| When is something going to break the deadlock in the US? The nation is awaiting clarity in a tense presidential campaign that appears stuck in a dead heat. The notorious "October Surprise" could come from any direction, most obviously the Middle East and the US ports strike. But one doesn't happen until it happens.

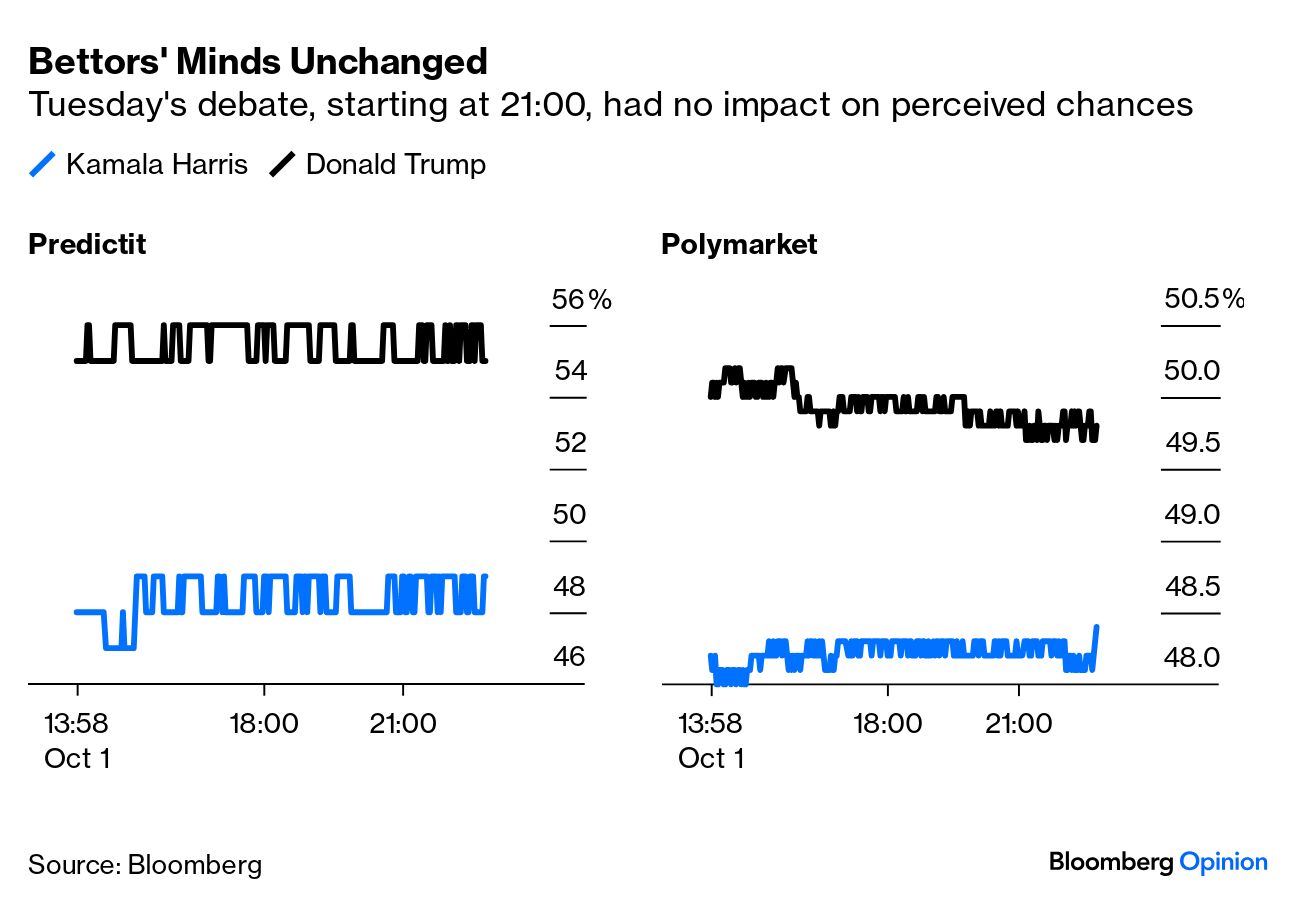

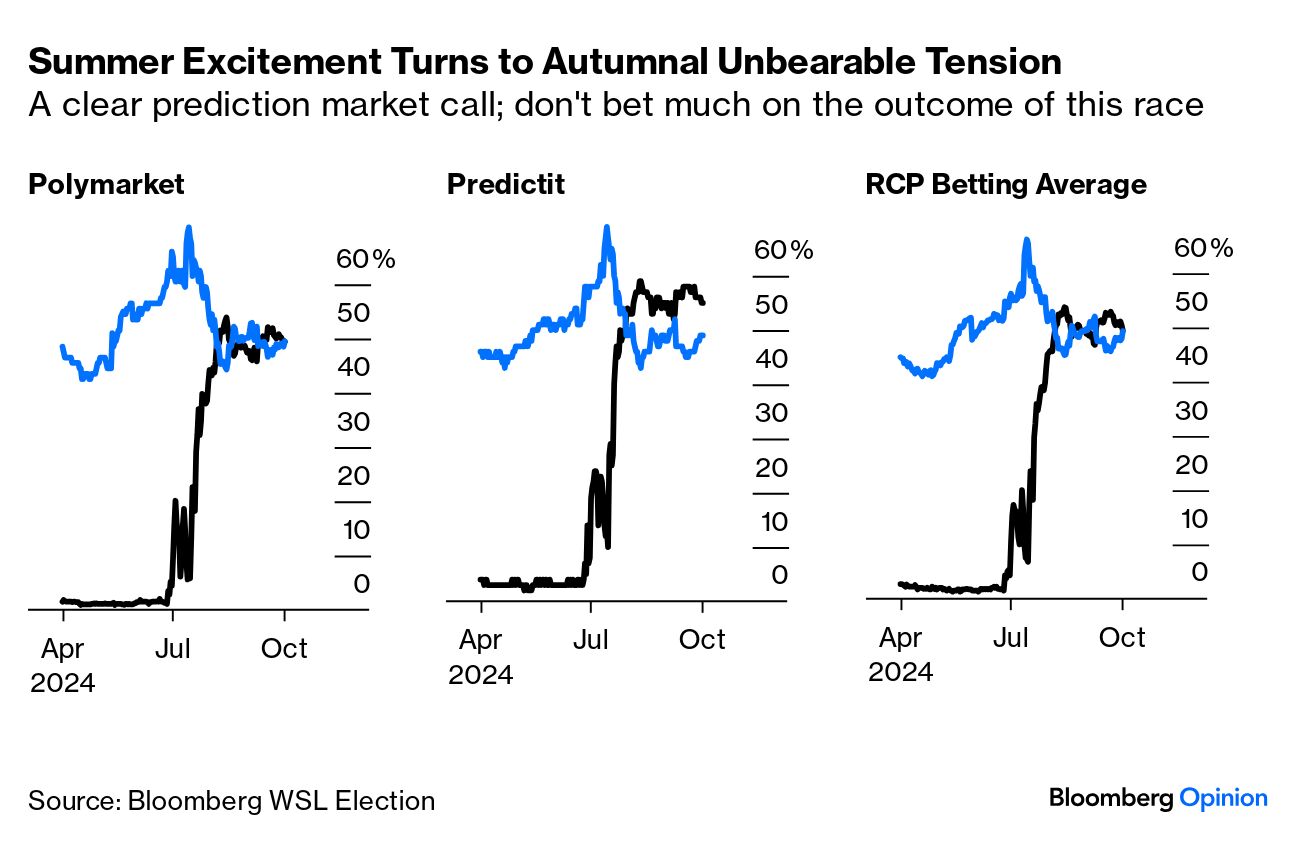

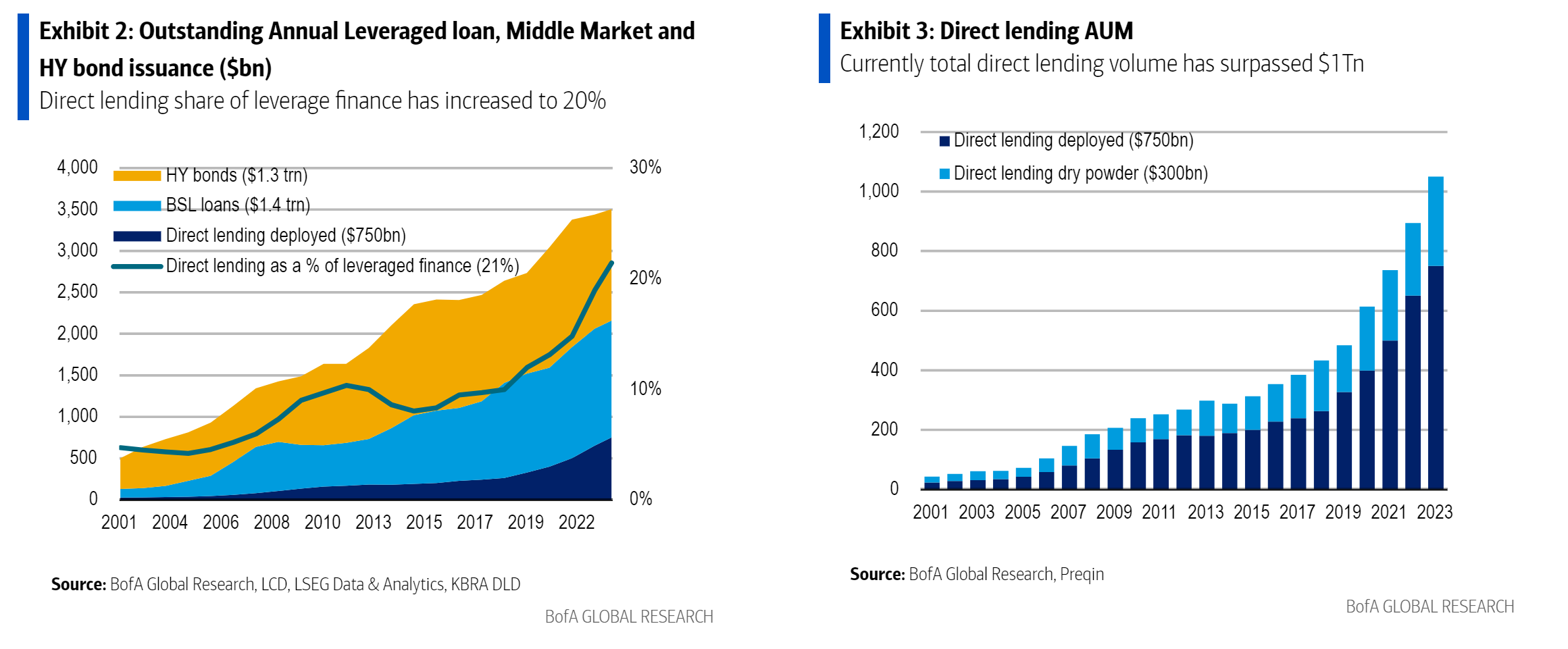

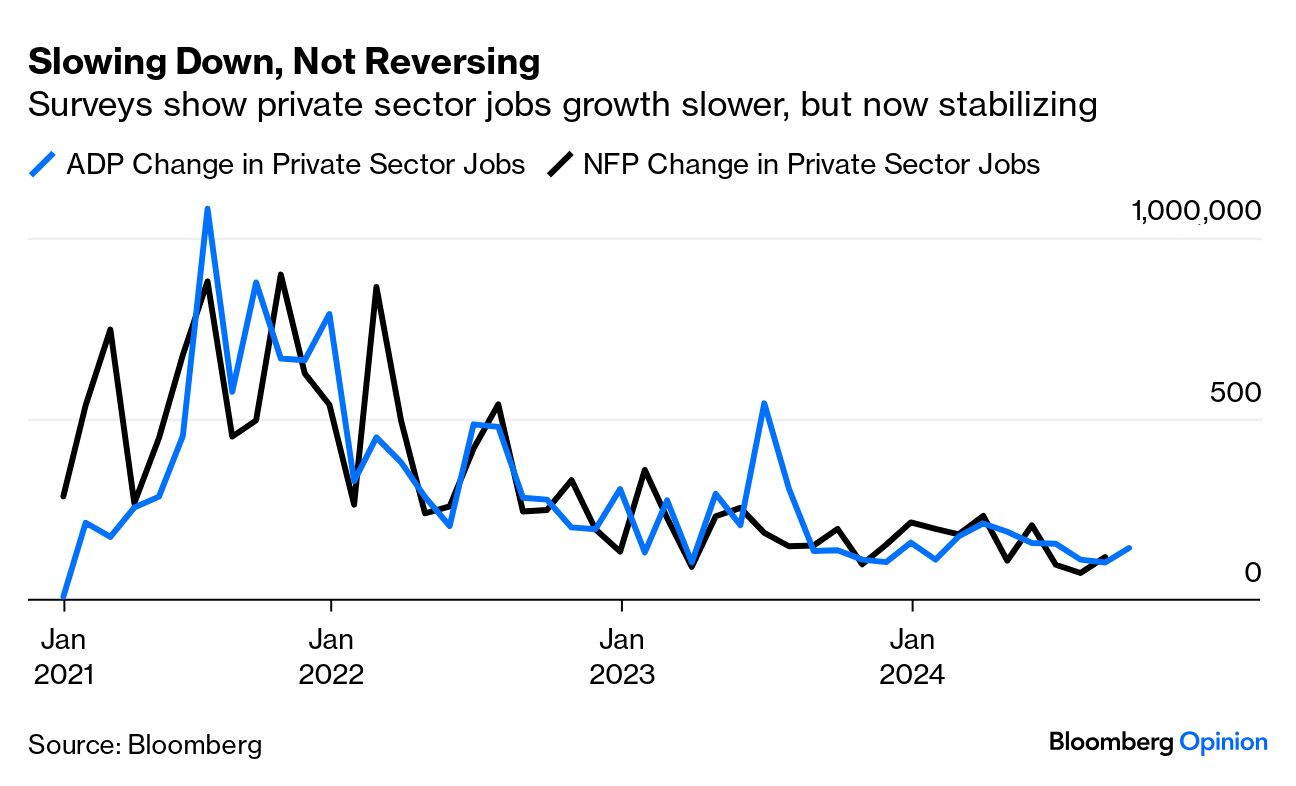

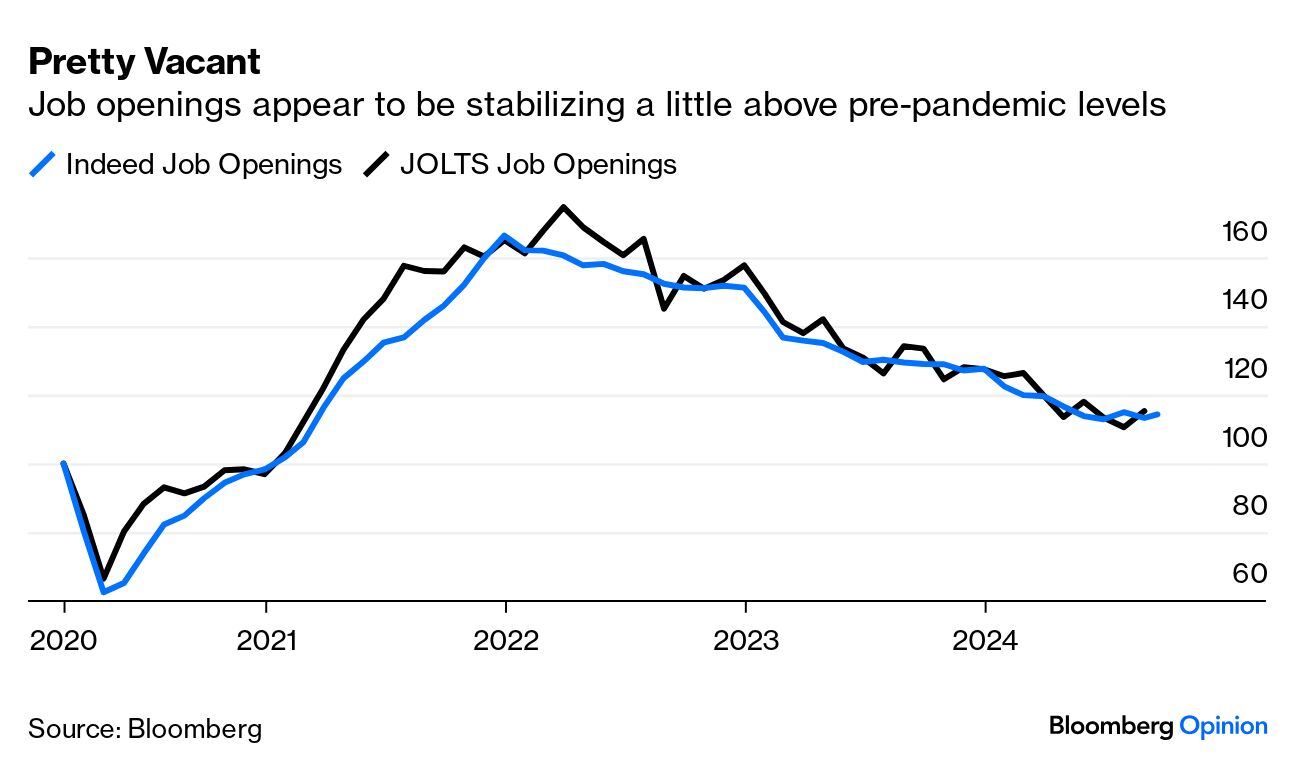

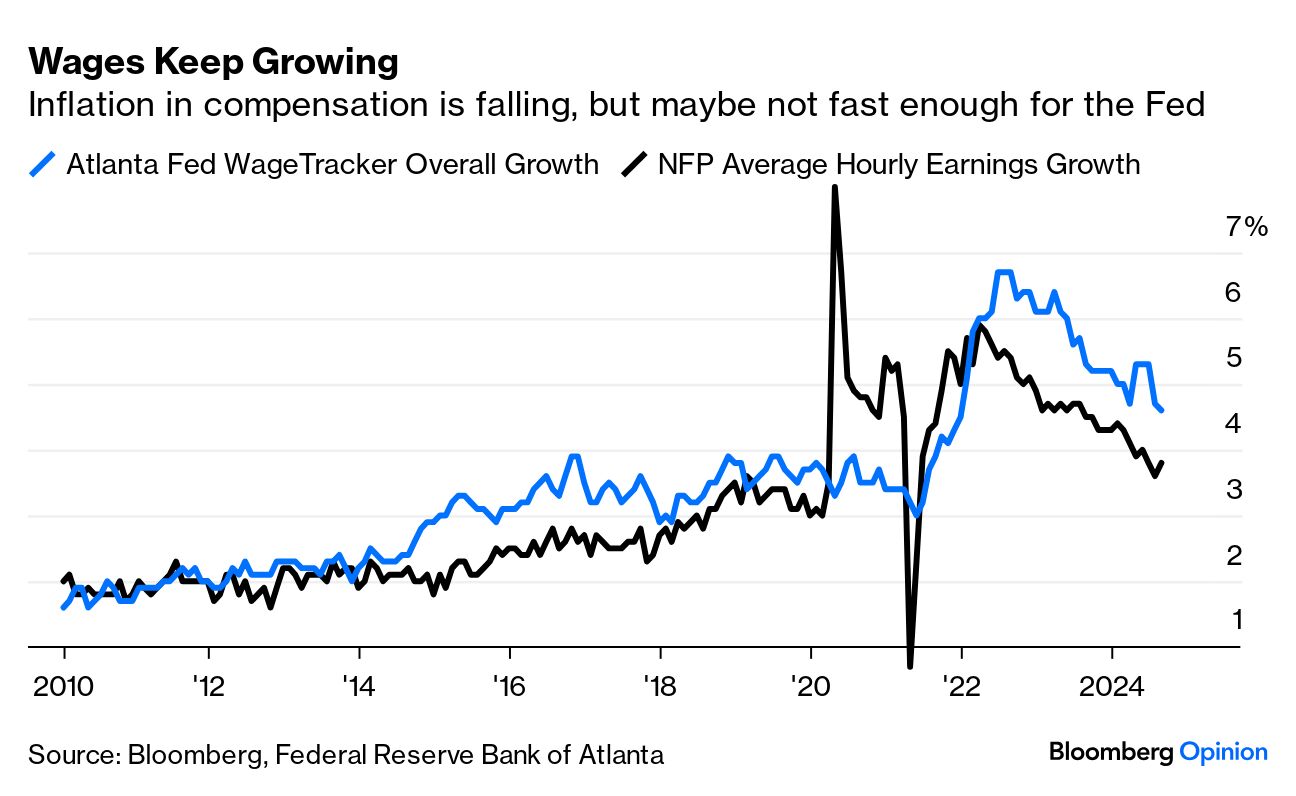

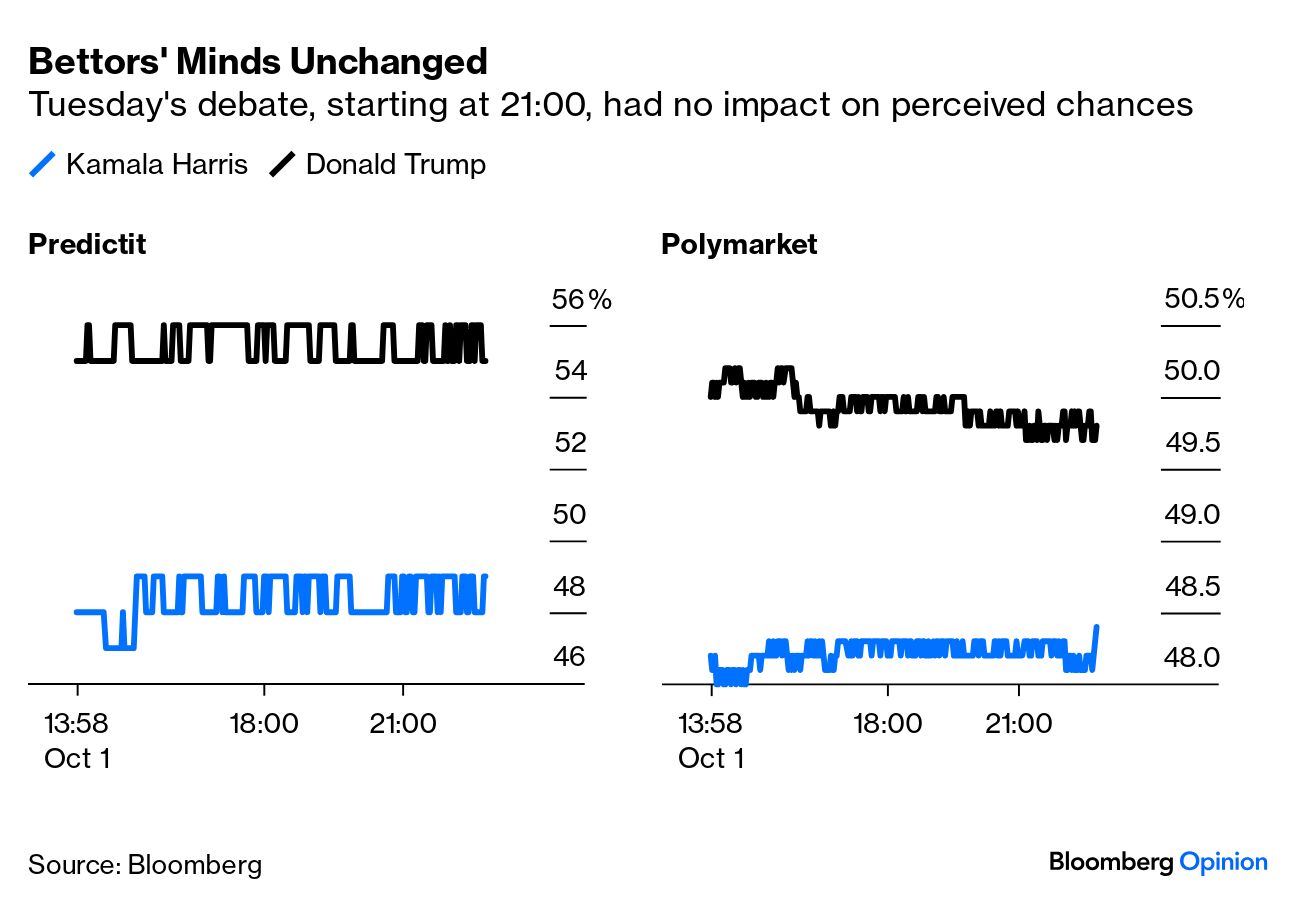

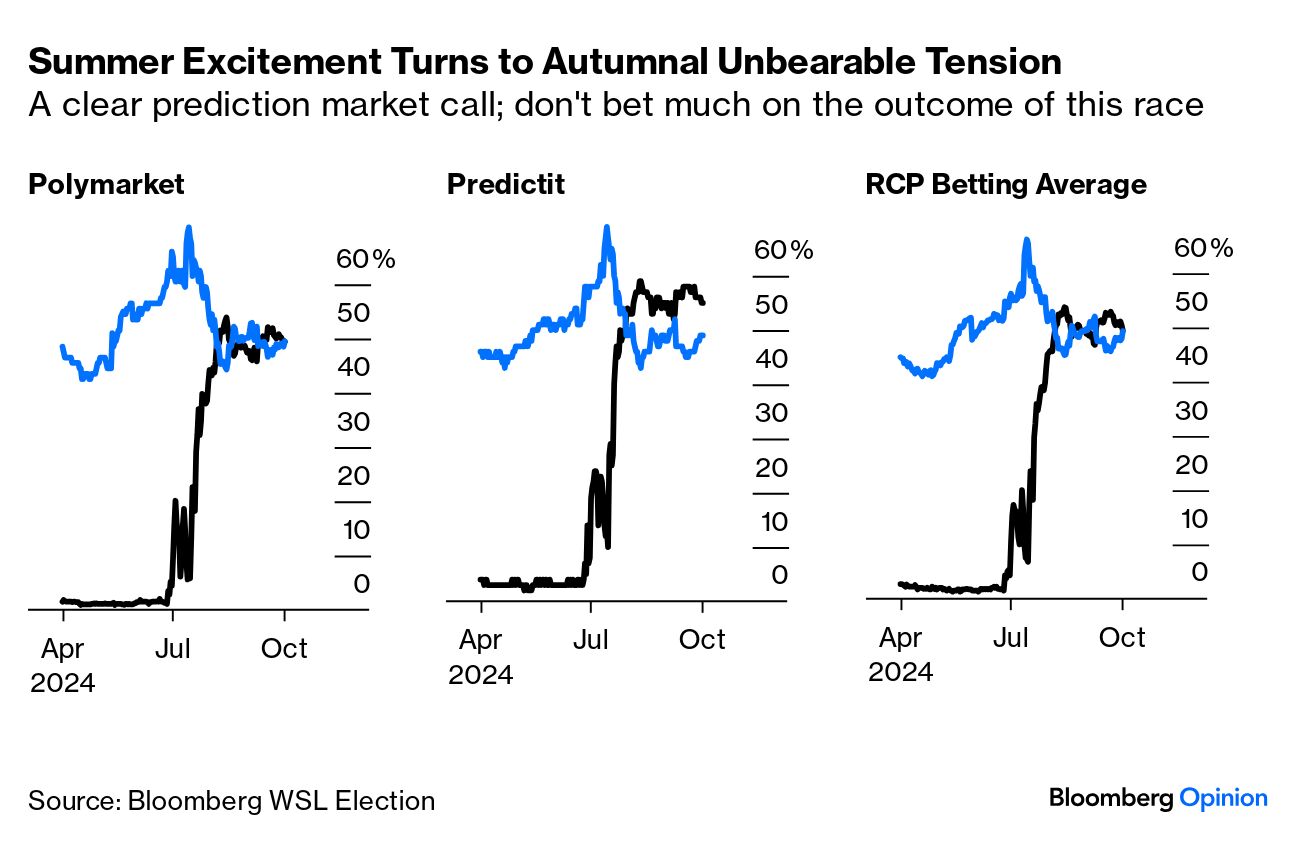

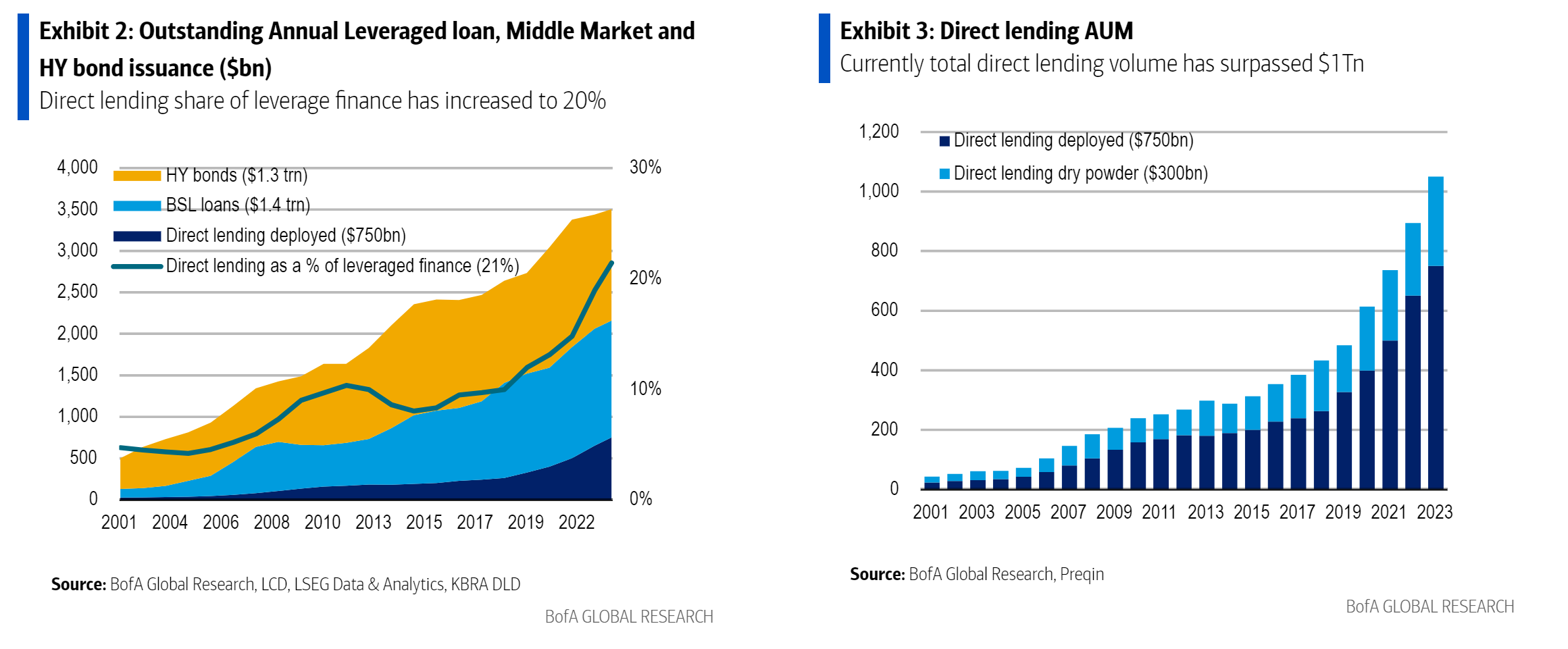

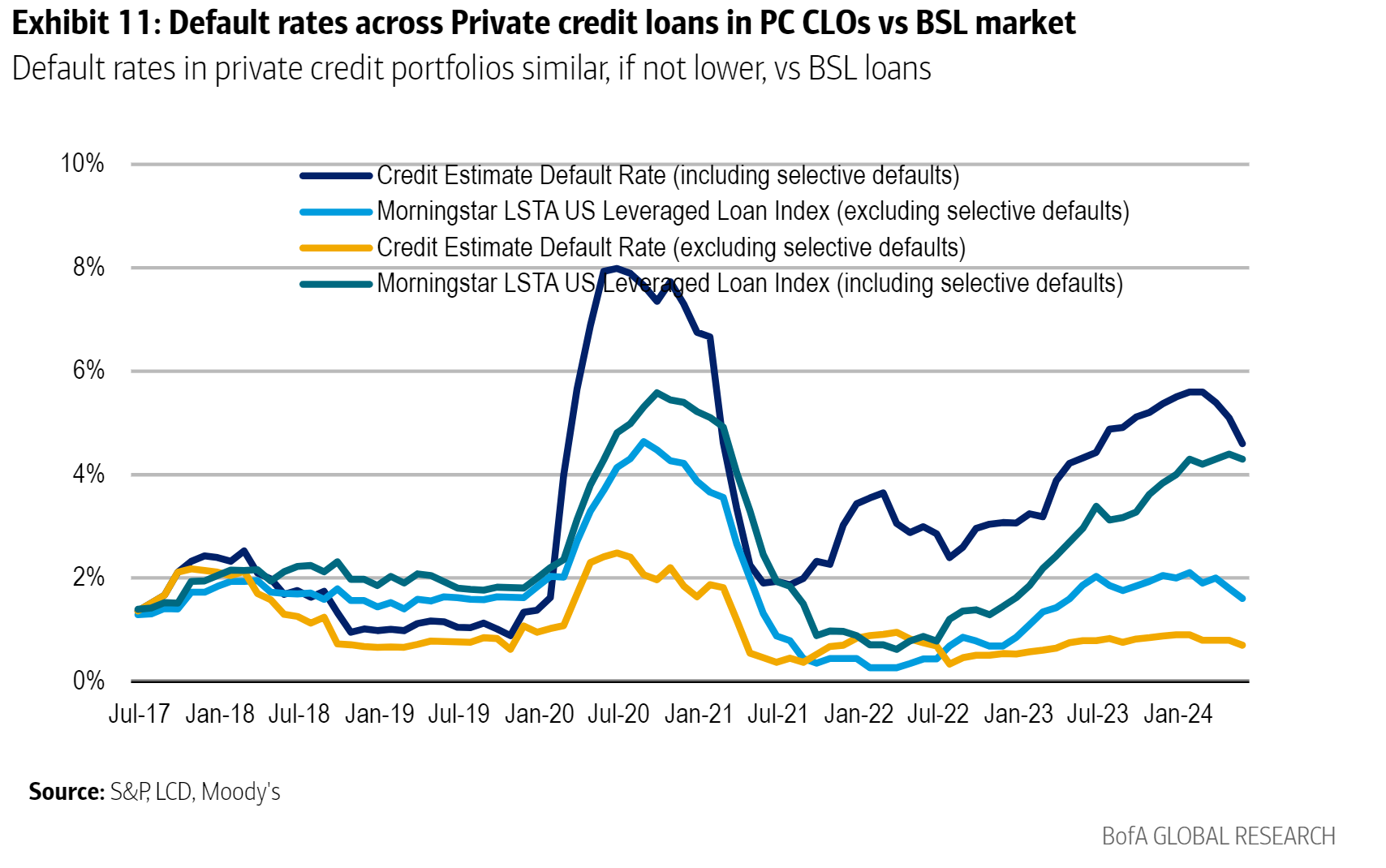

Then there's the economy. Markets have been celebrating imminent sweeping rate cuts from a data-dependent Federal Reserve for a while. Yet the data are not complying — and have started to surprise positively for the first time in five months, ahead of a welter of employment numbers to end the week:  The index adjusts as it goes along and it is now beating less-ambitious targets, but the point that data is not deteriorating as expected is important. Complicating this picture slightly is the first major new download of the month, the Institute of Supply Management's survey of manufacturing, which showed its headline number, as well as inventories and new orders, below the 50 level that marks the divide between expansion and contraction:  The survey has been in recessionary territory for more than a year without as yet triggering a downturn, making it one of the many recession indicators that generated false positives in that time. But it's notable that supply managers appear to be in suspended animation waiting for election results and interest rate cuts. The ISM's Timothy Fiore explained in the official release that this uncertainty has created an "unwillingness to invest in capital and inventory" and many companies are now focused on 2025 business planning. A furniture company executive was quoted as saying: "Business is flat. Waiting for interest rates to drop and the election outcome in November before we confirm our 2025 plans. Currently planning on a flat 2025." These results don't suggest any great excitement, but also imply that politics is weighing heavily on decision-making. The early numbers on employment for this month suggest more a state of suspended animation than ongoing decline. The estimate of private employment from the ADP payroll group ticked up very slightly. After varying widely from the official non-farm payroll data (due Friday) in the immediate aftermath of the pandemic, ADP's figures have been in much closer alignment of late. Slower job growth in the last couple of years isn't collapsing in a way that requires emergency tactics from the Fed. Rather, it looks like a soft landing: Something similar is afoot in job openings, which reached extreme levels in 2021 and 2022. The JOLTS (Jobs Openings and Labor Turnover Survey) comes out with a long lag, but we now know that it showed a surprising rise in vacancies for August. Meanwhile, the estimate of openings kept by Indeed.com, a jobs-listing service, suggests that vacancies stayed at much the same level in September: This is consistent with a steady slackening in the labor market, but not — at least as yet — with a significant slide into joblessness that would prompt the Fed into aggressive rate cuts. Wage growth — the crucial mechanism by which a tight labor market can create inflationary pressure — also shows a pattern of declining from a very high level. As of August, the Atlanta Fed wage tracker (based on census data) and the average hourly earnings number calculated as part of non-farm payrolls were both down from their highs, but still at levels that might make central bankers uncomfortable. (The swings in average hourly earnings are a statistical quirk caused by the fact that people laid off during the pandemic were disproportionately those on lower pay): It looks like the Fed, now more motivated by the employment side of its mandate than inflation, will have no need and little justification for another jumbo cut this year, even though the market still regards this as a virtual certainty. Friday morning should be interesting. Prediction markets are under attack, but they have their uses. Tuesday night's vice-presidential debate will not have changed many minds. JD Vance was widely and reasonably held to have done a better job of presenting himself, but there was never much chance that his face-off with Tim Walz would make much difference. It's the people at the top of the ticket who matter — for voters and bettors. Using Blooomberg's trusty WSL Election function, this is how the odds on victory shifted during the day on the PredictIt and Polymarket sites. They disagree a bit, with PredictIt persistently more enthusiastic about Kamala Harris. But both were utterly unmoved by the debate:  That confirms a broader truth about the race that's putting a damper on the economy and markets alike. Nobody is prepared to bet anything much on the outcome. After the titanic shifts during the summer as Joe Biden's dreadful debate performance led to his eventual replacement as Democratic nominee by Harris, the horse race has been in a deadlock since Labor Day. This is the move in probabilities over the last six months, according to Polymarket, Predictit, and the RealClearPolitics average of betting odds:  With conventions and debates now over, there are no more set pieces to give the campaign shape and direction over its remaining month. Without an October that really surprises, it will come down to mobilization efforts across seven disparate swing states on the first Tuesday in November. Either side could win. Gauging whom in such a contest is impossible. There are any number of arguments that either candidate will emerge victorious, but none on which you'd be prepared to base any major investment or business decision. Markets aren't moving with the elections campaign, simply because nobody is confident they can perceive who's ahead. Brace for stasis and suspense for another month, to end in a big way when either something tips the odds decisively, or when the election results are in and both sides have accepted them. Might be a while. Private credit's popularity has soared in recent years as tight bank lending prevailed. The asset class now holds about $2 trillion, a milestone that came nearly 15 years after the Dodd-Frank Act clamped down on banks' risky lending that helped trigger the Global Financial Crisis, effectively pushing those loans out of the banking sector. Fed easing will put a damper on one of the factors that has driven private credit's growth. Morgan Stanley's Ashwin Krishnan notes that direct lending to private non-investment grade companies thrives in high and rising rate environments. When he measured returns over seven different periods since 2008 when rates rose by 75 basis points or more, he found that direct lending yielded average returns of 11.6%, compared with 5% for leveraged loans and 6.8% for high-yield bonds. This Bank of America chart tracks direct lending's remarkable surge since 2001:  On this basis, managers should adjust their expectations for returns as the transition to low rates unfolds. Bank of America researchers expect a "modest decline" in returns, although they predict an improved performance for the companies they hold, which stand to benefit from a lower interest burden at the margin. This relief is timely, as rising private credit defaults were starting to raise concern of a much bigger contagion should rates stay high and the asset class turn sour: Default rates, including selective defaults, should improve on a go-forward basis. Companies with PIK (pay-in-kind) provisions have increased in share, but with lower rates, that should decline. Moody's upgraded a few business development companies on the back of improved performance based on higher asset quality.

As this BofA chart shows, while default rates are rising, it's not the worst out there: For lenders, there are opportunity costs to not getting involved as the Fed steps down from high rates. Heron Finance's Khang Nguyen argues that having many lenders chasing very few deals in recent years has meant that some end up lending on very borrower-friendly terms, cost-light, or covenant-light structures. Under these conditions, when things go south lenders have very limited tools to navigate the downside: But now, if rates are lower and expect to go even lower, and private equity has been trying to get back into the game and can actually start making acquisitions, then that will create a fresh source of deal flow. More deal flow will create more balanced deal dynamics.

From a dealmaking perspective, the lower rates are always a boon as they often reduce the valuation gap between buyers and sellers. Points of Return noted here how higher-for-longer rates sidelined dealmakers. Returning to lower rates, BofA's researchers say, will provide sellers with lower interest expenses and better cash flows: This aligns with reduced discount rates and higher valuations from buyers, bridging the gap between what buyers are willing to pay and what sellers are asking. In addition, buyers will have more borrower capacity to pay more. Therefore, we expect a pick-up in LBO/M&As driven by pent-up demand as PE sponsors look to return capital to prior investors as they start new funds.

Prior to the Fed's easing cycle, intense competition required private credit lenders to evolve. Those hoping to stay profitable in a lower-rate world where banks compete with non-bank institutions must now face up to a test. The migration of trillions of dollars from bank to non-bank balance sheets is a big opportunity; but it's equally important to keep tabs on risk as regulators play catch-up. —Richard Abbey  Kristofferson in the film 'Cisco Pike,' 1971. Photographer: Columbia Pictures/Moviepix/Getty Images Kris Kristofferson died over the weekend at 88. I didn't write about him because I didn't know much about him; since then, the outpouring of tributes suggests this was a big omission. He came across as authentic in every song and screen appearance he ever made. He was a brilliant athlete (varsity football and rugby at college, and also a Golden Gloves boxer); won a Rhodes Scholarship to Merton College, Oxford, where he earned a Masters in English; and then went through US Army Ranger school before serving in the military for several years. He chose his career as a country singer in preference to an offer to be the professor of English at West Point. He had a counterculture streak, and his songs all sound like he lived them. Apart from Me and Bobby McGee (immortalized by Janis Joplin) and Sunday Mornin' Comin' Down, Help Me Make It Through the Night struck a chord and multiple memorable duets. His empathetic friendship with Sinead O'Connor was remarkable, as you can see from this and this. And he was an actor, most famously in A Star Is Born, and most infamously in the legendary disaster Heaven's Gate (whose reputation has greatly improved since it opened to a box office bomb). He was also a passionate activist for liberal causes, with his military career giving him great credibility in disputes with more conservative country musicians like Toby Keith. What a life, what a man, and what an inspiration. Rosh Hashanah, the Jewish new year, is getting underway, and Points of Return will be taking a long weekend. A happy new year to those who celebrate it, and a good weekend to all. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment