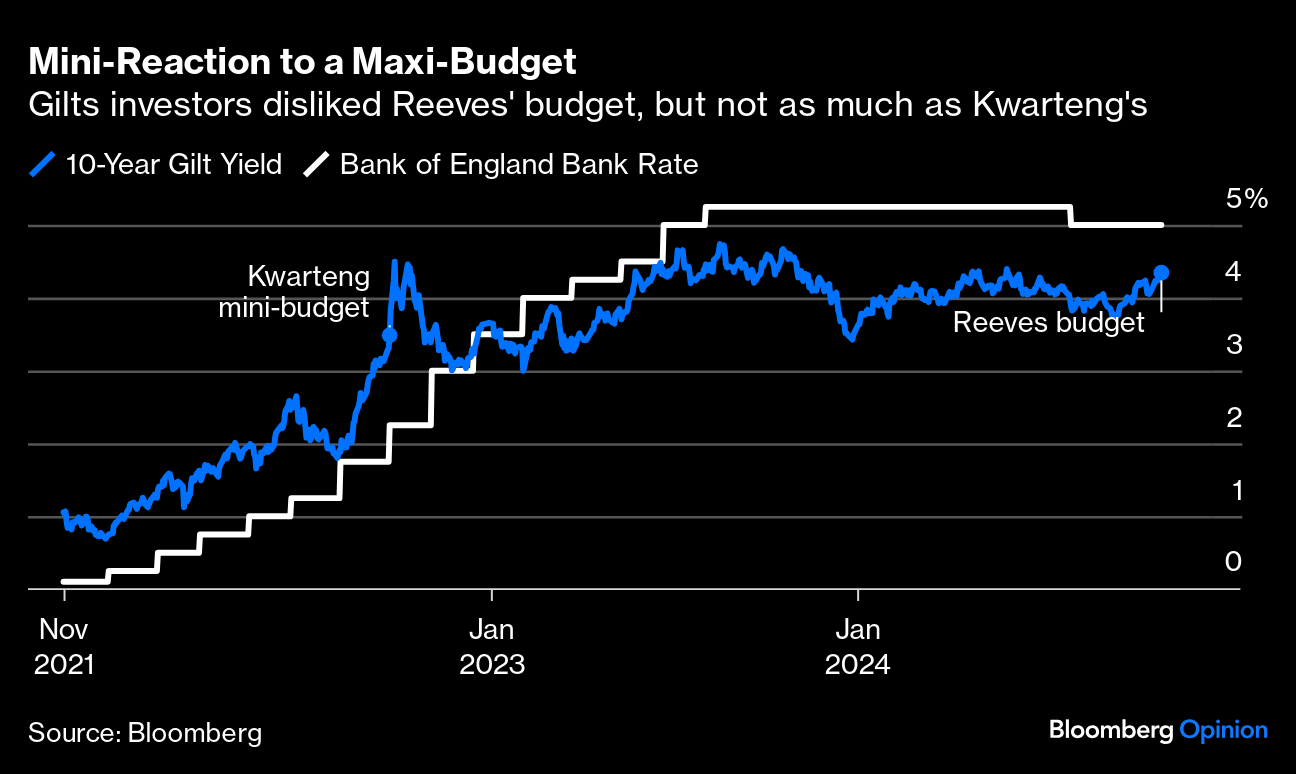

| The UK's annual budget wasn't supposed to be fun any more. What takes the US months of protracted negotiations, votes, amendments and threatened amendments, Britain gets done in one speech lasting about an hour. The chancellor announces, point by point, all the changes in taxation and spending for the next financial year. No leaks are allowed; a chancellor once had to resign just for telling a reporter about tobacco tax on his way to the House of Commons. Guidance was non-existent. Treasury press officers would stand in newsrooms, handing out printed copies after each section of the speech was completed; nobody could know anything before MPs did. Financial news hacks then stayed at their typewriters until midnight, deperately churning out copy as the hours ticked by. Oh yes, I remember it well. Communication is more sophisticated these days. Nobody wants to repeat the reception for Kwasi Kwarteng's "mini-budget" of 2022, which led in short order to a gilts crisis and the resignation of Liz Truss as prime minister. Labour governments have more need to be transparent with markets that are inclined not to trust them. So Wednesday's maiden budget by Rachel Reeves packed no surprises. Everyone knew she would loosen the fiscal rules to invest more, and hike taxes — a classic "tax and spend" budget. That's what happened. Taxes will rise by £40 billion ($51.8 billion) while borrowing will increase by £140 billion more over the next five years than previously advertised. What's surprising is the response. Gilt yields fell while Reeves was speaking, suggesting that the bond vigilantes were comfortable. Minutes after she finished, they surged. The 10-year gilt yield suddenly bumped up by almost 20 basis points to 4.4%. The larger continental European economies also saw a big bump in yields, although far more muted than in gilts: At its peak, the 10-year gilt yield was its highest in 11 months. This was a sharp reaction, ostensibly in response to little new information, even if it seemed muted compared to Kwarteng's budget two years ago. These advertised tax hikes caused less alarm than those surprising tax cuts: So why such a strong reaction, so late in the day? Britain's budgetary traditions haven't faded that much. The Office for Budget Responsibility didn't publish its economic and fiscal outlook until the minute after Reeves sat down. She didn't repeat Kwarteng's deadly mistake of not passing the measures by the government's fiscal watchdog, but it was critical, forecasting that Reeves would spend billions for sluggish growth. John Higgins of Capital Economics drew this lesson: Just because you don't sideline the Office for Budget Responsibility (OBR) or opt for huge unfunded tax cuts doesn't mean investors will be indifferent to your plans — especially if they are on a huge scale.

Concerns about extra borrowing fed into fears about monetary policy, as it could revive inflation and force the Bank of England to abandon planned rate cuts. Ever since the BOE's surprise cut in July, the market has discounted a steady easing campaign ahead. Overnight index swaps, as analyzed by the Bloomberg World Interest Rate Probabilities function, suggest the expected Bank Rate after the BOE's February meeting is now its highest since then. Effectively one 25-basis-point cut has been canceled over the last month: Again, the big rise took place after her speech, when the OBR's assessment came out. If the Bank can no longer be so lenient, then bond yields will have to rise. It's possible that this is an overreaction, as Reeves does have some fiscal room. Freya Beamish of TSLombard suggests: The fiscal rules, even expanded as they are, still leave a lot to be desired, giving the impression that fiscal headroom is a lot tighter than it actually is. Investors can take advantage of the psychological biases flooding out of major institutions and think tanks here.

It's also perhaps fair to say that Reeves has played a bad hand about as well as she could. But it's a really bad hand. Meanwhile in the US, Janet Yellen — likely nearing the end of her term whoever wins the election — plays her own very bad hand like a master. Wednesday brought the quarterly refunding announcement, in which the govenrment lays out its borrowing plans. This was a flashpoint with the markets several times last year, but Yellen announced that auctions of longer-term bonds will be unchanged compared to the previous quarter, and also predicted that there wouldn't be a need to increase the amount of debt it auctions "for the next several quarters." That runs counter to the belief animating the "Trump Trade" that the Treasury will soon have to borrow a lot more. It might even suggest that the Treasury believes in a Harris victory. It also shows that the Treasury is, responsibly, minimizing the risk of a market disruption when political uncertainty is high. Tom Tzitzouris of Strategas Research Partners said: The Treasury has punted on stabilizing the nation's financing, and in the near-term, likely helped to slow some of the recent losses in Treasuries and MBS. Much like most of the market, we anticipated the Treasury not rocking the boat a week before the election.

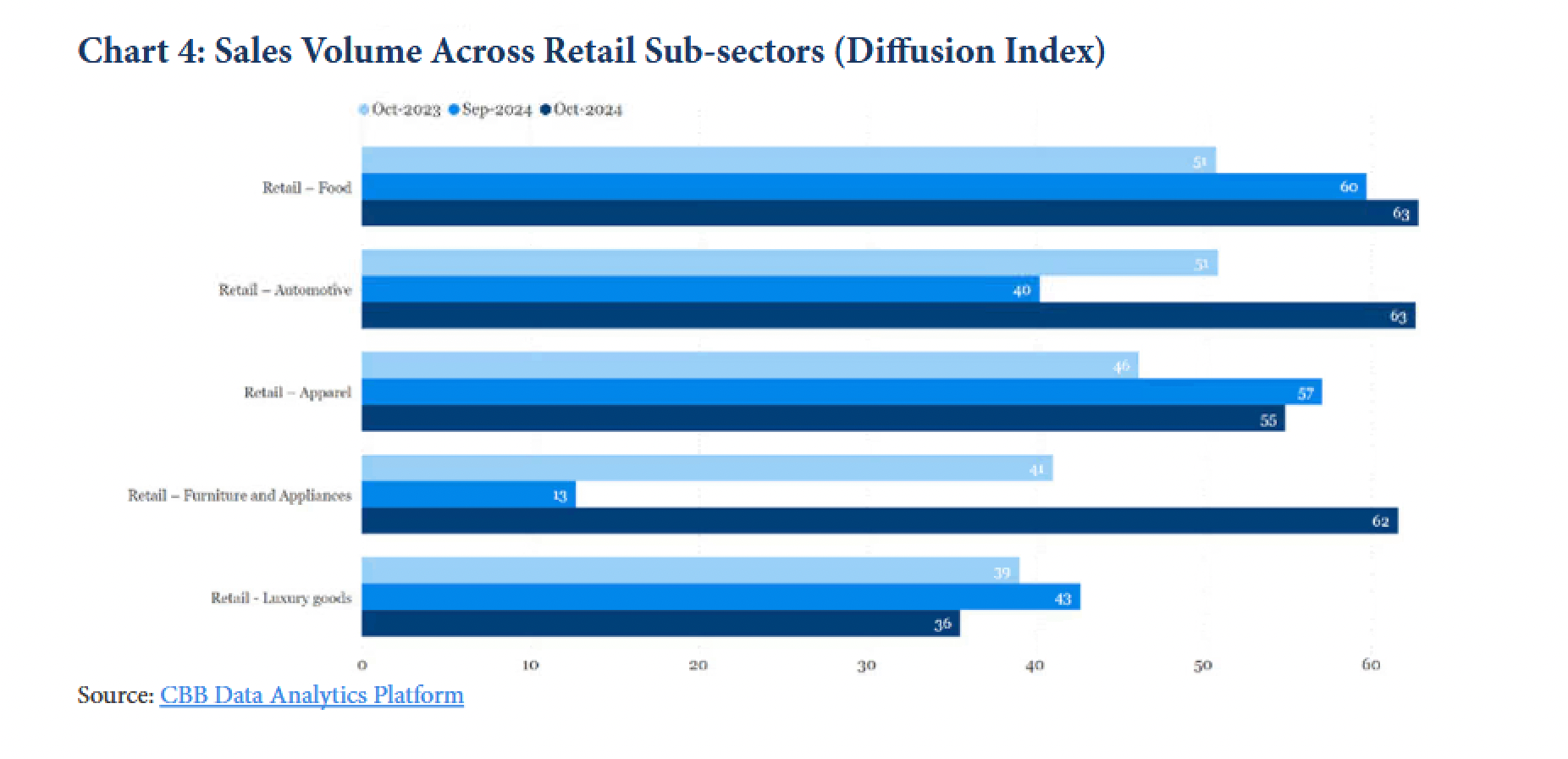

But even if Yellen kept Treasuries broadly stable in a time of extreme political sensitivity, the pattern of ebbing confidence is clear and concerning. Michael Howell of CrossBorder Capital in London points to the ratio of gold to Treasury bonds to show a "Trump Effect" crushing bonds: This run on confidence, the worst since the 2011 debt ceiling crisis that culminated in a downgrade for Treasury's credit rating, has happened despite the jumbo cut of 50 basis points to the fed funds rate last month, which should have been directly supportive. If we compare the ETFs with the tickers GLD and TLT, the most widely held trackers of the two asset classes, we see that the trend has been uninterrupted since the Fed started to hike rates in 2022, and now seems to be in overdrive: Note also that this particular version of the Trump Trade doesn't correlate very strongly with his chances in the election. As Bloomberg's Cameron Crise points out, the economic data is more than enough to explain what's happening to bonds. The fog around Beijing's fiscal stimulus is slowly dissipating. Investors are beginning to believe that the economic rescue mission entails putting a floor under a potential crisis, rather than driving a new wave of growth. The challenge has never been in doubt — rather, it's about the effectiveness and timeliness of the firepower to be deployed. If reports are anything to be believed, a fiscal package of about $1.4 trillion, or 10 trillion yuan, falls below the initial estimates of up to $3 trillion as what's required to make a meaningful impact on the Chinese economy. Given the whatever-it-takes stance that officials signaled before the Golden Week break, investors shouldn't be dismissive of the package, even if it falls short of what they they think necessary. With the rally in Chinese equities long halted, it's possible that investors are just biding their time. Both the CSI 300 index of stocks quoted in Shanghai and Shenzhen, and the offshore "red-chip" companies in Hong Kong's Hang Seng China Enterprises Index have been going sideways: There's a similar pattern in the bond market. News of the stimulus helped arrest Chinese 10-year yields' long-running decline, but the trend remains downward. Those yields are more than two percentage points below equivalent Treasuries. Coming out of the worst of the pandemic in early 2021, if not the restrictions that accompanied it, Chinese yields were two percentage points higher: Even without the government pressing heavily on the accelerator, the economy is recovering. That shows up in the latest PMI numbers, for October. Further, the research group China Beige Book shows that consumer spending rose in October, with a more active Golden Week than in 2023, suggesting that the splurge of reforms announced before the break had an impact. Among the consumer sectors, hospitality firms saw the strongest sales expansion while chain restaurants also improved: The troubled property sector remains in the doldrums, however, despite the extra policy support, with firms reporting another monthly slowdown in sales prices. It has had a protracted slump that cannot be reversed overnight, but the point for policymakers is to put a floor under the sector. That means that evidence reported by China Beige Book that interest rates are actually rising, despite the central bank's attempt to ease them, is disconcerting: This is a risk, if stimulus turns out to simply mean more money for the supply side. October's credit data had a surprise: Interest rates went up, not down, per firms on the ground. More evidence that Beijing's credit transmission mechanism is not working as quickly as assumed — or possibly at all. Investors should remain skeptical of monetary easing boosting the economy.

It will garner little attention given next week's other events, but the National People's Congress Standing Committee will hold a meeting where the 10 trillion yuan fiscal boost could be approved. The package is expected to include 6 trillion yuan for debt replacement for local governments and 4 trillion yuan earmarked for buying property. If these impressive figures are passed, their overall impact could still be limited.  Stimulus so far may fall short of what China's economy needs. Photographer: Raul Ariano/Bloomberg The debt exchange amount barely scratches the surface of overall local credit overhang. Bloomberg Economics' David Qu and Eric Zhu argue that it's inadequate, given that local government financing vehicles have massive "hidden debt." The IMF estimate is 60 trillion yuan. Regardless, Gavekal Research's Andrew Batson believes these efforts do show a new urgency: To keep Local Government Financing Vehicles from defaulting, local governments need to prioritize supporting these hidden debts. One way they do that is by delaying other payments, creating another implicit debt that does not accumulate interest. LGFVs are, in turn, delaying payments to other companies, adding to a liquidity squeeze for the private sector. Any fiscal expansion would get diverted to dealing with these debt burdens.

Investors' frustration is justified. However, Chinese officials know they have to get back on track, especially as the US election could further damage their economic prospects, as Opinion colleague Shuli Ren points out here. It makes them prepare for a scenario of heightened antagonism in the form of increased tariffs. There are pressing matters all around that require urgent response, but getting it right in a timely fashion matters more. —Richard Abbey More on Madison Square Garden. Maybe this is ironic, or appropriate, but on Wednesday the arena followed up Sunday's epic Donald Trump rally with an act from another returning elderly New Yorker: Cyndi Lauper's Girls Just Wanna Have Fun tour. Lauper is now 73, five years younger than Trump. If you want an illustration of the US gender gap, and frustration with the way the older generation won't relinquish power, MSG just staged it.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marcus Ashworth: Gilt Market Gives Reeves the Benefit of the Doubt

- James Stavridis: North Korea Troop Deal Exposes Putin's Weakness

- Adrian Wooldridge: Masayoshi Son May Be the Oddest of the Oddball Billionaires

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment