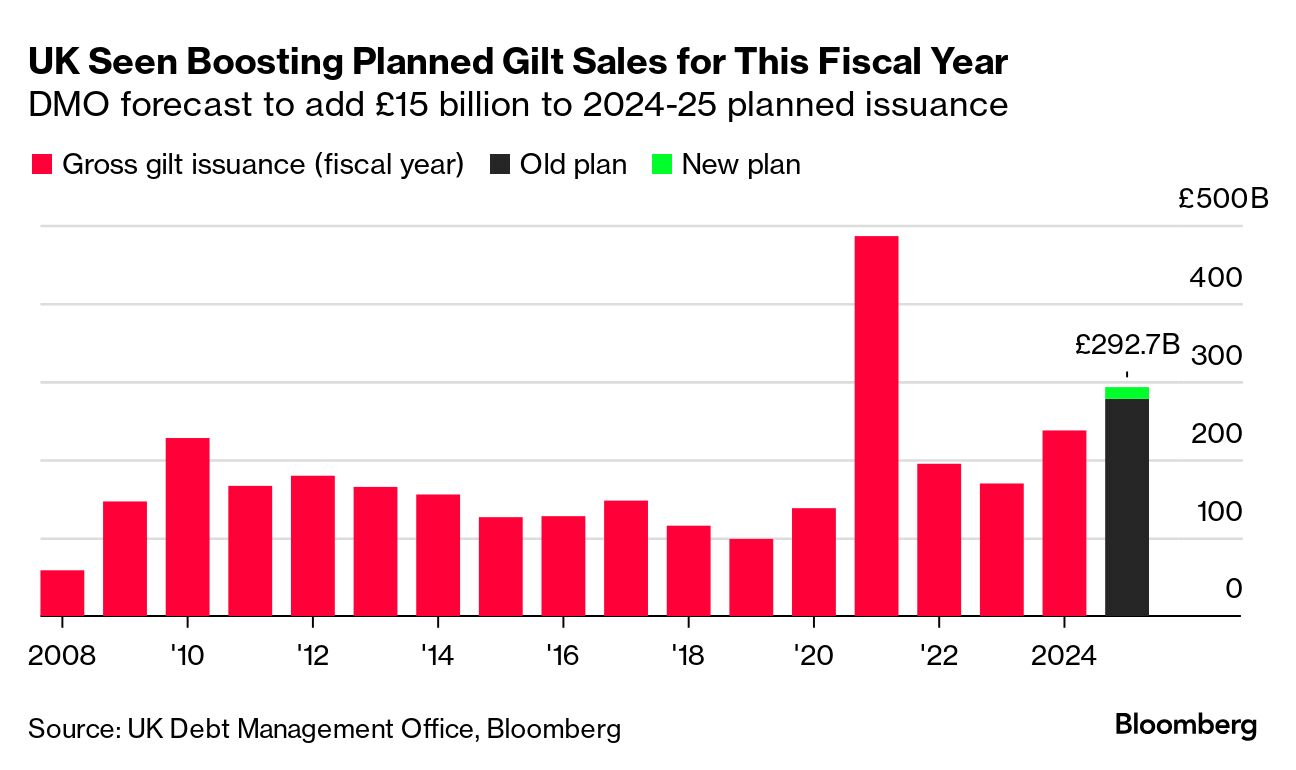

| Can a pitch be over-rolled? It's typical to get lots of expectation management ahead of large fiscal events. Perhaps it's therefore to be expected that a budget compared by the chancellor to some of the most significant ones in Labour history has had the heaviest pitch-rolling in history, too. But with such a long wait between Labour's election win and their first budget, the pitch is so well-rolled that many of us feel flattened. Just look at business confidence – this survey last week showed private sector growth at its lowest in 11 months. UK political editor Alex Wickham is not mincing his words when he describes the stakes, calling it a: "budget that will define UK politics for the rest of the decade." The prime minister was out today with his heavy roller, giving a speech in Birmingham that warned about the "tough decisions" to come. I'm not going to point out that the last time he gave such a set-piece speech (in the Downing Street rose garden) things afterwards went a bit south. Oh, OK I have. But if we want this country's reputation to stabilize, we have to hope this speech doesn't suffer a similar fate. There's a lot we don't know: we don't know how folk will react to a suspected manifesto-breaking tax hike; nor what the markets will do about changes to borrowing rules. Today we have a story about how bond traders expect one of the "biggest borrowing plans on record," which could take total borrowing to £293 billion — the highest for any year other than 2020, which was skewed by the pandemic. That said, our reporters say investors and strategists are confident the market will cope. It's telling that both Labour and Tory strategists regard this budget – and how it plays out – as key to the next election. The context also appears to be getting more fraught, and the Bloomberg site today is chocker with stories of big behemoth corporations rolling out bad news. Shares in Philips – makers of electric razors and other things – have dropped after the company slashed its forecast sales growth on tepid demand from China after new rules there have hit the company's ability to trade. VW in Germany has announced it is closing at least three factories and will cut wages by 10%. A fortnight ago we ran this scoop that one of our own car manufacturers was in trouble: Stellantis, which has been in talks with the government about its UK zero-emission vehicle sales mandate, which it says is unsustainable without government support. Perhaps each is sui generis, but these stories suggest storm clouds gathering for companies that may feel like the last thing they need is for Labour to increase employer's National Insurance contributions, as rumored. The increase in government borrowing could also put pressure on the Bank of England to slow down their program of interest rate reductions, also affecting big business. As well as this, the other great unknown is the possible election of Donald Trump and the effect he could have on the global economy – his tariff agenda at its most extreme would impact UK Plc substantially. In dispatches from his rally last night in Madison Square Garden, our reporters showed Team Trump at its most incendiary, but also its most bullish.  A sign for Trump's Madison Square Garden rally in New York Photographer: ANGELA WEISS/AFP If you want to feel like you were there, here's the definitive analysis, from our columnist Timothy L. O'Brien. "From a strategic sense, it made no sense for Trump to be there rather than in one of the seven swing states that will decide the election's outcome," he wrote. "But Trump isn't a strategist. Never was, never will be. Strategy didn't inform his visit. Neediness and media exposure certainly did, however. Trump still wants New York to love and accept him." The budget may be being billed as a major change for the UK, but what happens next week in the US will be just as important. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment