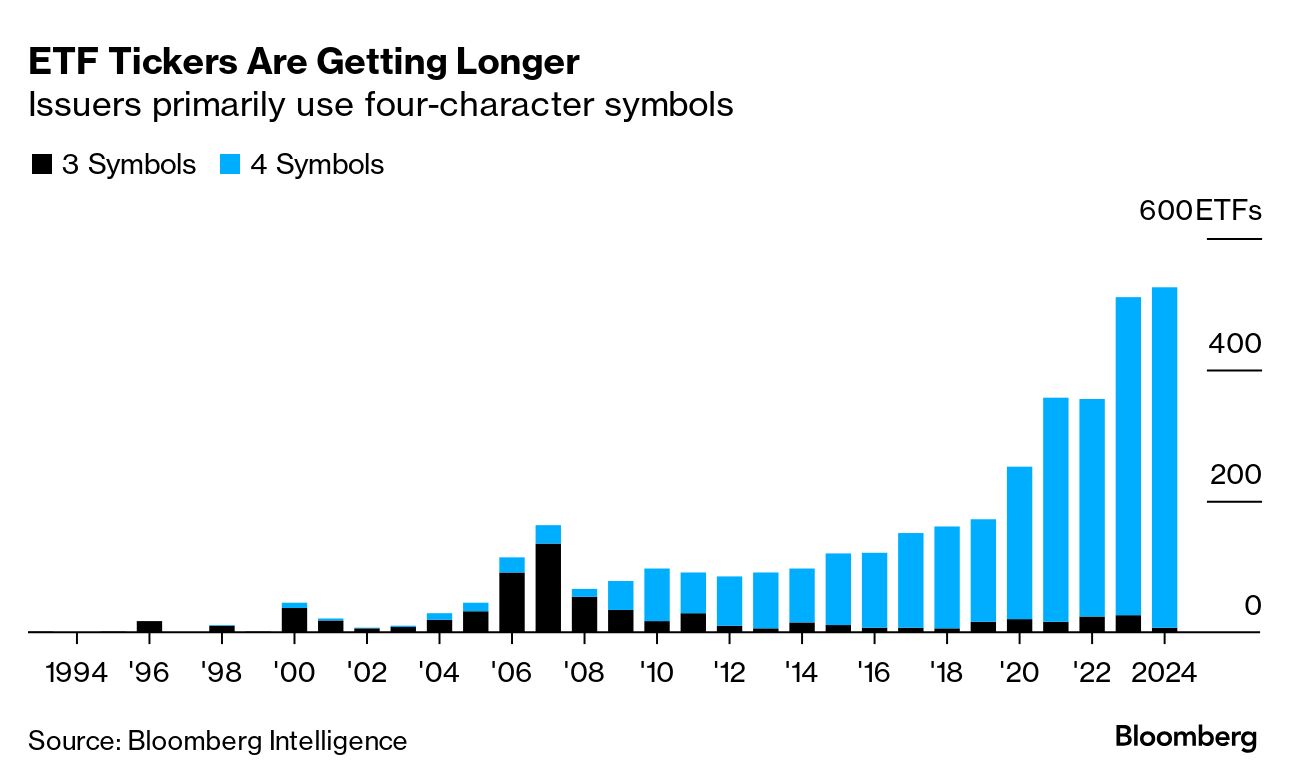

| Back in May, this newsletter mused that there could be a ticker shortage brewing in the single-stock ETF arena. Fast forward a few months, and it turns out some issuers are taking matters into their own hands. Enter Matt Tuttle, chief executive officer of Tuttle Capital. He, along with Rex Shares, recently launched the T-REX 2X Long MSTR Daily Target ETF (ticker MSTU). Tuttle estimates that he's sitting on about 20 tickers at the moment. "There are guys who are going to stockpile symbols — maybe me, for example — and on the good names, you are potentially going to run into an issue," Tuttle said. "You also really want like the 'U' or something like it for the bull, and a way to discern between the bull and the bear if you do both sides." How could there possibly be a ticker shortage, you might exclaim, with so many potential four-letter combinations? You're not wrong: there's 456,976 amalgams, theoretically. But if you narrow it down to the single-stock ETF universe, possibilities dwindle dramatically. Take the recent wave of MicroStrategy-inspired ETFs. MicroStrategy carries the ticker MSTR, leaving issuers with one character of real estate if they chop off the letter 'R'. That leaves just 52 or so realistic options, assuming the extra letter is placed either before or after 'MST'. As such, issuers need to be creative and quick — and in some cases, start hoarding. It's the latter impulse that's making life a little bit harder for the likes of Will Rhind, chief executive officer of GraniteShares. Nowadays, GraniteShares is turned down "more often than not" by the exchanges for single-stock ETF ticker requests. That's either because the combinations they're seeking have already been reserved or belong to funds that have been delisted, Rhind said. A neat solution would be for US exchanges to follow Europe and Asia in expanding the character limit or allowing the use of numbers. But for their part, the exchanges don't seem too fussed. "I don't think there are any concerns today around a ticker shortage," Jeff Thomas, Nasdaq chief revenue officer and global head of listings, said in a Bloomberg Television interview. "We do occasionally get questions from companies saying, hey, how can I get more creative on these tickers? Can I include numbers in addition to letters?" |

No comments:

Post a Comment