| The rule of thumb when gauging geopolitical risk tends to be brutally simple: Will it affect the supply of oil? If the answer is "yes," as in the wake of the 1973 Yom Kippur War or Saddam Hussein's 1990 invasion of Kuwait, then it matters greatly to world markets. If the answer is "no," it can be safely ignored. And the last 48 hours have borne out the maxim beautifully. Now that the Jewish high holidays have drawn to a close, the risk of an Israeli military retaliation against Iran is acute. (It hasn't happened at the time of writing.) That Israel will do something is a given. It's exactly what it does that matters. Shortly after the US stock market closed Monday, the Washington Post, impeccably well-briefed by the US foreign policy establishment, ran a story under this headline: Netanyahu Tells U.S. That Israel Will Strike Iranian Military, Not Nuclear Or Oil, Targets, Officials Say

The market responded exactly in the way the cynical adage would have predicted. This is how futures in West Texas Intermediate crude have traded since the market opened Monday: In the absence of any pushback against the story in the 24 hours since it published, traders are working on the assumption that it's true, and that escalating war doesn't matter too much as it will leave refineries and pipelines untouched. Without a galvanizing shock in the Middle East, there doesn't seem to be much to prop up oil — unless China can successfully stage a resurgence. On which subject... The market's certainty about additional Chinese government stimulus is unwavering. The extent of the work required to jump-start the economy is not in doubt, nor is the prognosis. The present weight of investors' expectations isn't lessened by government officials' reassurances after the central bank and Politburo coordinated messaging on supporting economic recovery. Saturday's Ministry of Finance press conference was treated as another "boring" reassurance, nothing like the coveted necessary heavy lifting. Instead, Finance Minister Lan Fo'an detailed measures to help local government deal with mounting debt risks, which the International Monetary Fund says fuel deflationary woes. Chinese investors weren't inspired, and the CSI 300 index of stocks quoted in Shanghai and Shenzhen snapped back again. Global investors buying stocks that stand to benefit from Chinese growth are showing much the same pattern. This chart shows MSCI's index of the 100 stocks in the World index with the most exposure to China relative to MSCI World, as well as the CSI 300. In China, the excitement is reversing: elsewhere, China-exposed stocks are back to flatlining:  Is this classic buyer's remorse or profit-taking as traders finally have the chance to make money after a prolonged period of depressing performance? It could be either, or a combination. BCA Research's analysts Jing Sima and Arthur Budaghyan argue that it's probable that Chinese share prices have bottomed relative to the emerging markets and global benchmarks, possibly even in absolute terms. They argue that the recent volatility will persist in coming months: The base case is that the economy will fail to recover quickly. Hence, volatility-adjusted equity returns will be poor. That is why we remain cautious on Chinese stocks in absolute terms for now. In relative terms, we maintain an overweight position on Chinese onshore equities and a neutral stance on investable/offshore stocks in global and EM equity portfolios.

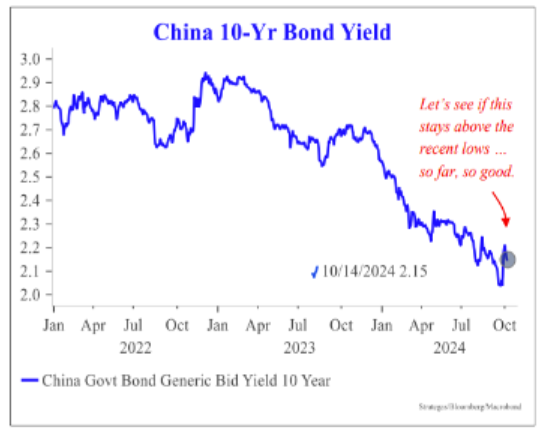

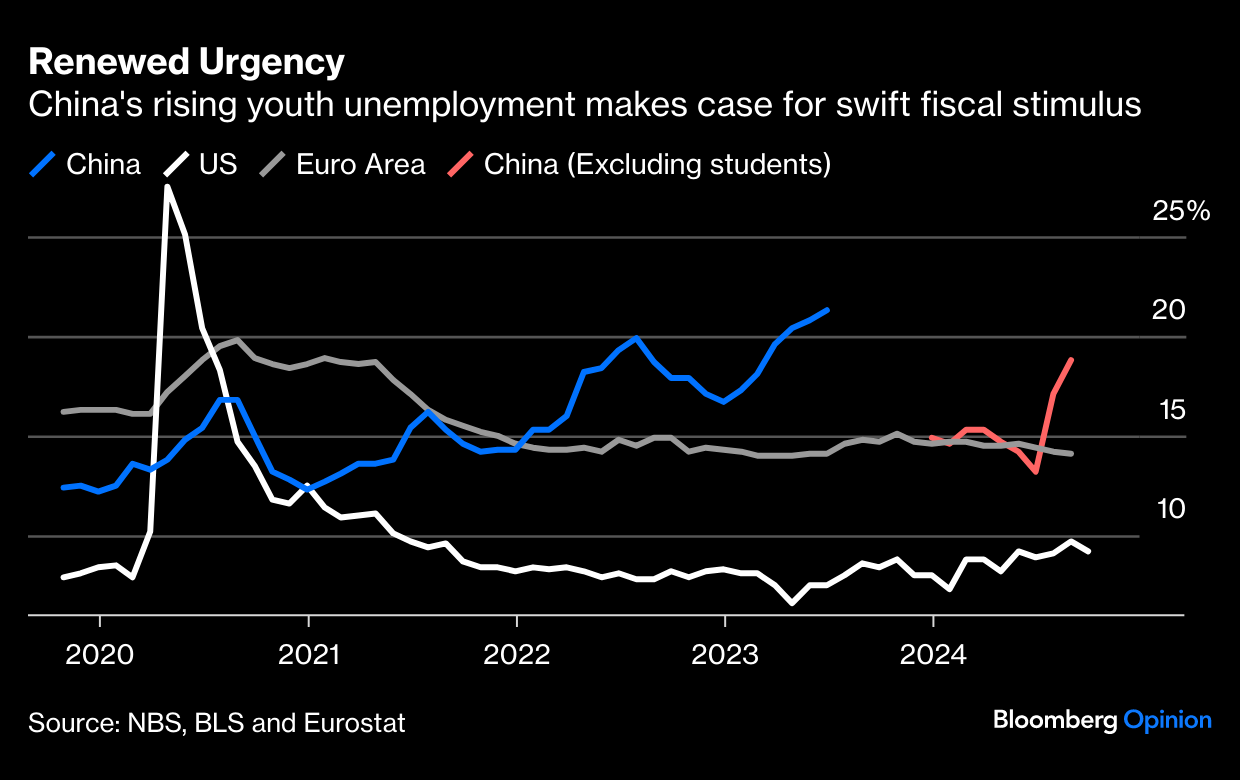

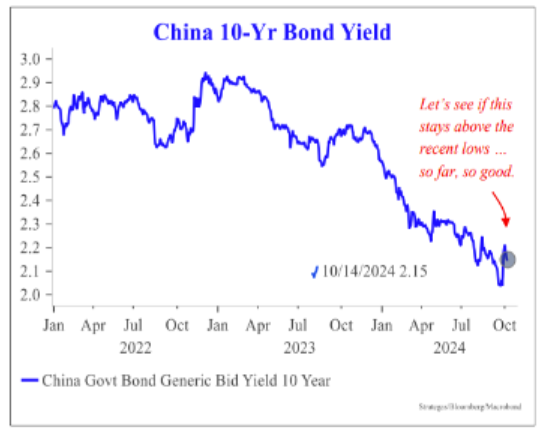

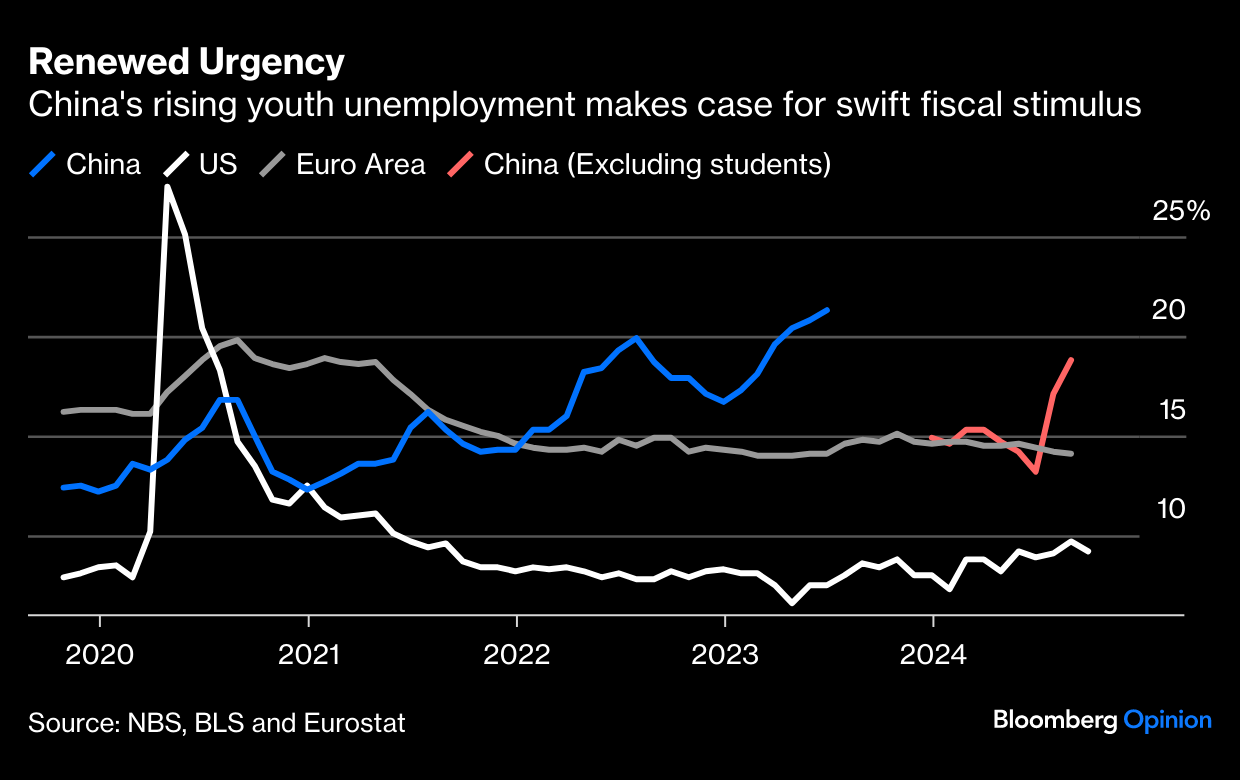

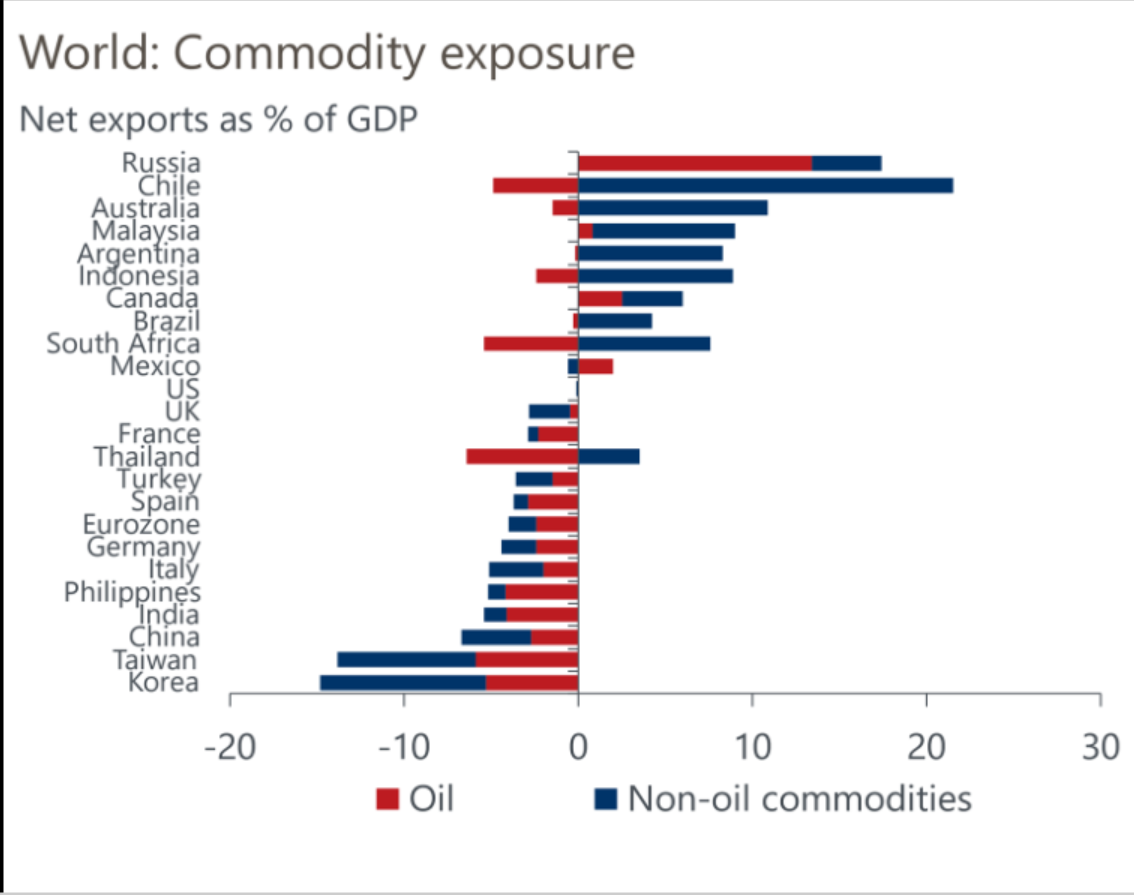

However, Strategas' Don Rissmiller believes the wait-and-see approach could be justified by a constellation of factors, including the US election, ongoing labor actions, weather-related disruptions in key labor market data, and heightened geopolitical tensions. He adds that China's deflation fears are adding to the list of items causing firms to be careful when taking on new commitments, and are reflected in the continuing very low level of 10-year Chinese bond yields. Beijing's monetary easing is helpful, but ultimately, a fiscal boost will be necessary if the 10-year yield is to steer clear of the 2% mark it nearly breached a few weeks ago:  A meeting of China's parliament, which approves national budget changes, is the next opportunity for the government to show investors a clear path of support for the economy. Last year, this meeting ended up increasing the fiscal deficit to 3.8% from 3%, so it's not unreasonable to hope for major anouncements on spending — but recent disappointments remain fresh. Another letdown would not be healthy, but investors appear ready to accommodate an approach that addresses deep-seated structural imbalances. Rising youth unemployment, especially with university graduates set to enter the job market in coming months, adds to the Communist Party's need to jolt the economy back into life. At present, Chinese youth unemployment is running at much higher levels than in the US or Europe:  Getting the economy back on track has effects far beyond China, and the recent optimism has spurred a mini rally in industrial commodities. Oxford Economics' Innes McFee identifies winners and losers as Beijing's slump weighs on commodities: Big net commodity exporters such as Russia, Chile, and Australia would be losers, but most advanced economies and some key Asian economies, such as South Korea and India, would be gainers via this channel. The US would be in a roughly neutral position. Notably, economies like Australia, Malaysia, and Russia look significantly at risk through both channels.

McFee provides this chart to illustrate the exposure: As it stands, if China can pull itself back into gear, the US and Europe stand to lose out. Commodity producers from Russia to Latin America would benefit. China doesn't make its policy in a vacuum. —Richard Abbey Having given all due credit to a scoop by one of our competitors, the Washington Post, I now draw attention to a very important interview with Donald Trump — and not just because it was conducted by a British financial journalist called John who happens to be my boss. It was the first time the former president had spoken to a skeptical journalist in a month, hosted by the Economic Club of Chicago. He was asked the questions that Points of Return needed asked, and his answers were always revealing and sometimes enlightening. The key is to understand what Trump means by tariffs and what he hopes to achieve from them. He's not backing down from the protectionist agenda, describing tariff as "the most beautiful word in the dictionary." But one Micklethwait question produced this response: "No, there are no tariffs — all you have to do is build your plant in the United States and you don't have any tariffs. That's what I want." Tellingly, the Trump campaign pumped up this moment on social media. The message he was sending to Xi Jinping (a friend of his, he told the audience) was that the US was open for foreign direct investment (FDI). The tariffs are to force companies to relocate to American shores — and he's proposing to set them far higher than in his first administration to make sure they come. "The higher the tariff, the more likely the company would come into the United States," he said. "So high, so horrible, so obnoxious." A 10% tariff wouldn't be persuasive enough, he argued, but 50% might. Earlier this year, after Trump barely mentioned tariffs during his speech at the Republican National Convention, Points of Return quoted the idea floated by Marko Papic of BCA Research that Trump was angling to make some sort of Nixonian grand bargain with China, rather than try to be a latter-day McKinley and fight and win a trade war. That message now seems clearer. Trump is no Richard Nixon, and any mercantilist settlement like this will be difficult to broker, with benefits a long time in the future. Whether he really has the diplomatic skills to pull this off is wide open to question. But Papic commented that he does have a political opportunity. The Democrats, he points out, "are afraid of being called weak on trade." Trump, on the other hand, has no such concerns. As he himself has said, his supporters will support him no matter what he does. As such, his domestic political maneuvering room is enormous.

