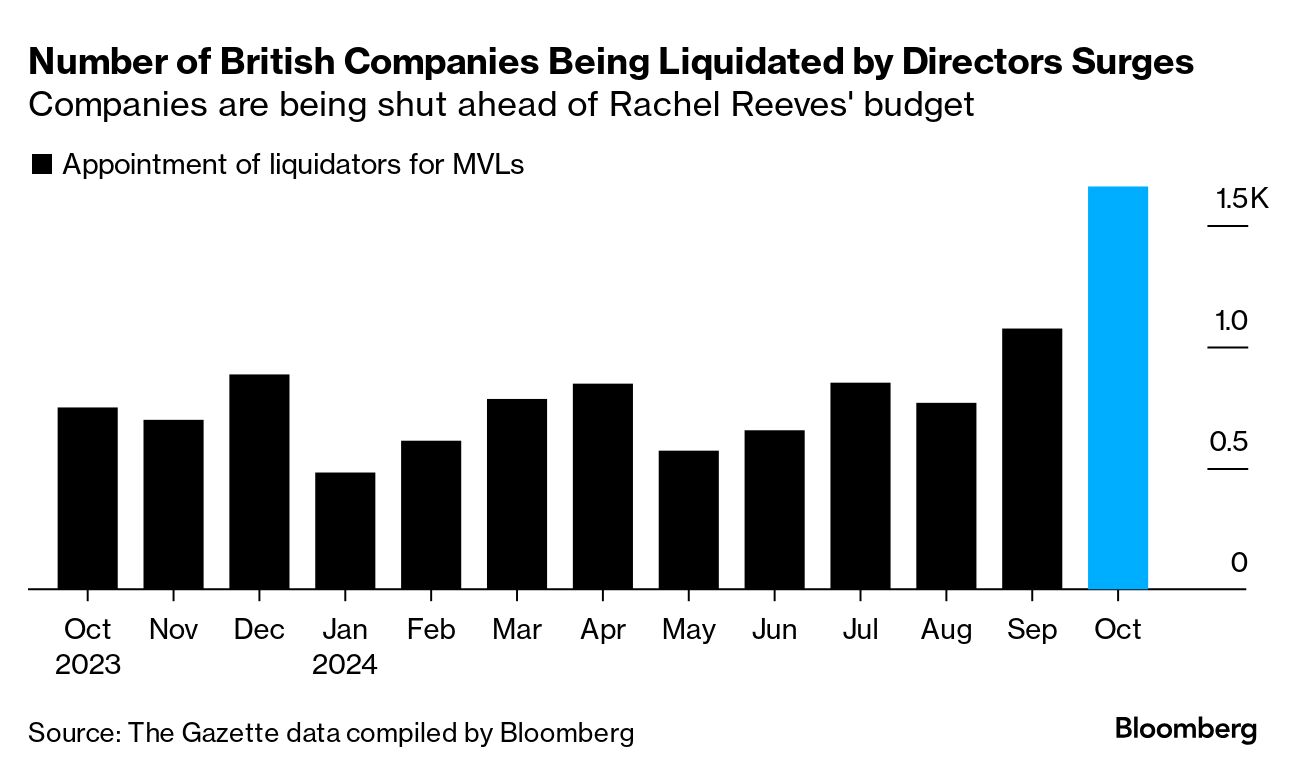

| Take a deep breath — there are only half a million seconds to go until Rachel Reeves stands at the despatch box to deliver her first budget as chancellor of the Exchequer. Yes, I did the math(s). Reeves and the prime minister could be forgiven for wishing the time would pass sooner, as each day (aka 86,400 seconds) seems to bring more bad news. Ignoring the rows over Labour support for Kamala Harris's presidential campaign and the awkwardness of Vladimir Putin's BRICS summit, back at home the economy has stuttered to its slowest growth for almost a year — at least according to the latest purchasing managers' index from S&P Global. S&P's surveys, like many others, attribute some of the downturn to the overwhelming sense of misery, gloom and tax hikes (my words) that has stopped businesses from making major decisions, and limited how much people are buying. This kind of sentiment can be easily reversed, for example with a strong budget that removes uncertainty, but one thing that can't is the shutting down of companies. So it's worrying to see thousands of solvent businesses being wound up seemingly because their founders fear a tax raid on their capital gains. The rate of these closures has doubled since this time last year, Bloomberg reported today. The numbers followed Keir Starmer's insistence that the budget will not drive entrepreneurs away from Britain (whether or not they are giving up on their companies.) Let's hope he's right, but either way, these are not the kind of questions the prime minister will have wanted to face during a 9,500-mile trip to Samoa. Reeves, meanwhile, is putting on a brave face during her own excursion to the US and will be sitting down for a chat with Treasury Secretary Janet Yellen at around the time that you read this. Earlier, Reeves effectively confirmed that she was changing the UK's (self-imposed) fiscal rules to allow for more borrowing to fund infrastructure projects and boost growth. Her plan to take on more debt has lifted the government's cost of borrowing to a slightly startling degree and gilts tumbled again after this afternoon's news. However, it's worth noting that they are still higher than 10 days ago. Overall, the bond markets remain just about on side — which is some good news, at least. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment