| Sky-high stock valuations, super-concentrated markets and the US government's enormous interest bill — here are the charts spooking investors.

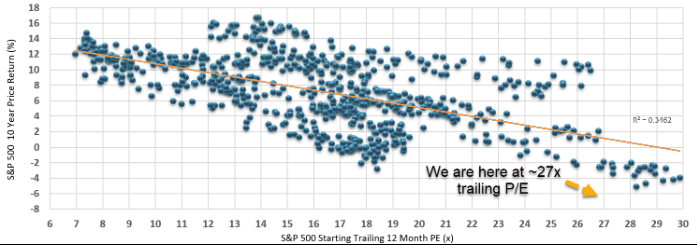

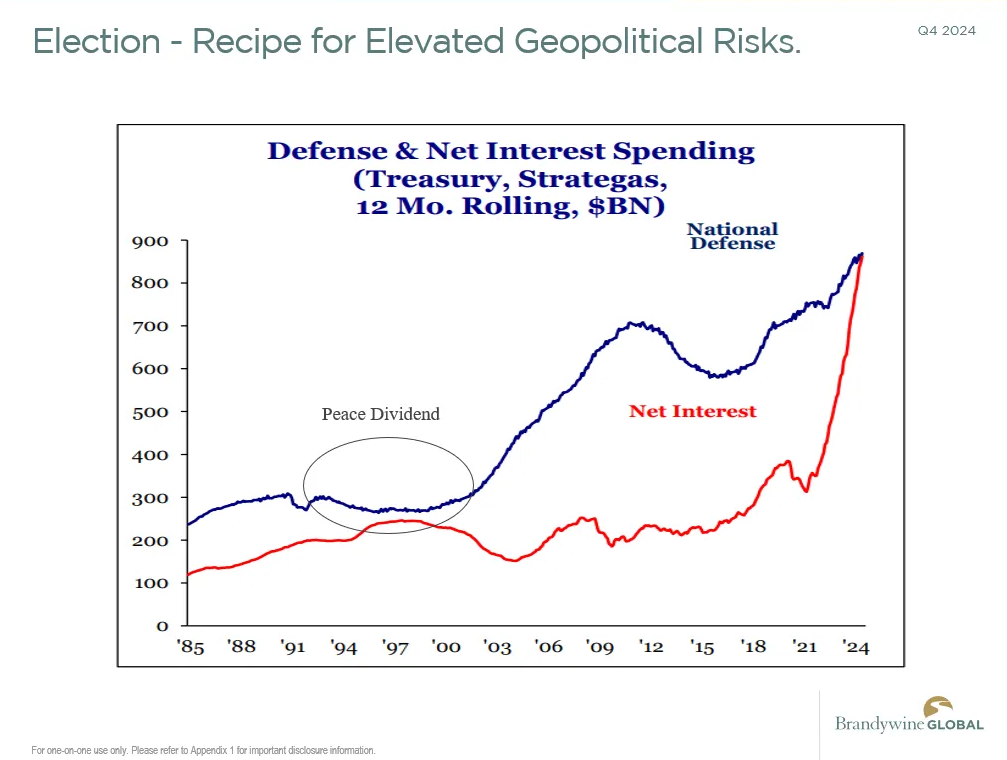

Precarious P/E: "We are at the third-highest valuations on the S&P 500 in modern history only behind 1999/2000 and 2021. If this valuation upside continues, it leaves forward-looking returns less compelling," says Emily Roland, co-chief investment strategist for John Hancock Investment Management. US concentration: "Current pricing prices a likely implausible concentration in earnings and wealth into US companies forever in the future. The last time the US showed a market cap share like this was just ahead of the tech bust, and we all know how that went," says Bob Elliott, co-founder and CEO at Unlimited. Deficit spending: "The US government pays out more in interest expense than it spends on national defense. Both are not going to be going down anytime soon. It just highlights we're spending way beyond our means, living on debt and at some point the bond vigilantes will emerge with a vengeance. Maybe as soon as next week," says Jack McIntyre, portfolio manager at Brandywine Global Investment Management. For more market charts, check out the full story. |

No comments:

Post a Comment