| Brazil's standing at the forefront of climate change, and how it can leverage its natural resources to attract more investment at a time of growing geopolitical instability, were recurring themes at Bloomberg's New Economy at B20 conference in Sao Paulo. Bill Gates and the heads of agriculture giants and technology firms spoke of the opportunities for the Latin American nation, the need to lower the costs of the energy transition for consumers, and how to boost private sector engagement and government support to attract more capital to funding climate solutions. More than 90% of Brazil's energy grid comes from renewable sources, which opens the door to produce everything from steel to hydrogen and power the data centers needed to deepen technological solutions. But the country needs to do a better job of selling itself to the world, said Karina Saade, a partner at MEP Family Office. "When we tell our own story, we tell the story for other Brazilians. We don't tell the story with foreign stakeholders in mind," she said at the event. Becoming an attractive destination for investment is even more key when considering how scarce financing is for developing nations. Just 7% of climate financing goes to emerging markets, according to Paul Polman, a former CEO of Unilever Plc and co-author of Net Positive. Andre Esteves, the chairman of BTG Pactual, said the country could become a hub for data centers as it becomes increasingly difficult to get connected to a clean energy source in other nations. "In Brazil you have huge investment in transmission lines and renewable energy fully available, not expensive," he said. "Brazil could be a very important hub for global data centers." Gates, the co-founder of Microsoft Corp., said he's investing in solutions for everything from fusion to nuclear energy solutions and healthcare to bring down the cost of cleaner solutions. Those include a company working with partners in Brazil to produce green steel. But his verdict on Brazil was mixed. "Brazil's got a lot of assets, it's kind of a mixed story because they've had challenges with governance. They're like the US — they have a party that's against all climate things...and a party who cares about that," he said. Also from the conference: - Coming up: the UK and Norwegian central bank chiefs speak in Washington, and the Cleveland Fed president hosts an event with a senior European Central Bank official.

- Japan's Liberal Democratic Party may fail to win a majority for the first time since 2009. Meanwhile the Bank of Japan chief explained what keeps him up at night.

- The RBNZ is still thinking about lingering price pressures, even as it cuts interest rates to reflect a lower inflation outlook, Governor Adrian Orr said.

- Growth in Russia's wartime economy peaked after overheating in the first half, analysts say. South Korea's barely managed to eke out any expansion last quarter.

- Prime Minister Justin Trudeau's government is reducing inflows of newcomers to Canada for the first time in more than a decade.

- Argentina is in talks with several banks for a loan of around $2.7 billion for about three years to meet debt obligations, a person familiar with the negotiations said.

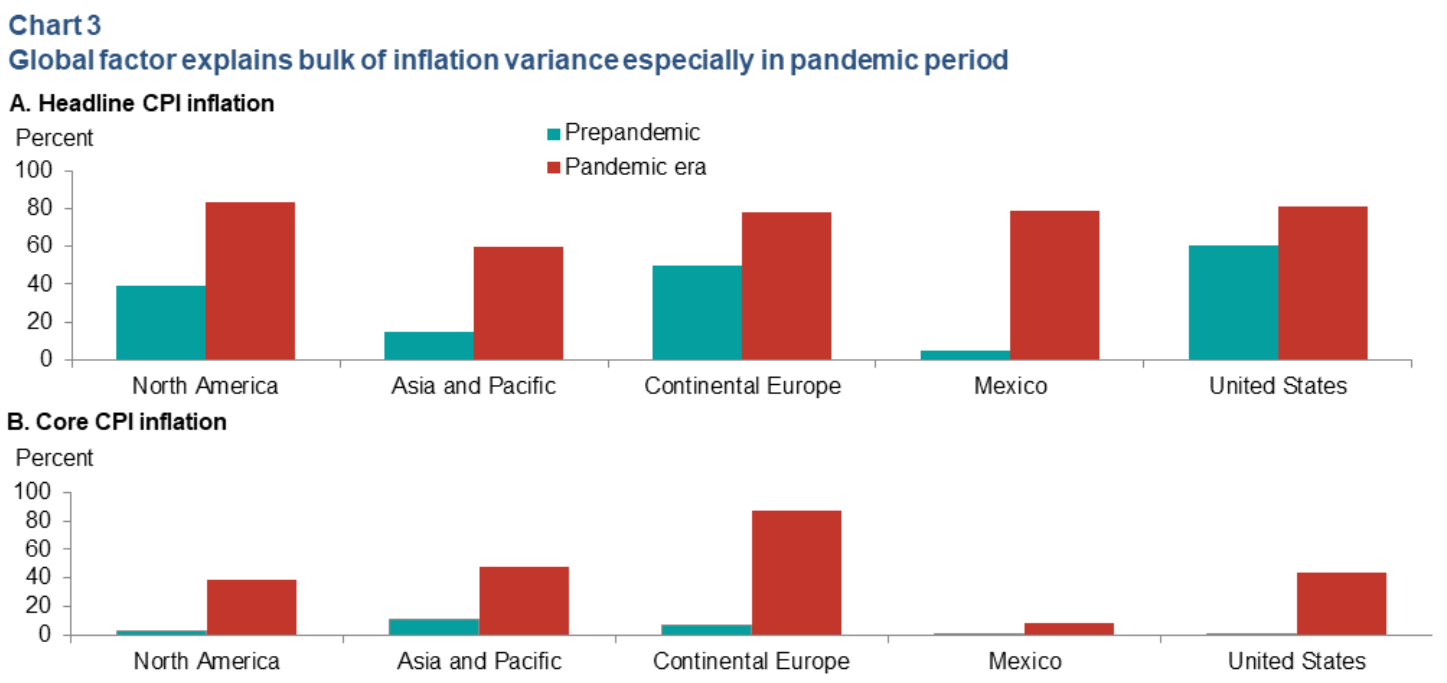

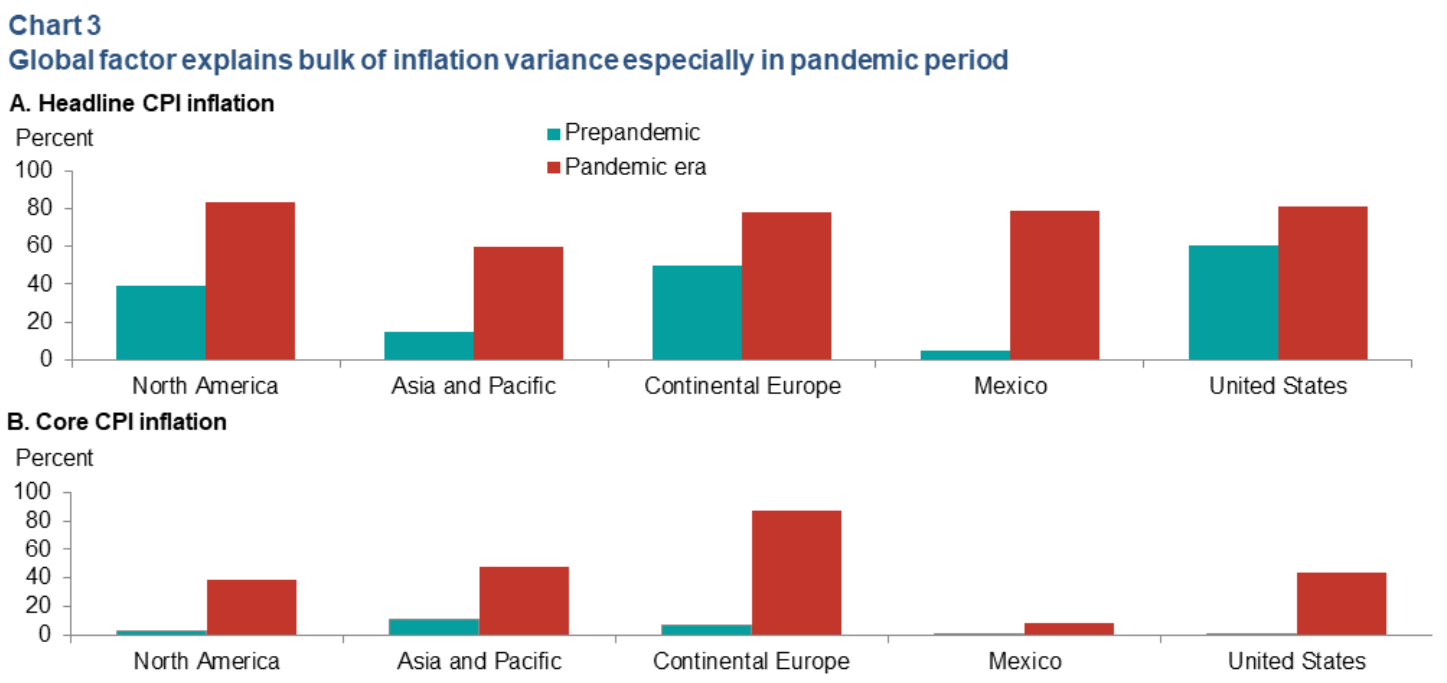

A contentious element of the surge in US inflation that began in 2021 has been the extent to which it was influenced by the Biden administration's super-sized stimulus package. New research from economists at the Dallas Fed emphasizes the international aspect of the jump in prices. Global factors include common shocks (such as from oil prices), pursuing similar monetary policies (many central banks use 2% inflation targets) and integrated supply chains that can amplify shocks. They explain 81.3% of US inflation variance during the pandemic, the study said.  Source: Christopher Otrok, Braden Strackman While the authors, Christopher Otrok and Braden Strackman, concluded that US policies are capable of getting the country back to 2% inflation, "policymakers may need to monitor international events and potential international sources of inflationary pressures more closely." Enjoy Economics Daily? Plus, here are some newsletters we think you might like |

No comments:

Post a Comment