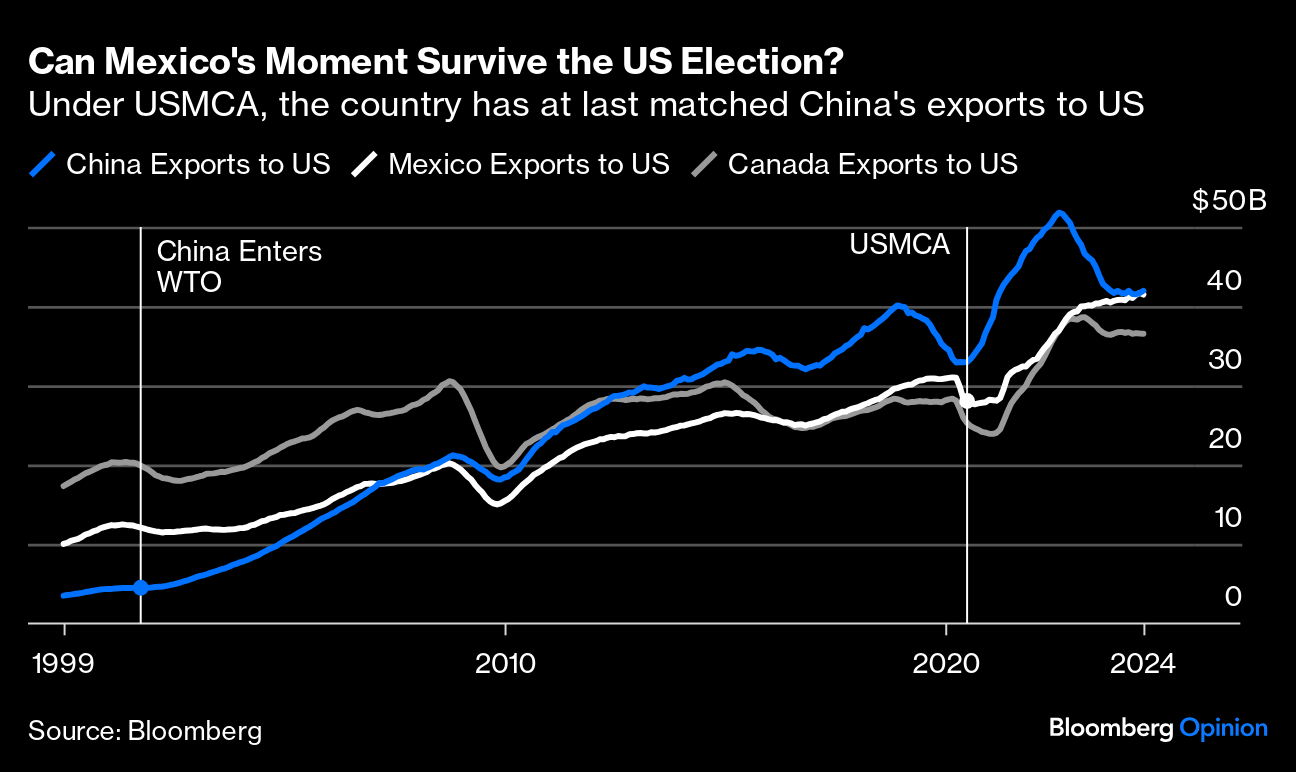

Papic backs him to "land the plane on tariffs," although it's easy — and scary — to imagine that plane crashing. But one implication is that the US might actually help China sort out its economy (wisely or not). Europe risks being caught in the middle. The biggest losers are likely to be the economies that stood to benefit from "near-shoring," as companies relocated under political pressure from China to countries like Vietnam and particularly Mexico. For all the abuse that the US's southern neighbor has taken over the alleged "sucking sound" as it took American jobs under Nafta (the North American Free Trade Agreement), it never benefited as much as hoped; China's 2001 entry to the World Trade Organization soon swamped it. In the last two years, under the new US-Mexico-Canada Agreement, Mexican imports have finally risen to match China's. It's a huge breakthrough. The chart below shows 12-month moving averages for legibility to avoid big seasonal effects: Most trade agreements are indefinite. The USMCA must be renegotiated in 2026. A Trump administration would have leverage to make near-shoring harder. This may or may not end up creating more American jobs; but it's a safer bet that it will create yet another obstacle to Mexican growth. We have another Trump playlist. Monday evening's strange town hall in Pennsylvania, in which the Republican presidential candidate finished taking questions early and then danced on stage for half an hour, gave us some more Trump songs to savor. (For those that his DJs have wanted to play, but faced opposition from the artists, look here). The music playing while Trump swayed gently from side to side was eclectic: Nothing Compares 2U by Sinead O'Connor (who wasn't a great Trump fan), "Ave Maria," Hallelujah by Jeff Buckley, his old standard YMCA by the Village People, Guns N' Roses' November Rain, Oliver Anthony's Rich Men North of Richmond, An American Trilogy by Elvis Presley, Barbra Streisand's version of Memory from Andrew Lloyd Webber's Cats, It's a Man's Man's Man's World by Luciano Pavarotti and James Brown, Con te Partiro ("Time to Say Goodbye") by Andrea Bocelli. It's hard to find a theme but the former president has a great DJ. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Allison Schrager: Jerome Powell Is Not the Greatest Fed Chair Ever

- Daniel Moss: China Should Seize Control of the Economic Narrative

- Marcus Ashworth: ECB Should Shock and Awe With Half-Point Rate Cut

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment