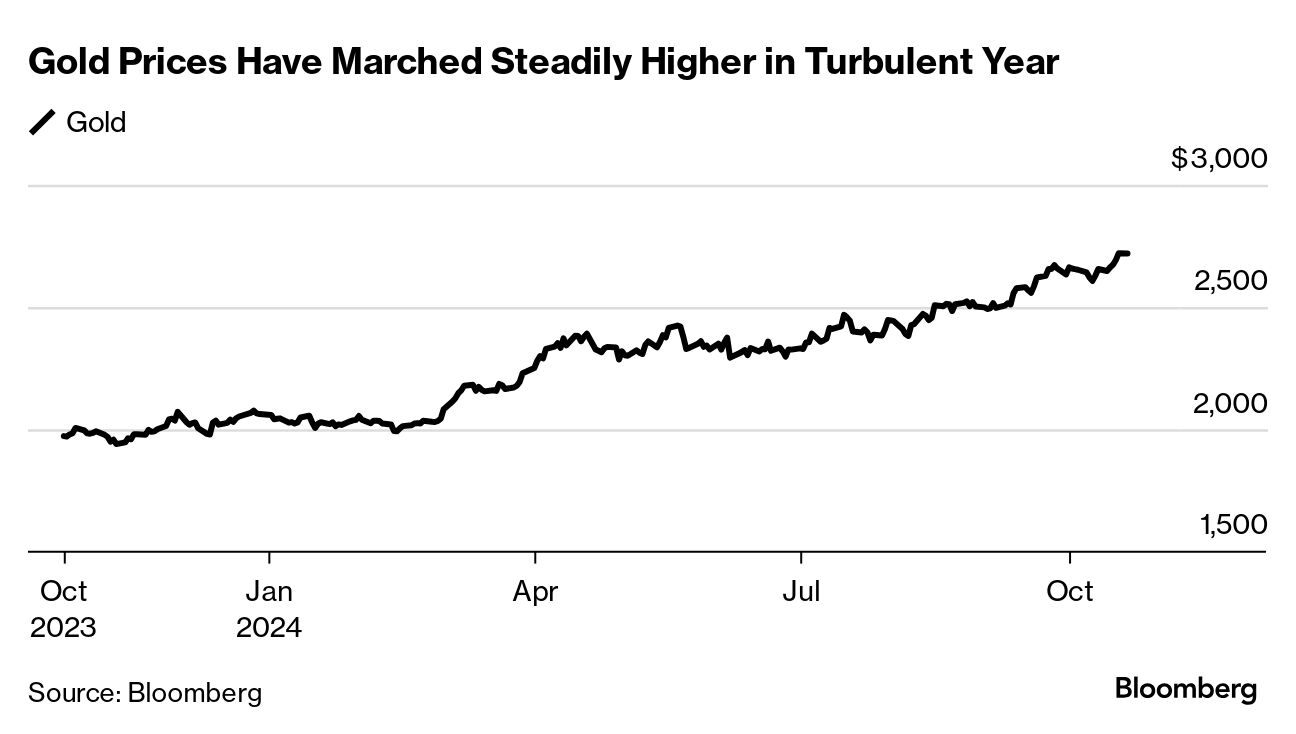

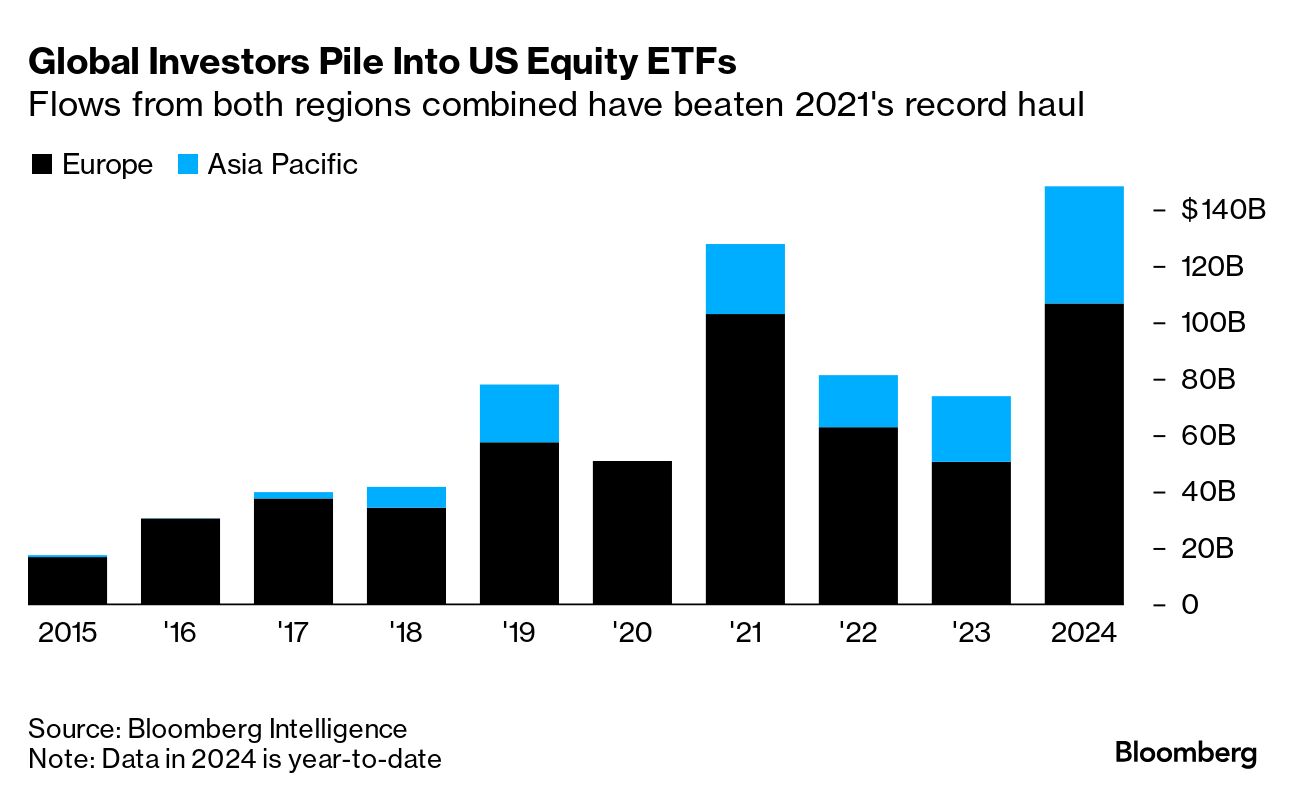

| Wondering where all the money comes from to push up US stocks, week in, week out? The answer is everywhere. Investors in Europe and Asia-Pacific have sent about $147 billion to US equity-focused exchange-traded funds this year, already eclipsing the record $124 billion for all of 2021, according to data compiled by Athanasios Psarofagis of Bloomberg Intelligence. About $106 billion came from Europe and roughly $41 billion came from the Asia-Pacific region. While the inflows are less than the $500 billion sent by US buyers, it's another marker of demand in the bull run that has sent the S&P 500 up 23% this year. —Isabelle Lee The S&P 500 has been advancing at a pace of about 2% a month so far this year, and gold has enjoyed an even greater rally. Will those gains extend for another year after the next president takes the White House? What will be Bitcoin's trajectory, depending on whether Kamala Harris or Donald Trump win? Share your views in the latest MLIV Pulse survey. |

No comments:

Post a Comment