| I'm Cécile Daurat, an economics editor in the US. Today we're looking at the American consumer. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Prime Minister Keir Starmer is trying to reclaim the mantle of "wealth creator" ahead of the UK budget.

- The outlook for US inflation and growth may be similar whoever wins the election, though economists in a Bloomberg survey give Kamala Harris the edge on the economy overall.

- Global public debt is set to reach $100 trillion, or 93% of global gross domestic product, by the end of this year, the IMF said.

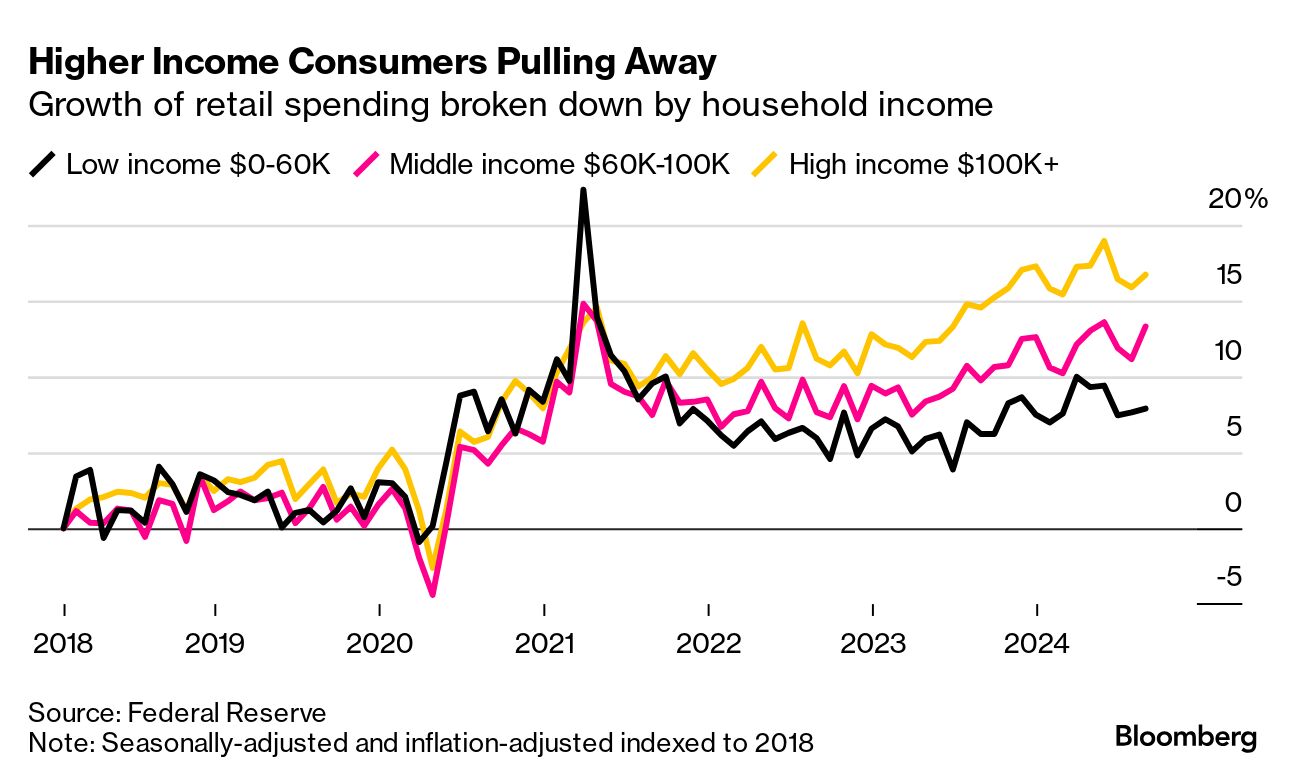

Never underestimate the mighty American consumer is a refrain that's proved true time and again as US consumption data has continued to defy expectations. By many measures, Americans appear to be tapped out: Credit-card delinquency rates are on the rise, millions are falling behind on student-loan payments and the explosion of "buy now, pay later" apps suggests shoppers are racking up billions of dollars in "phantom debt" that can't easily be tracked by economists. And yet last month's revisions to GDP figures suggest household spending was even firmer than previously reported. One possible explanation is that strong consumption by people who are better off is masking financial hardship in poorer households. A new study by the Federal Reserve puts data behind that K-shaped spending theory, showing that the recent strength in spending has been driven by middle- and high-income families. The Fed researchers used data from Numerator, a company that collects receipts from a panel of 150,000 households and is a good match for the retail sales figures published by the US Department of Commerce. Among key findings: - In the two years before Covid, growth in average retail spending was roughly the same across income brackets

- In the two years following the pandemic, low-income families boosted consumption much faster, helped by government stimulus programs

- In the past two years, higher-earning households were the main drivers. The Fed researchers speculate it may be because they are enjoying a wealth effect from soaring stocks and home values as well as higher interest and investment income

What happens next now that the Fed has started to cut interest rates? Wells Fargo economists argued in a recent note that lower rates may not provide much lift for consumer spending. At the macro level, they say, the lost interest income will likely be larger than the savings from households who will be spending less to finance their debt. - Coming up: Italy is set to present its budget later today, with the finance ministry scrambling on how to balance the books.

- Minneapolis Fed President Neel Kashkari said "further modest reductions" in rates will probably be appropriate in coming quarters.

- China may raise 6 trillion yuan ($846 billion) from ultra-long special government bonds over three years, Caixin reported.

- UK wages grew at the slowest pace in more than two years over the summer, keeping the Bank of England on track to cut rates in November.

- Economists are reviewing their forecasts for rate cuts in India after inflation accelerated faster than expected, fueled by surging food prices.

- Russia is willing to let the ruble weaken to ease sanctions pressure.

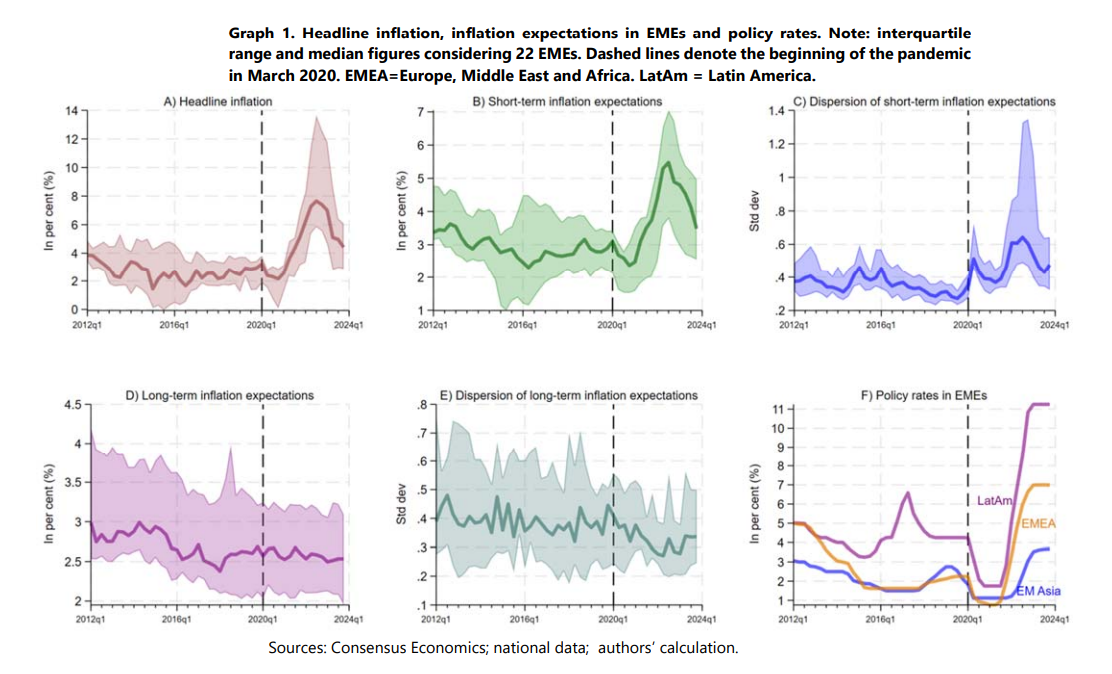

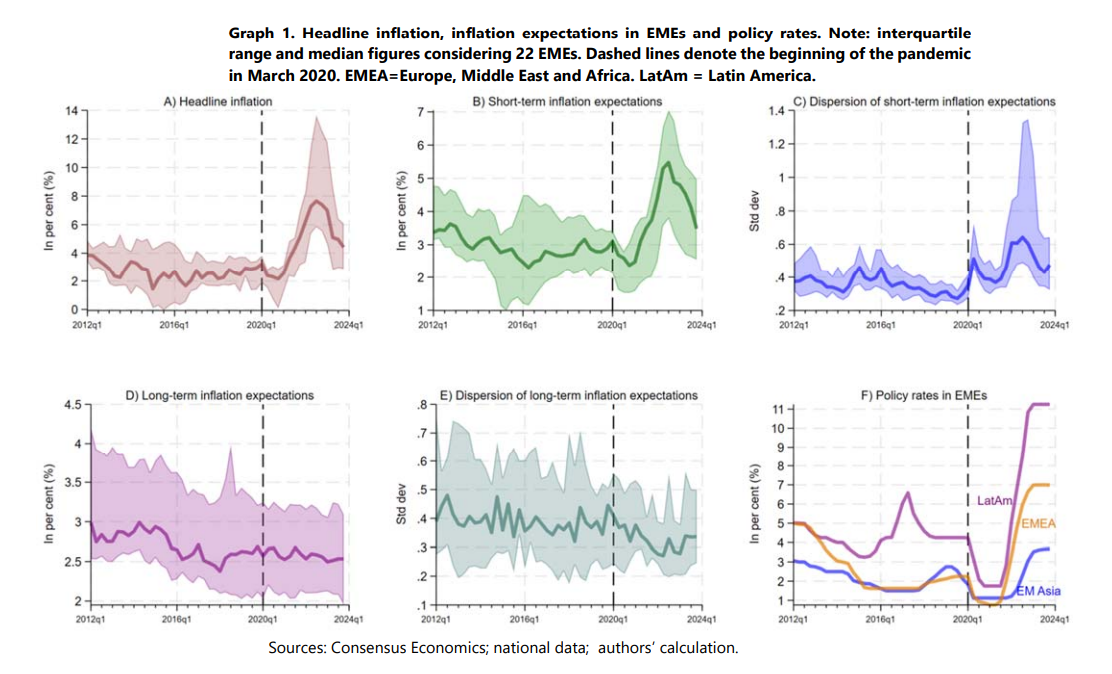

The most crucial task of central banks is arguably not to keep inflation down, but to control people's expectations on how prices will develop. For policymakers in emerging markets, this can prove challenging if the reasons for higher costs stem from abroad, like during the recent energy crisis. But such officials can still succeed in keeping predictions anchored, according to new research at the Bank for International Settlements.  Source: BIS High global inflation impacts short-term, but not long-term expectations, researchers Ana Aguilar, Rafael Guerra and Berenice Martinez wrote in a working paper after surveying data from 22 emerging-market economies. This means that rate setters who raise borrowing costs quickly and decisively can ensure that people stick to the belief that price growth will slow again, they conclude. Noting especially the successes of Latin American economies in bringing recent cost increases under control by acting early, they wrote that "central bank actions that confirm their commitment to low and stable inflation contribute to keeping expectations anchored even if headline inflation rises." |

No comments:

Post a Comment