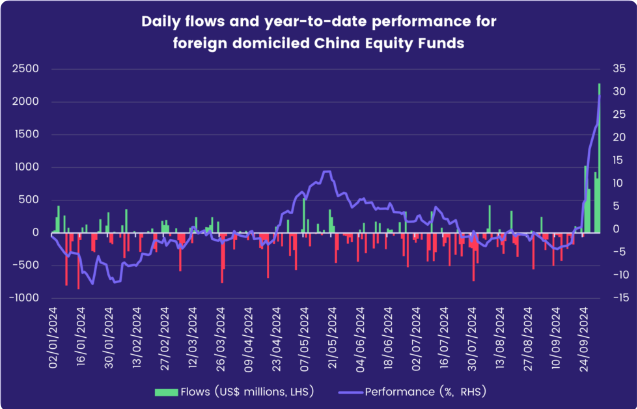

| It seemed like the perfect welcome gift for holidaymakers returning from China's Golden Week holiday. A 10% surge in the CSI 300 index of stocks quoted in Shanghai and Shenzhen in early trading on Tuesday came ahead of the much-anticipated press conference of the National Development and Reform Commission. Back in 2008, it was this agency that fleshed out the details of Beijing's historic 4 trillion yuan ($586 billion) infrastructure spending binge. This time, analysts had projected a fiscal package worth as much as 3 trillion yuan in the economic planning agency's briefing. Instead, they only got 200 billion yuan in spending, starting from next year. As investors processed the staggering shortfall, the CSI 300 gave up some of its gains, retaining about 6% — a decent haul for the new darling of global markets. But while onshore investors stood their ground, those in "red-chip" Chinese companies through Hong Kong's Hang Seng China Enterprises Index sold off by more than 10%: The shift in investment flows from external investors had been extraordinary. As Cameron Brandt of EPFR shows, China-dedicated international funds had been suffering steady outflows; and then with the stimulus heralded two weeks ago, many decided that China was investable after all: Not unreasonably, investors were caught in two minds as the markets moved sideways in the presser's aftermath. Is the rally losing steam already? Probably not. The chances are that China's "whatever-it-takes" moment, which has the onshore equities on their longest winning streak in 10 years, still has some way to go. So how does the agency's uninspiring unveiling make sense? Gavekal Research's Wei He and Thomas Gatley argue that after the dramatic market run-up, officials may now be keen to avoid adding more fuel to the fire. That means trying to manage expectations in both directions. But they haven't reversed course, and equity-market risks are still firmly tilted to the upside: For policymakers, the speed and scale of this rally invites comparisons to the 2015 boom and bust. From February to June 2015, the CSI 300 rose more than 60%, then nearly halved in the following two months. Officials almost certainly want to avoid a repeat of that painful episode, which damaged market confidence and led to the formation of the so-called National Team to support equity prices. Officials thus appear to be taking initial steps to curb market enthusiasm.

The year of 2015, to be clear, also saw a poorly managed devaluation of the yuan that drove international markets to the brink of crisis. So a desire not to overdo the hype is understandable. Investors' reaction to NDRC Chairman Zheng Shanjie's presser, however, was not so understanding and shows early signs of impatience. The selloff emphasized that the complementary fiscal support must come sooner, as any undue delay could hurt confidence. Investors will now shift their focus to the Ministry of Finance, typically tasked with issuing bonds to fund stimulus measures and additional spending. The ministry is set to hold a briefing soon that could deliver the kind of stimulus that markets want to see. Bloomberg News reports that banks, including Morgan Stanley and HSBC Holdings Plc, expect 2 trillion yuan in stimulus, while Citigroup Inc. put the amount at 3 trillion yuan. Another disappointment with expectations this high could be very damaging. It's already been two weeks since the Politburo'sannouncement. Much as the expectations for a fiscal stimulus from the NDRC was justified, BCA Research's Marko Papic believes it's too soon for Beijing to follow up with a package that shifts the base of the economy more into consumption. In the meantime, he sees the market's reaction to the disappointment as customary: China's been unloved for three years. There's a reason for that. It's because most people think China is uninvestable, and this market reaction right now is perfectly rational. It happens with every asset class in the history of mankind. When an asset class has been unloved for this long, any rally is going to be dismissed as just a bounce off the bottom as a short covering rally, and a lot of people who kind of panicked because of fear of missing out are going to say to themselves, 'Oh my God, what did I do?'

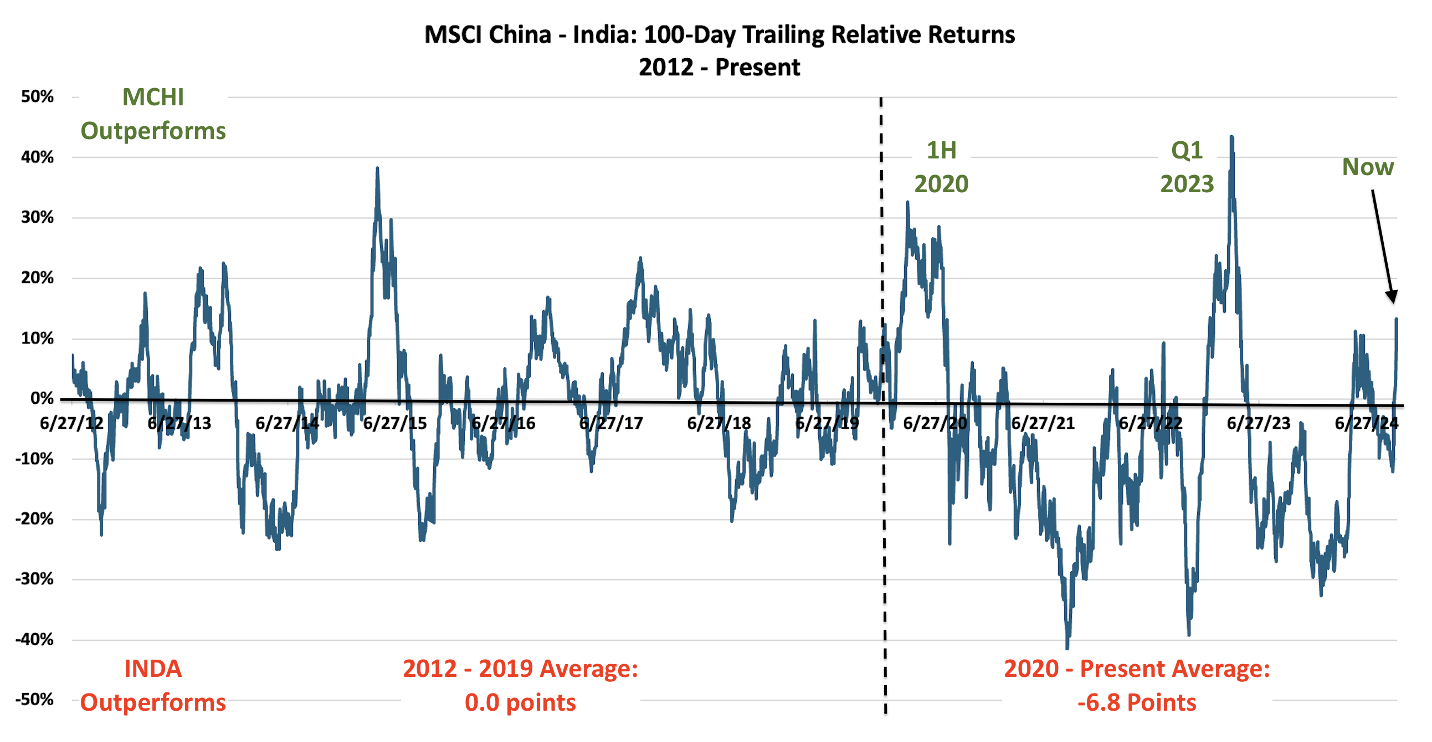

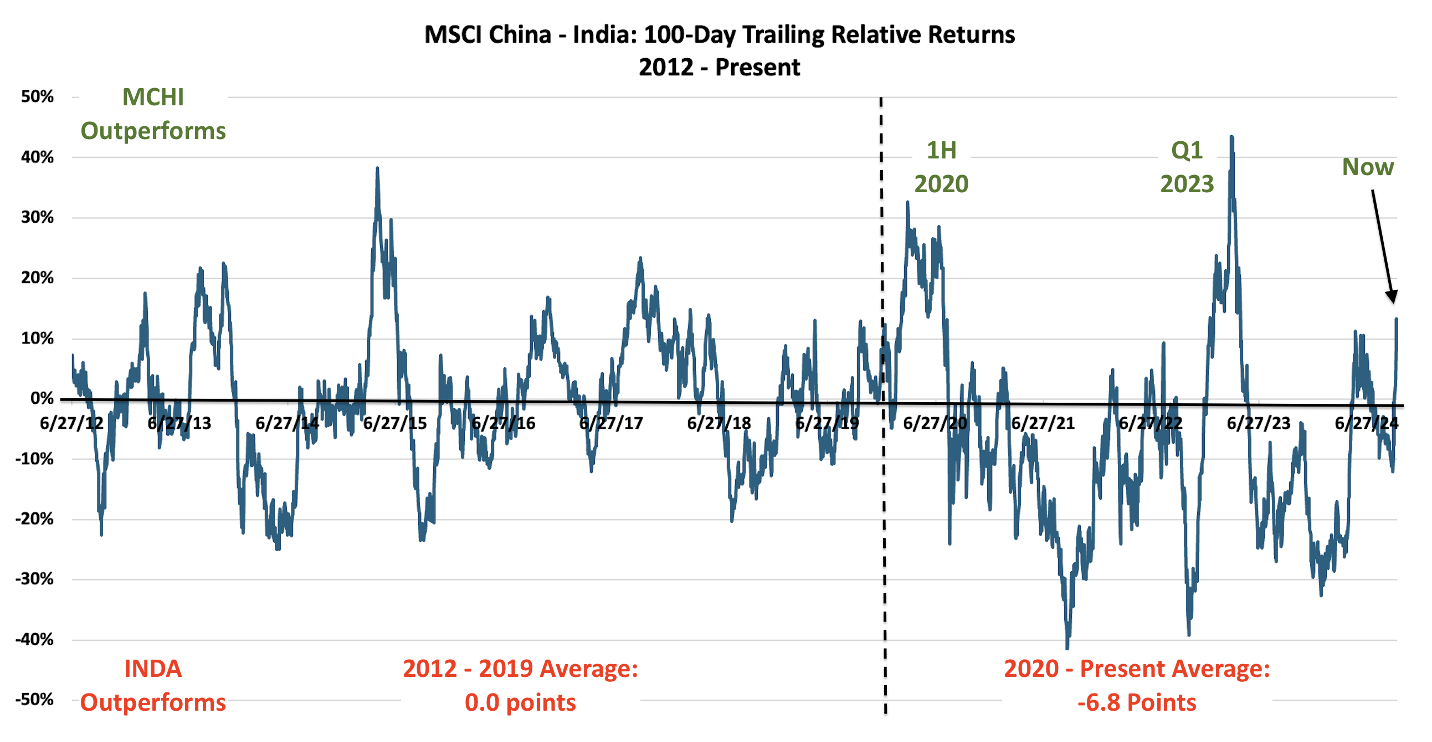

Meanwhile, China is once again dominating the emerging market portfolio, jumping ahead of India. The two countries account for almost half of the MSCI Emerging Markets index, with China's weighting higher (29.5% versus 18.6%). DataTrek Research's Nicholas Colas argues that due to Chinese stocks' underperformance over the years, many EM investors have come to view them as a structural underweight, with Indian stocks the most liquid and logically the balancing overweight. The recent rally has forced a rethink, if only on a tactical basis for this quarter and next. Since the stimulus announcements, inflows to India funds have been only 1% of flows into equivalent China funds, according to EPFR. Using 100-day relative return data for MCHI (MSCI China ETF) and INDA (MSCI India), he points out China's surge:  Are there any ways to take advantage of the cash that China is going to spend without risking another boom and bust cycle in the country's stock market? Gavekal's Louis-Vincent Gave notes that investors keen to participate in the rally while avoiding the Hunger Games pitfalls of Chinese capitalism can look to areas that include Macau casinos, internet platforms, energy, and education. These sectors support higher equity prices backed by a dominant local currency and have higher barriers to entry, which offer some protection from government interference. But none of the poor corporate governance and government interference that deterred international investors until they suddenly decided they could overlook them have gone away. And the hideous rise and fall of expectations on the fiscal plan demonstrates that China's authorities still haven't mastered market-based messaging discipline.

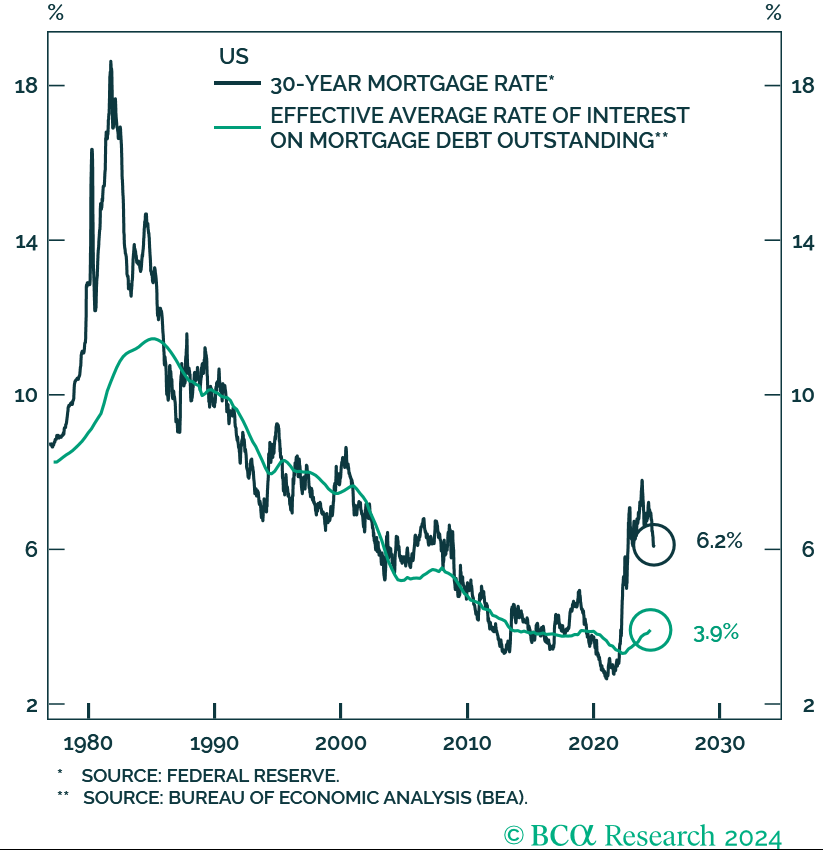

—Richard Abbey Where to next? Treasury bonds appeared to be locked into a new bull market (meaning yields declined) as everyone declared victory over inflation and waited for lots of interest rate cuts from the Federal Reserve. That assumption is now in question once more, with the 10-year yield back above 4%. Treasuries have a historic tendency to settle into long-running trends. The last secular bull market saw the yield decline steadily for almost four decades, from the era of Paul Volcker at the Fed in the early 1980s until the pandemic. Since then, it's plainly broken out of that downward path and arguably established a new upward trend. Since early April, however, it has appeared to be heading downward. Technical analysis shouldn't be taken too seriously, but it can have a big impact on traders' behavior. As this terminal chart shows, the yield has now reached a point where both the upward trend since 2020 and the downward one since April remain intact, while the yield is close to crossing its 200-day moving average. Edge much higher and sentiment could easily tip once more. The bear thesis would be seen to be confirmed:  Thursday's inflation data could have a big impact. So could the increasingly scary international situation. The week's most important new data point so far — on filling jobs — cut either way. The National Federation of Independent Business's long-running survey has been a great leading indicator in the past. The proportion who say that they're finding it hard to fill jobs has now dropped sharply and returned to pre-pandemic levels. That suggests the labor market has still been substantially tamed, and with it the inflationary pressure that it might produce. But jobs are still harder to fill than they were for much of the three decades before the pandemic, which might argue for continued high rates:  Away from the data, let's concentrate on two measures that have had slightly less attention. First, there is a bullish case to be made from the mortgage market. Arguably, the rock-bottom rates available through most of 2020 and 2021 are skewing perceptions. The average 30-year mortgage rate tends to move in line with long Treasuries and appears to be declining from levels that imply extreme pain for anyone owning or wanting to buy a home: This makes it look as though conditions have already eased substantially, even if mortgage rates remain higher than they were during the extended quantitative easing era of the last decade. Thus, debatably, there's little need for further easing by the Fed. However, Peter Berezin of BCA Research offers the effective average mortgage rate, derived by dividing total interest payable by the total volume of mortgage debt in force. This takes into account the many mortgages still in effect from 2020 and 2021. While the latest 30-year rate is about 6.2%, the average is only 3.9%: Berezin points out that this changes the picture for the Fed, as the average rate that people are paying will rise very substantially even if the fed funds rate stays constant. Cuts are necessary, along with falling bond yields, to avoid an effective tightening: If mortgage rates do not change, the average rate will eventually converge to the current mortgage rate as older, lower-rate mortgages are paid off and replaced by newer, higher-rate mortgages. As a share of disposable income, this would increase mortgage payments by 1.6 percentage points, forcing homeowners to cut spending on other items.

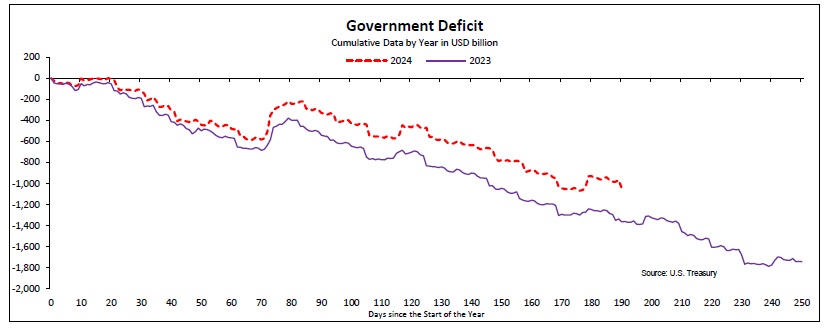

So that's an important element in the case for a continuation of the bull trend in the bond market. The needs of the US housing market and the impact on consumer spending will not permit anything else. To counter, Vincent Deluard of StoneX Financial declares that the Fed's jumbo rate cut last month has ushered in a new bond bear market. The extent of the deficit, and the likely pressing need to raise issuance, is key to this. Surprisingly strong tax collections this year mean that the US deficit is not quite as steep as it was at this point last year: He argues that this should "normalize" over the next three months, "as spending has picked up in the summer and should surge due to extraordinary spending caused by the wars in the Middle East and the floods in the South." That would translate into higher bond supply, and higher yields. Deluard also highlights the incongruity of the current market expectation that the fed funds rate will bottom just below 3% next year, and that recession will be avoided. The average low for fed funds in cycles where recessions are averted, he says, is 4.2%. The Global Financial Crisis was 16 years ago, and the number of people active in finance both then and now is beginning to dwindle. It's understandable that many are assuming that the new normal will be a return to the typical post-GFC norm, in which case a fed funds rate of 3% or lower seems to make sense. But they're probably wrong, and if so, the chances are that the bear market in bonds will continue. Another nomination for de-stress music to help cope with the last month of the US election campaign. Try sampling some songs by the wonderful British singer-songwriter Labi Siffre: Something Inside So Strong (which I only now learn was a tribute to Nelson Mandela when he was still incarcerated), It Must Be Love (later covered brilliantly by Madness), Bless the Telephone, or My Song.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Mark Gongloff: America's Flood Insurance System Requires Urgent Fixes

- Andreas Kulth: Vance Plays Saruman to Trump's Sauron

- Dave Lee: Meta Oversight Board's Big Leap Will Make a Small Splash

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment