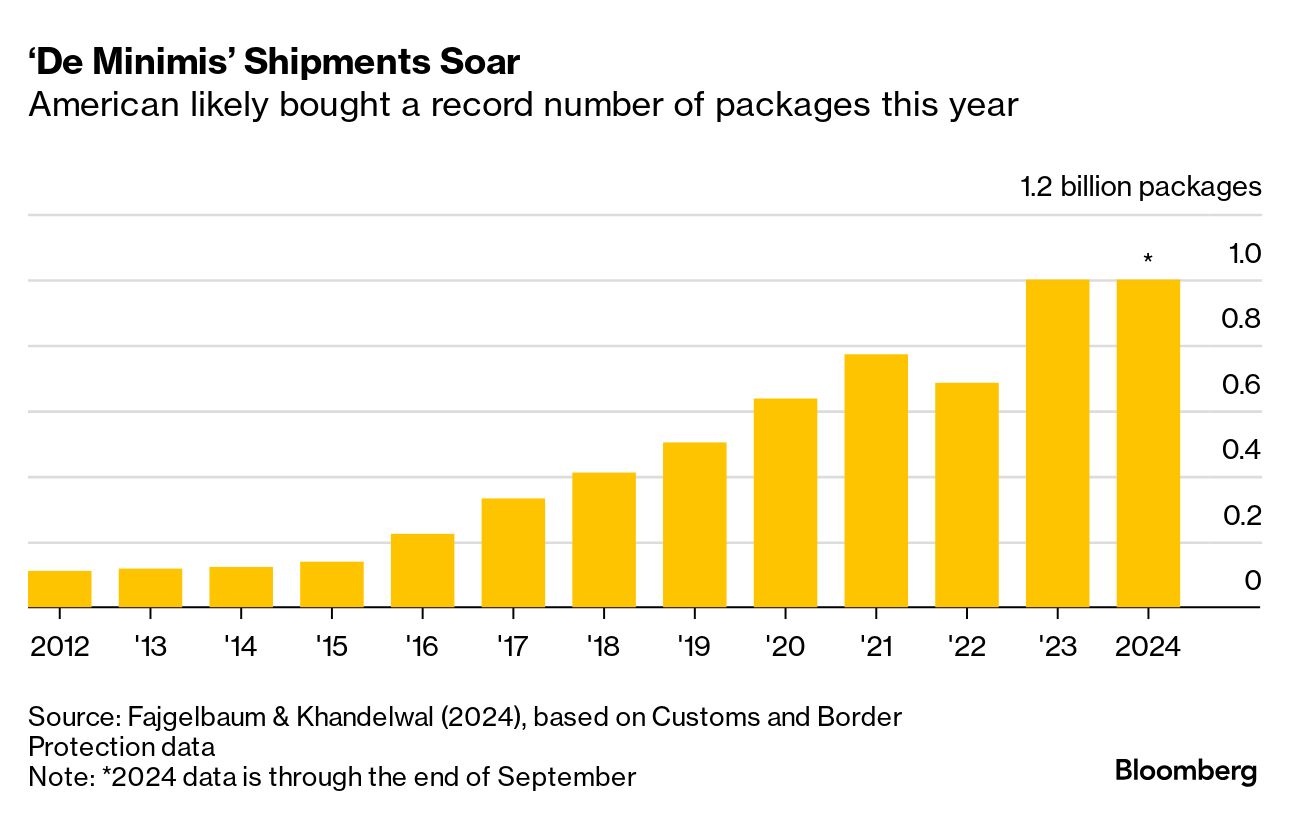

| I'm James Mayger, a senior economy and government reporter in Beijing. Today we're looking at a US tariff loophole that may now be closing. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. While both former President Donald Trump and successor Joe Biden framed the tariff hikes they implemented on Chinese goods over the past several years as measures to protect Americans from unfair competition, a new question of fairness has emerged. There used to be a loophole to get around tariffs: the "de minimis" rule, which lets individuals bring in shipments that are worth less than $800 without having to pay an import duty. The Biden administration is now cracking down on this measure. The effect is likely to fall hardest on poorer Americans, who are big users of popular cheap Chinese online shopping apps such as Shein and Temu. New research estimates it could cost consumers more than $10 billion if the loophole is eliminated entirely. So far this year, about a billion packages worth $48 billion have entered the US under the de minimis rule, according to the research from Pablo Jajgelbaum at University of California, Los Angeles and Amit Khandelwal at Yale University. Goods such as clothing, accessories, home goods, electronics, and small durable items from just Shein and Temu account for 30% of all such shipments, their research shows. In September, the US government said it would narrow the loophole that Chinese online retailers are using to ship a torrent of packages into the US every day. The changes will likely make it more expensive for Chinese merchants to ship goods direct to American consumers, hitting both the apps people use to buy and their wallets. While the shipments from China may be undermining companies in the US, they are providing poorer Americans with cheaper goods than would otherwise be available, and closing or limiting the loophole will hit those customers the most. About half of all de minimis shipments to the poorest zip codes in America are from China, the research shows, compared to only 22% for the richest areas. If the loophole is totally eliminated, "the tariff schedule would flip from pro-poor to pro-rich: the poorest zip codes would face average tariffs of 11.8% compared with 6.5% for the richest zip codes," Jajgelbaum and Khandelwal wrote. - China's central bank is expanding its monetary policy toolkit to get a better handle on liquidity in the financial system.

- The efforts to rebuild in Southeastern states after a pair of destructive hurricanes are at risk of being drawn out by shortages of a critical supply of workers: migrants.

- France's youngest-ever finance minister is tasked with reining in the country's runaway public finances amid political uncertainty.

- The Reserve Bank of India's upbeat growth estimates for the world's fastest-growing major economy is causing both confusion and concern among economists.

- Kamala Harris is seeking to persuade Black Americans that she can narrow America's centuries-old racial wealth gap.

- UK Prime Minister Keir Starmer said his government will "embrace the harsh light of fiscal reality" in a make-or-break budget on Wednesday.

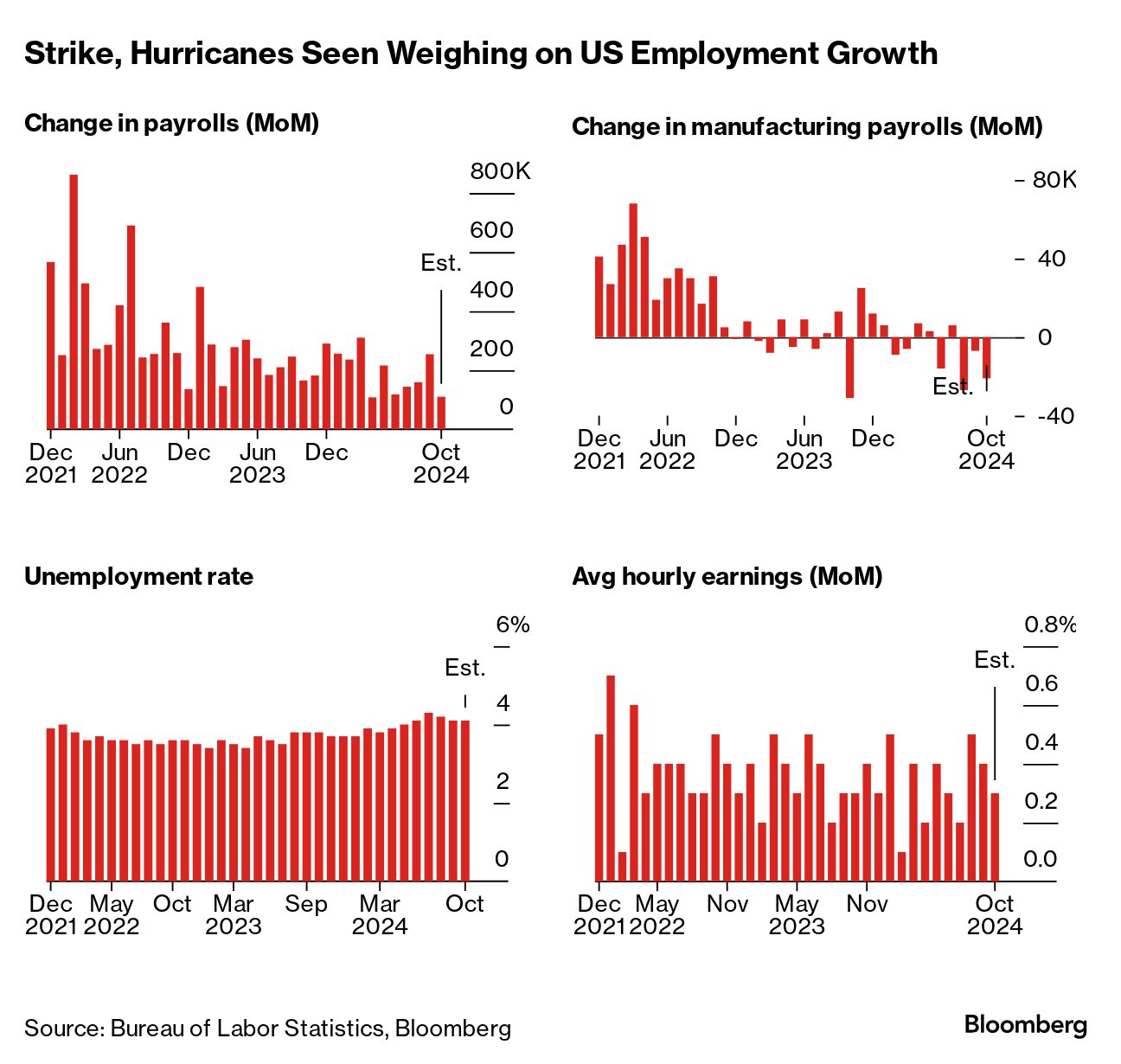

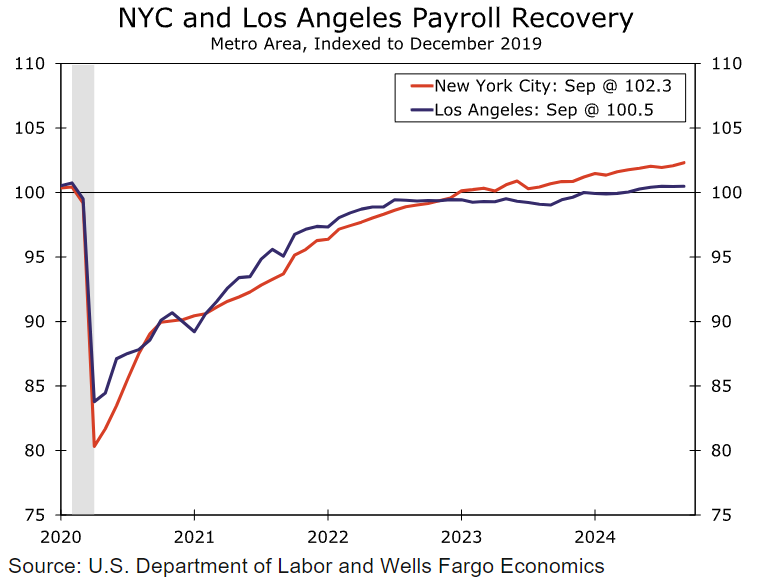

A week before Federal Reserve officials gather to reflect on the appropriate tempo of rates cuts, three high-profile reports are set to show underlying resilience in the US economy and a temporary hiccup in job growth. Friday's employment report, expected to show a modest 110,000 increase in payrolls — about half this year's average gain of 200,000 — will reflect hits to the labor market from two hurricanes as well as a work stoppage at aircraft maker Boeing Co. The unemployment rate is forecast to hold at 4.1%. See here for the rest of the week's economic events. With the baseball World Series (arguably a misnomer) under way, Wells Fargo economists took a look at the economies of the home cities of the two contestants: the New York Yankees and the Los Angeles Dodgers. While Los Angeles has some "green shoots," New York appears to have the edge in terms of post-pandemic economic recovery. LA only last year recorded its first rise in population since before Covid. Its film industry, walloped by the biggest strikes in decades, "continues to struggle," economists including Charlie Dougherty wrote in a note Friday. Tourism is also yet to fully recover, Wells Fargo analysis shows. New York also struggles with population declines, but its payrolls have exceeded pre-Covid levels. And its hotel occupancy is now back on par with 2019 averages. Positive economic data may offer solace to Yankees fans should the Wells Fargo prediction pan out: they see the Dodgers taking the title. |

No comments:

Post a Comment