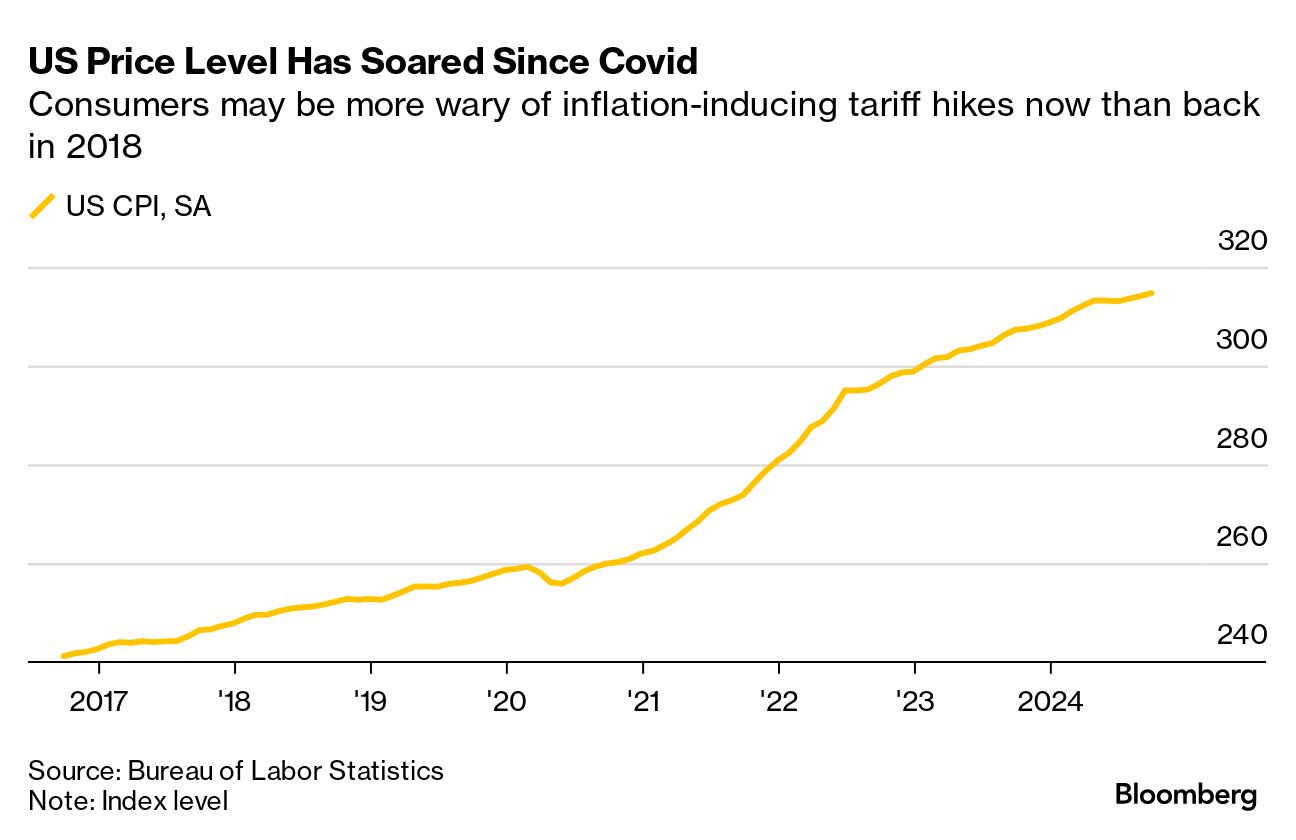

| Things never happen the same way twice, as fans of the Narnia stories know. Two top observers of the US-China economic relationship similarly caution against assuming that the first Trump administration is a good guide to how things would unfold if the Republican gets a second term. Arthur Kroeber, a founding partner of the Gavekal Dragonomics research service, told clients last week, "we need to be a little bit careful about assuming that Trump 2 is just going to be the same as Trump 1, only more." While he didn't want to be "too adventurous," Kroeber highlighted that the former president—for all his warnings of slapping 1930s-level tariffs on China—would have incentives for some kind of a deal. The scenario of a US-China agreement if Trump returned to the White House is "slightly underpriced," Kroeber said. By contrast, Scott Kennedy, a senior adviser at the Center for Strategic and International Studies (CSIS), warns about the risk of China responding in a much more muscular way to Trump salvoes. "It might be pretty messy," he said at a Harvard University event Monday. With Trump, according to the polls, running neck-and-neck with US Vice President Kamala Harris in the run-up to the Nov. 5 election, consideration of how US-China relations might evolve in the coming year is all the more important. What unites Kennedy and Kroeber is an emphasis on the very different backdrop in place today versus almost eight years ago, when Trump took office.  Chinese President Xi Jinping, left, and Donald Trump in Beijing in 2017 Photographer: Qilai Shen/Bloomberg While Trump hasn't specified exactly what actions he'd take if he wins next month—and allowing for the 78-year-old's regular habit of making false statements—he and his aides have floated 60% tariffs on Chinese goods, escalating the trade war he started in 2018. And the GOP campaign platform has called for revoking normal trade relations along with regulatory actions such as barring China from US real-estate purchases. Most, if not all economists would agree that slapping China with such high levels of duties would send US consumer prices higher. Trump "knows that inflation is a big problem," Kroeber said in a Gavekal webinar last week. "He might come in and realize that sort of a maximum tariff policy in the current macro environment in the US is very different to the macro environment of 2018," he said. The latest data on inflation, out Thursday, showed an unexpectedly big rise in prices, reminding households that their monthly bills are much higher than pre-pandemic. So, public support may be different about China tariffs this time around. Another big change, of course, is war in Europe. Kroeber hypothesized that if Trump were to try and negotiate with Vladimir Putin over his war on Ukraine, there'd be value in winning the participation of China, Russia's main supporter. In that case, he would have to "give the Chinese something that they wanted," he said—which could be some accommodation on trade. Indeed, in his interview with Bloomberg Businessweek in late June, Trump emphasized tariff threats as "good for negotiation." Finally, there's an arguably under-appreciated element of a Trump administration economic framework: the willingness to welcome Chinese manufacturing investment in the US. Decades ago, it was Japanese industrial investment in America that helped to keep a lid on bilateral trade tensions. "The way they will sell their product in America is to build it in America, very simple," Trump said of Chinese companies in his address to the Republican National Convention in July. Kroeber did note, however, there's no widespread backing for this approach among Republicans. The GOP governor of Virginia, Glenn Youngkin, demonstrated that in removing his state from consideration for a Chinese electric-battery plant last year. As for CSIS's Kennedy, who offered an update on China affairs this week at a Harvard Fairbank Center for Chinese Studies event, he discounted the potential for a deal involving the Chinese private sector plowing investment into the US. What instead may be underappreciated is China's readiness to strike back hard against protectionist US action.  Scott Kennedy Photograph: Bloomberg In Trump 1.0, China "sat back a little—kept their power dry," Kennedy said. While they did hit the US with reciprocal tariffs, they stopped short of options like sweeping restrictions on American businesses with major, profit-earning operations in China. What Beijing did do, however, was to build a toolkit for potential responses. That kit includes the "unreliable entity list," which China can use to penalize firms deemed to threaten national security, and the "anti-foreign-sanctions law," which involves potentially seizing assets and blocking business transactions. Based on what Trump has said about China tariffs, it seems more likely he'll be hawkish than deal-seeking, Kennedy said. And if the US executes a powerful set of highly protectionist measures, it would have the appearance of "declaring economic war—and the Chinese are likely to see it that way," he said. A "reasonable" scenario to envision is Beijing responding strongly, "to get him to cry uncle," Kennedy said— "tank the stock market, tank the bond market" to such an extent that Wall Street appeals to the White House to call the economic warfare off. "I think that scenario is underpriced." —Chris Anstey Bloomberg New Economy: The world faces a wide range of critical challenges, from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment