| Bloomberg Evening Briefing Americas |

| |

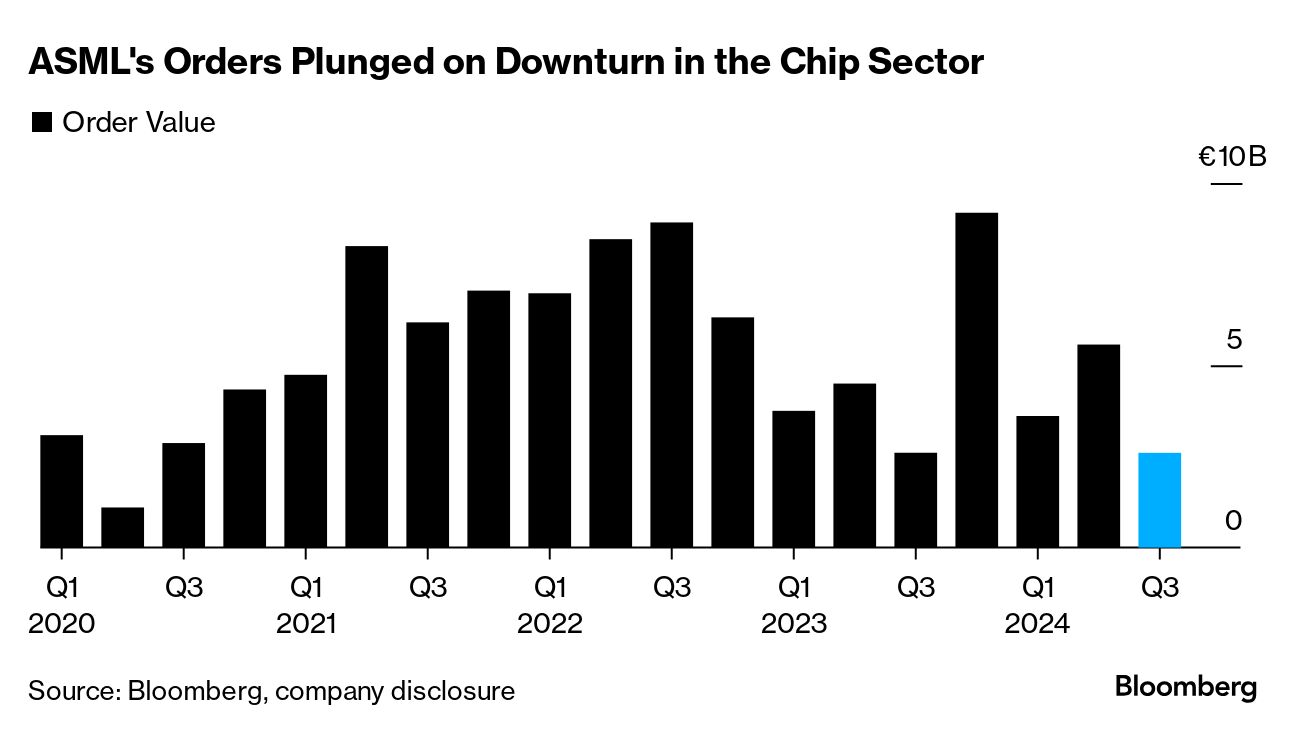

| Note to readers: For previous subscribers to Bloomberg's The Open, The Close and The Big Take newsletters, welcome to the Evening Briefing, our flagship newsletter that brings you the context and analysis you've come to expect from Bloomberg News. Manage your newsletter preferences anytime here. ASML Holding's shares plunged the most in 26 years after it booked only about half the orders analysts expected, a startling slowdown for the Dutch company, maker of the world's most advanced chip-making machines and one of the bellwethers of the semiconductor industry. Chipmakers are experiencing strangely uneven times. In areas such as artificial intelligence accelerators, companies like Nvidia are blowing down the doors of Wall Street and can't keep up with demand. But in other sectors, including automotive and industrial, the industry has been in a prolonged slump, with customers cutting back orders because they have too much inventory. Intel is slashing expenses in a restructuring that includes delays to planned factories in Germany and Poland, while memory chipmakers such as Samsung Electronics and SK Hynix are also being careful with their spending. —David E. Rovella | |

| Goldman Sachs profit soared 45% in the third quarter on a surprise increase in equity-trading revenue and a resurgent investment-banking business. The firm's stock traders recorded their best quarter in more than three years while dealmakers pocketed fees that exceeded estimates across every key business line. The investment bank's gains were tempered by a slide in fixed-income trading, however. But more broadly, investors have been sending Goldman shares higher this year as the bank abandons major parts of its consumer-banking push and positions itself to benefit from a rebound in investment banking. As for the rest of the big banks, the news is equally lovely these days. | |

| |

|

| But the broader stock market got hit Tuesday, as that disappointing outlook from ASML and concern about tighter US restrictions on chip sales spurred a selloff in the industry that's powered the bull market. Equities dropped from all-time highs, with the S&P 500 down almost 1%. The Nasdaq 100 slipped 1.4%. "We worry that valuations are getting stretched, as stocks are near 'priced to perfection'," said Lamar Villere, portfolio manager at Villere & Co. Here's your markets wrap. | |

| |

|

| Rejecting assessments by economists that his proposed policies would bring America's recovery from high inflation to a screeching halt while exploding the deficit, Donald Trump defended his plans for (among other things) high tariffs if he's elected next month. "It's going to have a massive effect, positive effect," Trump, 78, told Bloomberg News Editor-in-Chief John Micklethwait on Tuesday in an interview at the Economic Club of Chicago. Meanwhile, Vice President Kamala Harris, 59, has been calling on Trump to match her disclosure of medical records, which he hasn't done. The Democrat has been hammering the Republican as "unhinged," pointing to his meandering speeches, gaffes and repeated faslehoods—along with his promises to violate the Constitution. | |

| |

| |

|

| All but one of Canada's six biggest lenders now expect the central bank to cut borrowing costs by half a percentage point after inflation cooled by more than expected last month. Toronto-Dominion Bank is now the only major lender to see the odds of either a 25 or 50 basis-point cut next week as a coin flip, following the latest report that showed inflation fell below the Bank of Canada's 2% target for the first time in more than three years. Bank of Nova Scotia, Bank of Montreal and National Bank of Canada meanwhile joined Royal Bank of Canada and Canadian Imperial Bank of Commerce, changing their calls from the previous 25 basis-point forecasts for the Oct. 23 rate decision. | |

| |

|

| The Biden administration warned Israel for a second time this year that it must increase the amount of humanitarian aid making its way into the Gaza Strip if it's to keep receiving American weapons financing, as Tel Aviv fights Hamas in Gaza and Hezbollah in Lebanon while considering a strike on Iran. A previous warning to Israel in April resulted in an uptick in humanitarian aid, but the amount of assistance flowing into Gaza has dropped by more than 50% in the months since, the US said, adding that September's deliveries were the lowest of any month in the past year. More than 42,000 people in Gaza and more than 2,000 people in Lebanon have been killed by Israeli forces, according to Hamas's health ministry and the Lebanese government, respectively. In Gaza, approximately 1.9 million people have been displaced at least once during the year-long war, the United Nations said. The conflict, which has leveled much of Gaza, began when Hamas-led attackers killed 1,200 Israelis in the southern part of the country. | |

| |

|

| A Texas federal judge reviewing Boeing Co.'s plea deal with US prosecutors over two fatal crashes that killed 346 people asked for more information to determine whether he should approve it. Under the agreement, Boeing would pay hundreds of millions of dollars in fines and invest even more in safety improvements. Families of some crash victims said the deal didn't go far enough to hold Boeing accountable. The agreement allows Boeing to avoid a criminal trial after the US Justice Department determined that the company breached a 2021 deferred-prosecution agreement over the fatal crashes. | |

| |

|

| |

| Singapore oil tycoon Lim Oon Kuin, 82, is to be sentenced on Nov. 18 for cheating and forgery in one of the biggest trading scandals to rattle the city-state. In a Singapore court Tuesday, public prosecutor Christopher Ong argued for a 20-year jail sentence for Lim on three counts, including instigating forgery and deceiving HSBC Holdings. The sentencing will be the latest development in the dramatic downfall of the founder of now-defunct oil company Hin Leong Trading. Lim filed for bankruptcy this week after agreeing to pay $3.59 billion to liquidators and HSBC to resolve civil litigation against him and his family.  Lim Oon Kuin, founder of Hin Leong Trading, leaving a courthouse in Singapore on Tuesday. He is to be sentenced on Nov. 18. Photographer: Ore Huiying/Bloomberg | |

| |

| |

| |

| "Spring forward, fall back" is a twice-a-year ritual for roughly 70 countries around the world. In the US, lawmakers are considering measures that would end clock changes and make daylight saving time permanent. That would mean later sunrises and sunsets for half the year. There's evidence the public health effect would be mixed: fewer car accidents and heart attacks caused by time shifts, but maybe a loss of sleep quality for almost everyone in winter. The history of the issue both in the US and around the world shows that no approach is likely to make everybody happy. | |

| |

| |

| Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. | |

| |

No comments:

Post a Comment