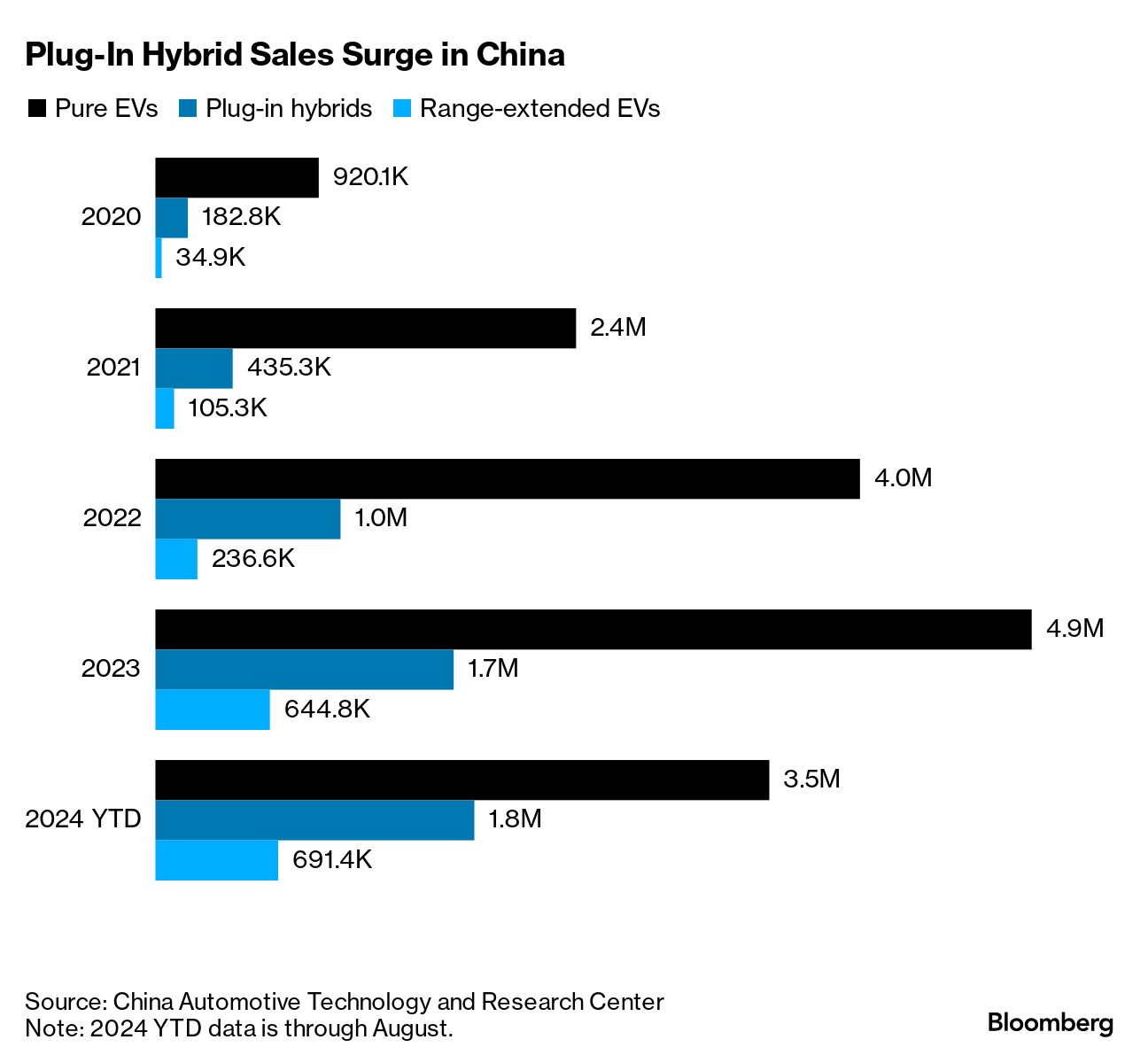

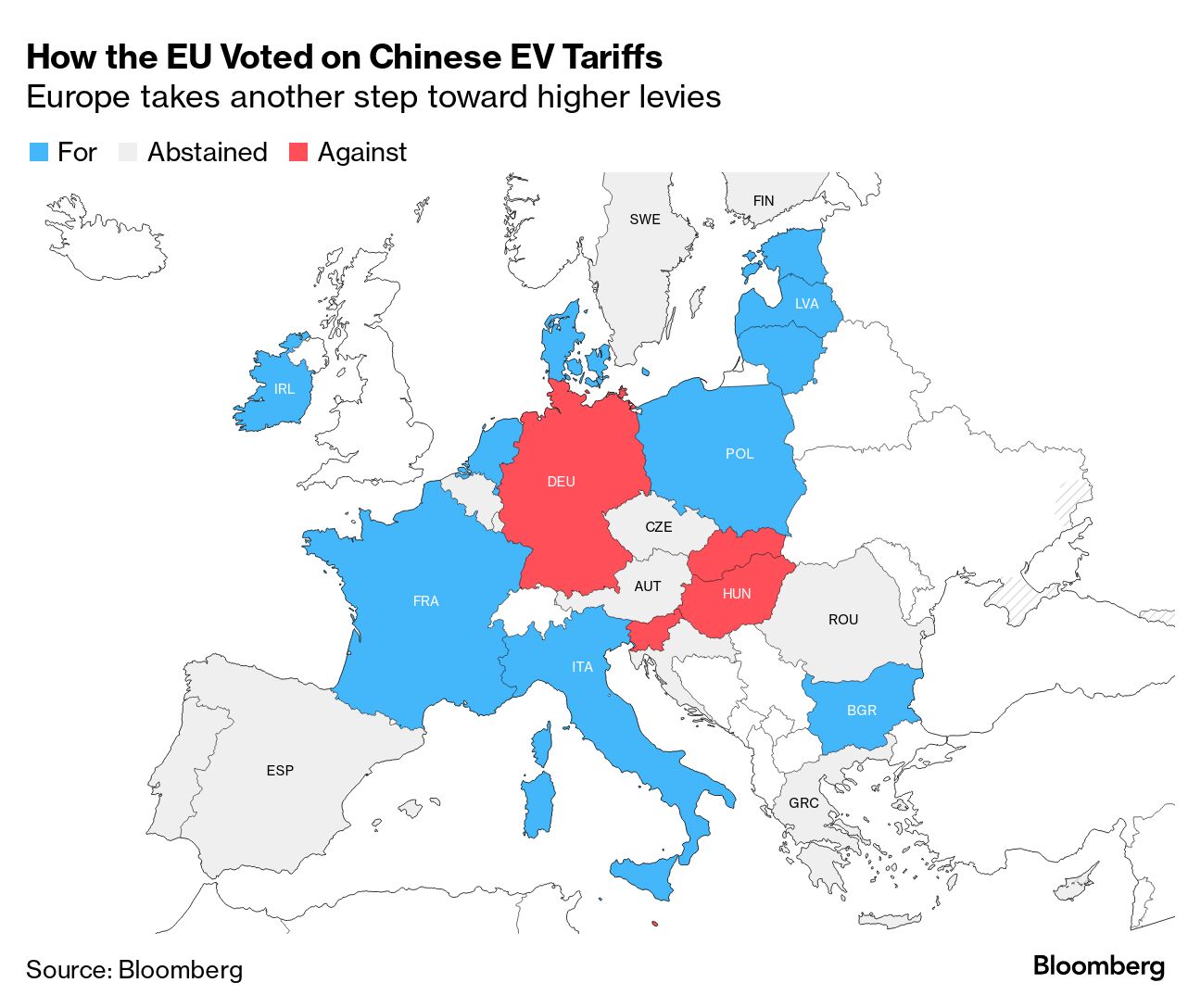

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. The world's largest auto market isn't ready to scrap the internal combustion engine just yet. Several Chinese carmakers that used to exclusively offer battery-electric vehicles have announced plans to start making plug-in hybrids or range-extended electric vehicles, both of which rely on engines along with onboard batteries. Companies that have been part of this trend include US-listed Xpeng and Geely's premium brand Zeekr. State-owned Guangzhou Automobile Group's Aion marque also is developing extended-range EVs, according to general manager Gu Huinan.  A Li Auto showroom in Shanghai. Photographer: Qilai Shen/Bloomberg Hybrids are enjoying a surge in popularity in China and beyond as they help assuage range anxiety and tend to be more affordable. Plug-in hybrids contain a fuel tank and engine that can kick in if the battery runs out of juice. With range-extended EVs, the gas engine runs periodically to recharge the battery. Their growth has outpaced that of pure EVs, with hybrid registrations in China surging almost 140% in August, and range-extended EVs soaring 90%. Pure EV sales rose 20% for the month, according to the China Automotive Technology and Research Center. Viability is another reason Chinese EV makers are branching into plug-in hybrids. During an earnings conference in March, Gui Shengyue, a senior executive with Chinese carmaker Geely, said the only auto companies in China making money are the ones producing internal combustion engines. "The pure electric-vehicle firms are not profitable," he said. With the sole exception of Tesla, no pure EV producer has managed to get out of the red. Chinese companies BYD and Li Auto are profitable, but they also make plug-in hybrids or focus on extended-range EVs. The shift speaks to Chinese automakers' willingness to cater to evolving consumer tastes, and runs counter to some executives' criticisms. Four years ago, Volkswagen China CEO Stephan Wöllenstein called extended-range EVs the worst solution for the environment, according to local media reports. Tesla CEO Elon Musk in July 2022 dismissed hybrids as "a phase" to move on from. Tesla's aversion to hybrids could cost the carmaker further market share loss in its largest overseas market. While the US company got a bump from Chinese EV subsidies last quarter, its global vehicle deliveries still fell short of many analysts' estimates. There's debate over whether the take-off of plug-in hybrid and range-extended vehicles ought to be celebrated. BloombergNEF's analysis indicates that while battery EVs will be the primary method of decarbonizing transport, hybrids can play a meaningful role. The researcher does caution that if hybrid drivers don't fully utilize their vehicles' potential to drive on battery power, their displacement of EV demand could add to oil demand. Geely's Gui sees lots of potential for plug-in hybrid technology and advocates for developing both internal combustion engine and battery-powered cars, as the journey to zero-emission transport may not be so straightforward. "BYD is a leading player, but the product that mainly contributes profits is their plug-in hybrids," he said. — By Linda Lew The European Union's decision to impose tariffs on Chinese electric vehicles has moved the focus to how and when Beijing will retaliate. Beijing previously threatened tariffs on EU brandy imports and launched investigations into pork and dairy products in response to the tariffs, offering a range of options that affect different parts of Europe. "Those that voted 'yes' will certainly be less favorably viewed by Chinese investors," said Deborah Elms, head of trade policy at the Hinrich Foundation, an Asian-based nonprofit organization that works to advance sustainable global trade.  The McLaren W1 supercar Photographer: Source: McLaren McLaren has Formula One on the brain, and not just because it's leading the constructor standings. The British manufacturer introduced a new supercar, the W1, on the 50th anniversary of its first F1 constructor's championship with driver Emerson Fittipaldi, who also won the driver's championship in 1974. The successor to the McLaren F1 of the 1990s, and the McLaren P1 of the mid-2010s, starts at a cool $2.1 million. |

No comments:

Post a Comment