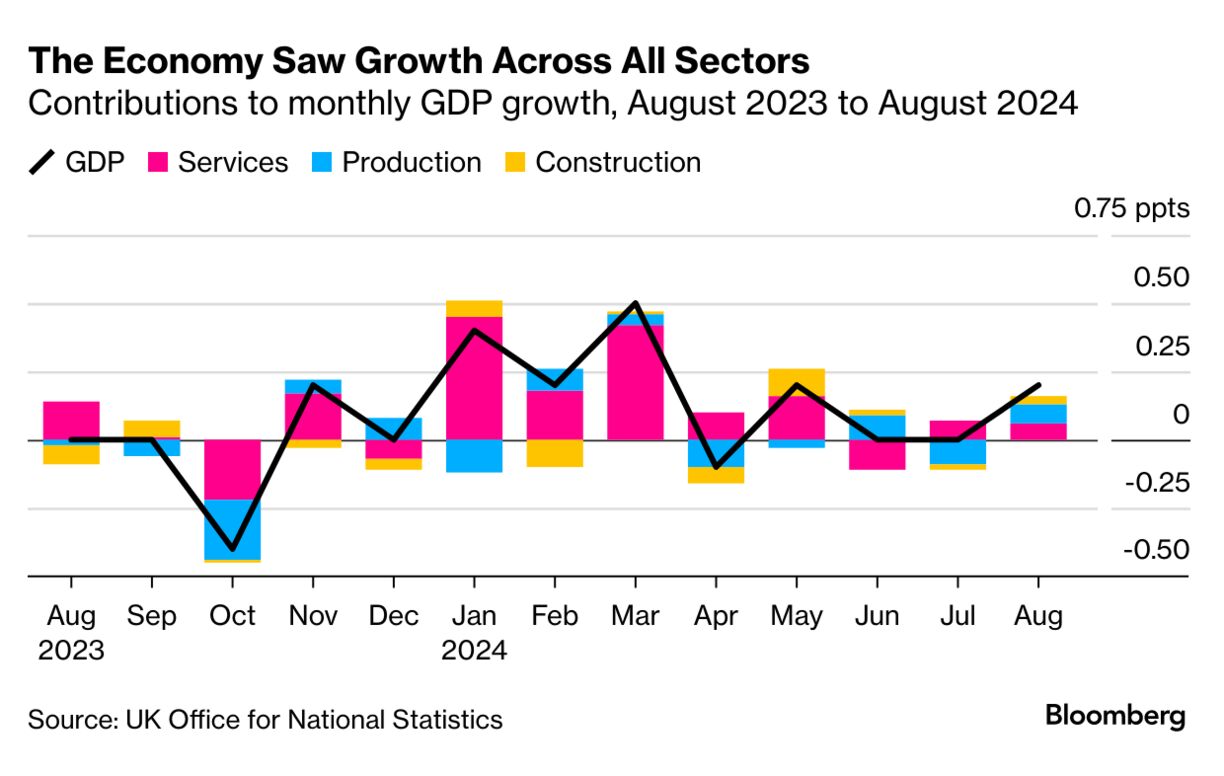

| Morning, I'm Louise Moon from Bloomberg UK's breaking news team, bringing you up to speed on today's top business stories. Presentation is key. Britain's GDP grew 0.2% in August, returning the economy to growth after two months of stagnation and leaving it on track to expand in the third quarter. Services, production and construction all grew. Welcome news, and a relief for the government. But that data refers to a period before business leaders became more nervous about Labour's doom and gloom messaging ahead of a "painful" budget on Oct. 30. Consumer confidence is low. How well the economy holds up in September, and going forward, is in doubt. On Monday, the government will host an international investment summit in London, which Keir Starmer has touted as key part of his pledge to spur growth. With lingering jitters and business executives still waiting for the Prime Minister's grand plans, it makes the job of new Investment Minister Poppy Gustafsson, co-founder and ex-CEO of Darktrace, all the more important. What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment