| I'm Alexander Weber, a reporter in Frankfurt. Today we're looking at how Europe's central bankers perceive the possibility of another Trump presidency. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - With bonds falling on the prospect of slower US interest-rate reductions, Federal Reserve official Mary Daly said she still expects to keep cutting.

- As rival economic blocs splinter, a large swathe of countries are trading both sides.

- The UK had a bigger government deficit than expected in the fiscal first half, ratcheting up pressure before Chancellor Rachel Reeves's budget.

Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us today and tomorrow in Sao Paulo as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. See the agenda here. From wars on their doorstep to cautious consumers, faltering industry and shaky politics, there's no shortage of things to worry about for European central bankers. But as the Nov. 5 US election nears, another concern looms increasingly large: What if Donald Trump returns to the White House? With memories from his first stint in office still fresh, nervousness about a new trade war is growing, as we explain here. That's partly because the Republican candidate's idea to impose 60% duties on Chinese goods, and as much as 20% on everyone else, threatens fallout on growth that would dwarf the impact of barriers he imposed after taking office in 2017. Such concern is understandable, not least because Europe's economies are now in a much more precarious position than they were before the pandemic. Germany is set for its second annual contraction in a row, France is taking deficit-cutting measures that could hurt output, and the UK's cooling expansion has investors betting on quicker monetary easing there too. Analysts largely agree that for Europe, the main fallout of new Trump tariffs would be a sizable hit to economic expansion as companies defer investments and households become even more hesitant to spend their money in light of the increased uncertainty. The impact on inflation is a bit trickier to estimate and will depend on how Europe — and China — respond. If any official needed a reminder of such threats, the International Monetary Fund's meetings in Washington this week may very well provide one. ECB President Christine Lagarde already set the tone before taking off for the US capital. "Any hardening of the barriers, the tariffs, the additional obstacles on that possibility to trade with the rest of the world, is obviously a downside," she told reporters last week. So how might Europe react to a new Trump-inflicted trade war? That's not yet clear, though higher debt in some of the region's biggest countries means the fiscal space to cushion any negative impact is limited. There's also disagreement within the European Union on how to respond to protectionism abroad, making it difficult to predict how the bloc would retaliate. All of that may once again put central bankers on the front line of any economic firefighting. With rates much higher than the ultra-low levels of before, they at least have more scope to respond to a Trump onslaught. But that's not much comfort. - Coming up: the IMF's economic forecasts come out at 9 a.m. Washington time, Lagarde speaks to Bloomberg an hour later, and Hungary's rates may stay on hold.

- There's a disconnect between what US inflation data show and what millions of Americans experience with their finances.

- After three decades of ultra-loose monetary policy, even small rate hikes by the Bank of Japan are poised to fuel an increase in the number of zombie companies.

- France is considering legalizing online casinos and taxing them as the cash-strapped government seeks to reduce its ballooning deficit and fight illegal gambling.

- Chancellor Olaf Scholz urged Germany's employers to hire more people. German manufacturers are increasingly directing investments to the US.

- In Brazil's Amazon, people are trapped in a vicious cycle in which deforestation begets poverty, and poverty begets deforestation.

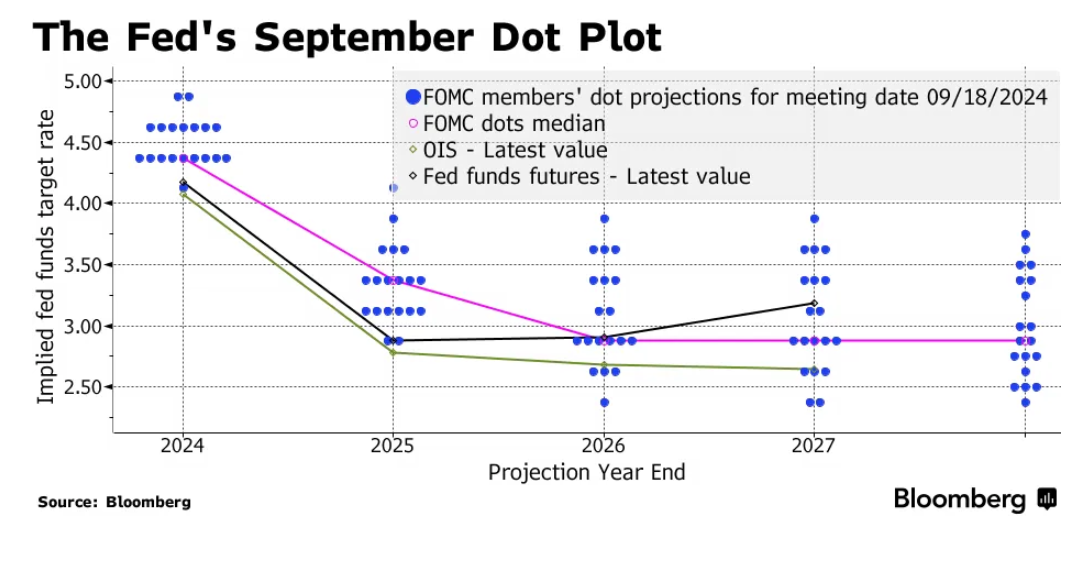

The Jerome Powell-run Fed's antipathy towards laying out forward guidance has stoked criticism that policymakers exacerbate financial volatility as they emphasize that they're data dependent and as the data fluctuate. UBS's US economists, led by Jonathan Pingle, say what's important is keeping in mind the over-arching message from the Fed chief back in August at Jackson Hole: "the direction of travel is clear." In other words, even if economic data come in stronger than expected, Powell and his colleagues are in risk-management mode and rates are heading lower. "All participants seem to agree policy is on a path to remove restrictiveness," they wrote in their latest weekly note. Absent a first-quarter inflation scare — a-la this year — the Fed "can concentrate on preventing further labor market slowdown, and maybe with some ebb and flow, stay broadly on track to get out of monetary policy restrictiveness next year." |

No comments:

Post a Comment