| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at China's stock market rally. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Coming up: The US jobs report is expected to show stable growth.

- US dockworkers agreed to end a three-day strike that paralyzed trade.

- Bets are rising for more aggressive easing across advanced economies, adding to pressure on the Bank of Japan.

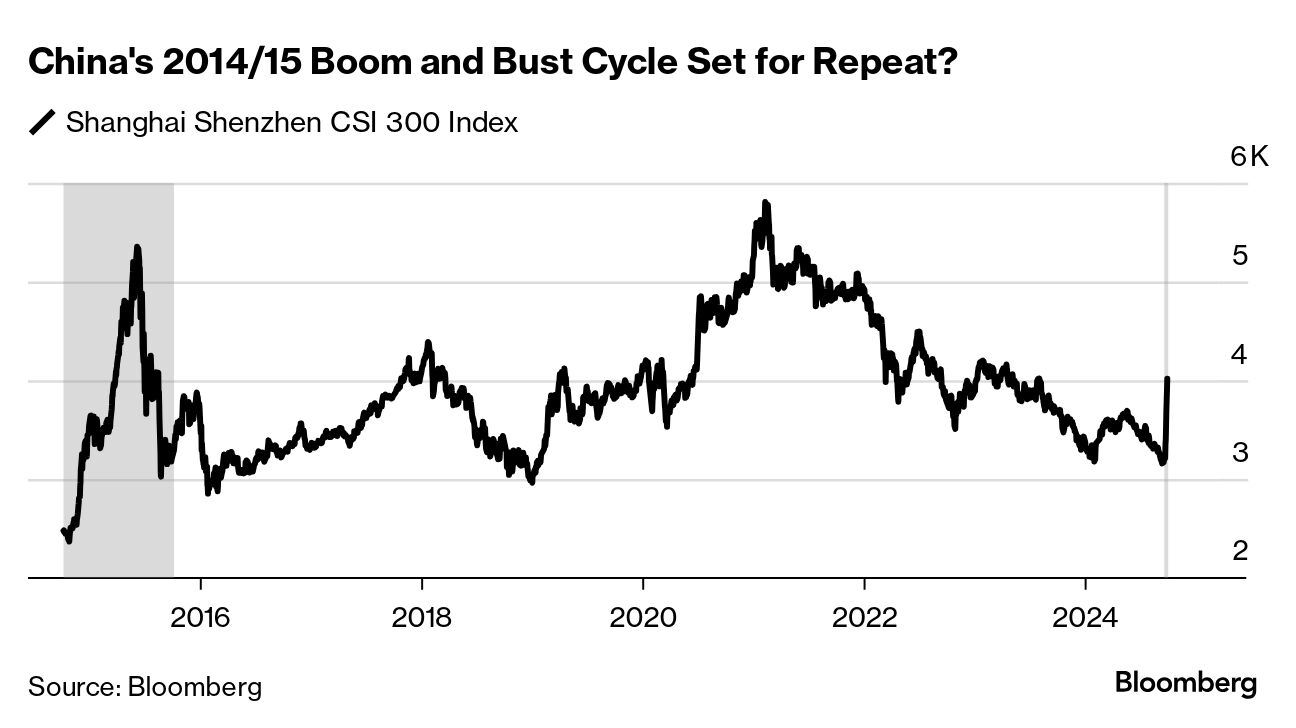

Confronted by slowing growth and disinflationary pressures, China swung into stimulus mode in late 2014, setting off an eye-watering stock market rally that spectacularly crashed back to earth in mid 2015. Confronted by slowing growth and disinflationary pressures, China swung into stimulus mode in late 2024, setting off an eye-watering stock market rally that… We don't know how that sentence will end this time around, but if history is any guide, China's leaders need to tread carefully in the months ahead. Authorities largely cheered on the surge a decade ago, especially in its early days — seeing it as a way to boost domestic demand. The fallout when it all went south only magnified their troubles, which they compounded with a botched currency devaluation that sparked an exodus of capital. While there may well be some fast money on the table as local and global investors alike rush to buy China's beaten down stocks, President Xi Jinping and his central bank governor Pan Gongsheng will be keen to avoid a repeat of the 2014/2015 boom-and-bust cycle this time around. Three Scenarios Nomura's chief China economist, Ting Lu, sees three potential paths: - A "good scenario" where officials avoid a bubble and cautiously manage the size and pace of fiscal stimulus while shifting efforts towards fixing the mess in the property sector and restructuring the fiscal system.

- A "bad scenario" where stock mania is followed by a 2015-style crash. The central bank struggles to clean up the mess and capital flight begins.

- A "baseline scenario" involving a bubble and bust on a smaller scale. In that case, Beijing introduces fiscal measures to stabilize demand and maintain local governments' basic operations, but fails to address any serious structural problems and clean up the real-estate mess.

But that's all in the future. In the here-and-now, the fear of missing out seems set to fuel the rally. Stephen Jen of Eurizon SLJ Capital says there's significant scope for a further rally because Chinese shares are still cheap and still under-owned. "For the purpose of charting out what might happen to the Chinese equities, bonds, and currencies, the right strategy I think is to go with the risk-on trends until they are exhausted," Jen says. - The European Union voted to impose tariffs as high as 45% on electric vehicles from China in a move set to increase trade tensions with Beijing.

- Europe's cash-strapped governments are turning to corporate profits to boost tax revenue.

- Czech central bank Governor Ales Michl reaffirmed his message of caution in monetary easing as he seeks to avoid a fresh wave of inflation.

- New Zealand's central bank will cut interest rates by half a percentage point at each of its two remaining policy meetings this year as risks mount of inflation undershooting its 2% target, economists said.

- New Japanese Prime Minister Shigeru Ishiba emphasized in his first speech to parliament that his top economic priority is to defeat deflation and put the nation on a stable growth track.

- Long periods without rainfall are becoming the norm — and the world's bread basket is a microcosm of how climate change is turning lives and whole economies upside down.

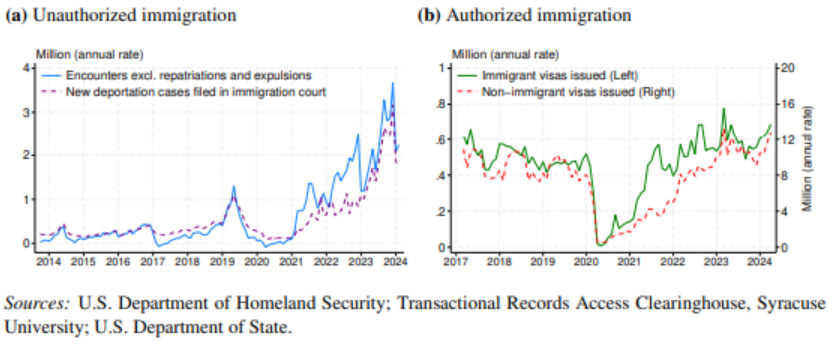

The immigration surge into the US seen after the pandemic began to wane can be interpreted as having either inflationary or disinflationary effects. On the one hand, the surge in migrants helped to bolster US labor supply at a time when there was a record number of unfilled jobs — helping to boost output and keep prices down. On the other, more workers also means more consumers, putting pressure on prices. In the end it's a wash, according to recent analysis by Federal Reserve Bank of Dallas economists. "Accounting for both supply and demand channels in our empirically motivated model, we find that the post-pandemic immigration surge had little effect on inflation." |

No comments:

Post a Comment