| Back in 2013, when the Federal Reserve was led by Ben Bernanke, he gave an important speech to bolster the Fed's image. This was in the wake of the Great Financial Crisis and multiple rounds large scale asset purchases by the Fed and during the European Sovereign Debt Crisis. Bernanke promised ever greater transparency for how the Fed makes decisions, outlining specifically how he thinks about the Fed's policy tools and communications. One of the more important things he said was about the term premium: it is useful to decompose longer-term interest rates into two components: One reflects the expected path of short-term interest rates, and the other is called a term premium. The term premium is the extra return that investors require to be willing to hold a longer-term security to maturity compared with the expected yield from rolling over short-term securities for the same period.

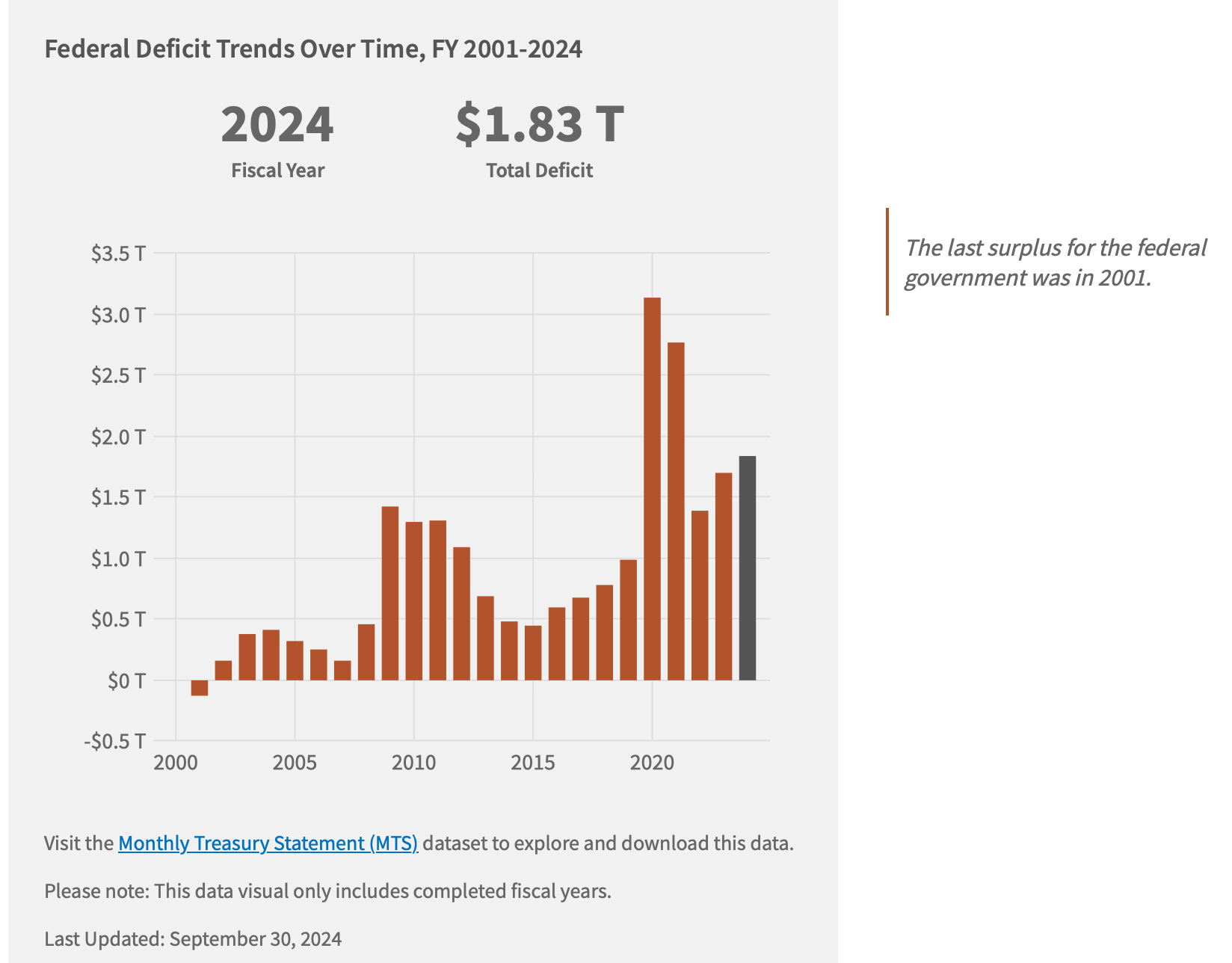

Translation: The only thing you really need to know about bonds is what the market thinks future interest rates will be and how much more yield investors will receive for taking on the risk of longer maturity bonds. That's it. If you know those two things, then you can place an informed bet accordingly. As it turns out though, the European Sovereign Debt Crisis was so wrenching and the demand for safe assets so large that the premiums Bernanke mentioned that the US government had to pay for longer maturity debt became discounts. The premium had been declining for years. But it was that loss of confidence in the bonds from countries like Italy, Ireland, Spain, Portugal and Greece that had investors clamoring for US Treasuries to the degree that they were willing to pay more than what average expected future interest rates would have dictated. In a sense, to lock in a return on a safe asset, people were paying more than that asset was worth. And when the pandemic hit, that willingness hit an extreme, which — combined with the Fed's zero percent policy rate — brought long-term Treasury yields to stunningly low levels. That was great for big corporations and wealthy and upper middle-class homeowners who locked in low debt payments. But when the Fed started raising interest rates, not only did the base rates go up, so did the term premium. Locking in a safe asset for 10 years when you didn't know the direction of inflation or interest rates seems like a fool's errand. And investors holding those assets got burned. Famously, Silicon Valley Bank went bankrupt because of it. So, where are we now? Right now, the term premium is rising at a fast clip as the US economy has avoided a recession and the torrent of debt from US deficit spending increases. Take a look at this chart from the US Treasury Department's website: Excluding the huge and necessary deficits of pandemic years 2020 and 2021, it shows deficits increasing every year since 2015. What's more, both major presidential candidates, Kamala Harris and Donald Trump, have economic plans that will keep this trend going. Harris' plans are not as deficit-inducing because she wants to increase some taxes on the rich and corporations. Trump's plan really makes him the "King of Debt." And that's a big reason people are talking about soaring yields, soaring Bitcoin and soaring gold prices as Trump trades. |

No comments:

Post a Comment