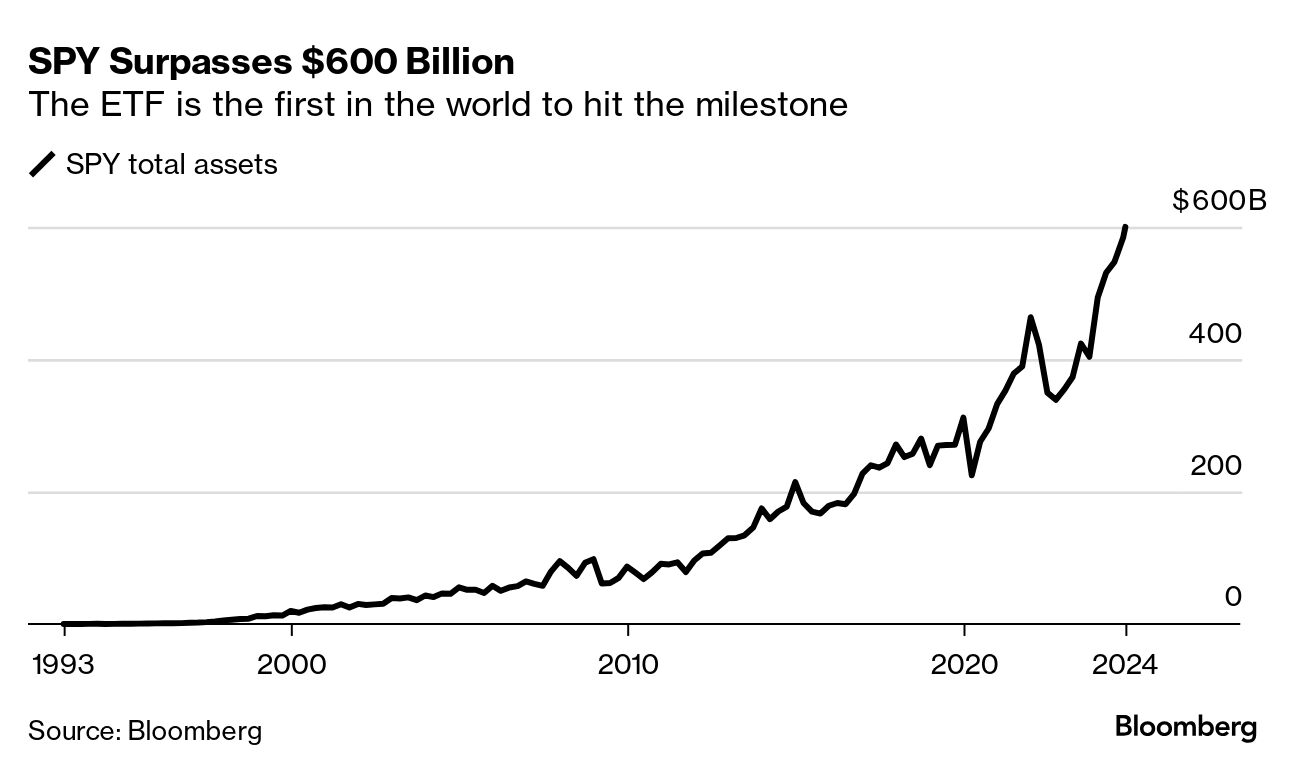

| I got an email the other day filled with facts that really astounded me. It came from a representative for the SPDR S&P 500 ETF Trust (ticker SPY), which in recent days crossed $600 billion in assets. The note said it was the world's first ETF to surpass this threshold. The email then laid out the following (emphasis is my own, to highlight how much the bullet points stupefied me): - SPY trades about three times more than Apple and about eight times more than Google

- It also trades more than the next three most liquid ETFs combined (based on year-to-date volume)

- The fund accounts for about 20% of US ETF trading volume

- It makes up roughly 6% of all US exchange volume

My first thought was that SPY has tremendous sway in markets on a daily basis. Given its popularity, it's possible that it has an outsized impact on correlated volatility within the stock market, says Art Hogan, chief market strategist at B. Riley Wealth. That's because the ETF is cap-weighted and every time investors buy it, they're purchasing a commensurate amount of each sector. "And that really drives that market correlation," he says. Or looked at another way: because the tech behemoths are so highly weighted within SPY, the ETF could be playing a big role in stalling out any potential market-wide rotations away from tech and toward less-loved stocks, including small-caps, which have lagged this year, says Matt Maley, chief market strategist at Miller Tabak + Co. Investors had been seeking a broadening out of market leaders this year, given how influential the Magnificent Seven had been on the overall market. But "when SPY starts to move, obviously those stocks move with it," he said. "It's part of the reason why if tech goes down, the market's going to go down — it's going to feed on itself." John McQuown, who started a $12 trillion financial revolution with the creation of the first index fund, has died. He was 90. In the telling of Scott Maidel, a 20-year volatility pro, it's official: the options-selling boom across Wall Street has now become too popular for its own good. JPMorgan Asset Management is looking to expand its exchange-traded funds business in Taiwan and China to help achieve a fivefold increase in assets by the end of the decade. Wall Street is rolling out a new breed of ETFs with varying degrees of exposure — or lack thereof — to megacap technology shares. In this week's Drill Down on Bloomberg Television's ETF IQ, Matt Markiewicz, Tradr ETFs' head of product and capital markets, stopped by to talk about his company's goal to offer investors a solution to "Daily Leverage Reset" ETFs. Here's what he had to say: "What we found is that most investors actually hold those daily reset products for longer than a day — much longer, actually. So, for most investors, that's not really a suitable time horizon to have a daily reset product. And the SEC and Finra are pretty clear that they warn you really should only hold these for a day. So, we're looking to solve that problem of getting the leverage that you're looking for over a longer period of time."

Alex Morris of F/m Investments, Stacey Sears of Emerald and Julie Cane of Democracy Investments join Katie, Eric Balchunas and Scarlet Fu on Bloomberg Television's ETF IQ. Watch live on Mondays at noon on Bloomberg Television, on the Bloomberg Terminal at TV <GO> and on YouTube. |

No comments:

Post a Comment