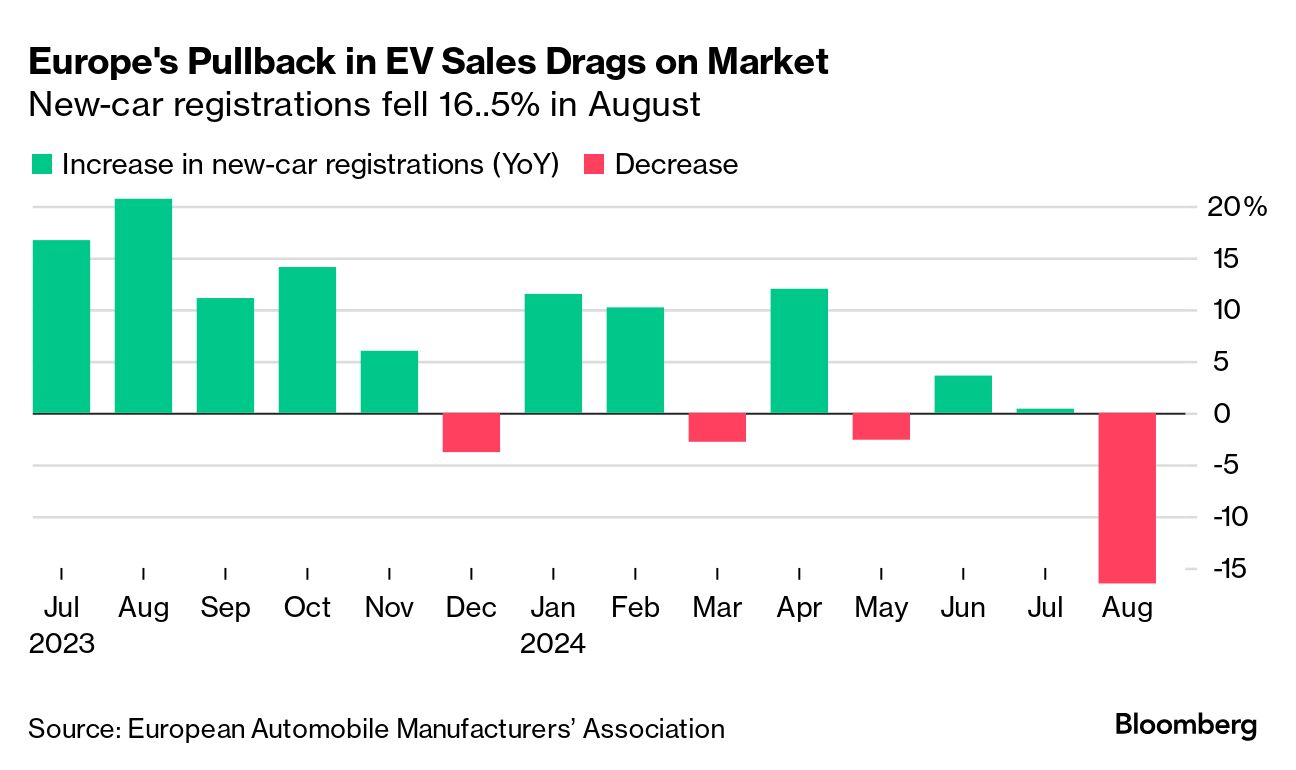

| Do we need to talk about electric cars? Our global business editor Jamie Nimmo thinks so: He has an exclusive about Ford, which is asking the government for more subsidies to boost its electric vehicle sales in the UK. The company's managing director for Britain and Ireland told him in unusually direct language that the UK must "do something" to help. Ford joins other car manufacturers in wanting subsidies reintroduced in this month's budget, as well as VAT on EVs and street charging lowered. This might sound like turkeys voting for Christmas to be postponed, or at least expecting help to make turkey-free versions of themselves, but is something fairly serious afoot? In June, when the Tory party was in charge, Jeep and Vauxhall maker Stellantis was already threatening to stop making EVs altogether unless the government eased sales targets. Since then, the only noise this new government has made on EVs is that while it will keep the Boris Johnson 2030 ban on the sale of new petrol and diesel cars, it will continue to allow the sale of some hybrids until 2035. But across the world, the numbers on EV sales in recent times are not pretty. And this graph about European sales is decidedly not pretty: It's not new that car manufacturers are asking for help meeting the deadline – they did it routinely when I worked in government in the runup to COP26, when we were resolutely cajoling consumers and producers away from the internal combustion engine. What's different this time is that there is a new government having to answer these pleas – and one that is seeking to redouble efforts to reduce the UK's carbon emissions, but this time in an era of strained finances where subsidies are harder to afford. This nice and crunchy piece by Joshua Gallu surveys the international picture and confirms the worries: "This year, the EV transition is having a wobble." It details how in Europe the shift to EVs "effectively went into reverse, as cars with exhaust pipes took a growing share of overall sales." A shocking fact: "In Germany, the continent's biggest market, EV sales plunged by 69%." There is of course one market that could help EV affordability – China — given its cheaper batteries, some of which use the more abundant sodium. But the EU and US are protecting their domestic TV producers with tariffs on these cheaper cars. It's a tough one. As our reporter puts it: "Western governments now face a dilemma: Opening the door to more imports and manufacturing of Chinese EVs and EV parts would help to keep prices falling in Europe and North America and spur demand. But it could also undermine local manufacturers and further entrench China's dominance in the clean industries of the future." On the more optimistic side of the ledger, newly reconfigured factories will soon produce new cheaper EV models in Europe. That effort just needs to go up a gear. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment