| Financial markets are heading for a pivotal two-week stretch. A blockbuster run of big tech earnings, jobs data, the Federal Reserve meeting, Chinese policy and Treasury market announcements, plus the final days of the US presidential election. As Bloomberg's Markets Live strategist Cameron Crise sums it up: "It will probably be a good idea to strap into your seat," he says. "There's a pretty potent cocktail of potential volatility."

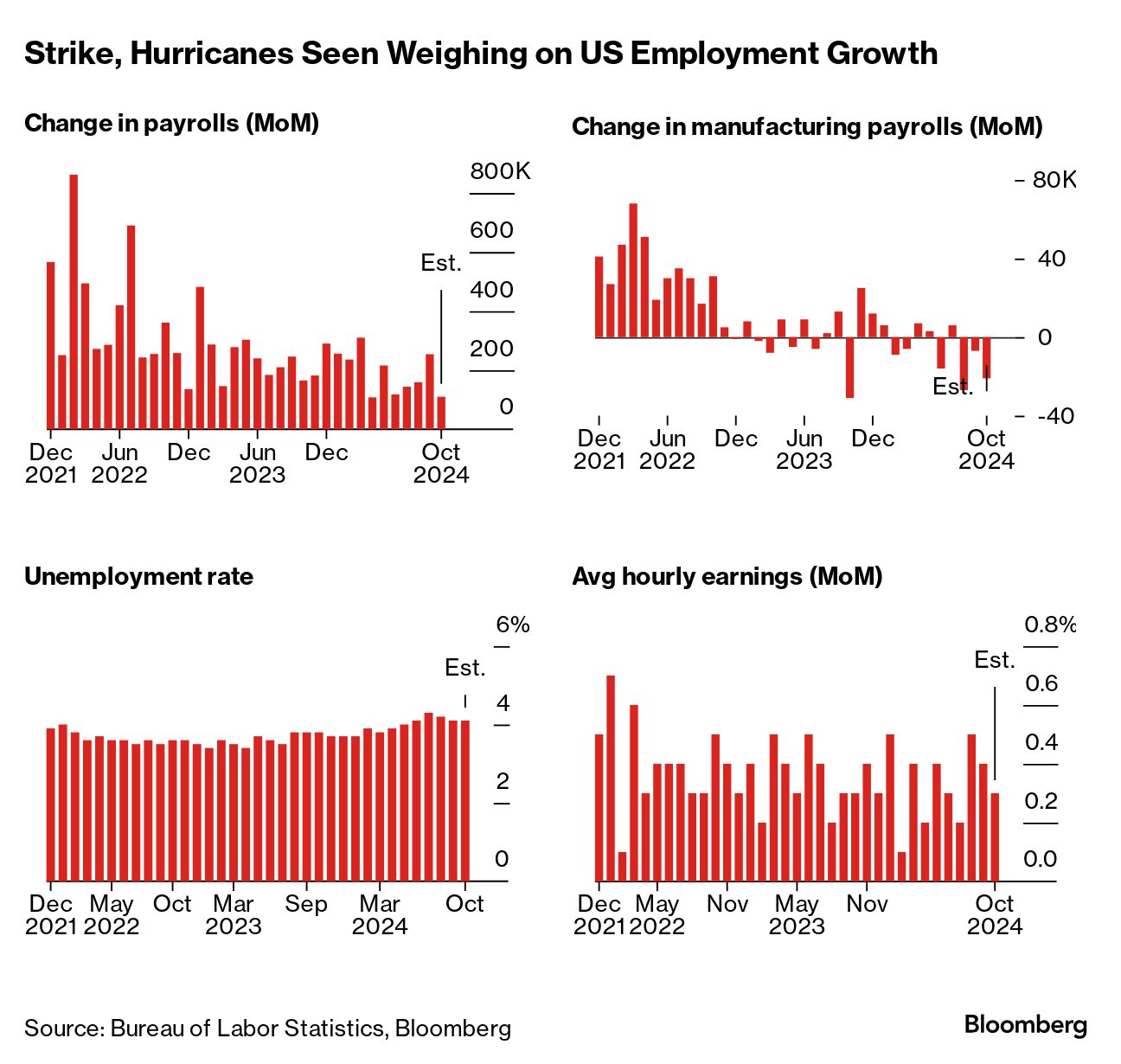

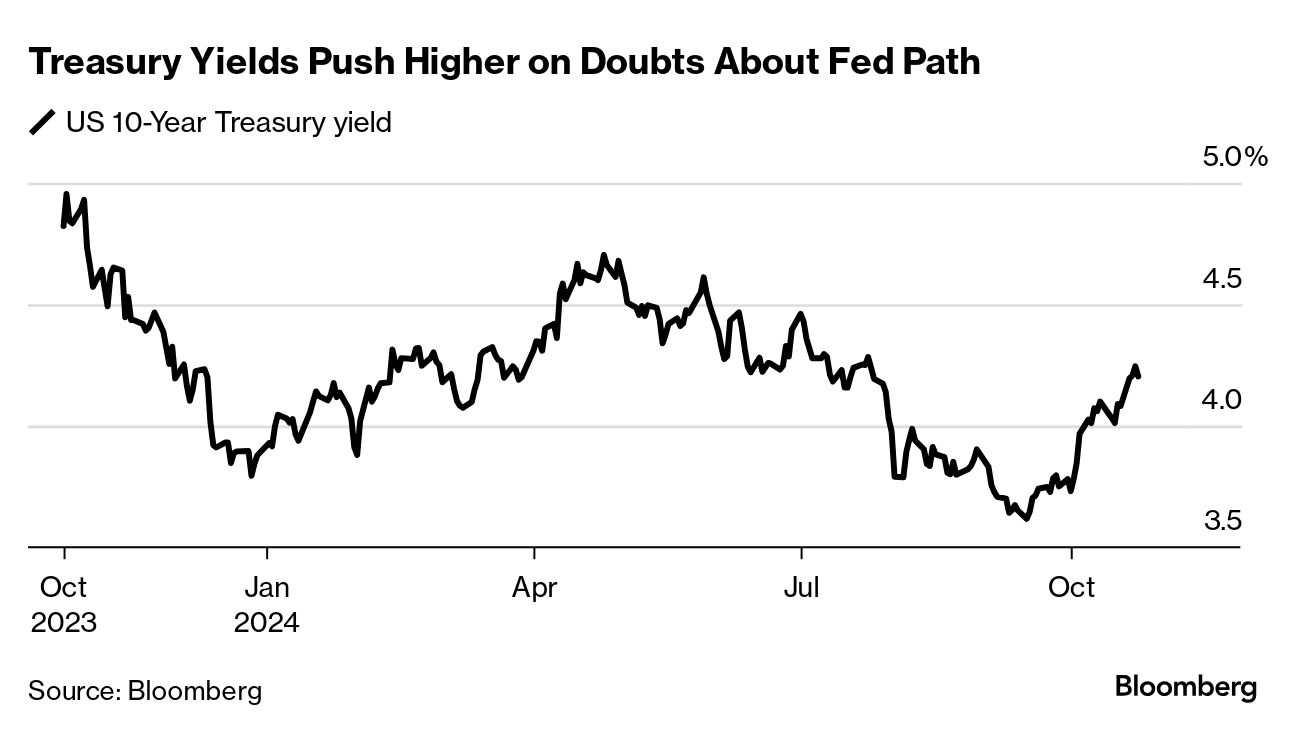

Here's a look at what's ahead: Earnings season rush: This week is the busiest for company results. Almost half of the S&P 500 reports over the next 10 days, including five of the Magnificent Seven, as well as Eli Lilly, Exxon Mobil and Visa. Nvidia isn't expected to announce earnings for another month, but results from the chipmaker's biggest customers will set the tone for its shares. Read more in this deep dive of what stock investors expect for US profits. US debt sale plan: The Treasury is expected to announce on Wednesday that it's keeping the size of its debt auctions steady in the upcoming quarter — averting any supply pressures — though traders will also be paying close attention to any signals on the future trajectory. Check out this rundown of what bond investors are watching.

UK budget day: The Labour government will reveal a historic package of tax hikes and extra borrowing in its budget on Wednesday.

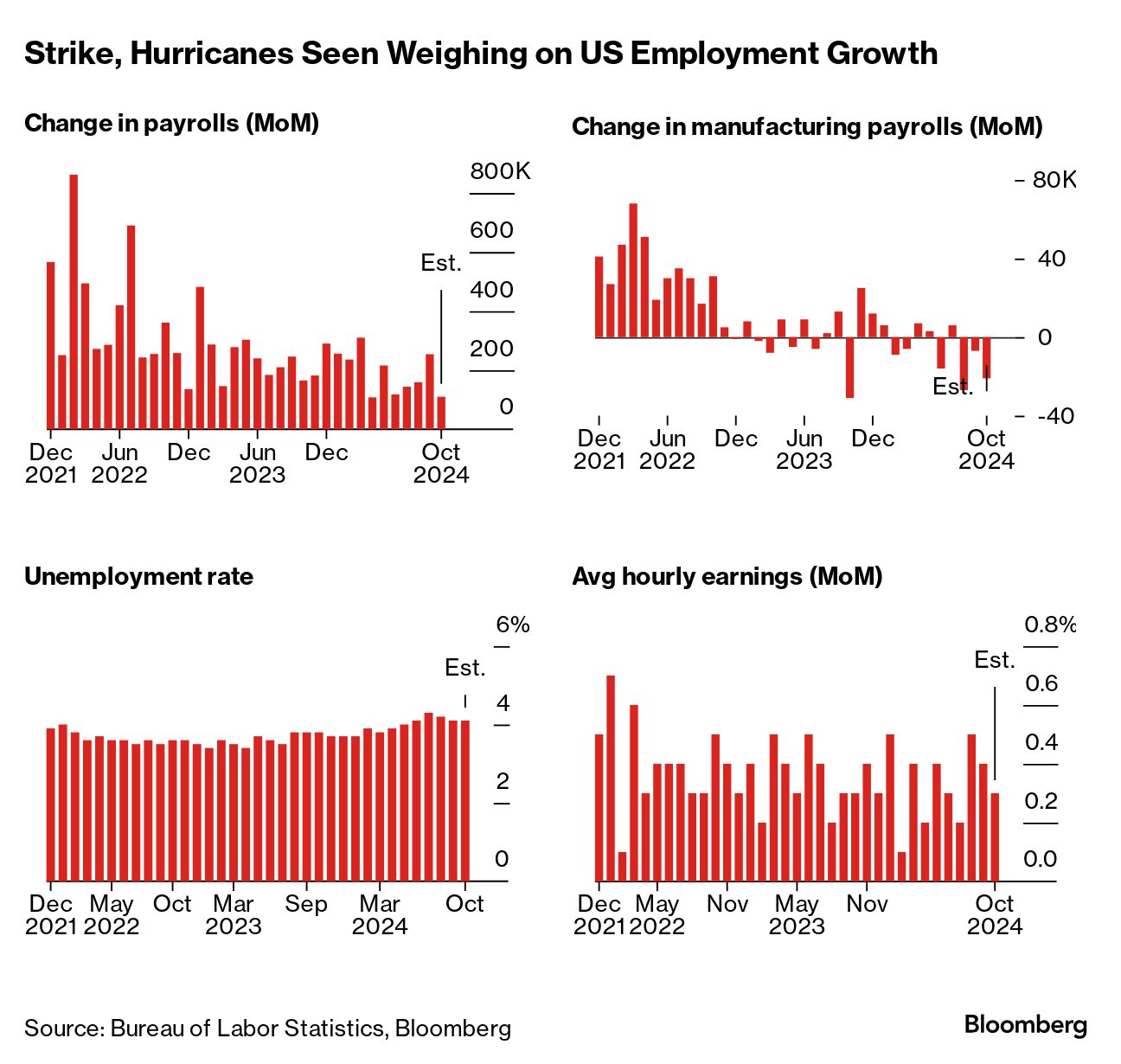

Inflation and jobs data: The Fed's preferred inflation gauge and the US employment report for October are scheduled for Thursday and Friday, and may show whether the economy is cooling enough to justify further interest-rate cuts.

Employers expanded payrolls by 110,000 workers in October, according to economists surveyed by Bloomberg. The numbers may be distorted some by the hurricanes that struck the southeast US and the strike at Boeing. Here's a full economics calendar.  Japan sets interest rates: The BOJ is widely expected to keep rates unchanged on Thursday. Given the yen's weakness, market players will be looking for any hawkish signals. US election day: Wall Street has been obsessed with the outcome of the race and what it will mean for markets after Nov. 5. Some strategists say win for Republican Trump would send bond yields higher on the basis of his pushes for higher tariffs and tax cuts. A Bloomberg Pulse survey to be released today will show respondents think the stock market is more likely to pick up steam under Trump than Harris.

Fed meeting: Swaps are pricing in a more than 80% chance that the central bank will cut rates by a quarter point on Nov. 7. But they also signal strong odds that it won't shift at one of the next two meetings and will look to Chairman Jerome Powell for clues. China policy meeting: The top legislative body will hold a highly anticipated session in Beijing on Nov. 4-8. Investors will be closely watching for any approval of fiscal stimulus to revive the slowing economy. |

No comments:

Post a Comment