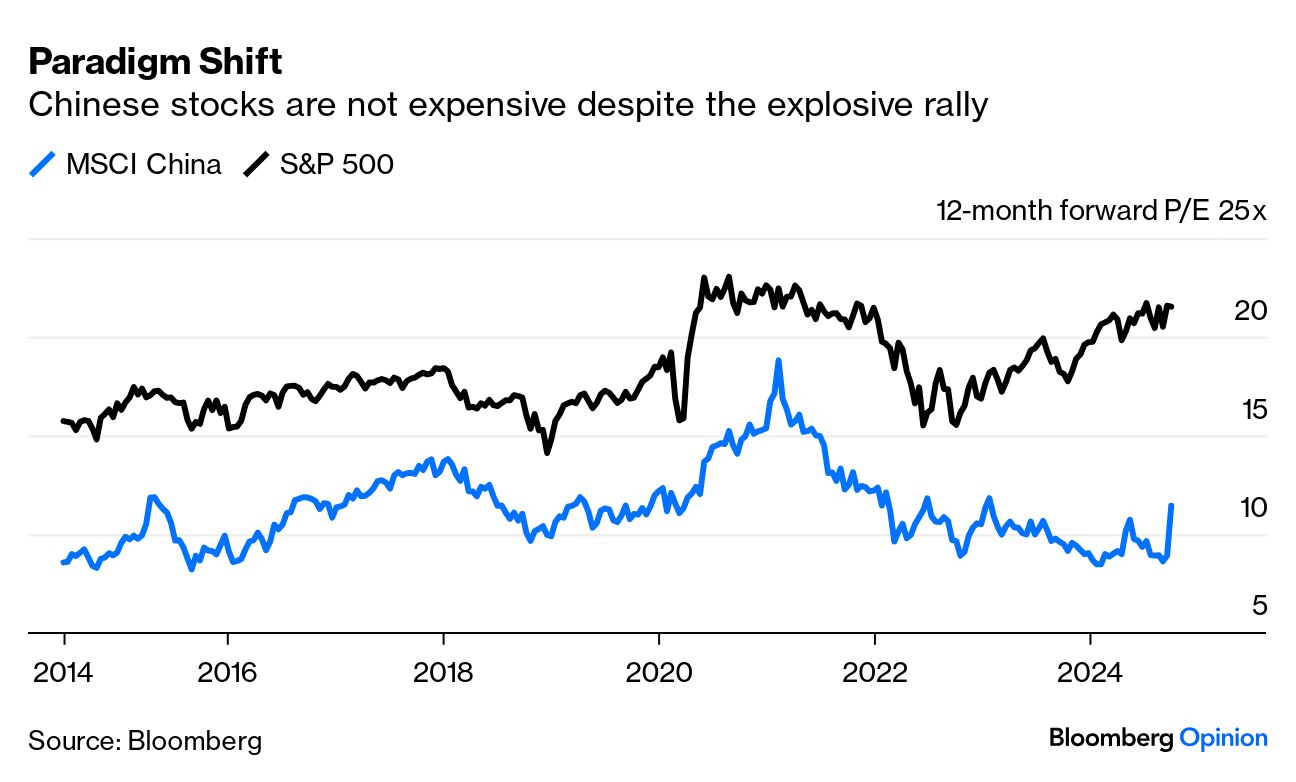

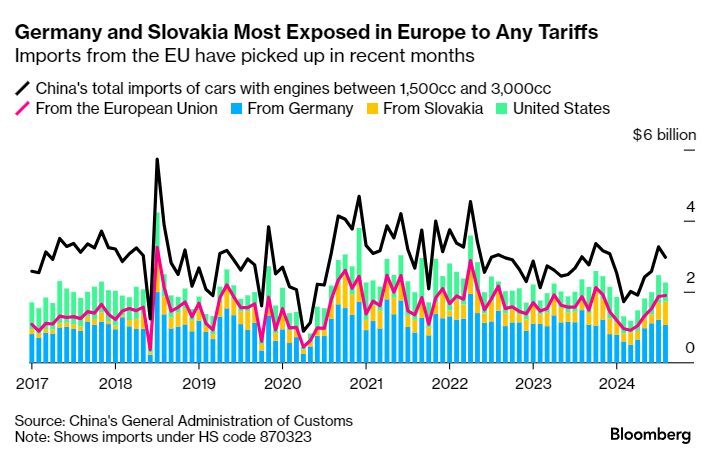

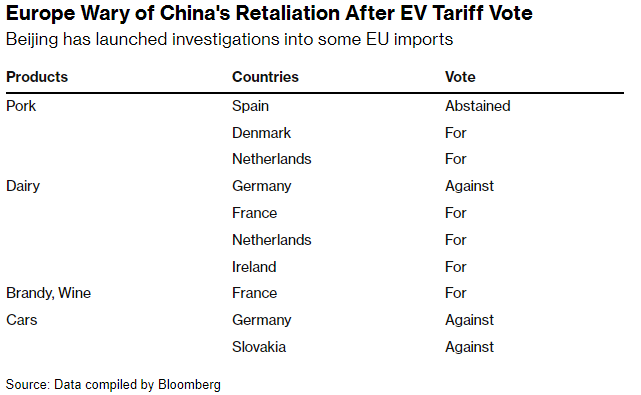

| Welcome to Next China. Each week, we take you inside the economic giant that is China. To subscribe to this newsletter directly, click here. This week, we delve into China's equities rally, the dispute with the EU over electric vehicles and take a peek over the Great Firewall. Hi, I'm Allen Wan in Shanghai. With the Chinese stock market soaring over the past few weeks on President Xi Jinping's stimulus extravaganza and then coughing up some big gains, I can't help but feel a bit of déjà vu. I was a Bloomberg stocks editor during the boom and bust of 2015, when the Shanghai Composite Index soared above the 5,000 level in June only to tumble more than 40% by late August. The question on everybody's minds now is whether the world-beating rally this time around is sustainable as a growing list of strategists revise their bearish forecasts. Or are we back to that fateful summer when Mad Max: Fury Road was on big screens and stocks were suffering through their own post-apocalyptic nightmare that would lead to a lost decade? The stakes are pretty high this time around. With the world's second-biggest economy in the deflationary doldrums and the government in danger of missing its growth target of about 5% this year, a buoyant stock market would provide a welcome jolt of confidence in the absence of rising incomes and property values. One reason for optimism now is stocks look cheaper. At the peak in 2015, the Shanghai gauge traded at nearly twice its five-year average. Tech stocks traded at an average of 220 times reported profits even before the peak, blowing away US counterparts at the height of the dot-com bubble in 2000. "Chinese equities are still not expensive despite the recent melt-up," Bloomberg Opinion columnist Shuli Ren wrote recently. Goldman Sachs this week upgraded its call on Chinese stocks to overweight, while highlighting cheap valuations. A further 15-20% gain is possible, if the authorities deliver on their policy measures, the bank's strategists wrote. The extent of the help coming from on high is unclear. A government briefing last month rolling out a host of measures got the excitement started but another one this week that stopped short of offering a large degree of support disappointed investors. Yet another press conference planned for Saturday by the Ministry of Finance has spurred bets that officials will ride to the rescue. Investors and analysts expect China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus at the briefing. One trader I used to talk to frequently during those wild days back in 2015 told me this stocks rally could have legs if the government announces sizeable stimulus this weekend. He worried, though, that depending too much on what officials roll out isn't exactly a healthy way to develop a market. What We're Reading, Listening to and Watching: The European Union's decision to hit Chinese electric vehicles with tariffs has put the ball in Beijing's court. Judging by past performance, Beijing will retaliate. The only questions are when and to what degree. China already said this week it would probe whether to boost tariffs on imports of Europe's large-engine vehicles and start collecting levies on brandy. It has also said it would investigate pork and dairy products. That gives Beijing a range of options that would affect different parts of Europe. Those moves came after the European Union decided to impose tariffs of as high as 45% on imports of China's EVs, the biggest escalation in trade tensions between the two sides in years. Ten countries, including Italy, France and Poland, voted for the tariffs, while Germany pushed hard for a softer approach and voted against the levies along with four other member states. Twelve others, such as Spain, abstained. Brussels and Beijing will keep talking to find an alternative to the tariffs. The sides are exploring whether a deal can be reached on a way to control prices and volumes of exports in place of the duties. Without a deal, the tariffs are due by November and would be in force for five years. Pork is likely one of the sectors most vulnerable to China's response. Should Beijing's inquiry lead to tariffs, the impact will be focused on major suppliers like Spain but also Denmark and the Netherlands, which supported the EV decision. Dairy is also at risk, with the Netherlands, France and Ireland among China's key EU suppliers. The EU is already challenging China's investigation into dairy subsidies at the World Trade Organization — the first time it's taken such action at the start of the inquiry rather than wait for it to result in trade measures against the bloc. Beijing has also warned that EU will lose investment from Chinese EV firms and the opportunity to transform its own car industry, if the tariffs are adopted. While the full extent of Beijing's wrath isn't known yet, it's pretty clear that trade tensions with the bloc will persist into the foreseeable future. |

No comments:

Post a Comment