| During times of volatile price action, many crypto traders convert their digital-asset positions to stablecoins that track the US dollar or other traditional currencies in order to protect against losses elsewhere in the market. They also post stablecoins as collateral in derivatives trades.

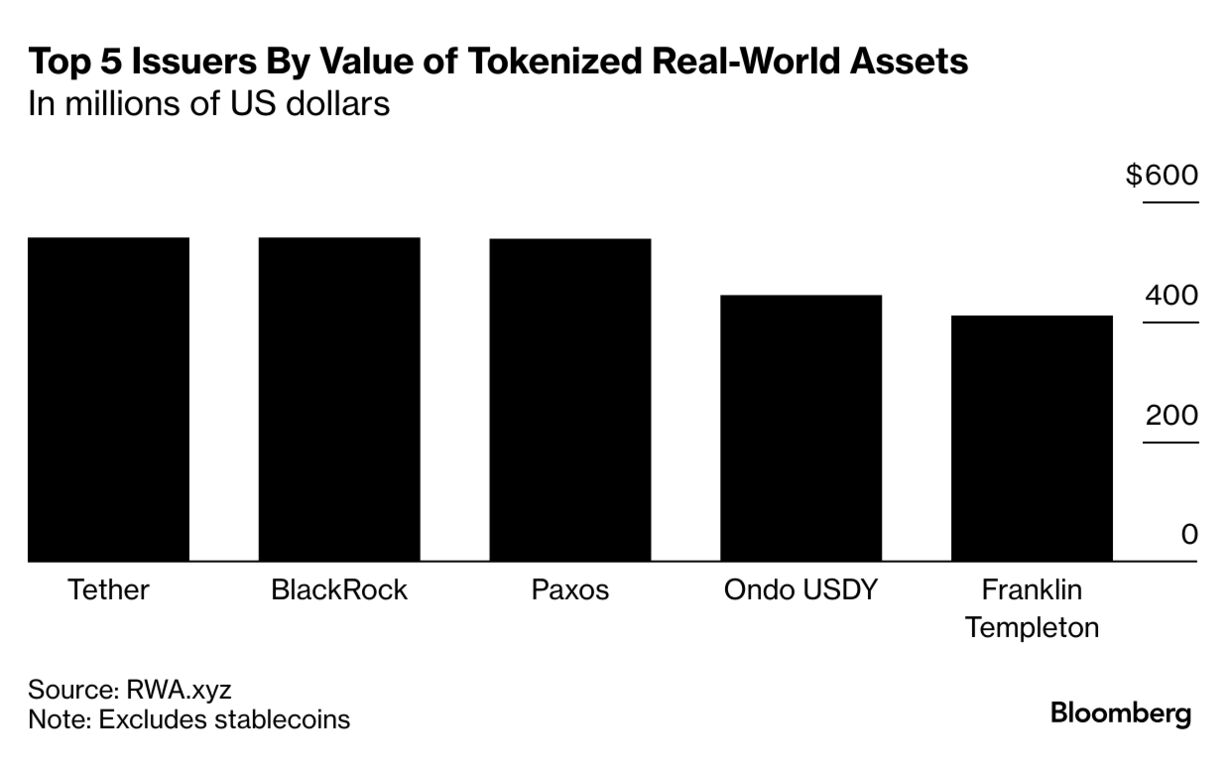

These use cases have been noticed on Wall Street, where some firms are looking to provide competition. Many fund issuers are hoping that people will use stablecoins mainly for payments, but after those payments have been delivered they will keep their money in tokens representing money-market, equities or other types of funds. The selling point is that holders of fund tokens can earn interest or benefit from rising asset prices, advantages that stablecoins usually do not offer. The world's biggest stablecoin, USDT, doesn't pay interest. Its issuer, Tether, puts the money backing the token into safe investments like Treasuries to earn yield for itself, booking $5.2 billion in profits in the first half of the year alone, according to the company, whose financial statements aren't audited. And while many yield-bearing stablecoins have debuted in recent months, most are offered by small, unknown companies and haven't gained much traction. Fund issuers like BlackRock and WisdomTree are offering an alternative. Users of their money-market fund tokens can earn interest rates of 4% to 5%, and also post the tokens as collateral in derivatives trades. Last week, Bloomberg reported that BlackRock is in talks with crypto exchanges to allow its money-market token to be used as collateral. The token is already accepted as collateral by the likes of Hidden Road, a crypto prime brokerage. WisdomTree is also in conversations with prime brokerages, trading desks and crypto exchanges about the use of its fund tokens as collateral, Maredith Hannon, head of business development for digital assets at WisdomTree, said in an interview. "Over the next three-four months, we'll continue to see tokenized money-market fund launches as more institutional firms realize their value and want to participate," Thomas Cowan, vice president of tokenization at Galaxy Digital, said in an interview. "Because everyone wants to earn yield." If this type of usage takes off, it could reduce the reliance on stablecoins like Tether among crypto traders. Tether didn't return a request for comment. And should interest rates decline, that may create demand for a more diverse universe of fund tokens. As more funds get tokenized, users will have the option to not only hold money-market fund tokens, but also tokens representing gold, equities and other types of investments offering the potential for returns that most stablecoins currently lack. "I do think this is revolutionary in bringing traditional finance on-chain," said Hannon of WisdomTree, which has 13 tokenized funds. "You could potentially hold Bitcoin, with gold, with a money-market fund in a diversified portfolio. And it's regulated. It's just going to expand on the types of platforms that are available and also who has access to them." |

No comments:

Post a Comment