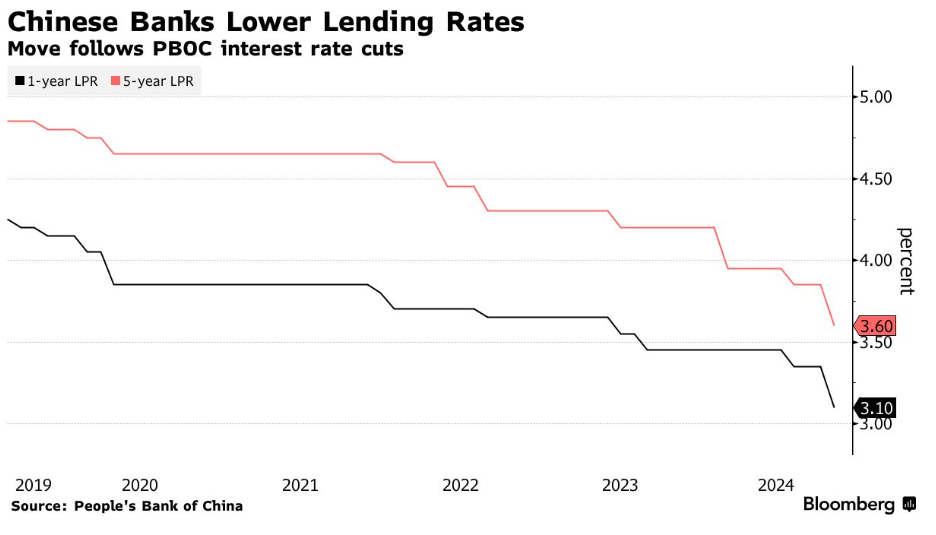

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the latest gathering of global finance chiefs in Washington. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - China's boldest economic stimulus since the pandemic failed to impress luminaries in Washington this week, and now the central bank just kept a rate unchanged.

- UK Chancellor Rachel Reeves embraced new rules allowing a ramp-up of new borrowing for an upcoming budget increasingly likely to tax investors.

- Before a US election that will reverberate through the global economy for years, here's a look at some business consequences.

A flight doesn't end when the pilot brings the plane down to the tarmac. Is there enough runway? Are there obstacles down the tarmac that could yet threaten the plane? That's the sort of vibe emanating from Washington this week, where finance ministers and central bankers from around the world gathered for annual meetings of the IMF and World Bank, along with the Group of Seven and Group of 20. "We observe good prospects of a soft landing of the global economy," a draft of the G-20 communique obtained by Bloomberg showed Thursday. Global output "remains resilient," the group said — as central banks make progress in bringing down inflation without triggering damaging recessions. Perhaps optimistically, the group added that "we commit to resist protectionism." That's despite new tariffs from the US, European Union and a raft of emerging markets placed on China, which many have charged with excessively relying on exports to offset muted domestic demand. And it comes less than a fortnight before a US election where Republican candidate Donald Trump is threatening higher import duties on goods from not just China, but allies including those in Europe. The US election "matters for the whole world," Gita Gopinath, the IMF's No. 2 official, told Bloomberg TV on Thursday. While the latest IMF economic projections show continued global economic growth next year above 3%, after the world survived "hard knocks" in recent years, Gopinath said uncertainties going forward surround "what kind of policies will we have." Brazil's central bank governor, Roberto Campos Neto, said that there's a lot of uncertainty around whether the US election will end up disrupting the global economy's soft landing and drive up inflation. So, not quite time to offer cheers to the cockpit. - Germany's business outlook improved in October — adding to evidence that the country's economic downturn may be ending.

- Inflation in Tokyo slowed below 2% for the first time in five months just as Japan heads into an election and a central bank decision.

- As bets on a half-point rate cut fluctuate, European Central Bank officials from Belgium and Lithuania are pushing against that outcome.

- Indonesia has started the process of becoming part of the BRICS in a sign of growing influence for the group.

- Australia's central bank Governor Michele Bullock said it will take "another year or two" before inflation is sustainably back within the 2-3% target.

China's series of economic support measures over the past several weeks appear more designed to put a floor under growth than to trigger a big upswing, according to Richard Yetsenga, chief economist at ANZ Bank. A key element to keep in mind is that China's population is now shrinking. That means that per capita spending must rise for consumption to expand. It also means that "the days of China reporting rising house prices everywhere" are almost certainly behind. So the "big wealth effect" of the past few decades is no longer a dynamic the economy can count on. It's "going to require continued policy effort to work against that demographic drag," Yetsenga said in a wrap-up of his latest visit to China. Economic support measures will likely become "part of the China economy new normal," he said. |

No comments:

Post a Comment