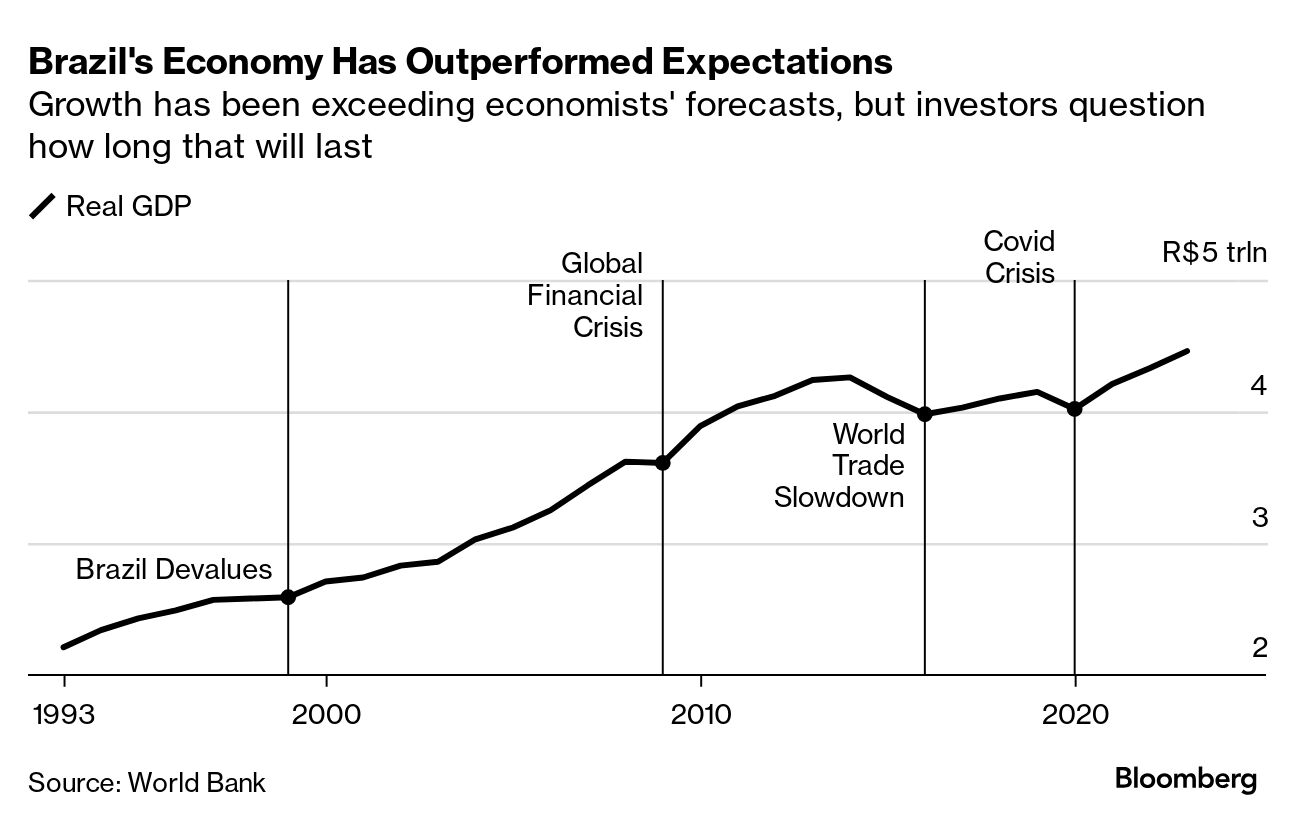

| With the US easing monetary policy and China appearing to embrace economic stimulus, these should be the best of times for Brazil. When a similar constellation of good news appeared at the end of the global financial crisis, Latin America's biggest economy boomed, its credit rating climbed and investors cheered. Indeed, this week saw Moody's Investors Service lift Brazil's rating, a move reflecting the nation's recent record of defying economists' forecasts of a slowdown. But investors are proving hard to convince. Brazil's currency is one of the year's worst performers and its stock market has underperformed. The worry is that President Luiz Inacio Lula da Silva—whose chosen candidates have been running behind ahead of Sunday's mayoral elections—will turn to cash handouts to make good on his 2023 campaign slogan, "beer and beef for all." "Rating agencies are looking through the rearview mirror—but markets are focused on the next 10 years," says Andrei Spacov, chief economist and partner at the asset manager Exploritas.  Luiz Inacio Lula da Silva, Brazil's president, speaks during the United Nations General Assembly in New York on Sept. 24. Photographer: Jeenah Moon/Bloomberg On the surface, Brazil's economy looks to be in decent shape. Gross domestic product is likely to hit 3% annual growth for the December quarter, securing a third straight year of similar rises. But some of the strength reflects tough labor-market reforms implemented back in 2017, which drove unemployment down to historic lows. Brazil's central bank recently raised its forecast for 2024 growth to reflect the better-than-expected numbers. The Treasury secretary, Rogerio Ceron, also pledged the nation's fiscal results will come in better than investors anticipate, following a long-awaited overhaul of the country's tax code. Lula, as the president is known, set time aside on his trip to New York last month for the United Nations General Assembly to meet with representatives of the rating agencies, seeking to restore the investment grade rating Brazil lost almost a decade ago. But financial-market metrics continue to illustrate investor skepticism. The benchmark Ibovespa index of stocks is down 1.9% for 2024 so far. In dollars, it's even worse, notching a 13% drop. The MSCI Emerging Markets Index meanwhile is up 16%, as is MSCI's global gauge. Currency depreciation has come despite the US Federal Reserve's shift to an easing cycle. Brazil's real is down about 11% for the year, which has made things tougher for industries including Brazil's airlines, which incur major costs in dollars. Behind much of the investor concern about Brazil is a suspicion that its economy is running too hot, putting a new interest rate-hiking cycle in play. Such a cycle would drive up company borrowing costs that are already well into double digits. The central bank's benchmark is currently 10.75%, following a quarter-point increase last month. Retail and health-care companies that are already deep in debt may potentially face bankruptcy. Even the agriculture industry, a cornerstone of the country's economic boom, is arguably at risk. Lula has advocated for lower interest rates, and recently had the chance to appoint the next central bank chief. Gabriel Galipolo, who's set to be confirmed by the Senate next week, is seen as an ally of Lula.  Gabriel Galipolo Photographer: Maira Erlich/Bloomberg But Galipolo so far is proving more hawkish than anticipated. Using a soccer analogy in the football-mad nation, he likened himself to a defender who stops balls from getting past him. The fastest incoming ball he faces may come in the form of fiscal spending. As Lula nears the halfway mark of his presidential term, increasing money transfers to households (and voters) seems the fastest way to deliver on his political promises. But that risks fueling further monetary tightening that would undermine business confidence. Spacov, the economist, cautions against getting excited about the latest Moody's upgrade. Brazil is like a man celebrating the loss of 20 pounds while still being 20 pounds overweight, he says. —Maria Eloisa Capurro Bloomberg New Economy: The world faces a wide range of critical challenges, from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment