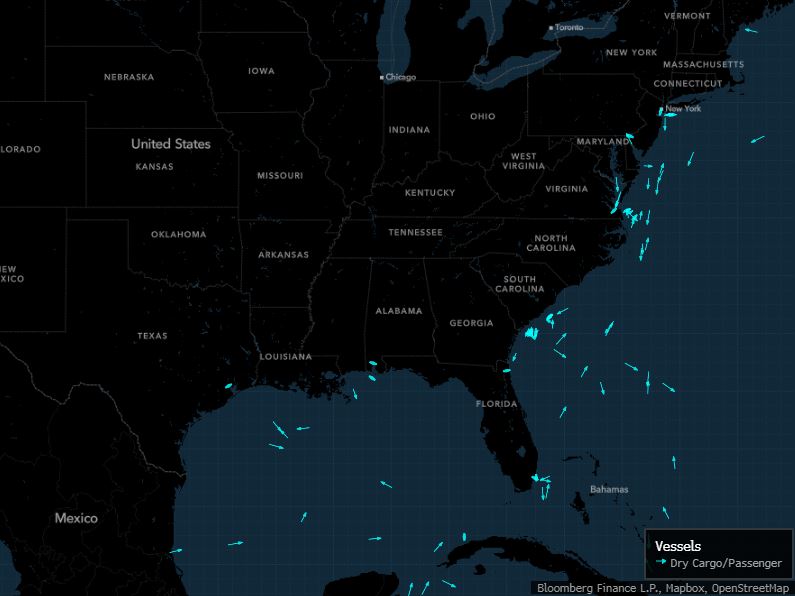

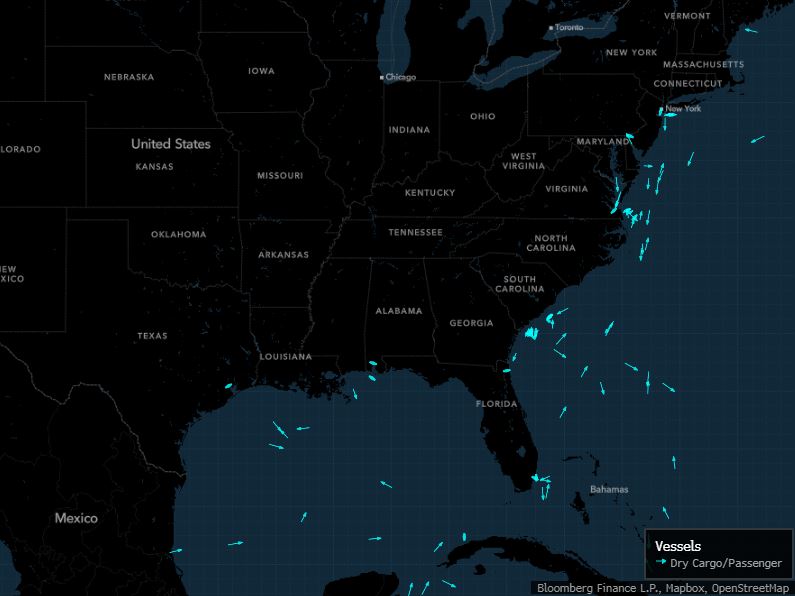

| The first dockworker strike on the US East Coast since 1977 began Tuesday, after an 11th-hour boost in the employers' wage offer came up short. Union members hit the picket lines after midnight, container terminals closed and auto shipments ground to halt. Unless it ends soon, the economic fallout could be wide and the recovery prolonged, analysts warned. Read More: Strike Shuts Eastern US and Gulf Ports, Threatening Economy "The consequences will be severe, not only through congestion at US ports, but importantly these ships will be delayed returning to the Far East for the next voyage," Xeneta Chief Analyst Peter Sand wrote in a blog post. "A strike lasting just one week will impact schedules for ships leaving the Far East on voyages to the US in late December and throughout January." Late Monday, the United States Maritime Alliance said it increased its wage boost offer to 50% and asked to extend the current contract so talks could continue without a work stoppage. The International Longshoremen's Association rejected that final proposal, saying it "fell far short" of what's acceptable. In a statement, ILA President Harold Daggett said "we are prepared to fight as long as necessary, to stay out on strike for whatever period of time it takes." Washington Edition: Strike Stands to Disrupt US Ports Meanwhile, anchored container ships and car carriers were starting to congregate outside ports from New York to Miami:  Source: Bloomberg, MAP —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment