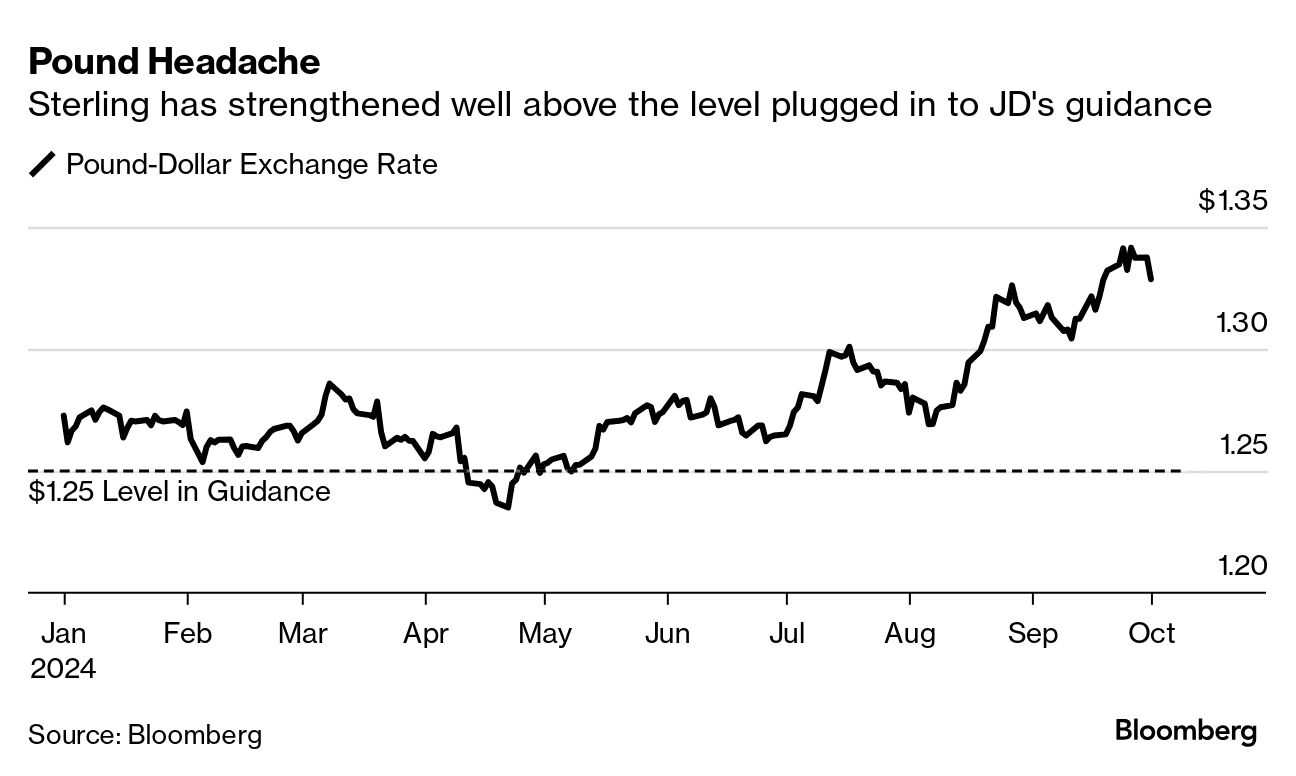

| Hi, I'm Louise from Bloomberg UK's breaking news team, catching you up on this morning's business stories. British people love moaning about the weather, but for some retailers the cloudy skies have become a real bugbear. JD Sports is the latest among a swathe of peers to blame the rain for a weakness in UK summer sales, at least in part (other factors include more demand for discounts than full price goods). It gives brands yet another reason to take on the tough challenge of going Stateside. For JD Sports, could it be Sweet Home Alabama? The athleisure retailer has been increasingly shifting its attention to the US, splashing out $1.1 billion on Alabama-based peer Hibbett to fuel its expansion earlier this year. The States accounted for the biggest chunk of first half revenue, ahead of the UK, and it has added 100 US stores in the space of a year. Plus, there is the strengthening pound, which could cost JD £20 million. Make sure to read Market Today's Dave Goodman below. It's not all bad, however: the sportswear brand reported overall growth in sales and maintained guidance for the most part. But with shares dipping 6% at the open, investors are looking at the clouds rather than the sunshine beyond. What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment