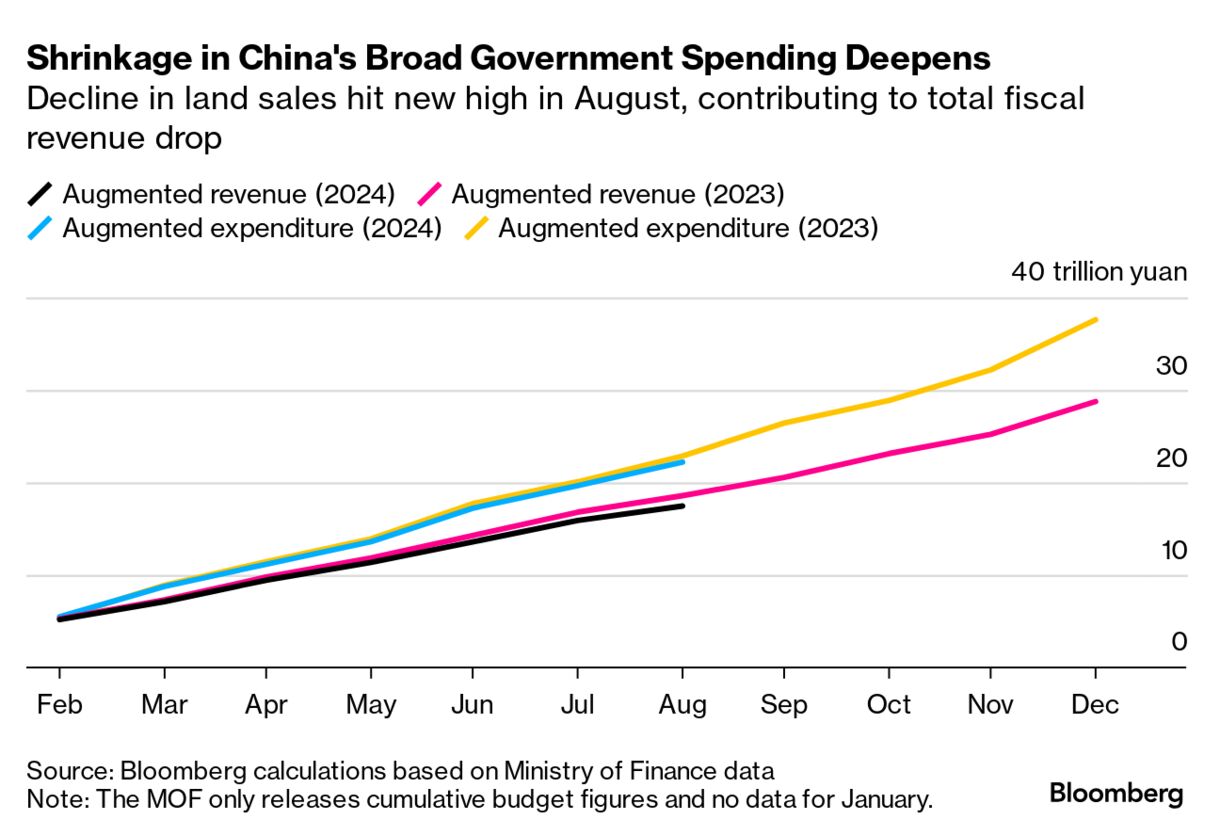

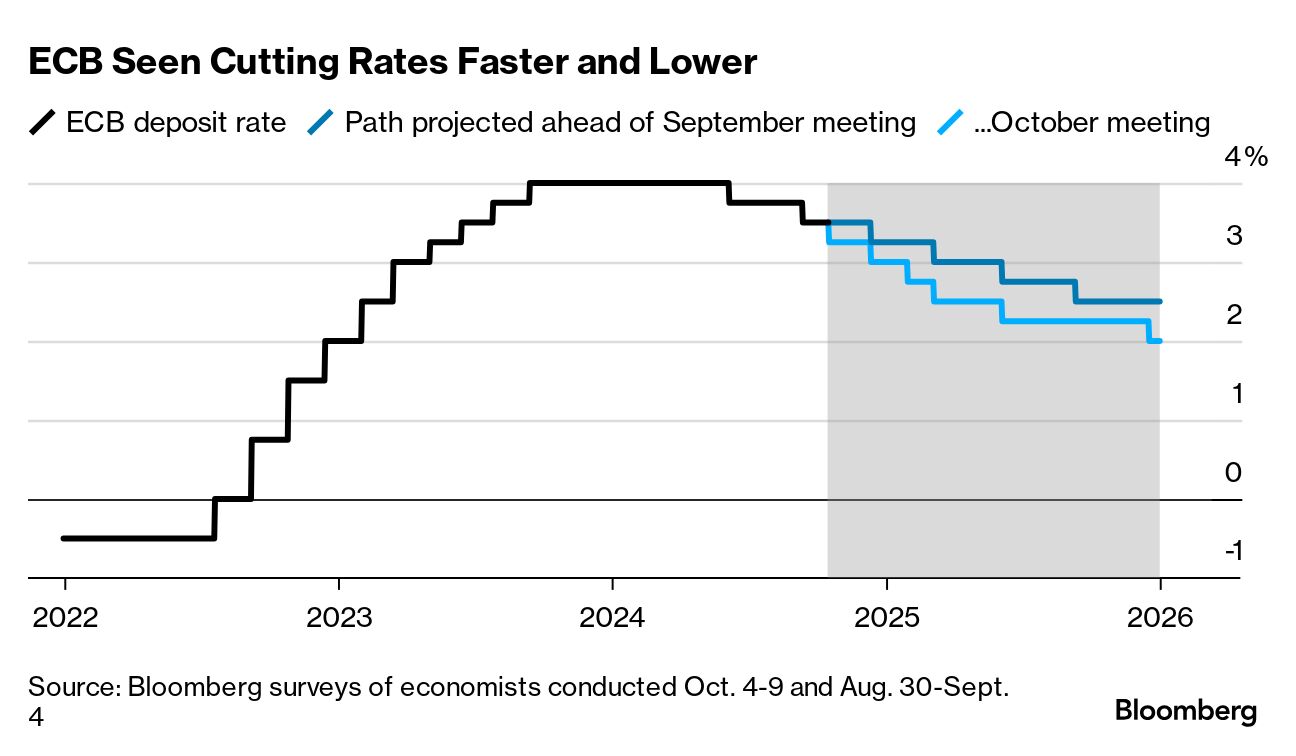

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at China's latest policy moves. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. China's leaders are now in cleanup mode to stabilize the two biggest drags on the economy — the housing slump and weak local government finances. That's perhaps the easiest way to understand the flurry of policy moves emanating from Beijing these days. The latest salvo came on Saturday, when Finance Minister Lan Fo'an held a closely watched briefing to unveil plans to allow local governments to sell bonds to swap debts and use special bonds to buy unsold homes, along with other measures. Investors who were looking for a big bazooka stimulus figure didn't get one, leaving markets puzzled. With fiscal plans needing approval from the legislature, those expectations may have been off the mark to begin with. But economists say it's the tone of the policy switch rather than any big number that really matters, and on that front, they're encouraged. Macquarie's China Economist Larry Hu says the key issue is whether policy makers have now decided to keep priming until it works, as they did in 2012, 2015 and 2020. Both the tone and the guidance of the Saturday briefing were pro-growth, suggesting that the policy goal is more than just achieving 5% growth in gross domestic product, Hu wrote in a report. Nomura's Ting Lu says the content of stimulus matters more than its size. Beijing has to "clean up the mess" created by the housing crisis and revamp its fiscal system as local governments can no longer collect massive revenue from land sales, he says. Goldman Sachs economists including Hui Shan saw enough in the Saturday policies to raise their 2024 GDP growth forecast from 4.7% to 4.9% and their 2025 forecast from 4.3% to 4.7%. But stimulus will do little to ward off other structural challenges, they warn: "The '3D' challenges — deteriorating demographics, a multi-year debt deleveraging trend, and the global supply chain de-risking push — are unlikely to be reversed by the latest round of policy easing." There's another reason the finance minister and his peers may avoid putting an overall price tab on their efforts. The 4 trillion yuan stimulus unleashed back in 2008 — while effective in boosting growth — is these days seen as contributing to debt and financial stability woes faced since. With no immediate new money in sight for now, policymakers are likely to focus on supporting local governments to deliver their budgeted spending while making use of existing resources to stabilize the housing market, according to Bloomberg Economics's Chang Shu. President Xi Jinping remains focused on "new productive forces" and "high-quality growth," and any big bang spending figure that splashes cash toward welfare risks going against such priorities. So it's a clean up job, rather than stimulus blitz, that's being pursued this time around. The European Central Bank will probably advance the global push for monetary easing in the coming week with an interest-rate cut that policymakers had all but ruled out just a month ago. The third quarter-point reduction of this cycle is seen likely by economists to herald a longer-lasting acceleration in action by officials seeking to cushion the euro zone from the hit to growth created by an extended period of high borrowing costs, and now playing out with a lag. See here for the rest of the week's economic events. You may have never heard of gallium or germanium, but along with palladium and silicon they're central to the production of semiconductors that power the modern economy. And their supply is dominated by China and Russia, according to research by the critical minerals security program of the Center for Strategic and International Studies, exposing supply chain risks and making prioritizing new sources key for economic security. The Biden administration's CHIPS Act focused on boosting manufacturing, packaging and workforce development, but did little for the related mineral inputs critical for production, researchers Gracelin Baskaran and Meredith Schwartz wrote in a note. "Building resilient supply chains for these minerals is essential for the next generation of chipmaking," they wrote, calling for tax benefits, research funding and other grants and subsidies. Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment