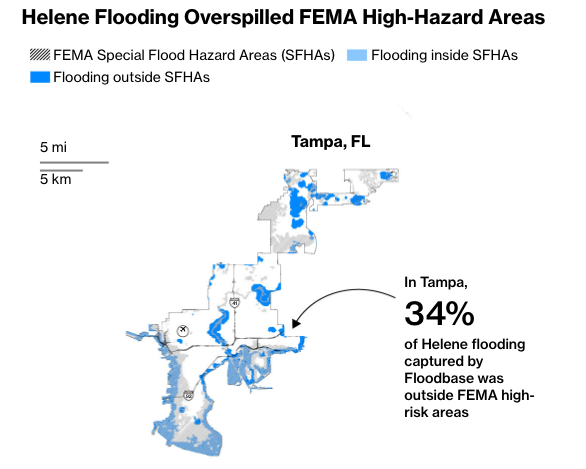

| By Gautam Naik Investors in catastrophe bonds are girding themselves for substantial losses as the combined destructive force of Hurricanes Helene and Milton looks set to trigger payment clauses on a scale not seen in years. Two weeks after Helene unleashed severe floods in more than a dozen states, Florida is bracing itself for the impact of Milton, which regained Category 5 strength on the five-step Saffir-Simpson scale. It's expected to make landfall early on Thursday morning, pushing a wall of water onshore. Millions of people have already fled the coastline, including residents in the densely populated city of Tampa. Even if Milton hits the Tampa metropolitan area as a weaker Category 4 hurricane, it "could lead to one of the biggest reinsurance loss events in history," Florian Steiger, founder and chief executive of Icosa Investments AG, said in an interview. Such a scenario would have the potential to exceed the fallout of Hurricane Ian in 2022, according to Steiger. Ian's impact led to a 10% slump in the Swiss Re Catastrophe Bond Index back in September 2022, sending shockwaves through catastrophe-bond portfolios and feeding an issuance boom as insurers shifted more of the risk on their books over to the capital markets. Tanja Wrosch, head of cat-bond portfolio management at Twelve Capital AG, says if Milton hits Tampa head-on as a major hurricane, catastrophe-bond losses "will be more significant than from Ian." The Swiss asset manager has a $5 billion portfolio, including $3.8 billion of catastrophe bonds. "A big component from Milton will be storm surge — flooding from the ocean," she said.  A mostly deserted street in Ybor City, Tampa, Florida, on Oct. 8. Photographer: Spencer Platt/Getty Images North America Catastrophe bonds, or cat bonds as they're known in the industry, are issued by insurers and reinsurers to provide financial protection against the most severe natural disasters. Investors who buy the bonds stand to make large gains if a predefined event doesn't occur, but can lose a big chunk of their capital if it does. Those losses are used to cover insurance claims. Potential cat-bond losses from Milton and Helene would mark a stark turnaround for a debt market that last year underpinned the most profitable hedge fund strategy, according to an analysis provided by Preqin. The Swiss Re Global Cat Bond Index soared 20% in 2023, trouncing returns across other key debt markets. In 2022, Ian caused about $60 billion of insured losses. Milton may result in $60 billion to $75 billion of damages and losses, with some models showing the total reach as much as $150 billion, Chuck Watson, a disaster modeler at Enki Research, said in an X post. Cat-bond investors may also take a hit from the inland flooding caused by Hurricane Helene. Moody's RMS estimates that US private-market insured losses from Helene will be $8 billion to $14 billion. "Helene was a one-in-a-thousand year rainfall event," said Jonathan Schneyer, director of catastrophe response at CoreLogic Inc., a catastrophe-modeling firm in Irvine, California. "It shows the power of a hurricane further inland." Read the full story and track Hurricane Milton's latest path on Bloomberg.com. By Leslie Kaufman and Leonardo Nicoletti Even before the second megastorm in as many weeks brings devastating floodwaters to the Southeast US, it's already clear that federal flood-risk maps underpinning decisions by millions of American homeowners and businesses are severely out of sync with a new era of climate-intensified disasters. The best-known guide to flood risk in the US is the Federal Emergency Management Agency's set of flood maps, which designate high-hazard areas where homeowners with mortgages must buy flood policies. Those maps — which are now widely and incorrectly used to understand flood risk more broadly — are often out of date and don't focus on the danger of rain-caused flooding, even as rain storms are supercharged by rising temperatures. That means many more Americans are exposed to flood risk than the maps, and a look at flood-insurance requirements, might otherwise suggest. A Bloomberg Green analysis shows discrepancies between the FEMA high-risk areas and four locations hit by Hurricane Helene's floodwaters: Tampa, Florida; Augusta and Valdosta in Georgia; and Greenville, South Carolina. Bloomberg compared FEMA's publicly available flood maps for the four cities with maximum-flooding estimates from Helene provided by Floodbase, a startup that performs flood analysis and sells parametric flood insurance. Not only are federal maps outdated, they're also "not very precise," said Joel Scata, a senior attorney at the Natural Resources Defense Council. "They operate within the 50th percentile of confidence," meaning they have a high degree of uncertainty. "If these flood maps are greatly underestimating the risk — the actual flood risk that people are facing — then we're not building to the standard we should be building to," he said. "And we're not requiring insurance for people who really need it." Read the full story with graphics on Bloomberg.com. |

No comments:

Post a Comment