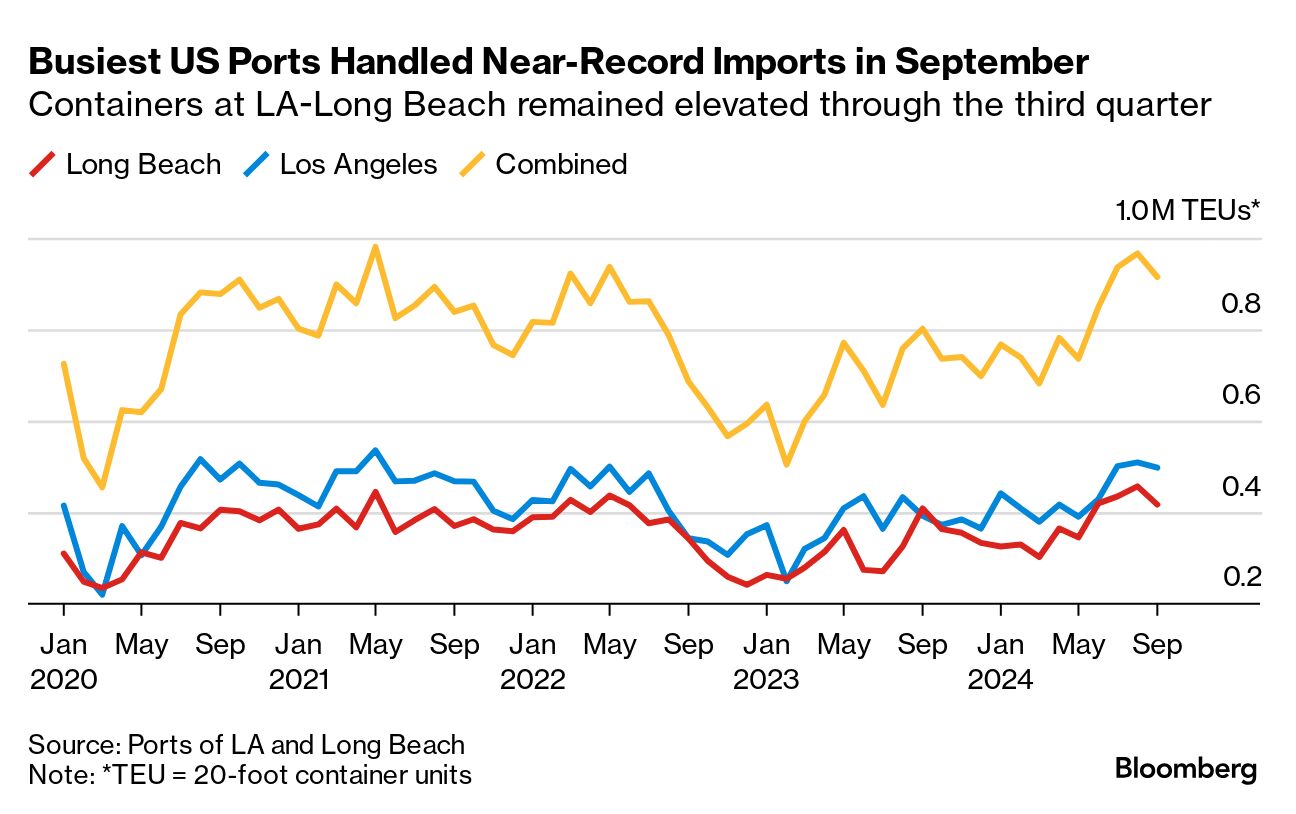

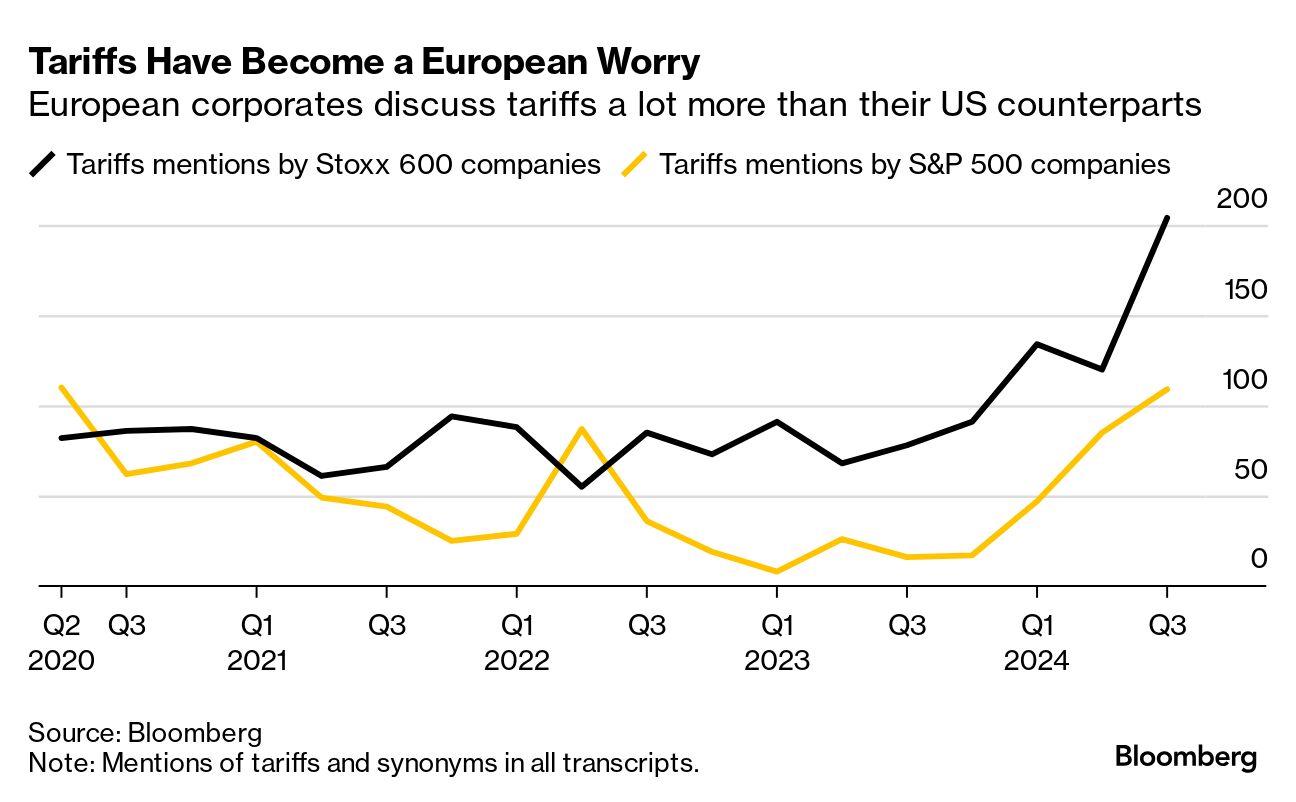

| Anyone who thinks protectionist policies like tariffs translate into less foreign trade and more goods produced a home ought to check out the kind of year that the US ports of Long Beach and Los Angeles are having. Cargo volumes flowing into through the Southern California facilities just wrapped their busiest ever peak season. What's the rush? Worried retailers and businesses are racing to get ahead of 1) tariff extensions or hikes that seem destined to accompany a new president next year and 2) another potential labor problem at Gulf and East Coast ports come January. Read More: Busiest US Trade Hub Beat Pandemic Cargo Record in Third Quarter LA-Long Beach volumes just beat the record set in the second quarter of 2021, when demand for consumer goods and supply chain snarls caused a massive backlog of ships offshore and a pileup of containers on the docks. So-called dwell times for containers bound for destinations via rail have crept up, but they're still well below their pandemic-era highs. "The third quarter marked our single highest quarterly performance in our 116 year history," Executive Director Gene Seroka told reporters Friday. Long Beach also had its busiest-ever quarter, and CEO Mario Cordero said the trade hub there's plenty of room for more. The deluge on docks that link the world's to biggest economies across the Pacific lines up with some new research about the seismic shifts in global trade since tariff wars and the pandemic. In a new report titled "The Surprising Resilience of Globalization: An Examination of Claims of Economic Fragmentation" by Brad Setser. The senior fellow with the Council on Foreign Relations argues that China's "continued reliance on the world's big democracies for demand runs counter to any coherent definition of fragmentation." "Globalization is not in retreat," according to Setser's paper. "Global trade continues to rise alongside global economic growth. If anything, trade has picked up since the pandemic." Big Take: A $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics California's container crush is expected to taper off a bit through the end of the year, while remaining higher than the typical post-peak period, as importers bring in goods ahead of China's relatively early Lunar New Year in 2025. The increase is also due to retailers' worries about new tariffs ahead of next month's presidential election. "This is traditionally slack season, yet I see no evidence of a precipitous drop in cargo volume," Seroka said. "If some importers anticipate new tariffs, as they did in 2019, we may see an uptick in cargo brought in early to avoid those extra costs." What the Candidates Say: Many businesses are also planning for their spring merchandise to arrive early in case the labor dispute that shuttered every major port on the East and Gulf coasts earlier this month isn't resolved before the new Jan. 15 deadline — just five days before the new US president is inaugurated. Under pressure from the White House to reopen the ports, the International Longshoremen's Association accepted a 61.5% wage increase that will kick in when the new six-year contract with the US Maritime Alliance is finalized. The two sides still need to agree on what's likely to be even more contentious issue: automation at port terminals. Big Take Podcast: Inside the Dock Workers' Strike Deal "What we all want to see is that the parties, USMX and the ILA, reach a fair deal and get that in place so we don't have another interruption in service before this extension expires," said National Retail Federation President Matt Shay, who also joined Friday's briefing. "And you know very well the issues that are to be debated and are still unresolved." Related Reading: —Laura Curtis in Los Angeles Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment