| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. America's factories aren't built for the current cascade of extreme weather events. Dozens of industrial sites were in the zone of impact as Hurricane Milton slammed into Florida's West Coast this week, including several concrete plants, speed boat manufacturing operations and facilities owned by Honeywell International Inc., Johnson Controls International Plc, General Electric Co. and Illinois Tool Works Inc., among others. Meanwhile, a Baxter International Inc. facility in Marion, North Carolina, that makes 60% of the intravenous fluids used in hospitals around the country was shuttered because of damage from Hurricane Helene just two weeks ago. Mines responsible for producing more than 80% of the world's supply of commercial high-purity quartz in nearby Spruce Pine were also affected by severe flooding, raising the risk of disruptions to semiconductor production, which relies on the material. It's just the latest reminder that extreme weather — like labor strikes, shortages, cyberattacks, pandemics and geopolitics — has the potential to upend an already delicately confederated industrial supply chain. That's particularly true in the Southeastern part of the US, where manufacturers have increasingly clustered amid the lure of favorable tax and regulatory policies and an accessible workforce. Industrial companies have been moving away from a heavy reliance on far-flung supply chains centered in Asia and have been adding to their North American footprint. But there's an even more granular geographic consideration to this pursuit of redundancy: Just as it's not wise to depend on a single supplier for a key part, it's risky to concentrate the US wing of a company's manufacturing operations in one part of the country. Read More: Texas Forges Lead in Factory Building Boom

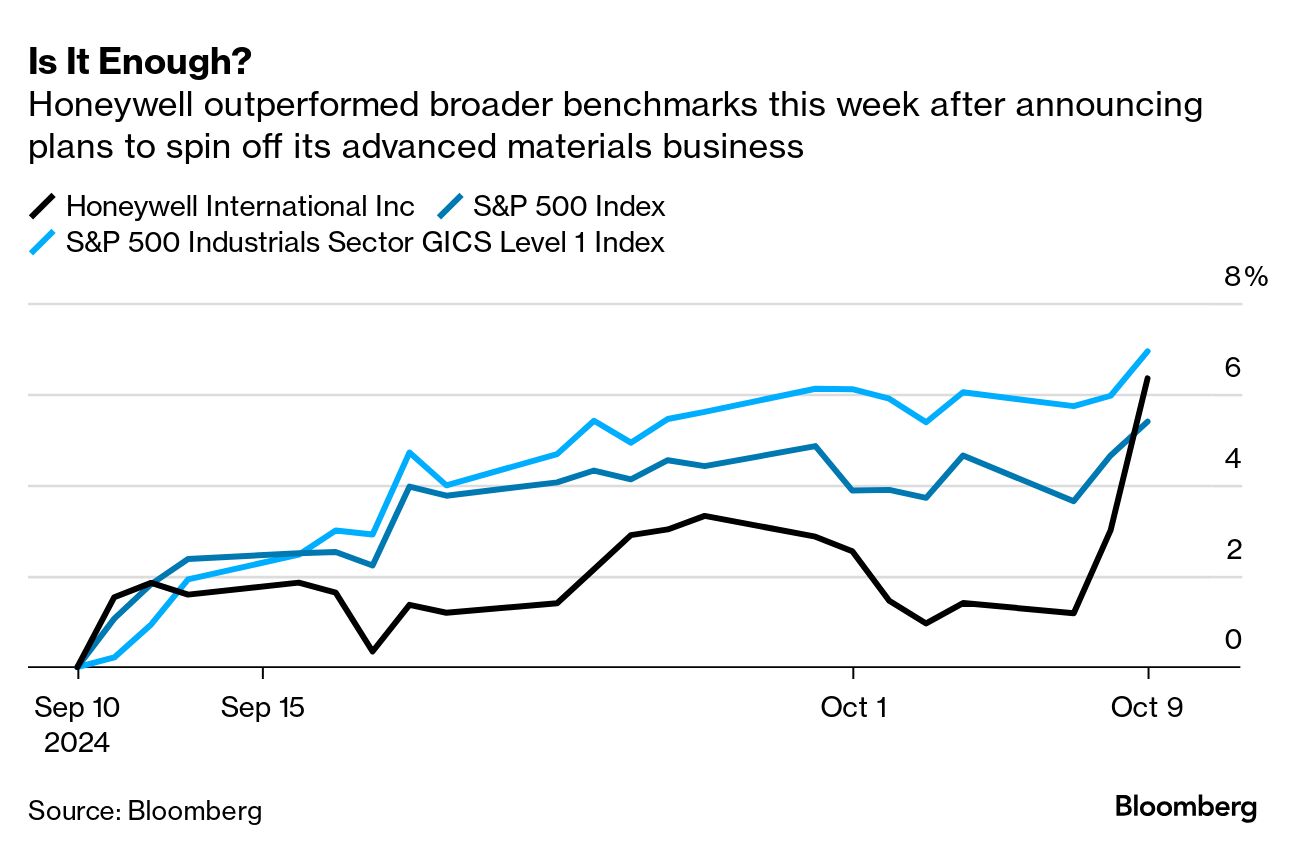

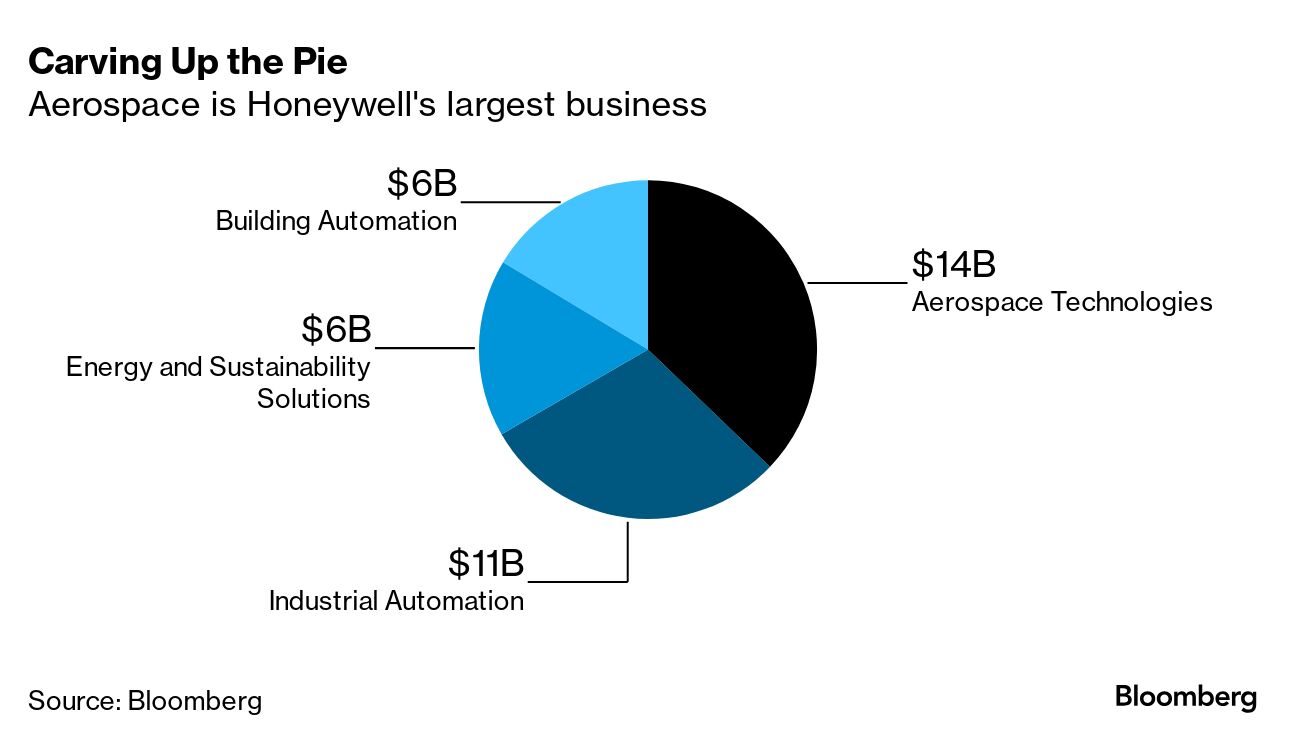

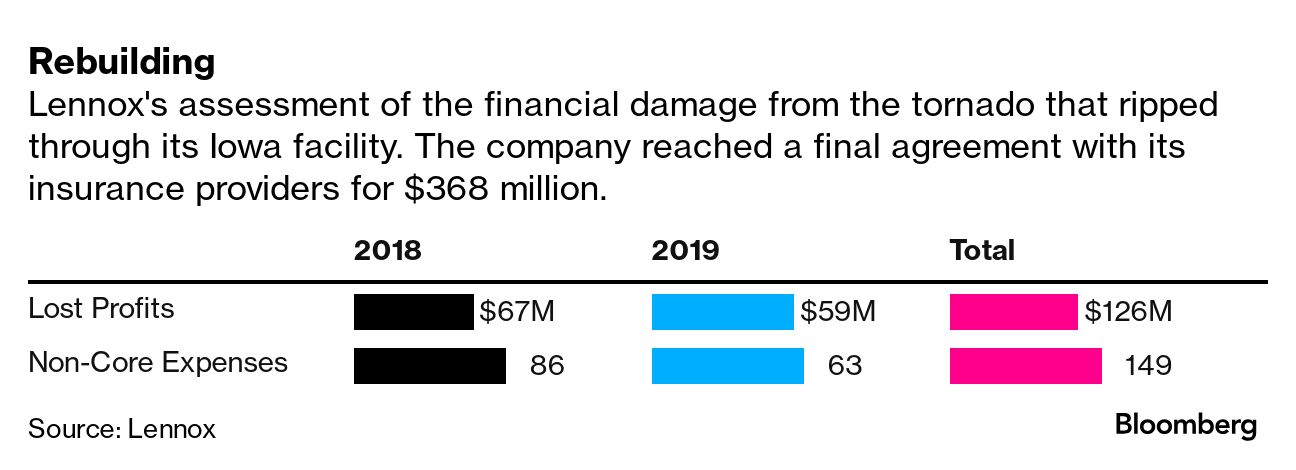

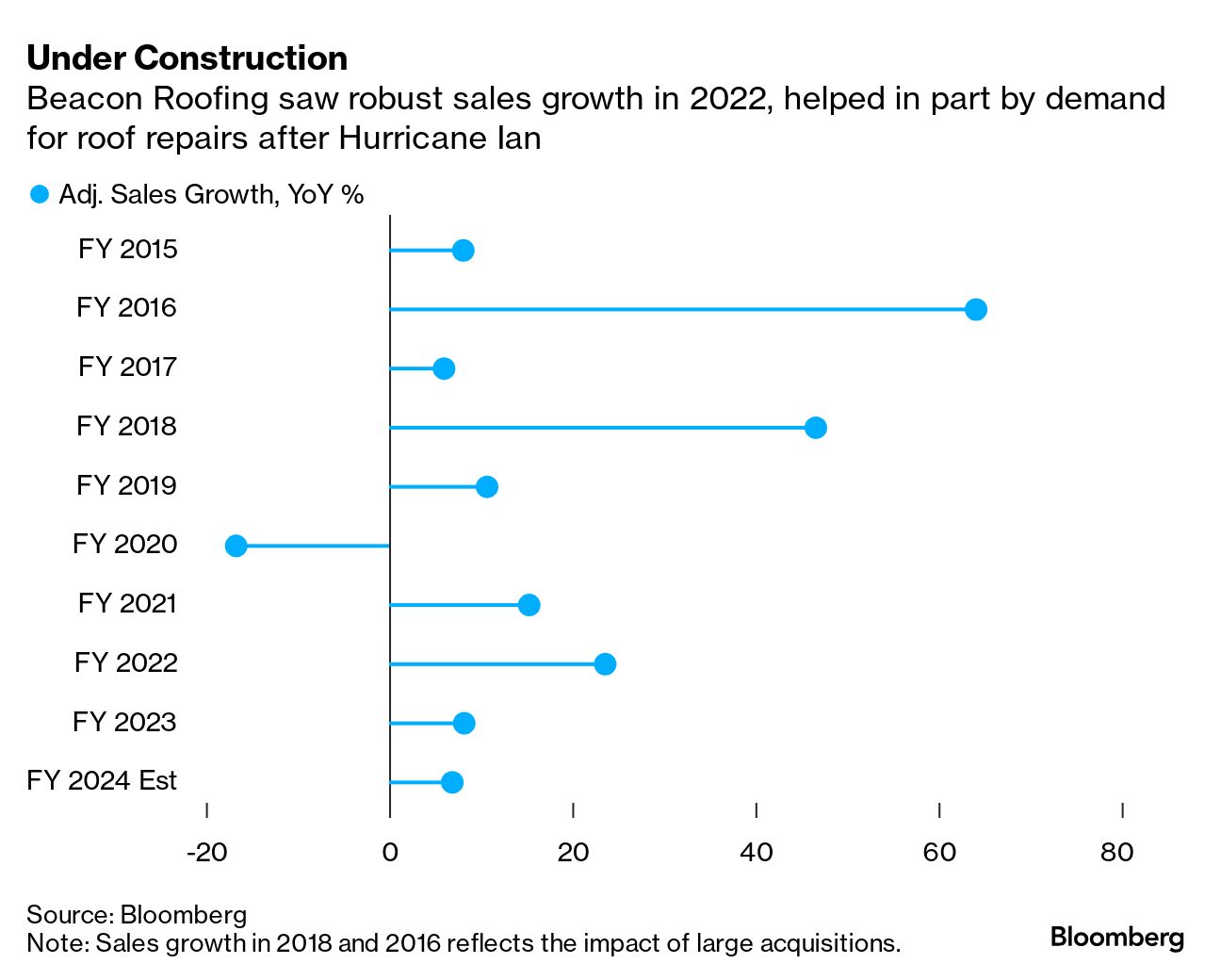

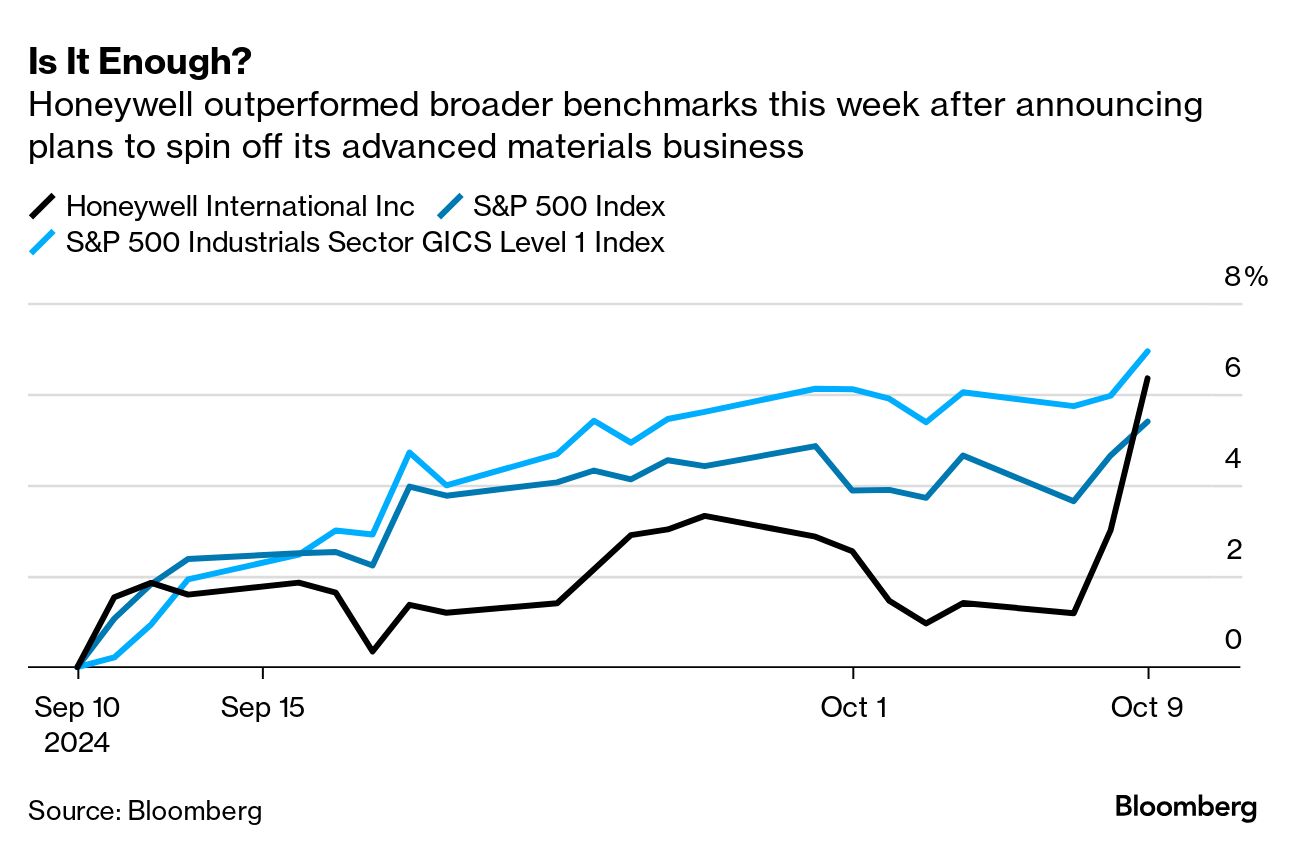

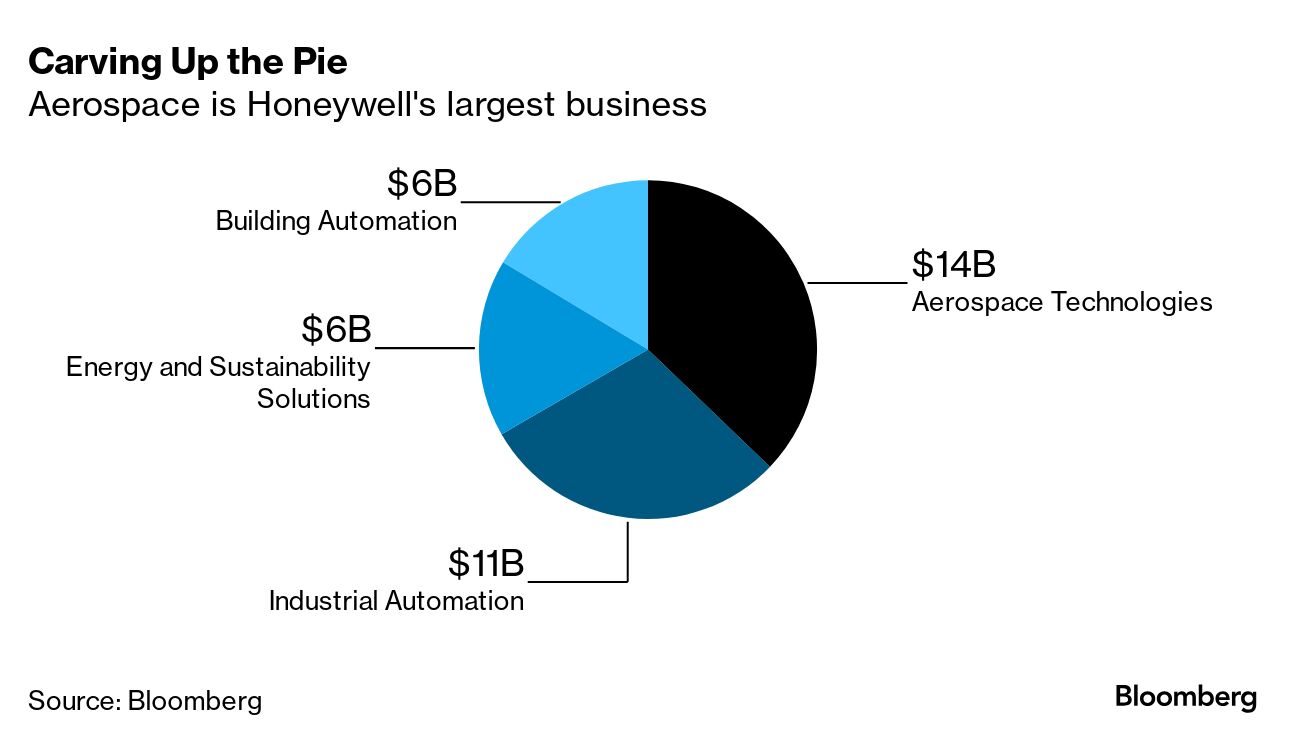

The risk of a tornado or violent storms is one reason why Schneider Electric SE decided to build a new switchgear and power distribution products factory in Mt. Juliet, Tennessee, rather than adding to its existing large electrical product manufacturing presence in Texas, according to Aamir Paul, president of the company's North American operations. The GE Aerospace facility in Clearwater, Florida is associated with the company's avionics operations. It has a similar site in Grand Rapids, Michigan. With climate change, weather disruptions are becoming more frequent, more severe and more unexpected. An unusual bout of extreme cold in Louisiana in late 2022 affected processing facilities serving Honeywell's performance materials business "because, frankly, they're just not built to operate in 5 degree weather," former Chief Executive Officer Darius Adamczyk said at the time. "That's not what you typically see in Louisiana in December." The effects from weather-related damage can be financially crippling. An Iowa tornado ripped apart a Lennox International Inc. air conditioning and furnace plant in 2018; it took years to rebuild the factory and the company's profitability has been pressured after executives signed contracts without inflation protections to help recover sales volumes. "We never want to use the 'T' word again in any of our conversations," Lennox CEO Alok Maskara said last year when the Iowa plant finally reopened. A Pfizer Inc. sterile injectable medicines manufacturing plant in North Carolina was closed for about ten weeks last year after a tornado blew off part of the roof.  A Pfizer pharmaceutical factory after a tornado damaged the facility. Photographer: Sean Rayford/Getty Images North America The flip side is that if factories can emerge unscathed, hurricanes and tornados — as catastrophic and gut-wrenching as they are — are actually pretty good business for industrial companies. Electrical transmission and distribution suppliers such as Eaton Corp., Hubbell Inc. and GE Vernova Inc. will be tapped to repair damaged power grids, while industrial distributors such as W.W. Grainger Inc. provide preparation and recovery supplies, including radios, tarps and generators to government entities and businesses, Melius Research analyst Scott Davis wrote in a note earlier this month after Hurricane Helene. Flooding from hurricanes typically generates higher volumes of cars that insurers deem too expensive to repair and those vehicles often end up in the hands of auctioneers like Copart Inc., which sells totaled automobiles to scrap yards, dismantler operations and buyers in emerging economies at increasingly high prices. Hurricanes also tend to boost demand for utility poles, made by the likes of Koppers Holdings Inc. And then there's the construction industry, with building materials companies including Beacon Roofing Supply Inc., Owens Corning and Eagle Materials Inc. likely to see increased demand for roof repair projects in the wake of Hurricane Milton, Jefferies analyst Philip Ng wrote in a report this week. Beacon Roofing estimated that Hurricane Ian, which made landfall on Florida's Gulf Coast in 2022 as a Category 4 hurricane, translated into demand for 3 million extra asphalt roofing shingles, or about 2% of the industry's annual shipments. "It might be a hospital, it might be a retirement home, whatever it is, call them up and see if they're okay," Dan Florness, CEO of industrial distributor Fastenal Co. said on the company's earnings call in July shortly after Hurricane Beryl barreled into Houston and knocked out power for more than 2.5 million homes and businesses. "I don't care if they're a customer of ours or not, be there to help because that's what we are. We're a supply chain when people need stuff."  Honeywell this week announced that it will spin off its advanced materials arm, which makes low-global warming refrigerants for air conditioners and colored biocompatible fibers used in surgeries. It's the latest step in CEO Vimal Kapur's effort to remake Honeywell's sprawling mix of businesses — an endeavor which up to this point has largely consisted of reorganizing operations around the three megatrends of aerospace, automation and the energy transition and pursuing almost $10 billion of acquisitions. The advanced materials unit is expected to generate about $3.8 billion in revenue this year, or roughly 10% of the total company's sales. The spinoff is a meaningful step but unlikely to be meaningful enough to change investors' perception of Honeywell as a company that's simply too big and too complicated. Even after this divestiture, Honeywell will still sell everything from control systems and pressure gauges to cockpit controls, warehouse robots, face masks, bar code scanners and fuel catalysts. Industrial spinoffs have a history of begetting even more industrial spinoffs. A partial or halfway breakup will often simply refocus investors' attention on the next ill-fitting unit. And once a management team has acknowledged that there's no secret sauce or philosophical reason for keeping a company together, it's that much easier to take that next breakup step. Honeywell itself indicated this is more of the beginning, rather than the end, of its simplification journey: "There are still more opportunities we continue to work on," Kapur said on a call to discuss the advanced materials spinoff. "Please stay tuned." Read More: Honeywell's New CEO Needs to Pick a Lane Analysts are raising the prospect of a host of other breakup moves for Honeywell. Barclays Plc's Julian Mitchell points out that personal protective gear doesn't really have that much to do with aerospace, automation and the energy transition, while the warehouse robot business has proved particularly volatile amid the surge and crash of e-commerce demand during the pandemic. The UOP fuel processing equipment division is also a bit of an odd fit with the other businesses.  Many aerospace manufacturers command higher valuations than Honeywell and without a meaningful rebound in the share price, the company will likely face increased pressure to turn its jet component and engine operations into a standalone company, Mitchell said. Activist investor Dan Loeb encouraged Honeywell to spin off the aerospace division in 2017, but the company opted instead to separate out the much smaller Garrett Motion Inc. turbochargers business and the Resideo Technologies Inc. home products operations.

"Low growth and complex is not a winning formula — how the board hasn't seen this reality far sooner is a head scratcher to us," Davis of Melius Research wrote in a note. "There remain many assets that we do not see fitting into the aerospace/automation core that shareholders largely favor." Boeing Co. withdrew an offer for a 30% pay raise after hitting an impasse in mediated talks to end the first strike at its Seattle-area factories since 2008. "The union made non-negotiable demands far in excess of what can be accepted if we are to remain competitive as a business," Stephanie Pope, the head of Boeing's commercial airplane unit, said in a memo shared by the company. "Given that position, further negotiations do not make sense at this point." There's no obvious end in sight to the standoff: Recent labor victories at the US ports, automakers and United Parcel Service Inc. have given workers reason to hold out for a better offer, while Boeing's precarious financial situation makes it highly unlikely that the company will ever meet the union's other demand for a restoration of pension benefits. S&P Global Ratings said this week that it's considering downgrading Boeing's credit to junk, with the strain of a continued strike putting the company on track to burn about $10 billion in cash this year.

Barnes Group Inc., which makes highly engineered aerospace components, agreed to sell itself to Apollo Global Management Inc. for about $3.6 billion, including the assumption of debt. The purchase price of $47.50 a share represents a roughly 20% premium to what Barnes shares traded for in late June, before Bloomberg News reported on a potential sale. Apollo also has a growing aircraft and engine leasing and lending business. Another aerospace parts maker, Triumph Group Inc., is exploring options including a sale, Bloomberg News reported, citing people familiar with the situation. - Two US factory towns show how tariff fights can backfire

- Home Depot shrinks bloated warehouse real estate holdings

- Aerospace giants propose supply-chain reforms after fake parts scandal

- Biden sets 10-year deadline for replacement of lingering lead pipes

- Rivian seeks federal loan to restart construction of Georgia EV plant

- Lingering freight recession keeps pressure on profits: Talking Transports

- The balance between climate change and history is delicate in Europe

- Equinor bets on offshore wind with $2.5 Billion stake in Orsted

- Uber will offer shuttle rides to LaGuardia Airport for under $20

- Perrier is stuck between contamination concerns and French laws

- Qantas Airways apologizes after airing R-rated film on every seat screen

|

No comments:

Post a Comment