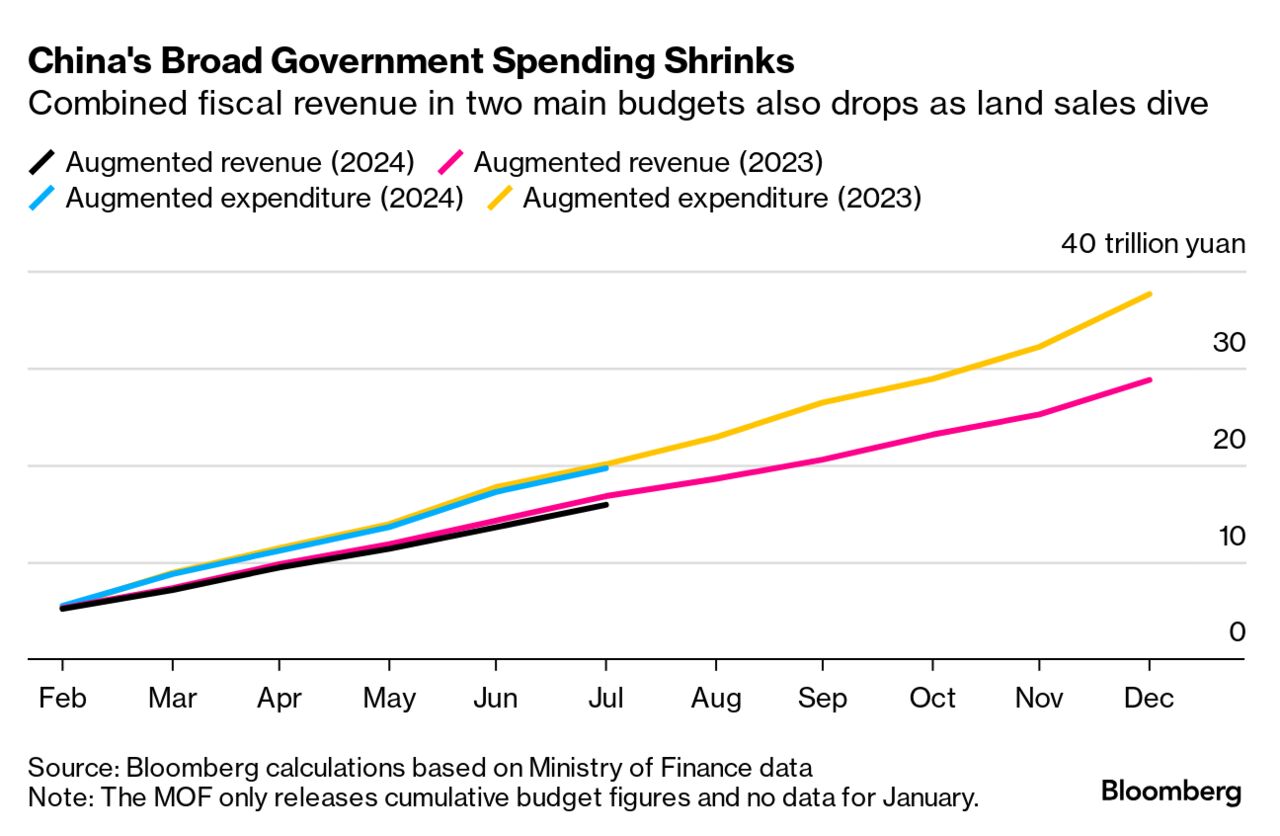

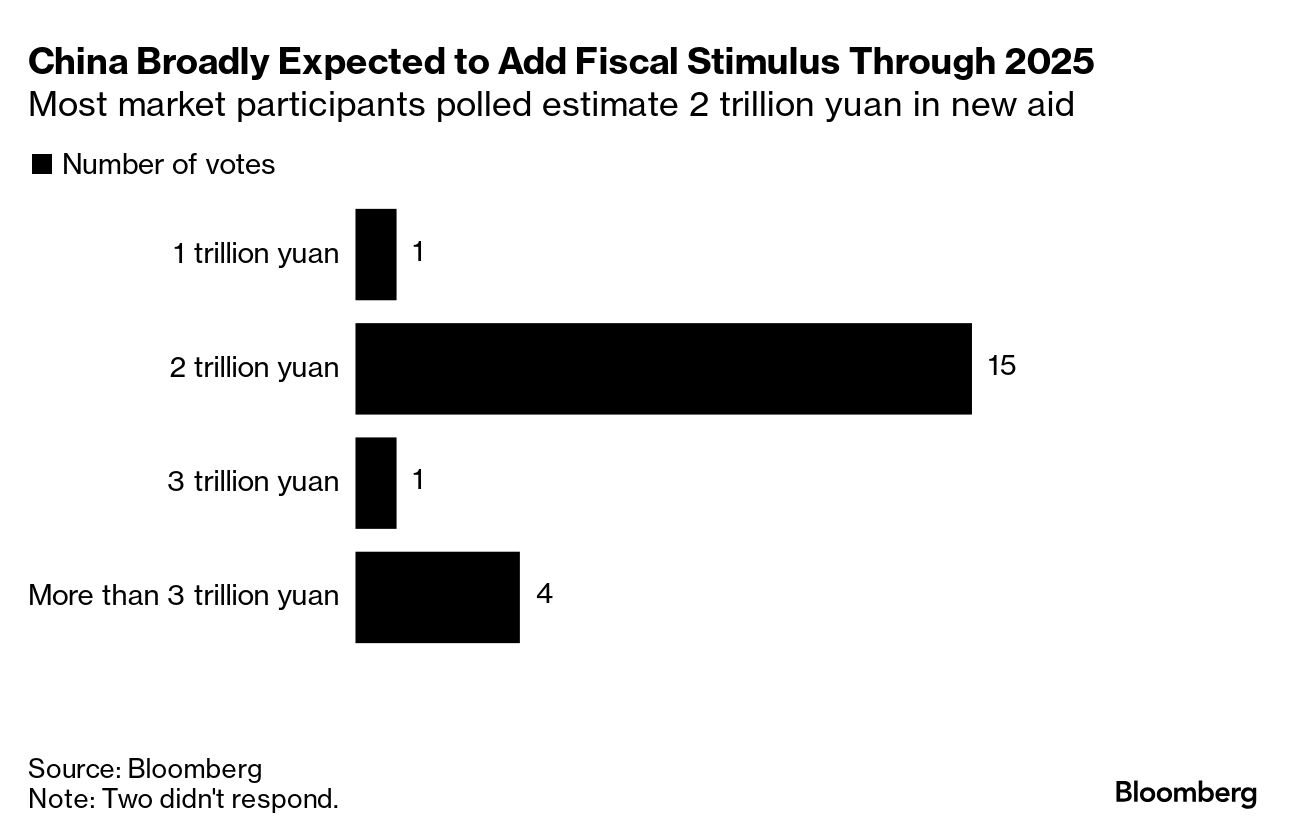

| Hello, this is Jasmine Ng in Singapore. The highly anticipated briefing by China's Ministry of Finance has wrapped up — alas with no specific pledge of the 2 trillion yuan ($283 billion) in fresh economic stimulus that investors were hoping for in the lead up to the event. Chinese bulls are bound to be disappointed. The Monday market open will likely lack the same euphoria that powered a more than 30% stock rally since late September, when the central bank unleashed its biggest stimulus in years.  A person poses for photographs with the Bund Bull in Shanghai, China. Photographer: Raul Ariano/Bloomberg But the Finance Ministry briefing wasn't a complete snooze. Policymakers offered clearer guidance on the focus of fiscal policy, vowing new measures to support the beleaguered property sector and to relieve the debt burden of local officials. Minister Lan Fo'an also hinted at room for issuing more sovereign bonds, signaling a possible mid-term revision to the budget. That might be a pretty radical move given how the ministry has tended to be extremely cautious. "The MOF set a rather active tone for policies to come by providing forward guidance even though the short-term measures may sound a bit weaker than market expectations," said Jacqueline Rong, BNP Paribas SA's chief China economist. "I think that's a very smart way of guiding expectations." With that, investors are turning their attention to the next meeting of China's top legislature, the National People's Congress Standing Committee, which has the power to approve more government bond sales. Last year, the committee gave the green light at its October meeting for an extra 1 trillion yuan in sovereign debt, pushing the 2023 fiscal deficit to around 3.8% of GDP, above the government's usual 3% limit. Some economists expect China to do something similar this year. Analysts at Goldman Sachs said Beijing could approve the sale of an extra 1 trillion to 2 trillion yuan in special sovereign bonds at the legislative meeting around late October to early November. Even if that happens, it's unclear if investors would see it as a positive. For the rally in Chinese stocks to continue, investors are looking for more aggressive fiscal stimulus. Xin-Yao Ng, an investment director at abrdn Asia Ltd., suggested 10 trillion yuan or more might be needed to keep the market going given the range of economic issues that needs to be addressed, though he didn't provide a time frame. Alicia García-Herrero, chief Asia-Pacific economist at Natixis, compared this to feeding the monster. "Every day you need to increase the amount of food or it turns against you," she said. So what's in store for us? Here are five things to know: Deflationary Spiral Officials still haven't convinced economists that they're doing enough to defeat deflation. The supportive measures announced by Finance Minister Lan gave little indication Chinese authorities felt any urgency to ramp up consumption, which many economists see as essential to reflating the economy and putting it on a more positive growth trajectory. More Spending?  Lan Fo'an, China's finance minister, center. Source: Bloomberg Finance Minister Lan said the central government still has quite a large room to borrow and increase the deficit, raising hopes for extra fiscal stimulus when the NPC Standing Committee meets in the coming weeks. Base Case Investors and analysts expect China to deploy as much as 2 trillion yuan in fresh fiscal stimulus in order to shore up growth and boost confidence, a flash survey by Bloomberg shows. Managing Expectations  The Beijing Stocks Exchange in Beijing, China. Photographer: Na Bian/Bloomberg The wild market swings after a recent briefing by China's economic planner, the National Development and Reform Commission, shows the mismatch in what equity investors expect and the intention of policymakers in Beijing. Rally Under Pressure Chinese stocks capped their worst week since July before the Ministry of Finance briefing. There's been plenty of concern the rally that began in late September would unwind further if fiscal measures fall short of market expectations. |

No comments:

Post a Comment