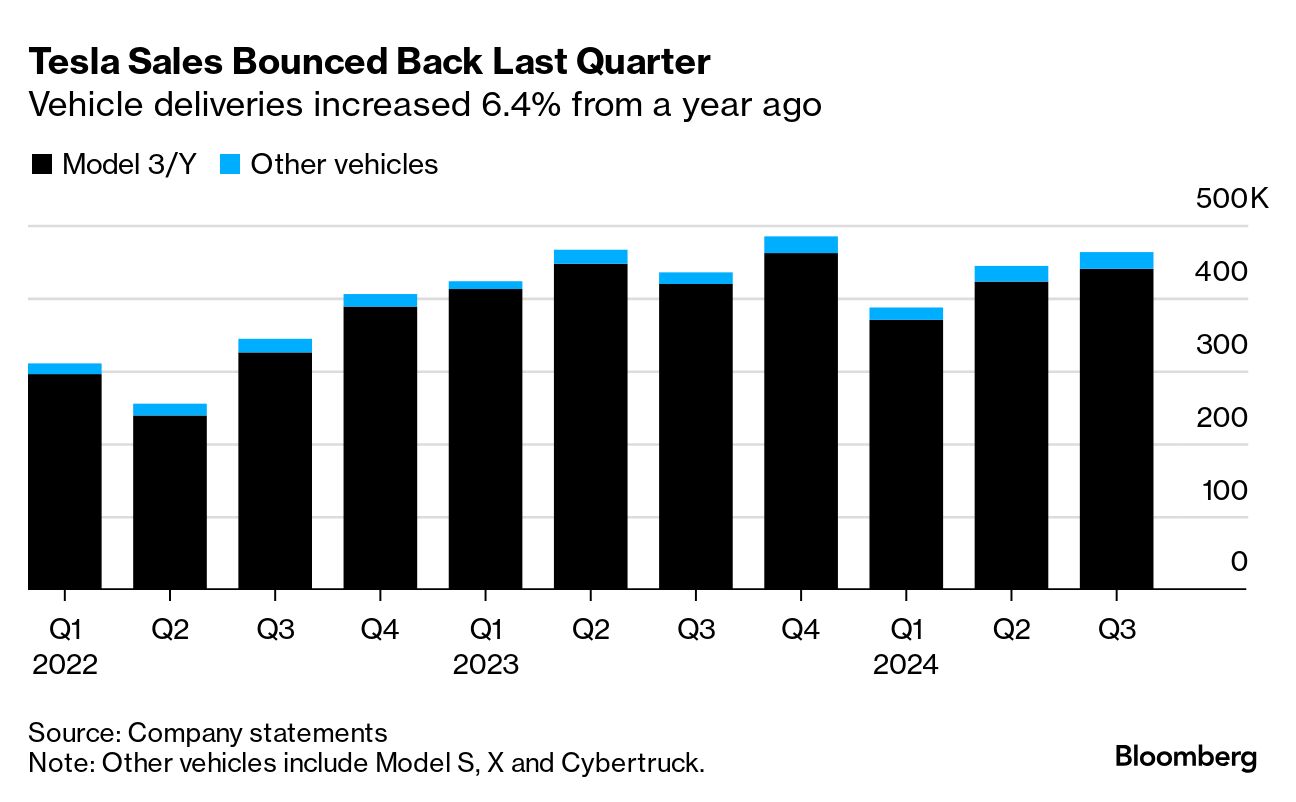

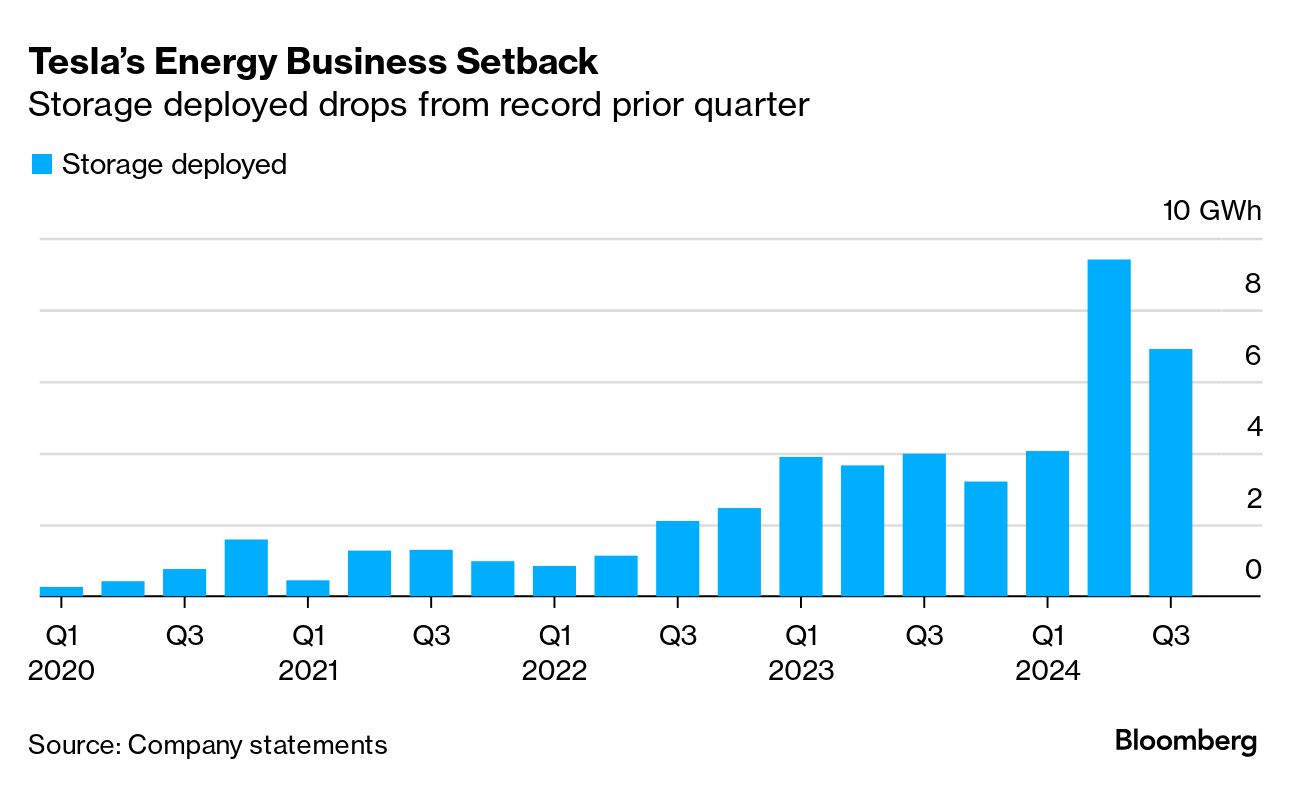

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story online here. Tesla posted its first increase in quarterly vehicle sales this year, though the automaker let down investors expecting more of a bump from China boosting electric car subsidies. The Elon Musk-led company handed over 462,890 vehicles to customers in the last three months, up 6.4% from a year ago. Deliveries came up shy of the roughly 463,900 units expected among analysts tracked by Bloomberg. "We will see some pressure on shares this morning as investors walk away from delivery numbers expecting more," Daniel Ives, a Wedbush analyst with the equivalent of a buy rating on the stock, wrote in a report Wednesday. Tesla shares fell as much as 6.4% as of 10:30 a.m. in New York trading. The stock had jumped 35% in the eight weeks leading up to the report. Tesla got a lift during the quarter from China's government doubling an incentive for consumers to trade in older cars for electric models, stoking demand in the world's largest EV market. This fueled optimism about improving sales and coincided with rising expectations for an Oct. 10 event near Los Angeles, where Musk will unveil self-driving vehicle prototypes. "This will be one for the history books," the CEO wrote last week on X, the social media service he owns. Tesla shares have had a tumultuous 2024, recovering from a more than 40% rout as of mid-April largely due to anticipation of Musk's long-promised robotaxis. The stock is now trading back below where it started the year. Tesla kicked off the year warning it may expand at a notably lower rate until it begin producing cheaper models in the first half of 2025. The Austin-based company will need a strong showing in the next few months to grow at all in 2024 — deliveries fell more than 2% in the first nine months of the year. Whereas vehicle sales have ticked up both from a year ago and sequentially, Tesla's energy business took a step back from a record second quarter. The company deployed 6.9 gigawatt hours of storage products in the last three months, down more than a quarter from the period that ended in June. It's still managed to deploy more energy storage products already this year than in all of 2023. Tesla scheduled the release of its third-quarter financial results for after the market close on Oct. 23. — By Kara Carlson and Dana Hull  One-third of car buyers polled by Edmunds said they're holding off on a new-vehicle purchase until after polls close on Nov. 5. Photographer: David Paul Morris/Bloomberg After a lackluster quarter of vehicle sales that was presaged by a rout in auto stocks, carmakers are hoping a little help from the Fed will lure customers back to showrooms. US sales fell to 3.9 million cars and trucks in the last three months, a 2.3% drop from a year ago, according to Edmunds. High prices, elevated financing costs and even anxiety about the November election kept some would-be buyers on the sidelines. Above all, they're waiting for better deals. Read More:  Northvolt's delayed battery deliveries held up electric-truck production at Swedish manufacturer Scania. Photographer: Bloomberg/Bloomberg The wheels are coming off Europe's bid to catch up to China and the US in critical industries, Lionel Laurent writes in his latest Bloomberg Opinion column. Swedish battery maker Northvolt is cutting jobs and selling assets amid slowing demand, months after securing €912 million ($1 billion) in subsidies to build a plant in Germany rather than the US state of Nebraska. Meanwhile, a planned Intel chip factory in Germany that was awarded €10 billion in subsidies has been delayed after the company decided to cut costs. |

No comments:

Post a Comment