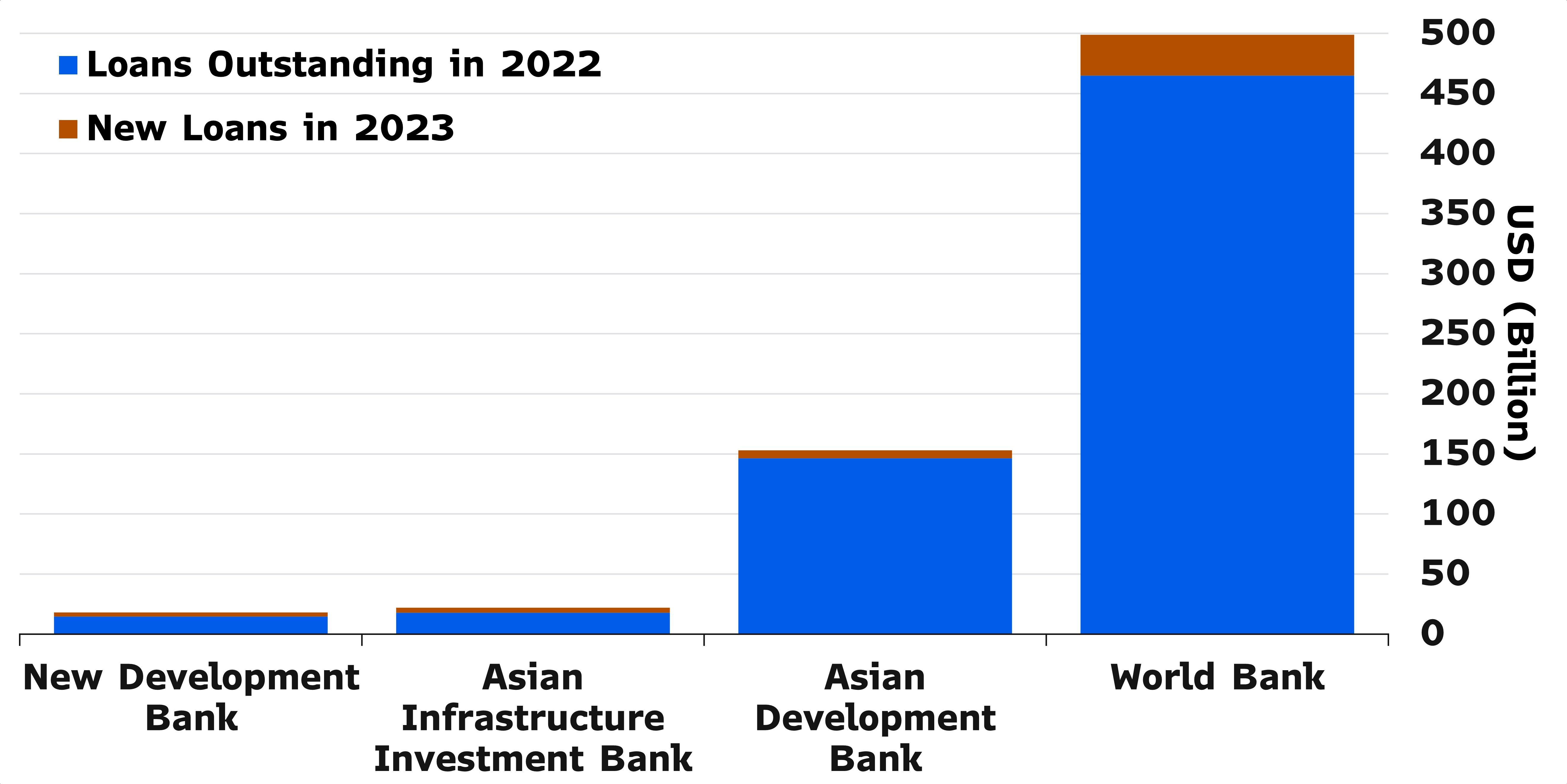

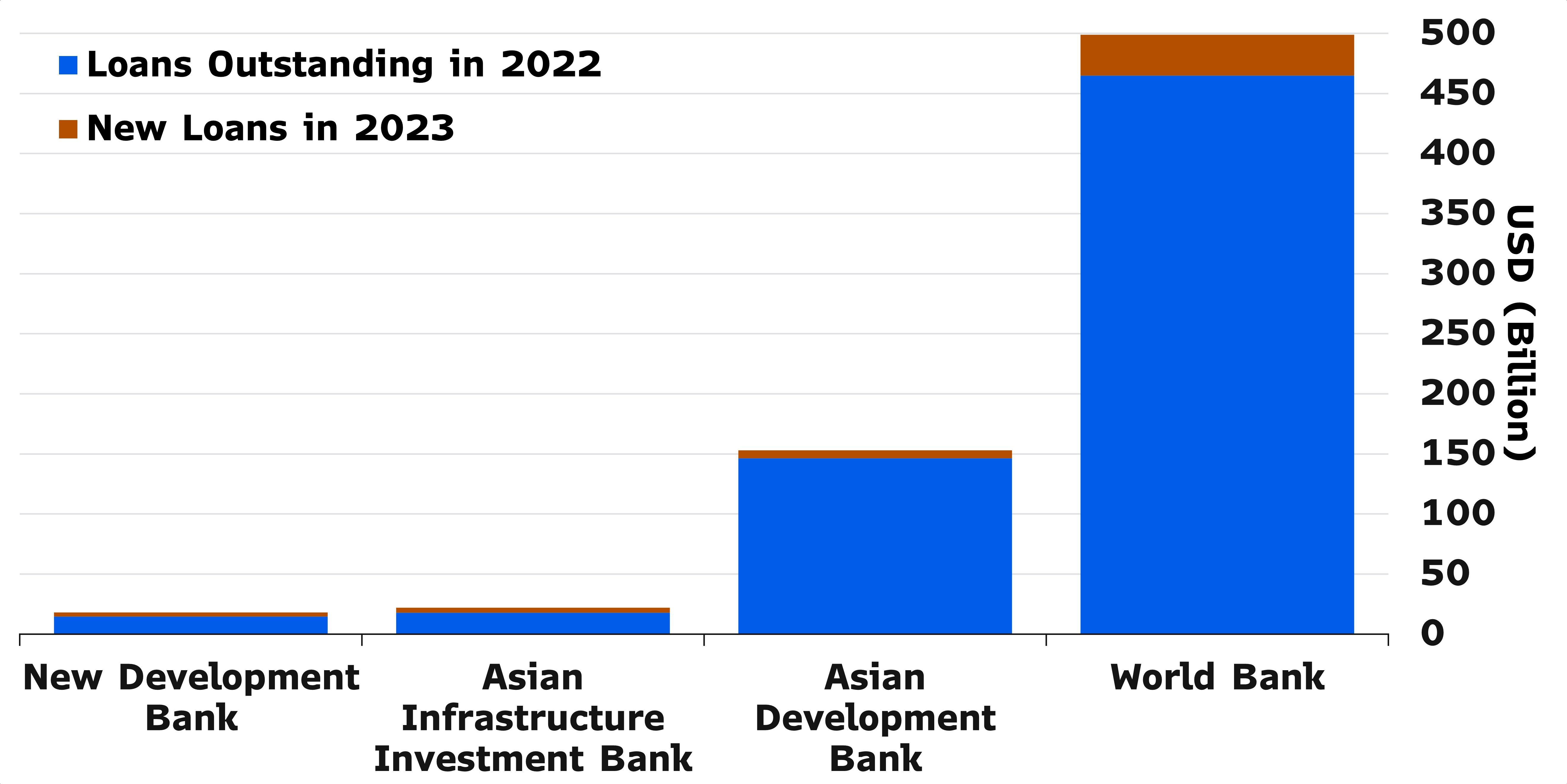

| "It's everywhere you want to be." That was the tag-line of an advertising campaign launched for Visa credit cards in the 1980s. The slogan works equally well for the US dollar, despite a lot of angst over the status of the world's main reserve currency. And that's true even in places you might not expect—like Kazan, Russia, where President Vladimir Putin—a champion of reducing the international role of the dollar—hosted the annual BRICS summit this week. Despite all the enthusiasm for de-dollarization, the confab's organizers advised attendees to bring greenbacks (or euros) with them to the city on the Volga. (Non-Russian Visa cards won't work, they added.) It's difficult to imagine a better example of how hard it is to disengage with a currency that's dominated the global financial system since the end of World War II. The missive from the Kremlin, which advised that dollars "can be freely exchanged" for rubles at most Russian banks, came even as Russia's finance minister, Anton Siluanov, trumpeted plans for a new cross-border payments system that will bypass Western platforms. The BRICS, anchored by its original members Brazil, Russia, India, China and South Africa, and newly buttressed by the energy powerhouse United Arab Emirates along with three other emerging nations, isn't a group to be sniffed at. Its economic weight is steadily expanding, Bloomberg Economics analysis shows. But the infrastructure that backs the dollar will likely give the US currency a decisive edge for decades to come.  The BRICS summit in Kazan, Russia Photographer: Alexander Nemenov/AFP As was the case throughout the Cold War, opposing alignment with America remains popular across much of Asia, Africa and Latin America. And that's helped drive interest in the BRICS as an alternative grouping to pro-Western alliances. The nine-member association has also extended an invitation to Saudi Arabia, which hasn't announced whether it will accept, and received requests to enter from others—including Turkey, which while a member of NATO has remained friendly with Moscow. Indonesia this week joined the list of those interested in joining, too. Putin—appearing to revel in hosting the biggest international summit in Russia since launching his fullscale invasion of Ukraine—said Wednesday that the BRICS "meets the aspirations of the main part of the international community" and showcases that "the process of forming a multipolar world is underway." While the group's members are disparate, the simple act of bringing their leaders together can prove influential. The Kazan gathering also served as a setting for the first sit-down between Chinese President Xi Jinping and Indian Prime Minister Narendra Modi in two years, potentially helping heal tensions stoked by hostilities on the two nations' border.  Xi Jinping Photographer: Maxim Shipenkov/AFP "A key task is to promote the use of national currencies to finance trade and investment," Putin said, blasting the use of the dollar as a political weapon. Putin wasn't wrong about weaponization. Even as he spoke, officials from the world's top industrialized nations were conferring in Washington on the details of using income accrued from Russia's frozen assets in the West to step up assistance to Ukraine, where Putin's forces have killed tens of thousands, destroyed towns and cities and allegedly committed a wide range of war crimes. That effort, led by the US and European allies, illustrated how the West has indeed been able to use the established international financial framework to punish Russia for starting the biggest war in Europe since 1945. No surprise then that Xi, with his own set of geopolitical tensions with the West, joined Putin in calling for stepped up financial connectivity among the BRICS members this week. He spoke of "the urgency of reforming the international financial architecture" and called for "high-level financial security." Xi also pushed for expanding and strengthening the BRICS' own multilateral lending institution, the New Development Bank. So far, it's proved a relatively small player in the multilateral finance scene. But it's early days.  Source: New Development Bank, Asian Infrastructure Investment Bank, Asian Development Bank, World Bank Group. Note: World Bank data includes the IBRD, IDA, and IFC. "There's a lot of urgency" from Beijing on global financial-system changes, longtime China watcher Bill Bishop said this week on the Sharp China podcast. "When Xi talks about how the world is undergoing these changes unseen in a century, part of those changes" are about the global financial system, he said. The BRICS essentially have three options to bypass the dollar in cross-border payments, say Alex Isakov and Gerard DiPippo of Bloomberg Economics—local currencies, new digital currencies or China's yuan. "Local currency settlement is typically costly due to low liquidity," they wrote in a note Thursday. "Digital currencies are too volatile" and "generally lack enough liquidity to handle major trade flows." (To see the full note on the Bloomberg terminal, click here.) That leaves the yuan, which China wants to internationalize but doesn't want to let fluctuate freely. There's also the outstanding question whether, in a crisis, it would be willing to pump unlimited amounts of yuan outside its economy. While US Treasury John Connally famously said in 1971 that the dollar was "our currency, but your problem," Washington has time and again stepped up to the global plate, Udith Sikand, an economist at Gavekal Research, said in a note last week. The most recent instance was in the 2020 crisis, when emerging nations including South Korea, Mexico and Brazil were all offered dollar swaps from the Federal Reserve. And that was during the administration of Donald Trump, the self-proclaimed America-firster. But China for now isn't ready to provide even its top partner Russia with sufficient yuan. It wasn't even suggested as a means of payment at the BRICS summit this week —hardly "everywhere you want to be" for the champions of de-dollarization. —Chris Anstey |

No comments:

Post a Comment