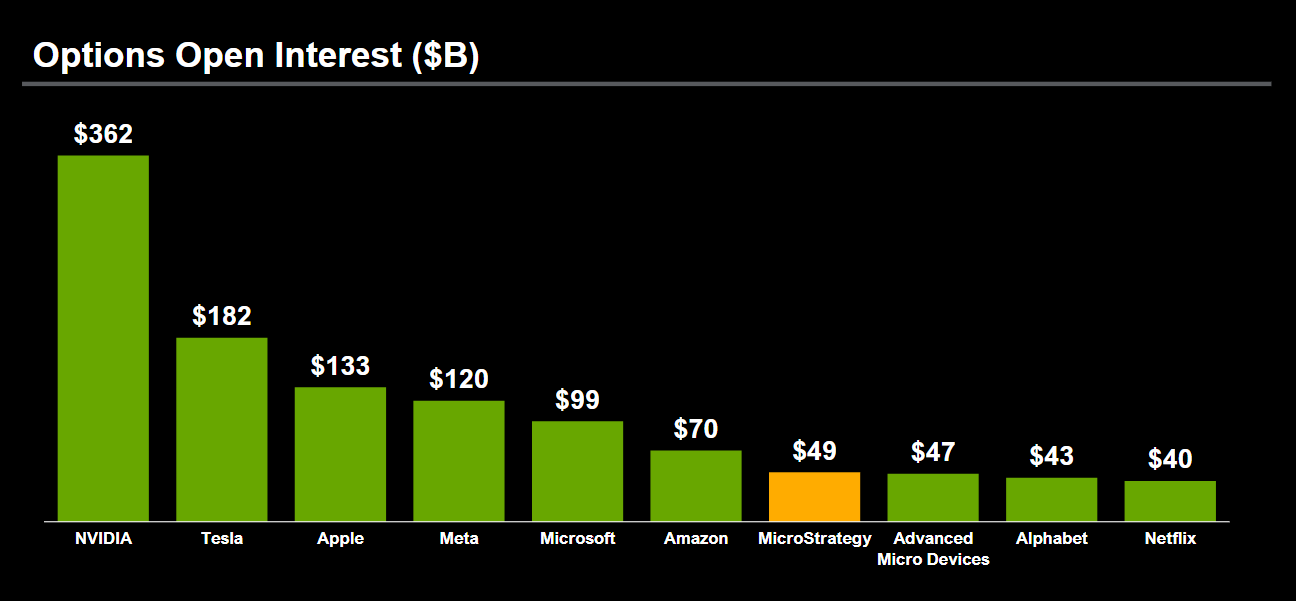

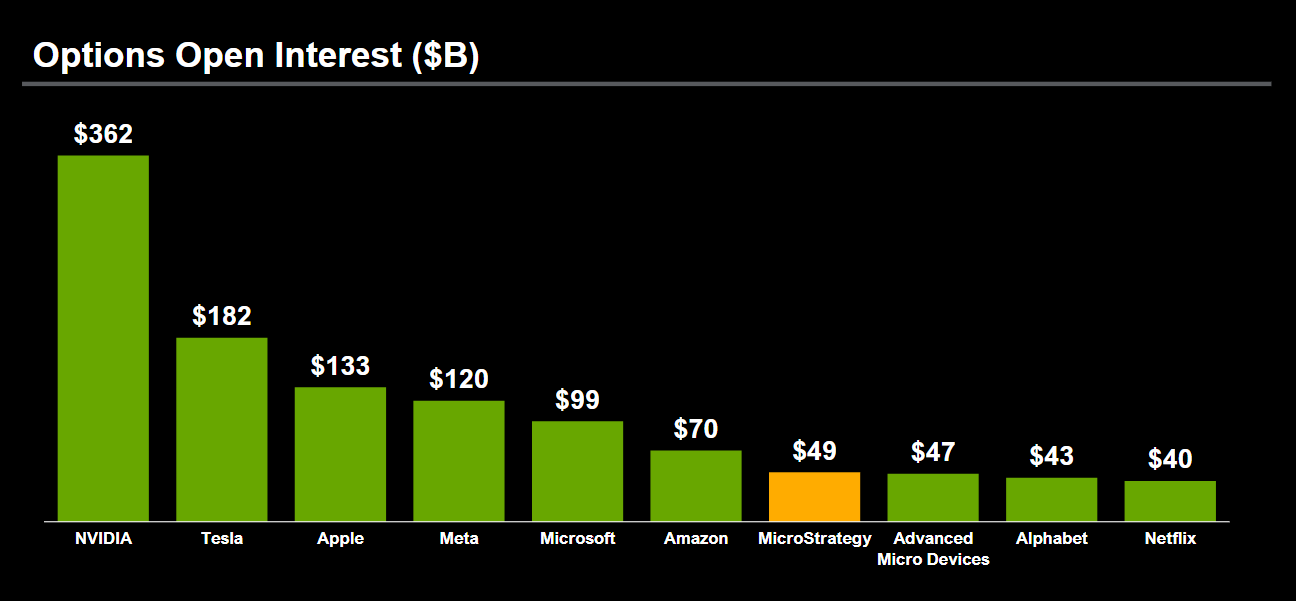

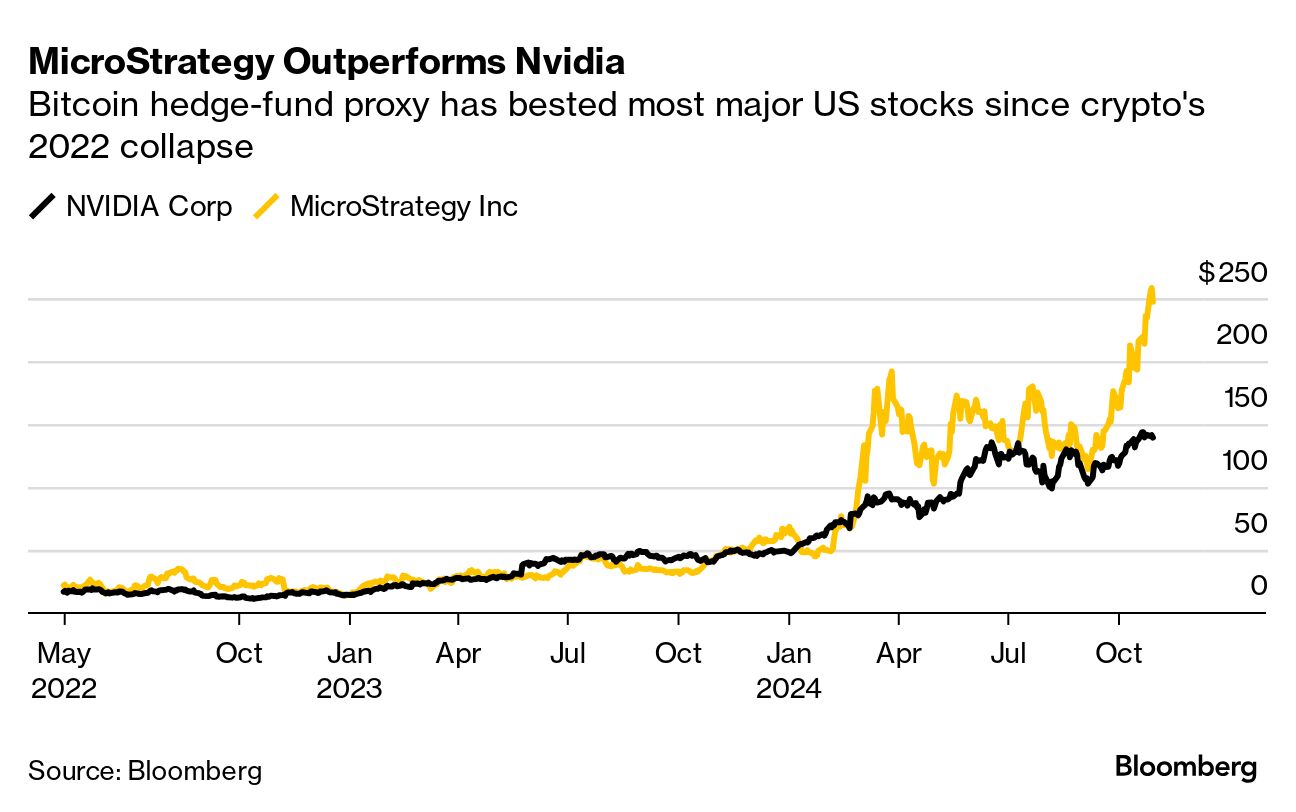

| MicroStrategy co-founder and Chairman Michael Saylor is taking the software maker's role as a Bitcoin hedge-fund proxy one step further, pitching investors on the idea that the company's highly volatile share price is a feature rather than a bug. The company has prided itself as the largest public corporate holder of the digital asset, with about $18 billion worth of Bitcoin on its balance sheet. Now, MicroStrategy aims to multiply that holding by selling up to $42 billion in equity and fixed-income securities. Saylor touted the plan in part as a way to make the link between Bitcoin prices and MicroStrategy shares even stronger, enabling traders in the traditional capital markets to benefit from the volatility of the largest cryptocurrency. "The reason MicroStrategy equity is exploding, and trading volume is, is because the market likes a security backed by digital capital," Saylor said on the company's earnings call on Wednesday. "When you embrace volatility, then you're outperforming the S&P. And now the capital isn't toxic, the capital is healthy." The volatility seems to have worked for the company, at least so far. MicroStrategy is the fourth-best performing stock in the Russell 1000 Index year-to-date with a 287% gain, beating out high flyers like Cava Group and even Nvidia Corp. It is also among stocks with the largest number of options trading, as Saylor pointed out. One way that options bring more liquidity into the stock is when dealers end up buying the shares to hedge their positions in the derivatives contracts.  Source: MicroStrategy Nonetheless, MicroStrategy's bet on Bitcoin is a bold one, to say the least. The $21 billion at-the-market equity raise would be the largest single offering ever in the stock market. With another $21 billion set to be raised from fixed-income securities, MicroStrategy is likely to be one of the most-leveraged bets on Bitcoin available in the stock market. The meteoric rise in Bitcoin prices since 2020 has fueled a gain of almost 2,000% in the share price. An even more drastic surge may take place if that upward trend continues, with the level of leverage higher than Bitcoin-proxy competitors such as crypto-mining stocks or exchange-traded funds backed by the digital assets. But what if it falls? For diehard Bitcoiners, when that happens you just keep on holding. Yet that ethos isn't so prevalent in the stock market, so MicroStrategy's volatility may not be such a selling point on the downside. |

No comments:

Post a Comment