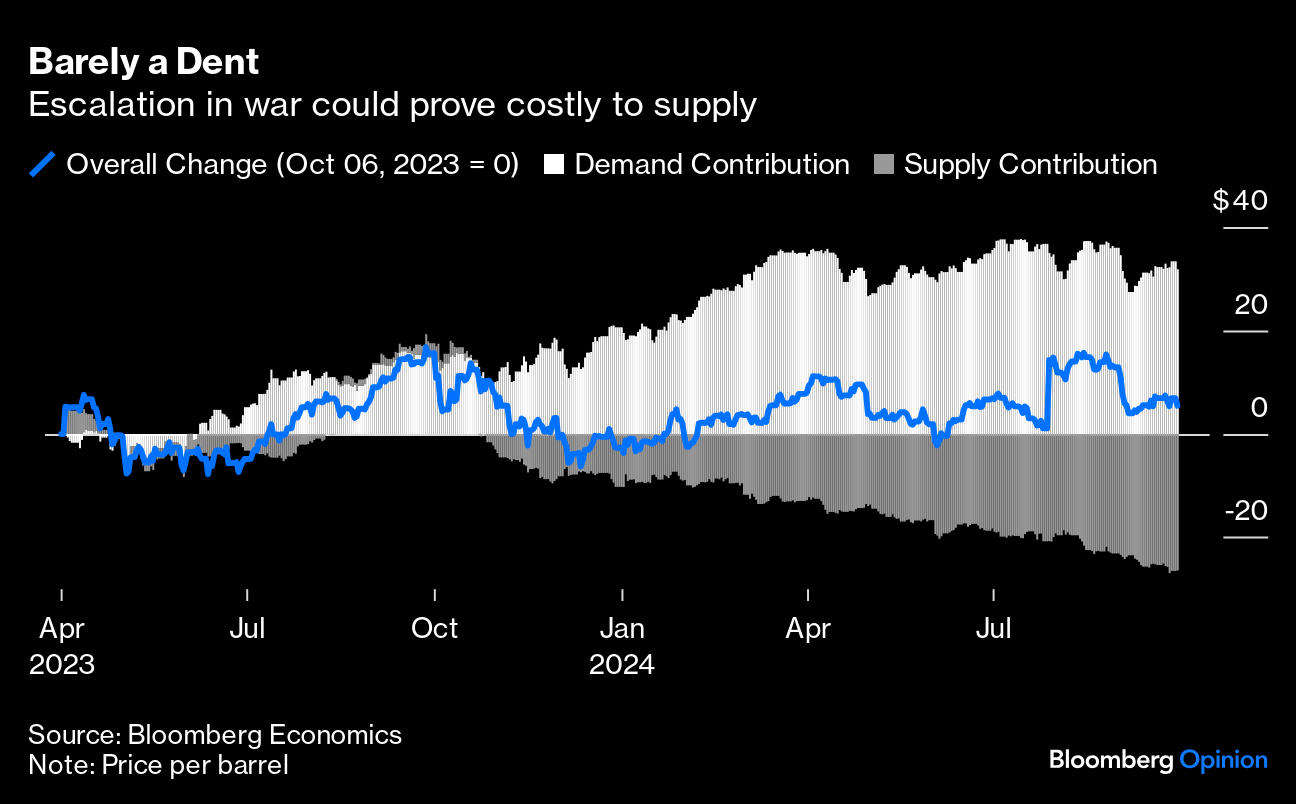

| The Yom Kippur War of 1973 still stands as the one terrifying precedent that shows conflict in the Middle East can create economic turmoil for the rest of the world. It led to the Arab oil embargo and round after round of stagflation. Iran has just launched the biggest attack on Israel since then, coincidentally the day before Rosh Hashanah, the Jewish new year and another massively important date in the religious calendar. Will we live to talk of a Rosh Hashanah War shock to match that of Yom Kippur? The odds are against it, although the day's frantic events shows that the oil price has not, after all, lost all its potentcy as a gauge of geopolitical risks, especially in the Middle East. Save for a few brief periods after Hamas's Oct. 7 attacks when the price spiked, oil has generally remained range-bound through almost exactly a year of escalating conflict. A supply glut coupled with weak demand as the global economy emerged from the pandemic made for muted prices despite rising tensions. Tuesday's rapid escalation when Iran fired a barrage of at least 180 missiles, which immediately promised an Israeli response, saw oil briefly climb by about 5%, the most in 12 months. The strike was a reprisal after Israel carried out a dramatic series of attacks in Lebanon in recent days, killing Hezbollah leader Hassan Nasrallah in a Beirut airstrike and sending ground forces across the border. Tehran had already threatened to retaliate after the political leader of Hamas was killed in Tehran in July — an attack blamed on Israel. Here's a chart tracking the shock to oil futures as the missiles took off and Tel Aviv foiled them: The surge proves that oil's sensitivity to geopolitical risk is very much alive. But in the greater scheme of things, this still isn't much to worry about. Oil prices surged 233% in the 12 months following Arab armies' surprise attack on Yom Kippur in 1973; even after today's surge, they're still down 11.5% since Oct. 7. Whether that continues will be a function of how direly the conflict degenerates. How would Israeli retaliation this play out? One plausible scenario is to inflict economic damage on Iran's oil industry, which makes up about half of Tehran's budget, possibly by attacking refineries. That would reduce supply. And as the war expands, Bloomberg Intelligence's Ziad Daoud argues that there's a broader risk to supply, via ports and the vessels plying the busy routes. If Iran were to try to block the Strait of Hormuz, the impact on oil flows would be profound. The current supply abundance can't replace potential outages from the Gulf Cooperation Council, Iran, and Iraq, he says. This Bloomberg Economics chart shows that over the last year, the Middle East conflict barely made an impact on supply:  With around a fifth of the world's oil coming from the Gulf region, there's a grave risk of prices skyrocketing if the conflict worsens. Daoud notes that a repeat of the strike on Aramco facilities by pro-Iranian militants in 2019, which took almost half of Saudi supply offline but didn't lead to lasting ruptures in the market, isn't out of the question: The price of crude might not quadruple, as it did in 1973 when Arab states imposed an embargo in retaliation for US support for Israel in that year's war. But if Israel and Iran are firing missiles at each other, oil prices could increase in line with what happened after Iraq's 1990 invasion of Kuwait. With a much higher starting point today, a spike of this magnitude could take oil to $150 per barrel.

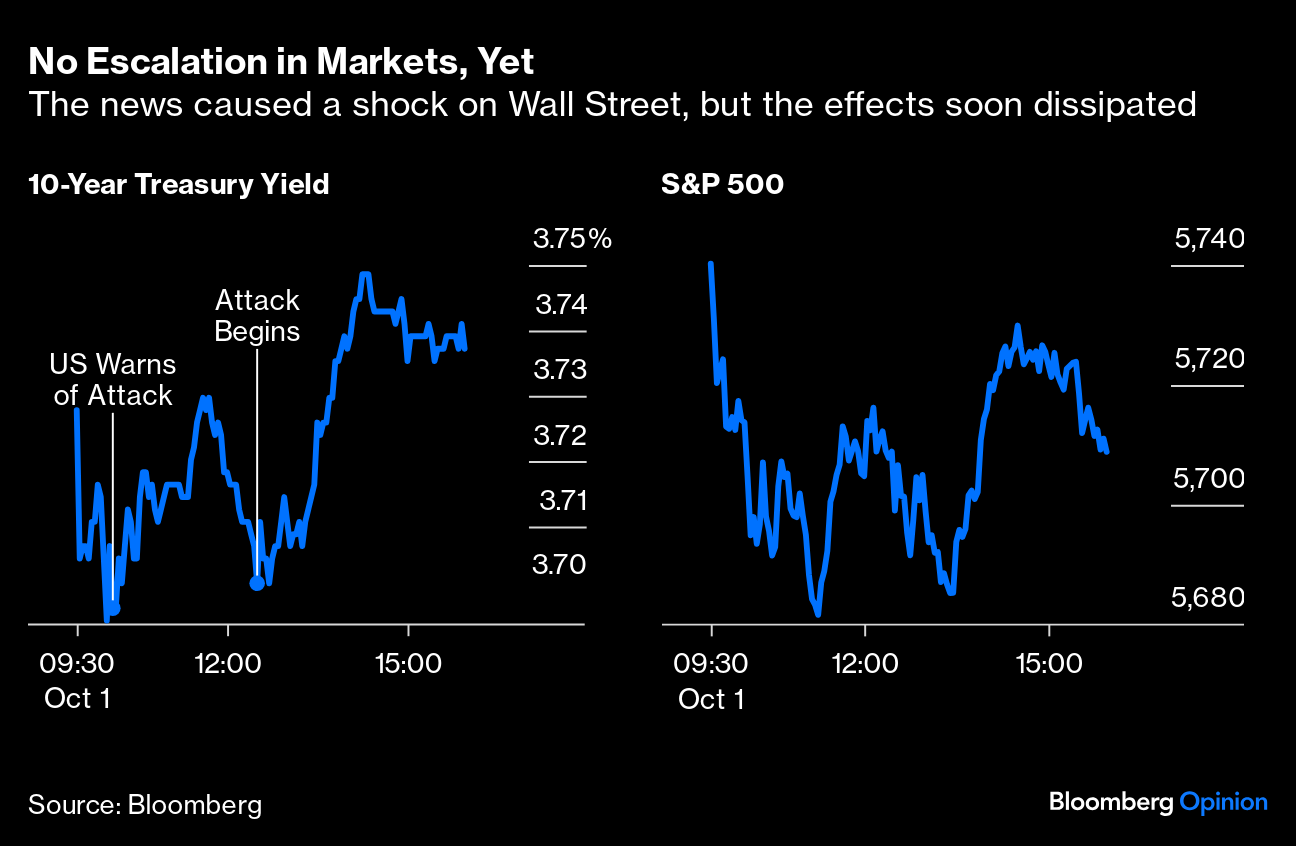

The Mideast conflict matters to broader markets more or less solely through the lens of whether it could cause an interruption to supply like in 1973. On Tuesday, there were sharp swings from stocks to bonds when the US warned of the attack, and again when the missiles arrived over Israel. But the effects soon eased: BCA Research's Marko Papic says he recently scrapped his advice not to go long oil due to the Mideast conflict — but that hasn't affected his views on stocks: What has changed? Not geopolitics. I still don't expect any oil supply to be lost. What has changed is the global macro context. The Fed is cutting rates by 100 basis points in just seven weeks! And on Sept. 26, the Beijing Politburo meeting flagged significant fiscal stimulus, marking a "policy bottom." As such, the macro context is bullish for oil. But should anyone short US stocks due to the conflict in the Middle East? No. Not even if the US and Israel attack Iranian nuclear facilities. The ability of Tehran to actually retaliate is highly minimal. It risks inviting the wrath of the US military aka the 1988 Operation Praying Mantis.

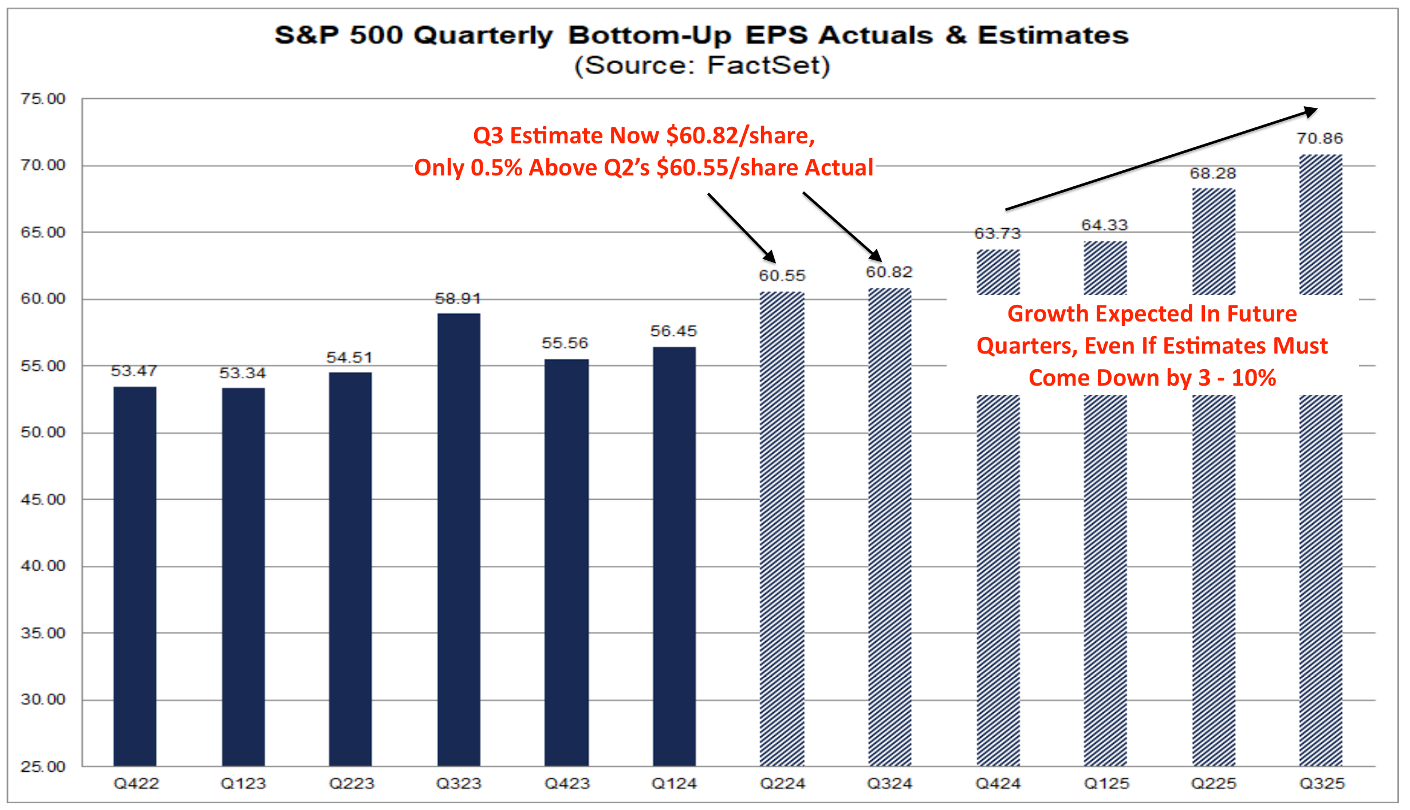

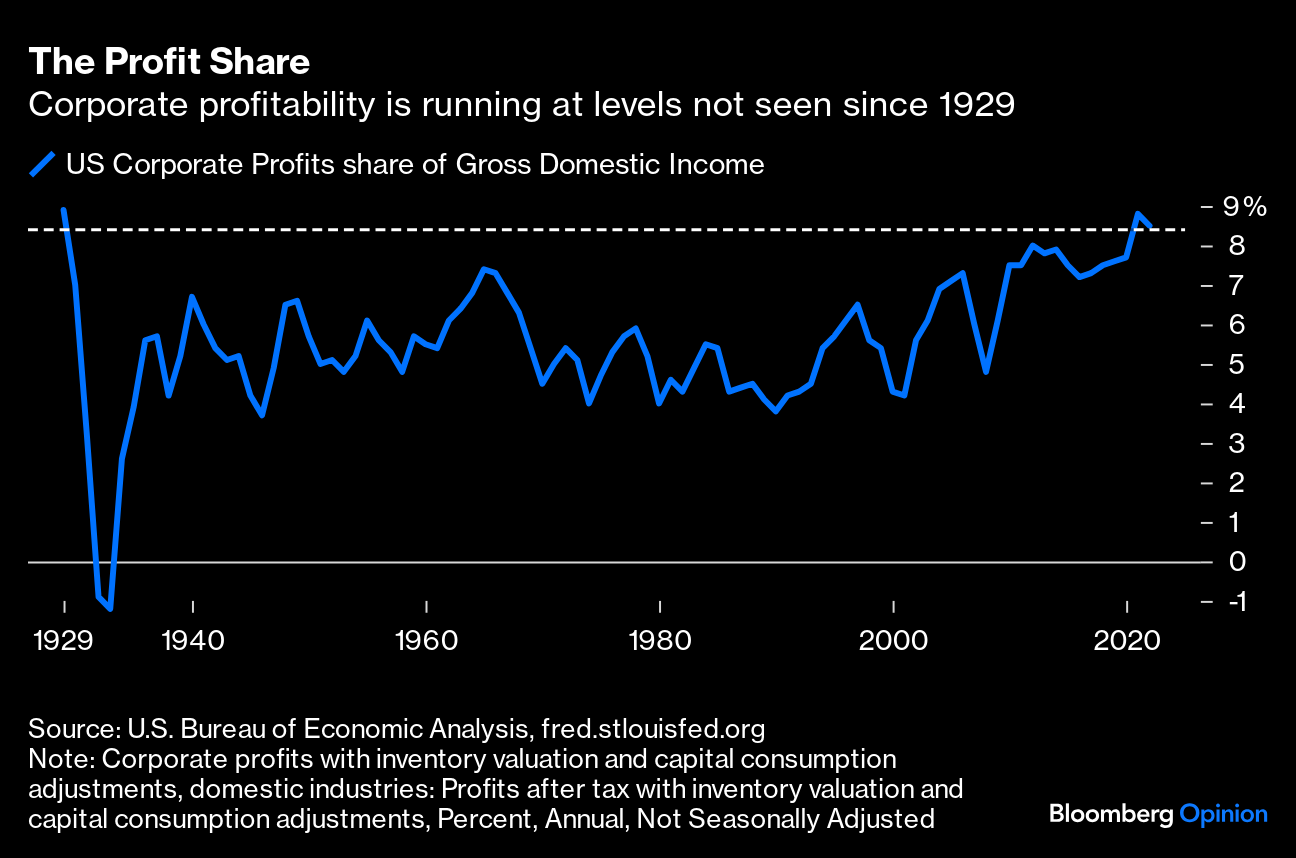

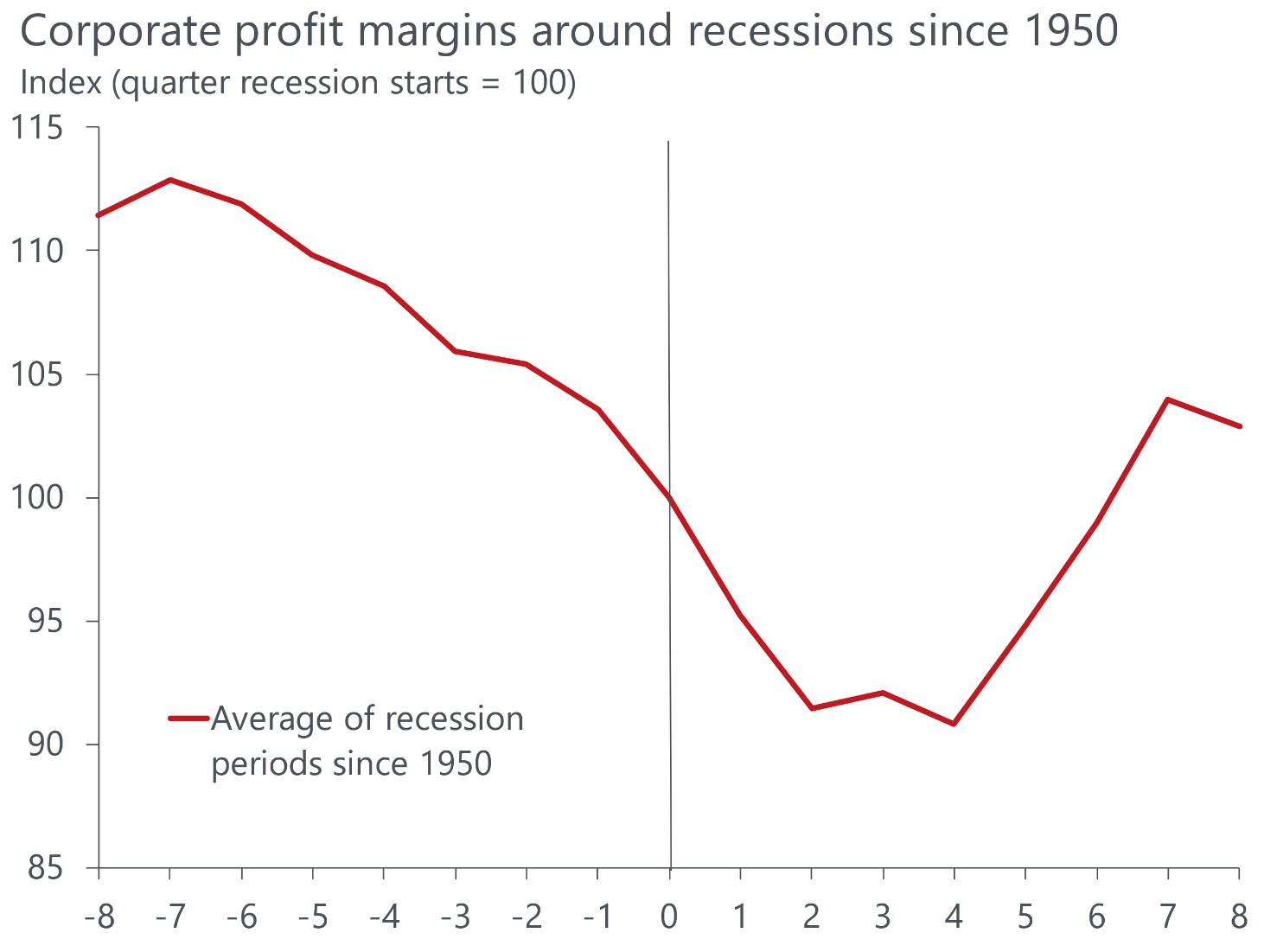

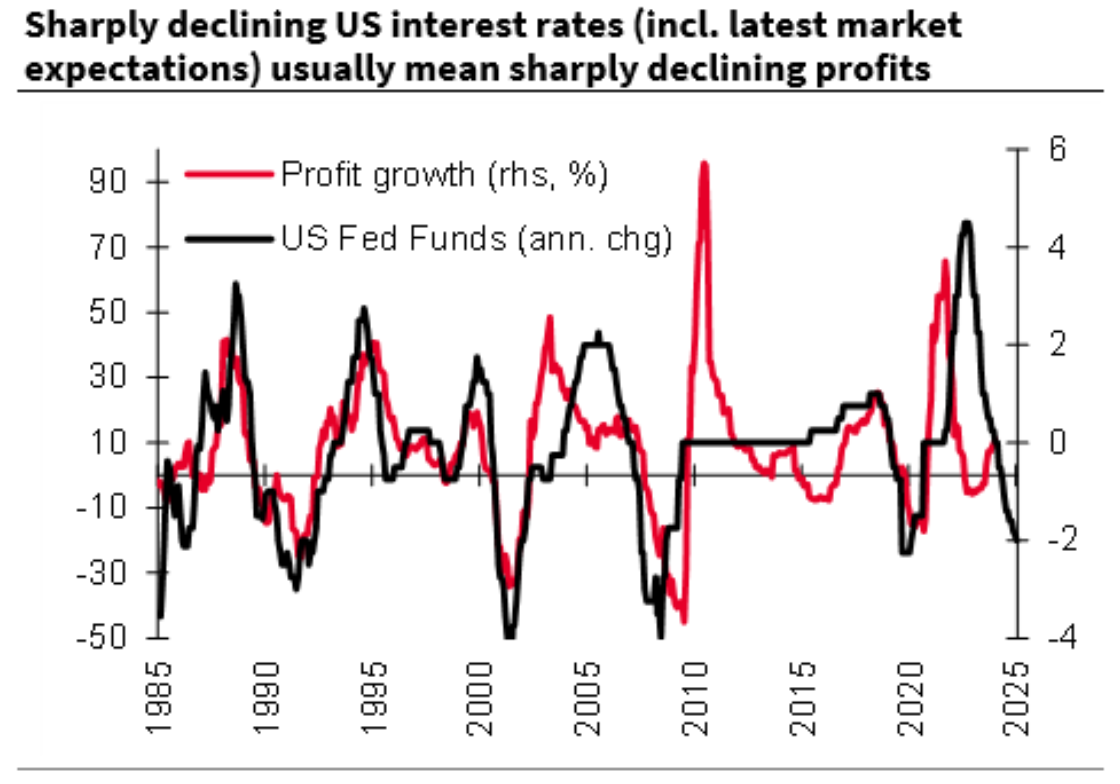

Ultimately, reversal in the course of oil prices would unsettle central bankers after a prolonged battle to bring down inflation. Hoping abundant supply can constrain prices at this point makes sense. But that's no guarantee in the event of a full-blown conflict. —Richard Abbey Away from politics and war, it's worth a reminder that the third quarter is now over, and another earnings season will soon be upon us. The chances are that it will be positive for the US stock market (providing no political or military horrors get in the way). The reason is that S&P 500 companies have been set a low bar to beat. That wasn't the case for the second quarter, when earnings estimates barely moved as the end of June approached, and contributed to the selloff that followed in August. There's been no such mistake this time. Estimated earnings for the S&P 500 as measured by Bloomberg have fallen sharply in the last three months, in a very different pattern from the previous period: Nicholas Colas of DataTrek International points out that the average fall in estimates during a quarter (all part of the game that investor-relations departments play with Wall Street) is 3.3%. This time it's 3.8%. That means that current estimates imply growth of barely 0.5%, quarter-on-quarter. That, he says, "should be an easy hurdle to clear given continued US economic growth." It should also create a useful tailwind for the stock market, as the Street expects new highs for index earnings. "Even if those estimates come down (and they certainly will), actual results should show further improvements in corporate earnings", say Colas. DataTrek's chart illustrates this point: After taking comfort from a market set up for a positive surprise, however, there are some contradictions to be resolved. As it stands, we're expecting rising profits, rising margins, an economic soft landing, and falling interest rates. One will have to give. Margins are already very high in historical terms. The official figures produced by the Bureau of Economic Analysis show that profits in 2021 and 2022 took a higher share of gross domestic income than at any time since 1929, year of the Great Crash: Figures for 2023 aren't yet available, but the point is that there are well-established limits to the margins that companies can extract from their operations that are now being approached. Meanwhile, Oxford Economics points out that the latest revisions to gross domestic product data suggest that corporate profits are growing more than thought as a share of GDP: The data show that the US economy is growing faster than previously believed. Oxford's Daniel Grosvenor points out a "large upward revision to corporate profits with the latest estimate up 17%," despite firms paying more in interest. It suggests that profit margins have risen by 60 basis points over the past year. That implies that fears of a hard landing are overdone, as profit margins usually fall for two full years before a recession starts. So on the face of it, the profit outlook is impossible to reconcile with a recession any time soon: That's obviously encouraging. But then there's the issue of rate cuts. Historically, they almost invariably overlap with falls in profits. As this chart from Societe Generale SA's chief quantitative strategist Andrew Lapthorne shows, there is no precedent in the last 40 years for profits continuing to grow while the fed funds rate is falling: This seems like a completely contradictory message, expecting sharp US rate cuts yet also continued strong earnings growth, as these cuts would historically be consistent with a 20% or more decline in reported profits and so a 30%+ drop in forward earnings.

That's hard to reconcile with the latest data from Bloomberg's World Interest Rate Probabilities function, which currently suggest enduring confidence that the fed funds rate will come to rest below 3%, having spent more than a year at 5.5%. So, earnings season is nicely set up to keep US equities rising nicely, and might well strengthen conviction that a hard landing can be avoided. If it's as good as seems possible, however, it could also bring back fears of a "no landing" overheating, and douse hopes for multiple rate cuts. If anyone is able to pay attention amid the election furor of the next five weeks, earnings should be stock-positive and bond-negative. We await the results with interest… Rest in Peace, Charlie Hustle. Pete Rose, one of the most controversial, divisive and ultimately tragic figures in American sports, has passed away at 83. Rose made more hits than any other player in history, and led Cincinnati's Big Red Machine to victory in one of the most dramatic World Series of all time (unfortunately). He was also ferociously competitive, and therefore disliked. But his lasting fame rests on being banned from baseball for life for gambling on his own team when he was a manager. For this reason, he was barred from the Hall of Fame; if that's ever rescinded, it will have to be posthumously. Gambling on your team is a serious charge that rips at the fabric of sport's integrity — but it's more than a little rich that his ban has stayed in place long after baseball decided it was OK with sports betting.  Forty years after the Reds' World Series victory over the Yankees. Photographer: Kirk Irwin/Getty Images These days, Major League Baseball has its own official betting partner in FanDuel, charged with bringing "fans' viewing and wagering experiences closer than ever before." I still think that much of what Rose did was wrong and worthy of punishment. To my mind, the current wave of sports betting shows why baseball was right to ban him in the first place. Now that the sport has given up on that principle, it's tragic that he lived out his days without entering the Hall of Fame.

Rose would obviously be in the Hall if not for his gambling exploits. It's full of other not-nice guys (looking at you Rogers Hornby and Ty Cobb, but I'm sure there are others). He may not have been particularly nice, but he was great. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Thomas Black: Biden Should Intervene in the East Coast Port Strike

- Marcus Ashworth: Labour Has No Choice But to Move the Fiscal Goalposts

- Hal Brands: Israel's Devastation of Hezbollah Puts Iran in a Corner

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment