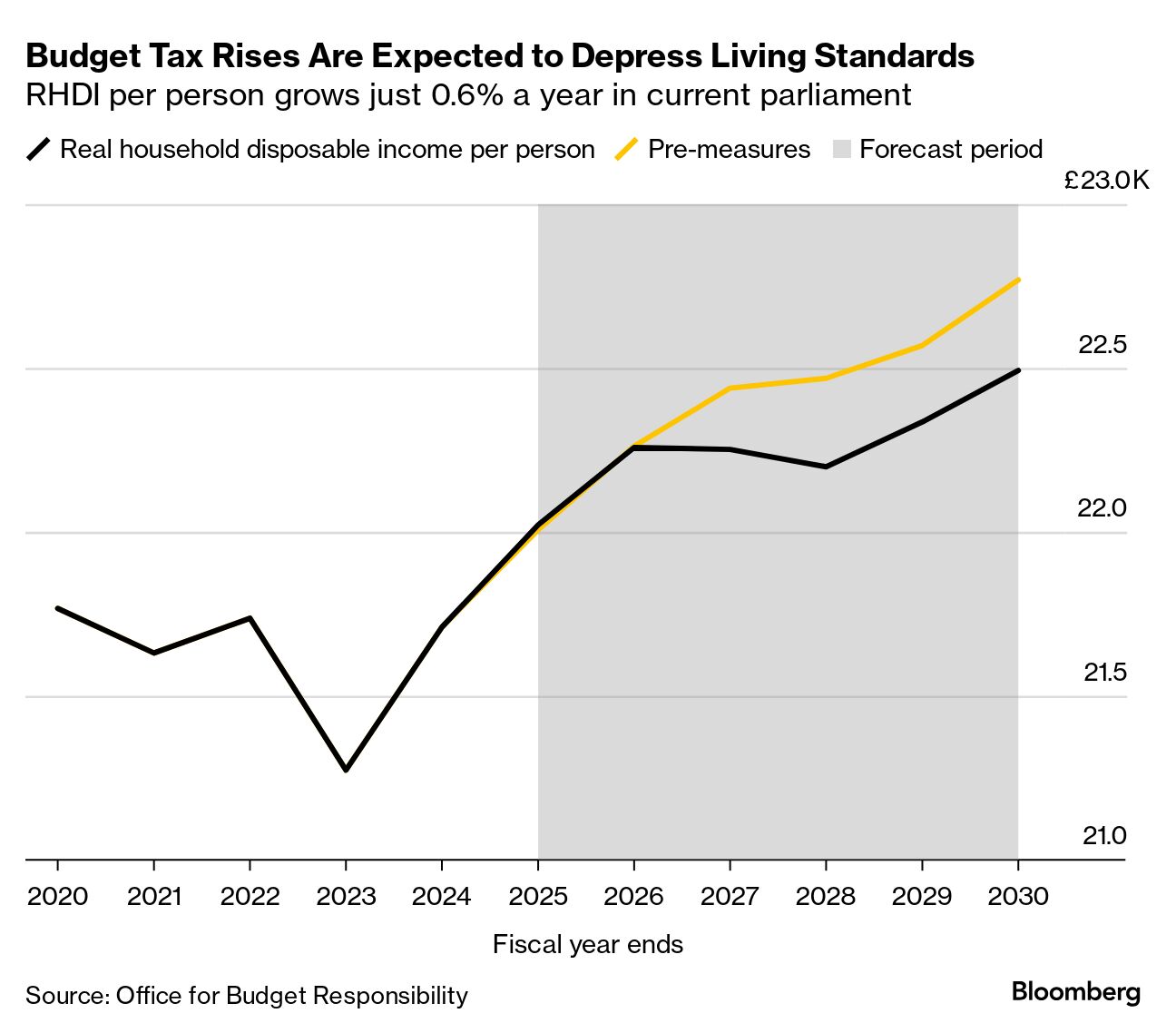

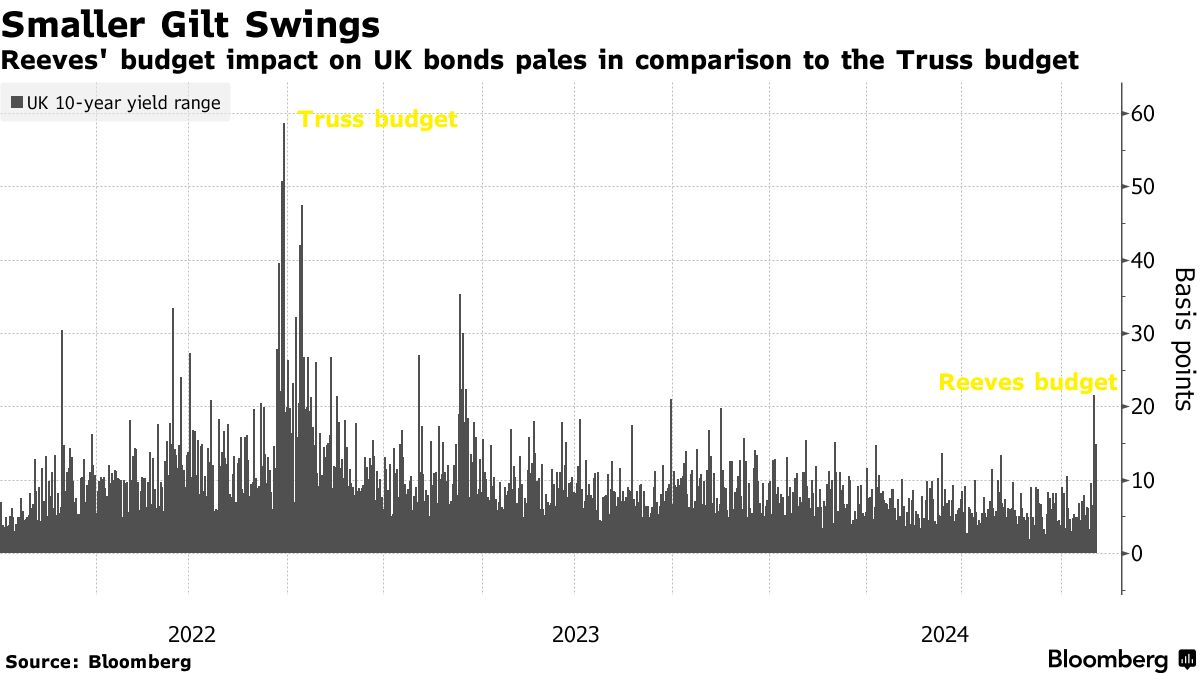

| The government's borrowing costs have gone frankly bonkers, to use a technical term, since yesterday's budget. A typical way of measuring them is to look at the yield on 10-year gilts, which jumped above 4.5% this afternoon to its highest level in nearly a year. As markets digested that move, Chancellor Rachel Reeves appeared on Bloomberg TV and, in an attempt to sound reassuring, insisted that economic and fiscal stability remained Labour's "number one commitment." The government now has more headroom than it was left by the Conservatives, she argued. So why have yields taken off? Firstly, traders are fretting about inflation in the UK and the chances of it staying stubbornly high. Reeves didn't help by shoving up the minimum wage by another 6.7% and making it more costly (through tax hikes) and difficult (through regulation) for businesses to take on staff. Secondly, and relatedly, the prospect of Bank of England rate cuts has now diminished. As recently as last Friday the market expected five quarter-point cuts by the end of next year; now it only anticipates three. Thirdly, Reeves has fired the starting pistol on a spending spree that, according to the Office for Budget Responsibility, will not meaningfully lift growth over the medium- or long-term. The UK's Debt Management Office is set for its second-biggest bond sale ever — but what will the country have to show for it? Investors are not sure. To make matters worse, living standards are likely to stagnate, the Resolution Foundation said, while the Institute for Fiscal Studies warned taxes will have to rise again next year unless the government "gets lucky." The IFS is one of the most respected voices to listen to straight after budget announcements when, let's face it, everyone is desperately trying to make their views heard. Reeves' debut has faced anger from farmers, frustration from medium-sized businesses, but also some relief from very small firms and people in the City. Ultimately, however, the market is king, and today's verdict is looking considerably worse than when the chancellor commended her statement to the House yesterday afternoon. The drama with gilts even pushed the pound lower against its major peers, and mid-cap stocks suffered their worst day since early August.

A little context, however. Today's market movements are still reassuringly dull compared with what happened after the budget delivered by Liz Truss' chancellor Kwasi Kwarteng in 2022. The 10-year yields I referred to above are up around 16 basis points at the point of writing; whereas the infamous "mini budget" triggered a rise of about 100 basis points. And that was after the yield had already soared in the preceding weeks as Truss laid out her plans. Reeves' budget is bruised, but at least it hasn't prompted an emergency intervention from Threadneedle Street (yet). Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment