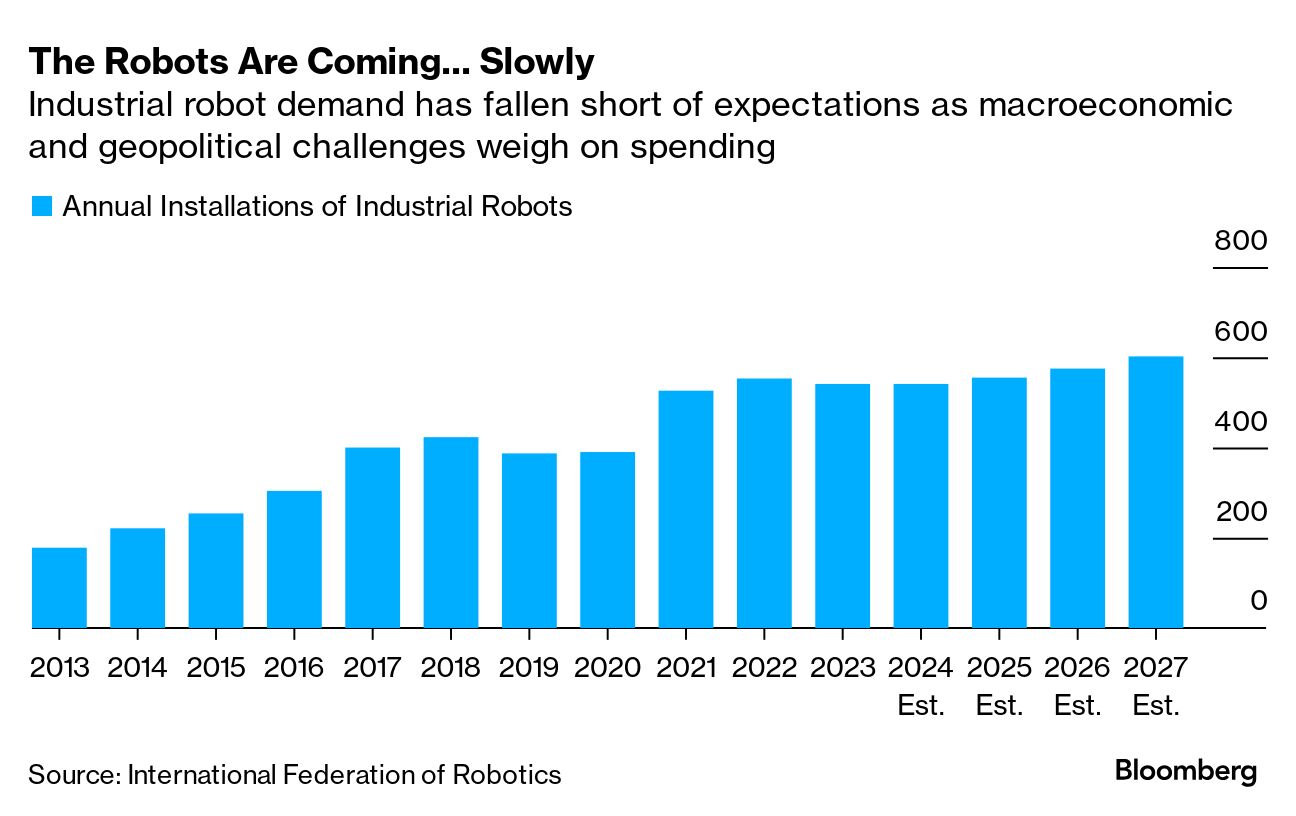

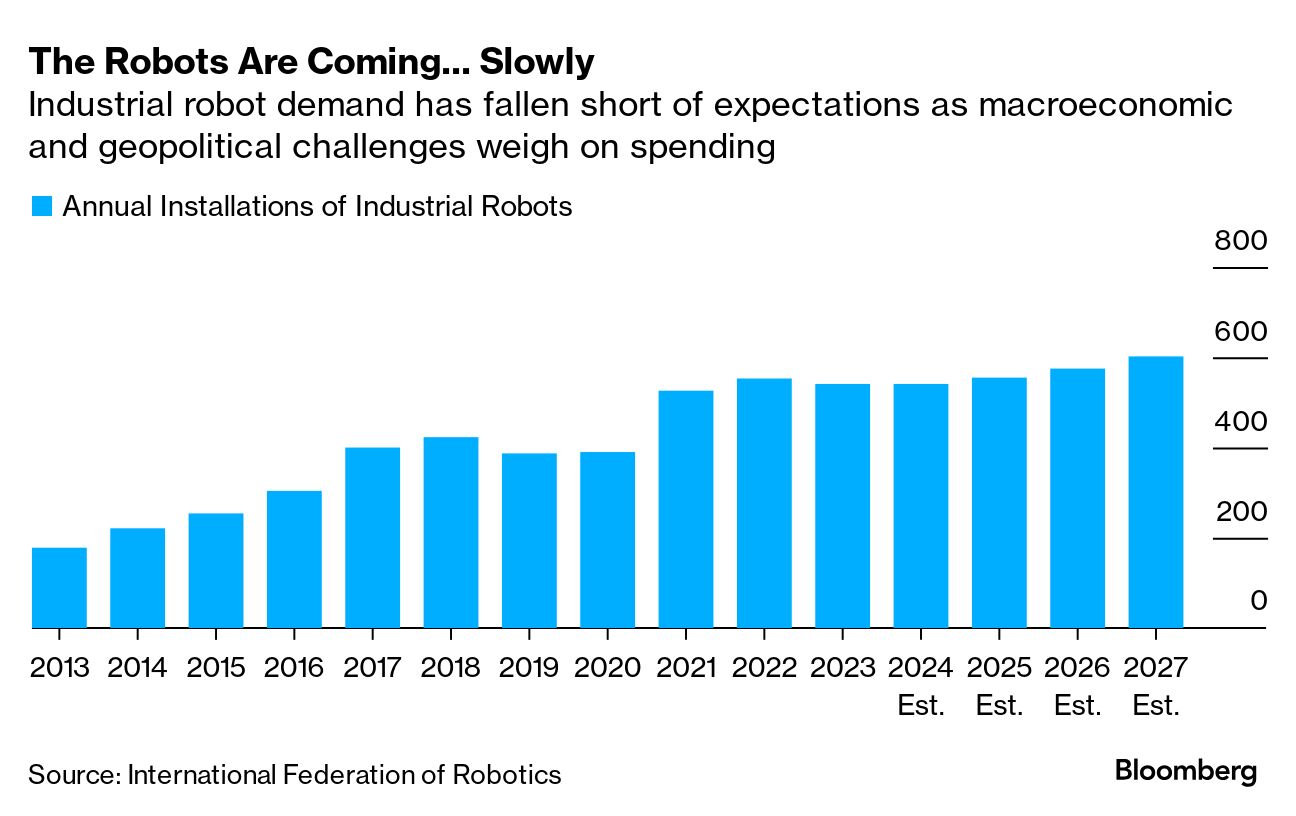

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Not even robots are immune to economic realities. There were 541,302 industrial robots installed globally last year, a roughly 2% decline from the record pace of adoption in 2022, according to a report released last week by the International Federation of Robotics. In the US, installations declined by 5% last year, led by a drop in the automative industry. The slowdown has continued into 2024, with Rockwell Automation Inc. and the factory businesses of Siemens AG and ABB Ltd. all warning of waning demand. High interest rates, policy uncertainty and economic weakness are leading customers across a broadening array of industries to defer spending, complicating efforts to clear out an inventory glut built up during the aftermath of the pandemic supply-chain crunch, Rockwell Chief Executive Officer Blake Moret said in an August interview. The IFR estimates that robot installations globally will be flat in 2024, before rising about 3% in 2025. That's down from expectations in last year's report for 5% growth in 2024 and 6% in 2025. Last year, "in many countries, economic development was impacted by high energy prices, a sharp rise in interest rates, a loss of purchasing power because of increased inflation as well as geopolitical crises and uncertainties," Michael Scheuter, chair of the IFR's industrial robot suppliers committee wrote in the report. "In 2024, the uncertainty of the global economy is still affecting the automation industry."  The slump in industrial robot installations in the US raises fresh questions about the much-hyped but increasingly nebulous manufacturing building boom in America. The expectation has been that any factories built in the US would need to be heavily automated to mitigate an unfavorable reversal of the globalization labor arbitrage. And yet there's still little evidence that the region is experiencing outsized growth in robot installations relative to the rest of the world. The market weakness also suggests that the march of robots into the world's factories isn't diabolical but rather pragmatic. When it's cost effective and beneficial for companies to invest in automation projects, they will do it. When it's not, they won't. Read more: Robots Versus Workers Is No Zero-Sum Game It's an interesting dynamic as dockworkers take a stand against their own economic realities. The International Longshoremen's Association went on strike early Tuesday for the first time in almost half a century after failing to reach an agreement on a new labor contract with the US Maritime Alliance, which represents port operators and shipping companies including AP Moller-Maersk A/S, Hapag-Lloyd AG and Cosco Shipping Holdings Co. The union agreed late Thursday to suspend the strike and return to work until mid-January while the parties continue collective bargaining. Without workers to man cranes and move containers around the shipyard, commerce essentially ground to a halt for several days at the East and Gulf Coast ports, with a few exceptions for military goods and energy supplies. Though brief, the work stoppage — estimated by Bloomberg Economics to cost the US economy as much as $3 billion a day — underscored the vital role human workers still play. That reality is the union's biggest bargaining chip and also its biggest vulnerability. The dockworkers want raises, but the real fight is over port operators' and shipping companies' aspirations for installing the kind of automation that's transformed the flow of goods at terminals across Asia and in Rotterdam and Los Angeles. The ILA is demanding contract language that would bar the installation of any kind of automation that replaces jobs or historical work functions. The détente between the dockworkers and the shipping companies is based on a proposal that would boost wages by 61.5% over a six-year contract, while the language on automation restrictions will be hammered out in the coming months, ILA Local 333 President Scott Cowan told a CBS Baltimore affiliate. It's not a coincidence that global robot installations spiked alongside the post-pandemic labor shortages. It just takes one weak link in the supply chain to grind production to a halt and more often than not in the post-Covid era, the weakest link was human-related as companies scrambled to fill open positions and train new, inexperienced hires. For businesses, there's perhaps no better advertisement for the benefits of automation than the strikes that have recently drawn headlines — not just on the docks but at Boeing Co. and Textron Inc.'s aviation arm. "Automation allows manufacturers to locate production in developed economies without sacrificing cost efficiency," the IFR said in its report. "There are no signs that the overall long-term growth trend will end in the near future." "Until Mr. Daggett tells us we're going to do something different." — Greg Washington, president of ILA Local 1426 in Wilmington, North Carolina

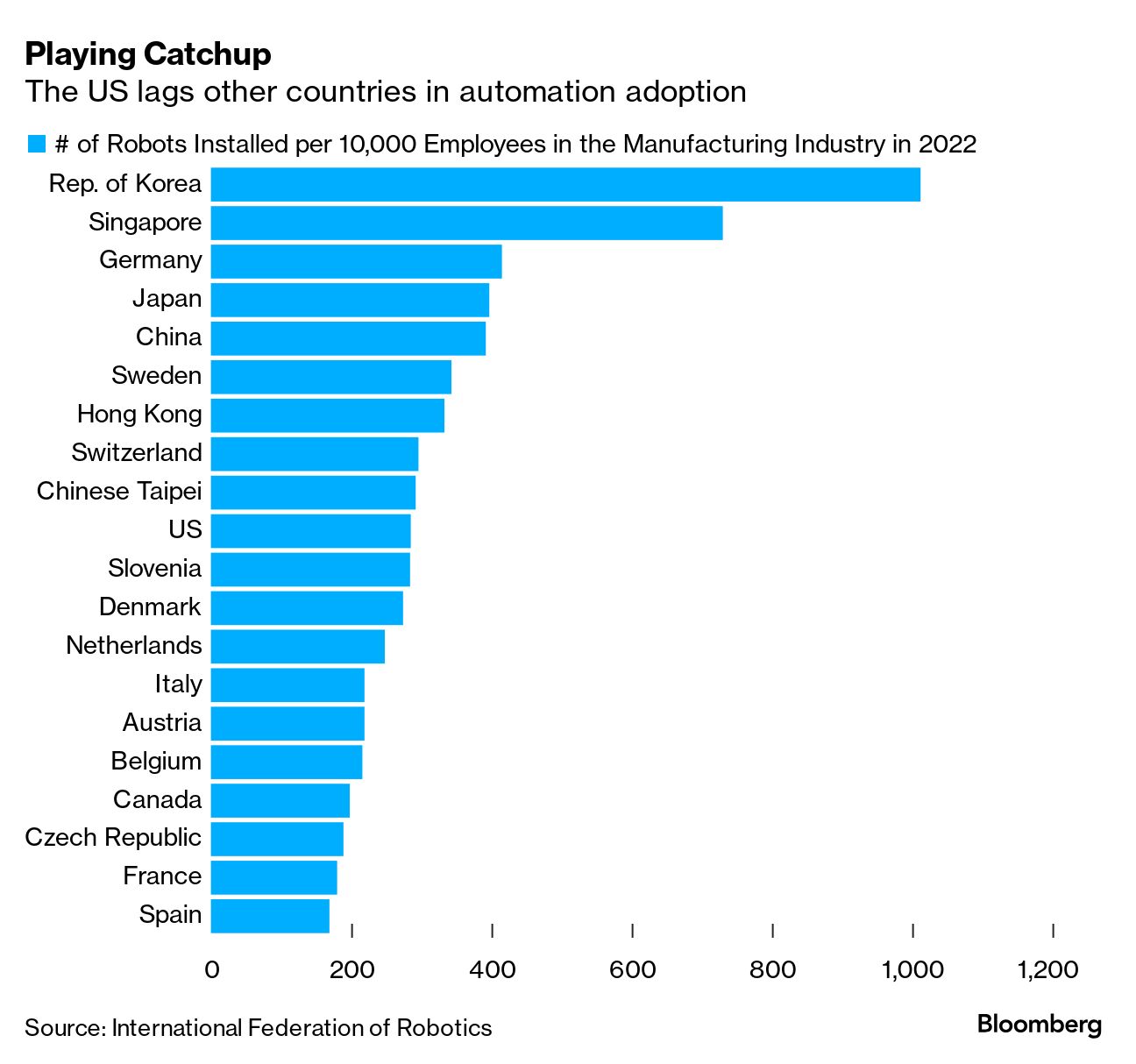

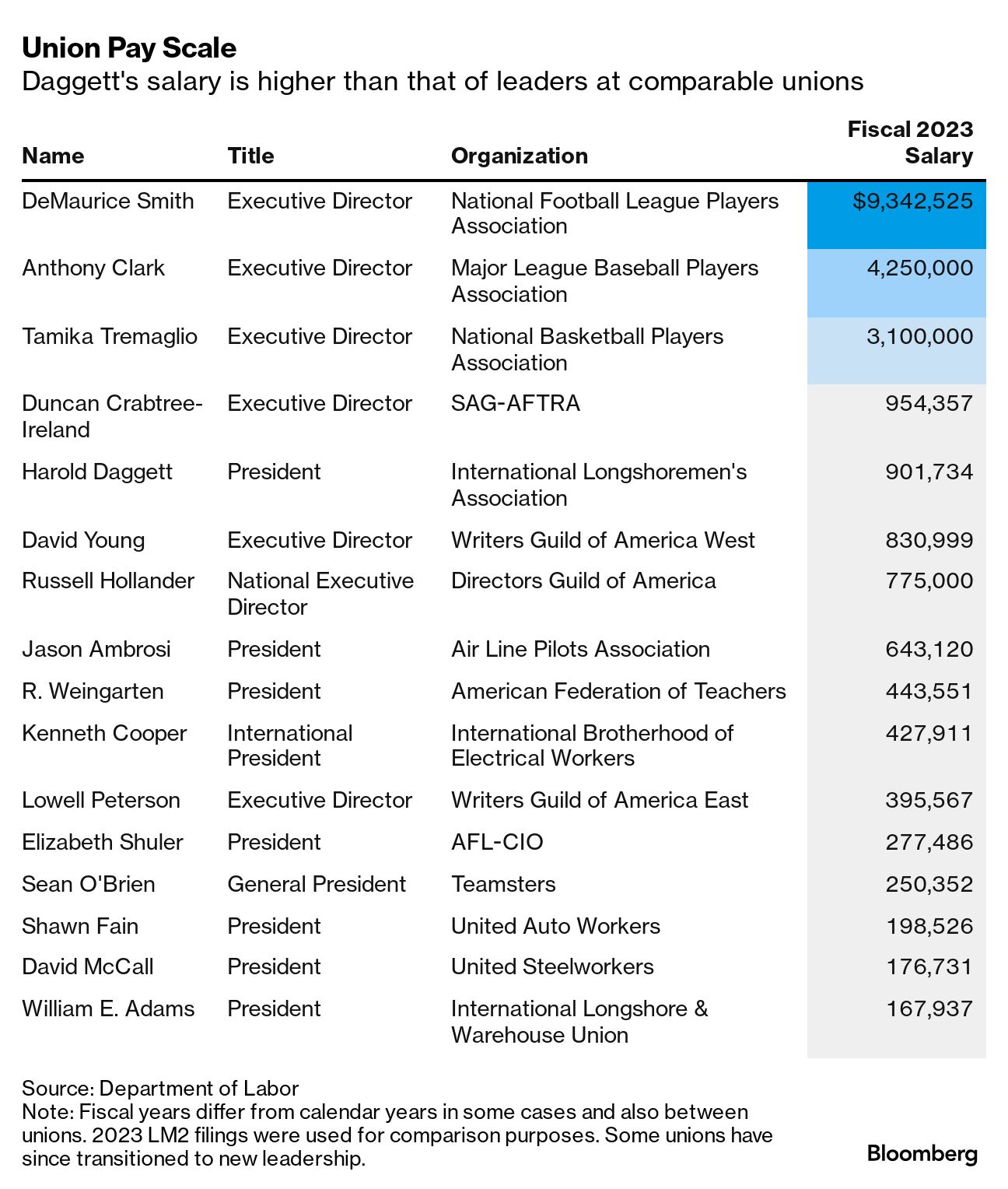

Washington was answering a question about how long dockworkers would man the picket line outside of the Port of Wilmington, with the fate of the strike largely resting with union leader Harold Daggett. Washington made the comments to Bloomberg News' Jarrell Dillard. Daggett told the ILA workers to stay on the picket lines for as long as it took to get the union's demands met. The strike underscored the unique sway he has over the union: in contrast to other groups that typically require a vote by members for a walkout, the ILA's rules give Daggett a significant amount of the power over labor negotiations. Daggett, a pugnacious and tough-talking 78-year-old with a penchant for gold chains, rose up from working the docks to become one of the highest paid union leaders in the US. Last year, he received about $900,000 in salary, thanks to dual six-figure payouts for his role as president of the ILA and an emeritus position for a local branch in New Jersey that his son, Dennis, currently oversees. Dennis also got separate six-figure salaries from both the local New Jersey union and the national headquarters for a total salary of about $700,000, according to filings with the US Department of Labor. They both make significantly more than William Adams, the head of the International Longshore & Warehouse Union, who represents dockworkers on the West Coast and receives a salary of about $168,000. Harold Daggett has a higher salary than most union leaders, in fact, other than those who represent professional athletes and Hollywood actors. Read more about the union leader here. Boeing Co. is mulling a stock sale that would raise at least $10 billion as the continued fallout from a midair jet blowout and a worker strike strains its balance sheet and investment grade credit rating, people familiar with the discussions told Bloomberg News. Any equity raise is likely on hold until Boeing has a better understanding of the full financial toll from the strike by 33,000 members of the International Association of Machinists and Aerospace Workers at its factories on the US West Coast. The strike appears unlikely to end any time soon, with the two sides still far apart on key issues including wage increases and pension benefits. A stock sale could be as large as $25 billion, said Melius Research analyst Robert Spingarn, noting that a $20 billion cash infusion would likely be enough to get Boeing through the strike, pay down its near-term maturing debt and prop up its balance sheet until the company can start generating cash again.

Johnson Controls International Plc has launched a sale process for its ADT alarms business, Bloomberg News reported, citing people familiar with the matter. Advent International, Bain Capital, CVC Capital Partners Plc and Triton are among the private equity firms that are assessing the unit, which could be valued at more than $2 billion, the people said. Johnson Controls agreed in July to an $8.1 billion deal with Robert Bosch GmbH for its residential heating and air-conditioning assets in an effort to simplify the sprawling company and focus on products that serve larger commercial buildings. |

No comments:

Post a Comment