| The most urgent questions for tech investors are: Who is going to make a windfall from the AI frenzy, and at what cost?

There's a lot riding on the answer that Microsoft and Meta will give later today, given the billions being spent by both companies. AI will all be worth it if they can show their investment is starting to paying off, like Alphabet did.

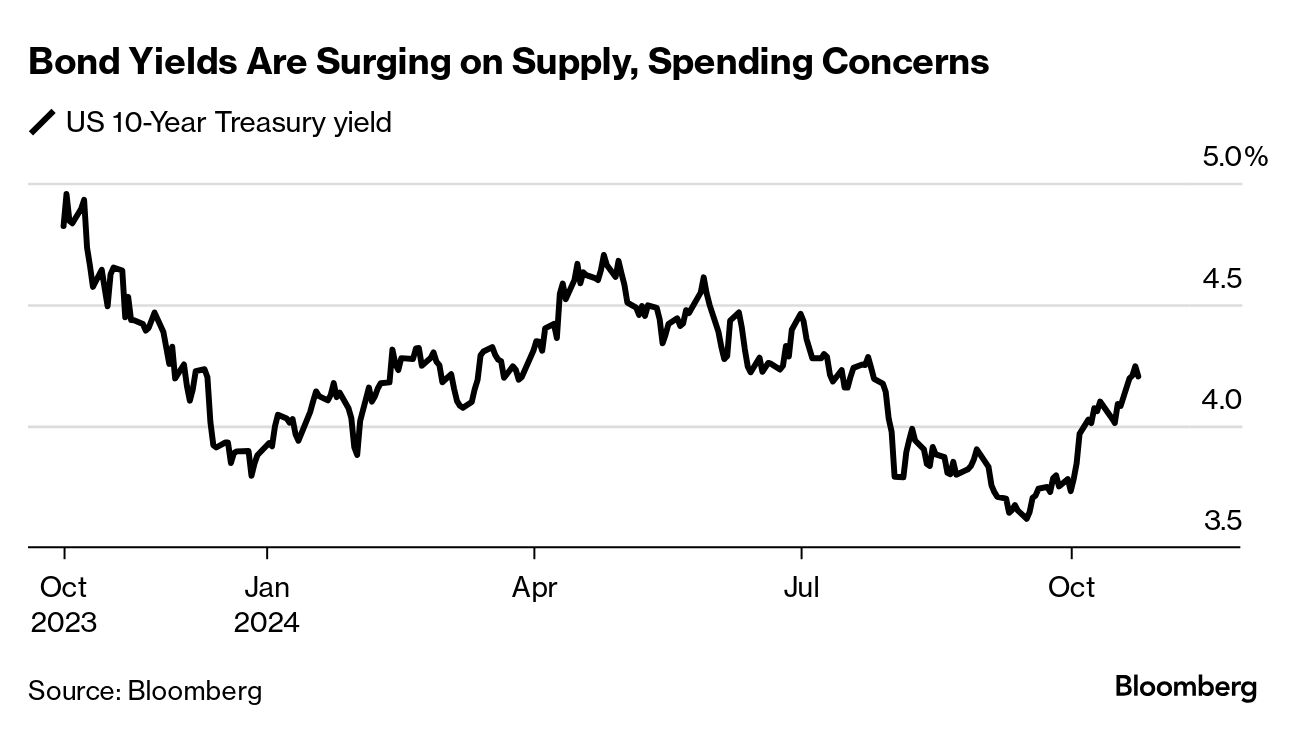

But there are also pitfalls. AMD was a disappointment and investors wiped $122 billion off Samsung's market value on the view it's an AI laggard. Investors have turned cautious toward megacap tech stocks, given the enormous AI investment, pricey valuations and slowing earnings growth. A gauge of the Magnificent Seven tech megacap stocks tracked by Bloomberg has struggled to regain its July highs. "There's been an enormous amount of capital spent on developing AI,'' said Brian Mulberry, client portfolio manager at Zacks Investment Management. "We're actually looking very specifically to see who is monetizing it, who's actually giving a return on investment and what does it look like."

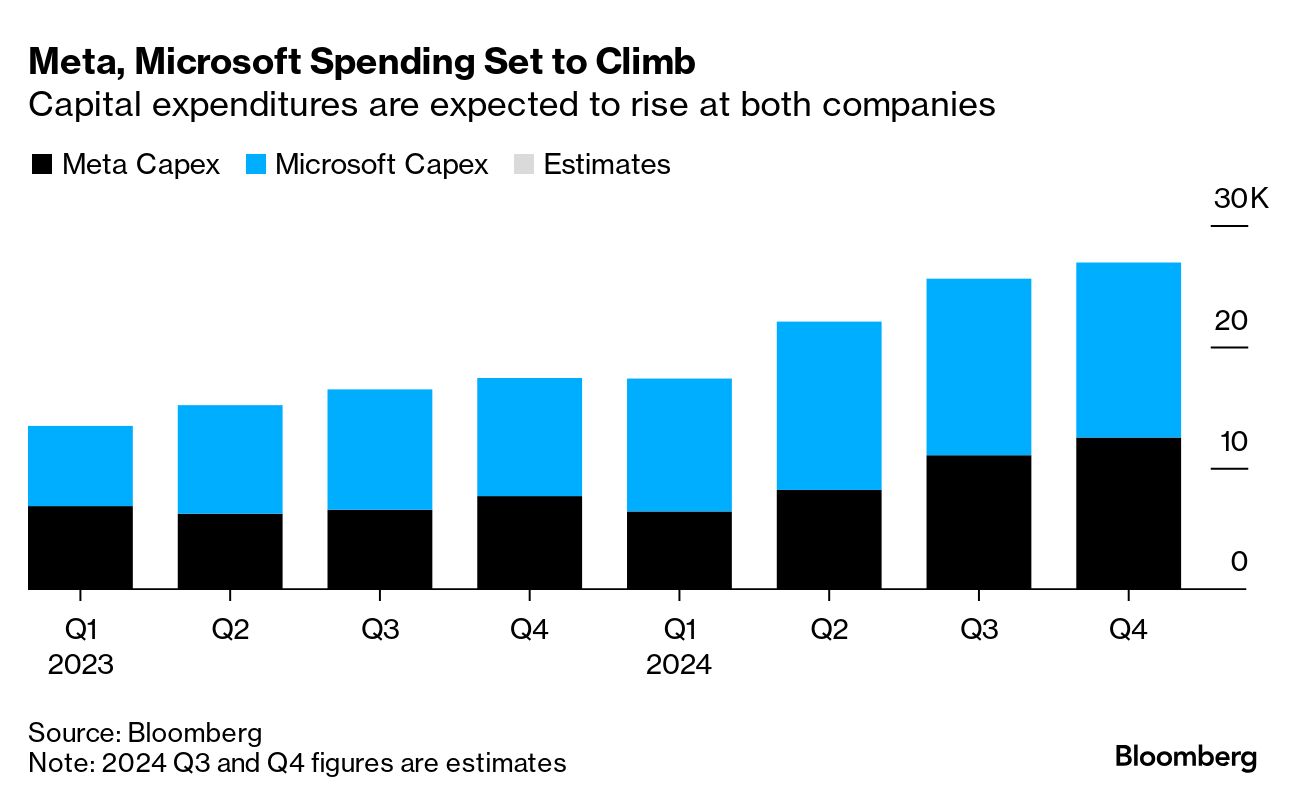

Microsoft's capital spending last quarter probably jumped 45% to about $14.6 billion, according to estimates compiled by Bloomberg. At Meta, spending is projected to have soared by almost 70% to $11 billion.

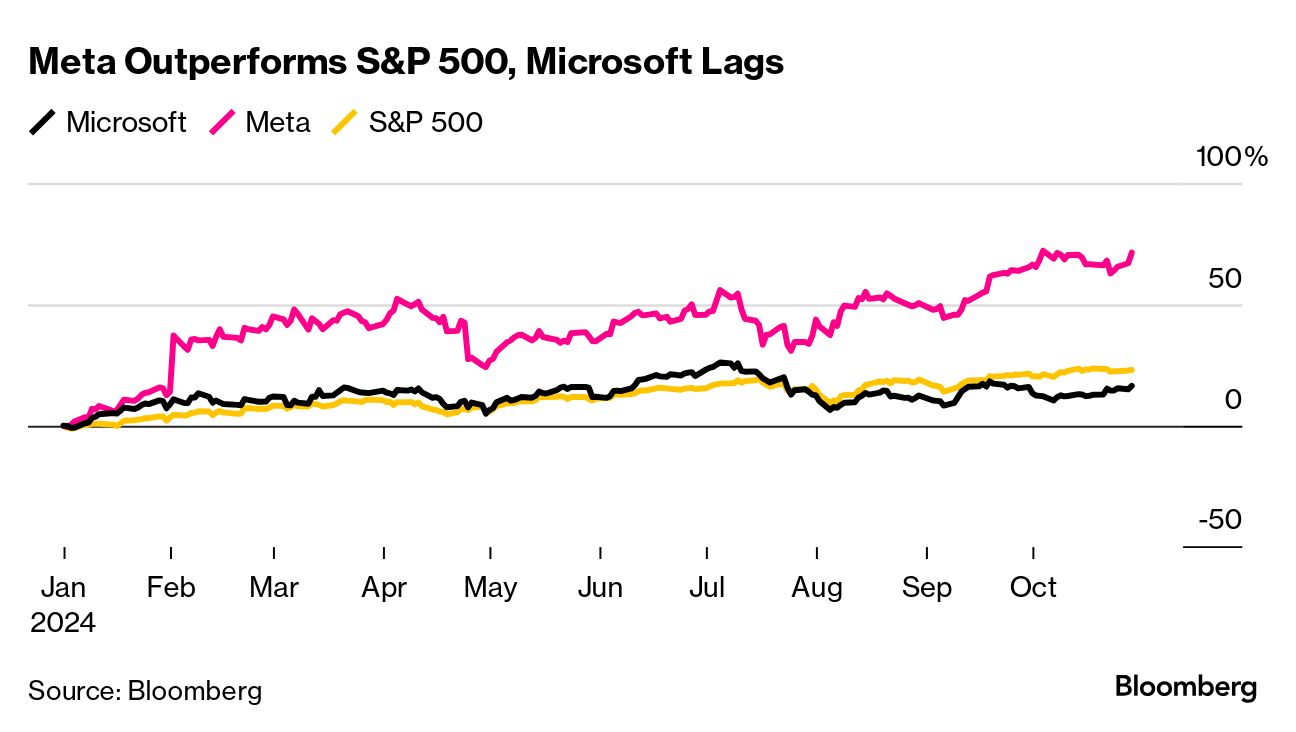

The push for answers may be greater among Microsoft investors. The stock is the second-worst performer in the Mag 7 this year, beating out only Tesla.

The shares have struggled as the market weighs the artificial intelligence outlays against slowing growth for the Azure cloud-computing service. Revenue is tipped to creep just 1% higher from a year earlier, on a constant-currency basis. Last quarter, faltering sales growth at Azure hit Microsoft stock. The mood going into Meta's results is different as the stock is up 64% this year, outpacing the broader market. In its last report, the company showed some progress in ad sales thanks to AI, buying it more time for heavy investments to pay off. Of course, both companies also risk disappointing investors by not spending enough — which could be seen as a sign that they're set to fall behind in the AI trend. "The CEO of a tech company is much more likely to get fired for not spending enough on AI versus spending too much," said Shana Sissel, president and CEO of Banrion Capital Management. "Because right now, that is the deciding factor." —Carmen Reinicke |

No comments:

Post a Comment