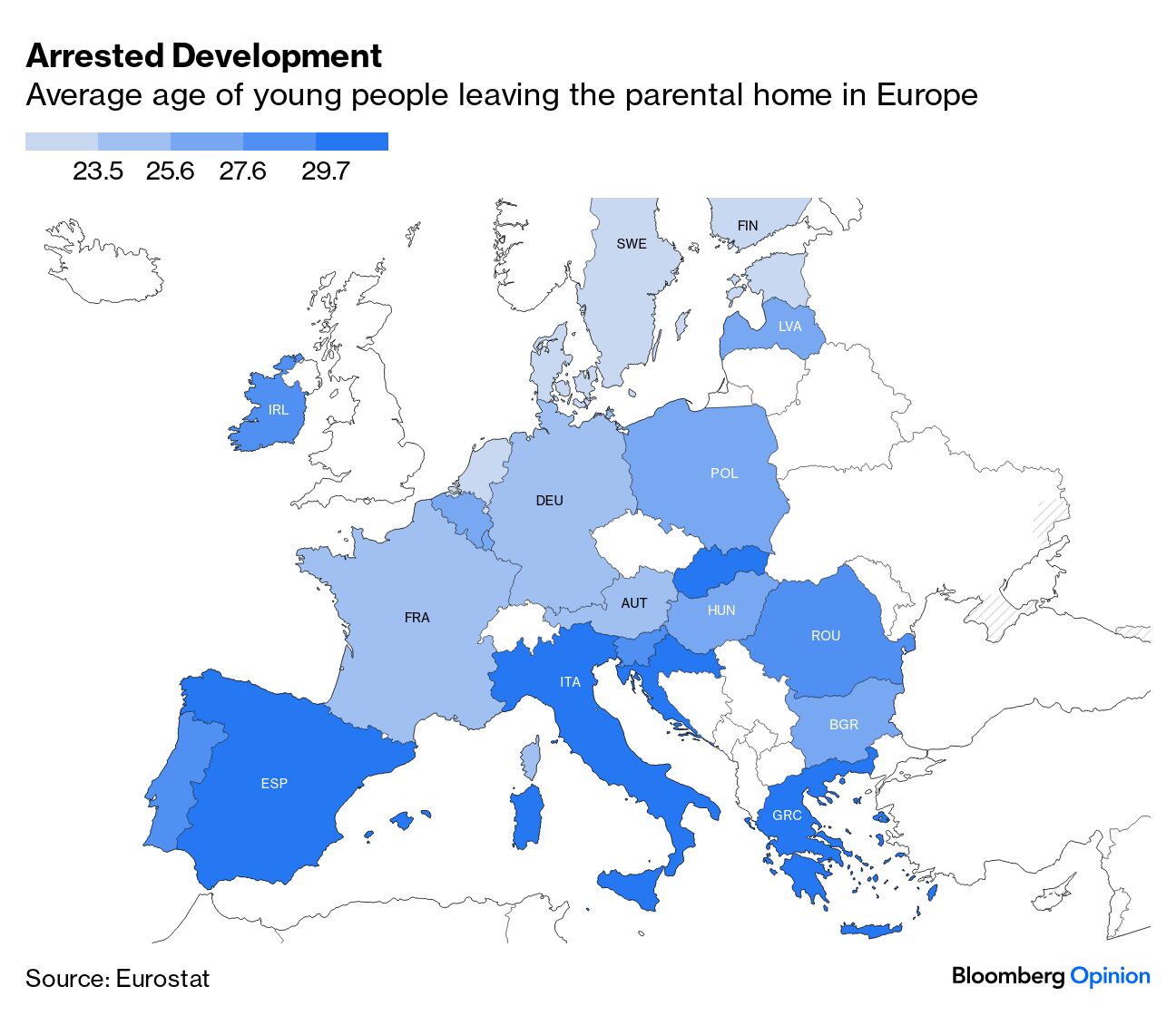

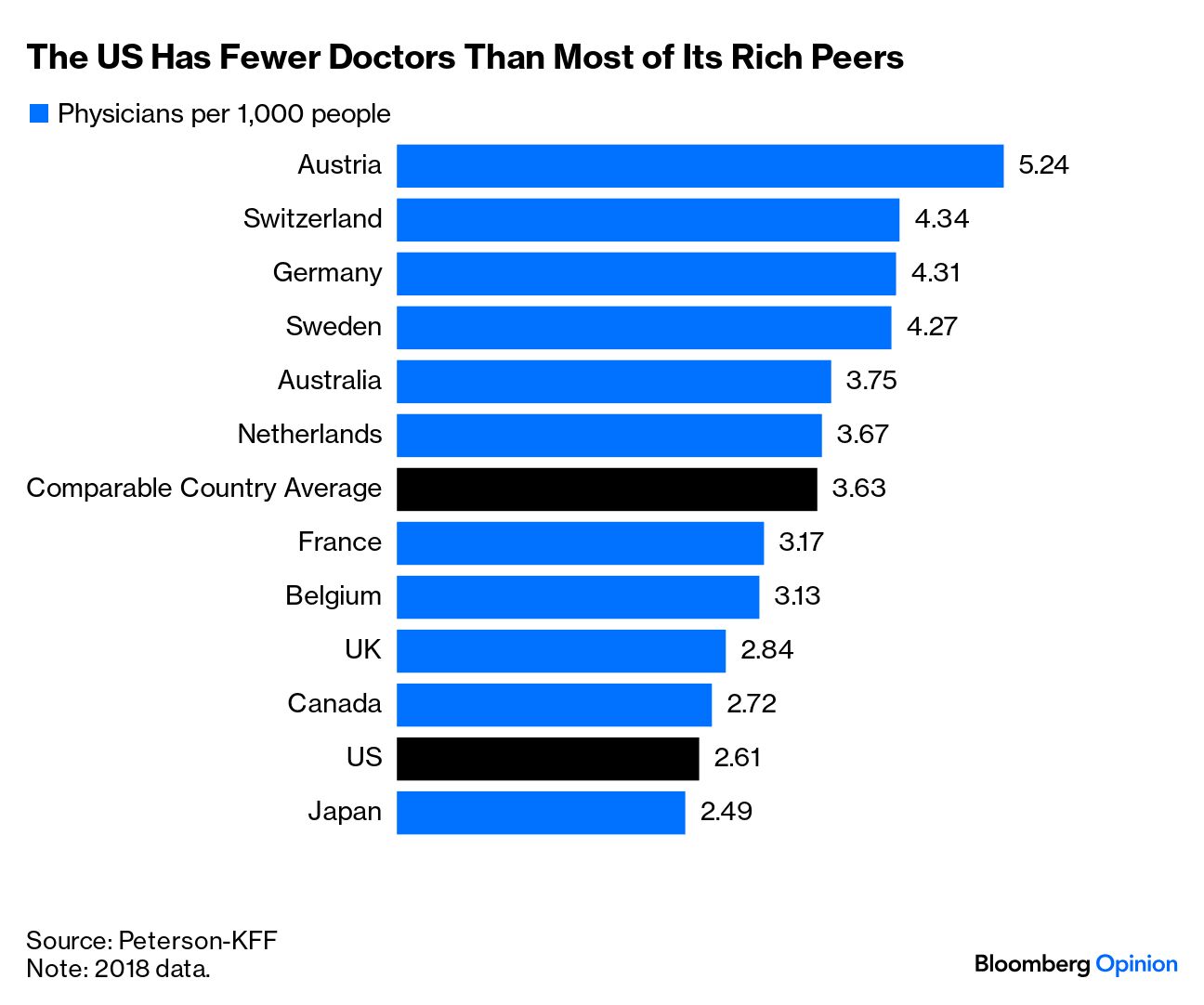

| This is Bloomberg Opinion Today, a bazooka of Bloomberg Opinion's opinions. Sign up here. In America, there's a subset of teenagers who drive golf carts to school and tractors to work, all without an actual driver's license. In Europe, though, license-less 14-year-olds get to drive these things: The Citroën Ami is technically a quadricycle, but most people just know it as the internet meme car. And at the Paris Motor Show this week, the fully electric buggy got a new face, literally: the all-new model has a slightly anthropomorphic quality to it, with a sympathetic expression and headlamps that resemble eyelids (ring a bell?). Measuring less than eight feet long, four-and-a-half feet wide and five feet tall, its compact size makes parallel parking a breeze, but if you're wanting to go fast or far, best of luck: It tops out at 27.9 miles per hour and the battery lasts less than two hours at maximum speed. The Ami looks and sounds like a video-game car, and maybe that's the point: Lionel Laurent says young people in France and beyond have "a tendency to delay life milestones like leaving home to start a family and more time spent in front of screens – including playing games like Grand Theft Auto." Getting them behind the wheel of an actual vehicle — whether it requires a license or not — is more of a challenge than ever: The dearth of new drivers entering the market is bad for European automakers, but tariffs on Chinese vehicles, coupled with affordable EVs like the Ami, could help keep the industry alive. On Monday, while attending the motor show in Paris, French President Emmanuel Macron admitted that it's a "difficult moment" for French and EU carmakers. In fact, it's a difficult moment for the European economy as a whole:  In order to avoid a return to deflation, Marcus Ashworth says European central bankers will need to pull out a "Federal Reserve-style bazooka" — also known as a 50 basis-point rate cut — later this week. The "warning signs are flashing red," he writes. John Authers agrees, saying the sick man of Europe is Europe: "The economic structure of the euro zone — which forced Mario Draghi to promise to do 'whatever it takes' to save the currency from its sovereign debt crisis 12 years ago — is in question again," he warns. A reimagined mode of transport for 14-year-olds probably won't heal all wounds, but it's a start. Speaking of sick men: Bloomberg's editorial board says US hospitals are exorbitantly expensive "labyrinthine institutions" that demand a rethink. The editors point to so-called scope-of-practice laws, which can increase costs and needlessly delay care: "One study found that relaxing such laws for nurse practitioners could save Medicare more than $40 billion annually," they write. As anyone who's tried to get a doctor appointment recently can attest, the wait time to see a medical professional can be weeks, if not months. And that's by design: "The US has fewer physicians per capita than most rich nations and the highest doctor salaries in the world," the editors note, because "lawmakers have consistently opted to limit competition and preserve the status quo." If you're a foreign-trained doctor, working in the US is a nightmare. There's miles of paperwork — both state and federal — and strict requirements: "Even those with decades of experience must pass a standardized exam, repeat their residency programs and apply for state licensure — which can take years and cost thousands of dollars," the editors write. The easiest and fastest way to lower health care costs would be to increase the supply of labor, either through relaxed restrictions or special permits for graduates of certain overseas schools. Read the whole thing. Bonus Health Reading: Foreign bidders can't buy French supermarkets. What makes consumer health care so different? — Chris Hughes You know it's bad when the co-founder of LinkedIn is saying the next president of the United States could doom businesses across the country for good: Companies can't thrive where an erratic, vindictive autocrat influences our courts and Justice Department. And they can't take Trump at his word if he's shown himself to be a serial liar whose tweets can depress markets. That is Donald Trump. And America can't afford to return him to power.

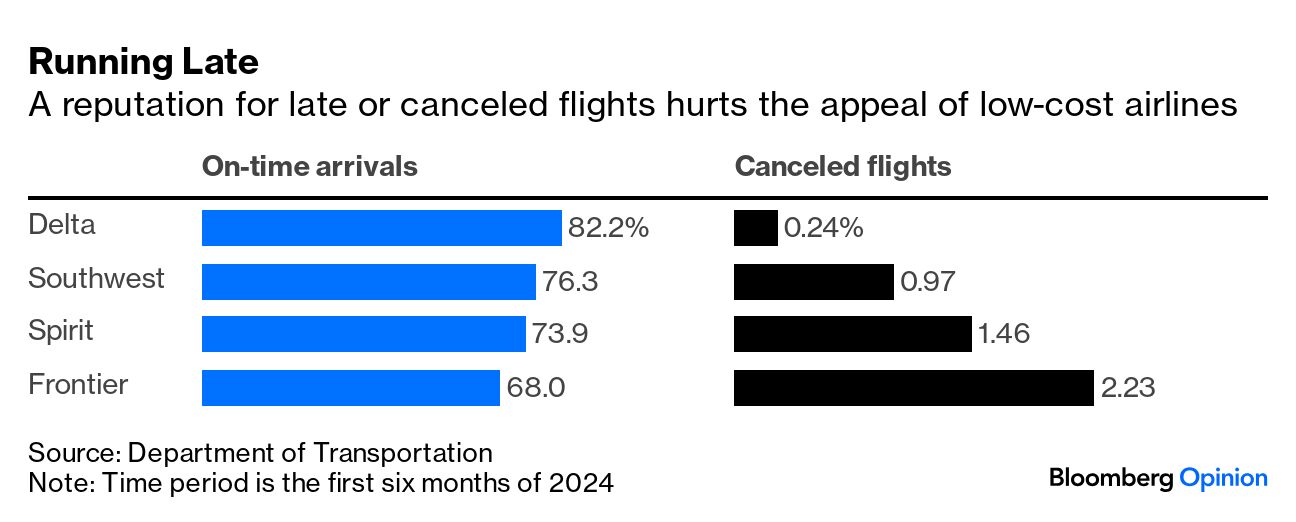

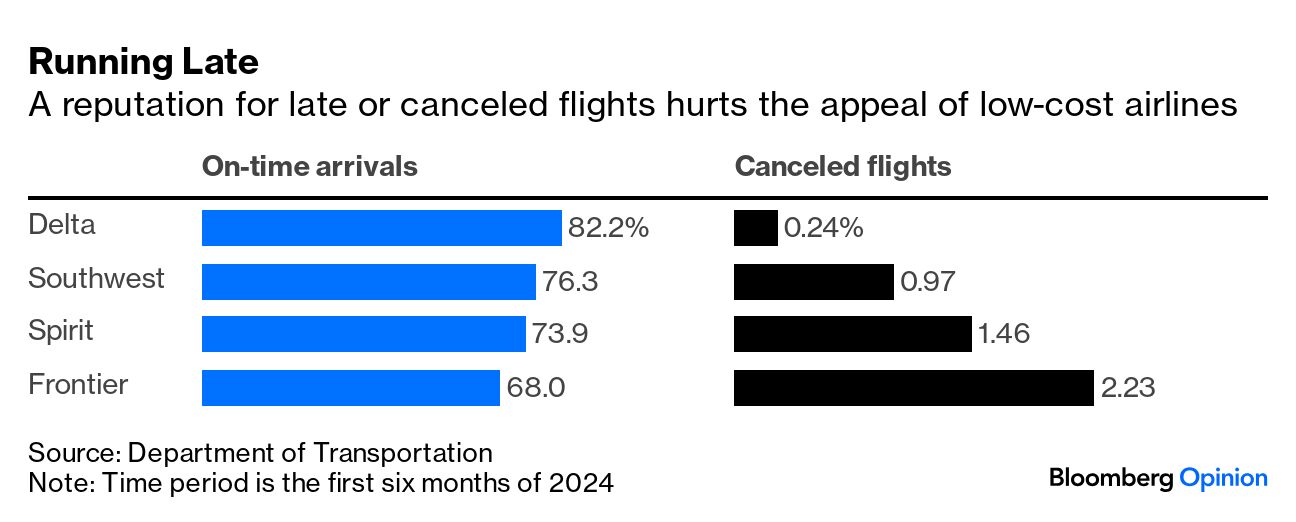

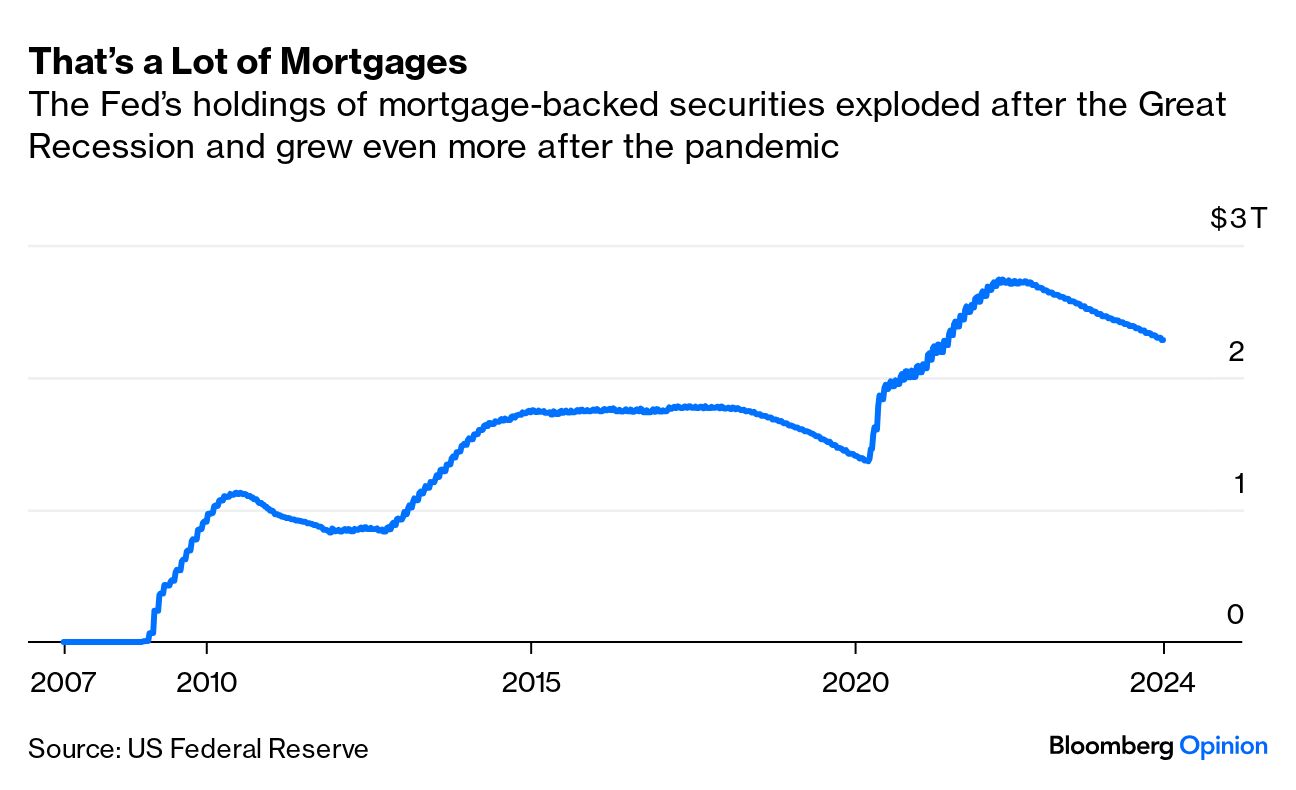

In a new op-ed for Bloomberg Opinion, Reid Hoffman makes the case for why corporate leaders should seek Harris' stability over Trump's chaos. Not only does Reid see risks in re-electing a man who pursues tax plans beneficial only to people like himself (i.e. real estate investors), he's also witnessed how Trump fails to to pay his own vendors. "When your modus operandi is to rip people off, you aren't qualified to be president," he writes. You probably also aren't qualified to run a suite of hotels and golf courses, but I suppose that's a LinkedIn post for another time. Bonus 2024 Watching: Why are Black men willing to vote for Trump? Tim O'Brien joined Nia-Malika Henderson and Brakkton Booker on X to discuss. "You had ONE job!" is a silly little meme, yes, but it's also the headline of Thomas Black's column about discount airlines' penchant for running late. "No one thinks comfort when clicking to purchase a flight on Spirit or Frontier," he writes "It's about price and the one indispensable question about service: Will my flight arrive on time or even at all?" The answer to that question, increasingly, is no:  Plenty of people — Matthew Yglesias included — look at Jerome Powell's accomplishments and say he's the patron saint of central banking. The chairman of the Fed may have all but secured us a soft landing, but Allison Schrager says his admirers have short memories. "The mistakes the Fed made in 2021 will haunt the US economy for years to come," she writes. To stop the economic bleed at the onset of the pandemic, Powell cut interest rates to zero, restarted quantitative easing and snatched up longer-dated Treasuries and MBS, or mortgage-backed securities. "It may have made sense for the Fed to restart QE in the spring of 2020 when the outlook was so dire," she writes. "But why did it keep buying MBS, in such large quantities, for another two years?" Behind Boeing's aircraft backlog is a mountain of cash, hopefully. — Thomas Black Wall Street bonuses have been salvaged by a stellar September. — Paul J. Davies Many cannabis companies used to be gold mining companies. — Matt Levine Google is giving new nuclear power exactly what it needs: time. — Liam Denning Some hedge funds are missing a trick — trading volume alpha. — Jonathan Levin China should seize control of the economic narrative. — Daniel Moss The battle between dockworkers and robots is far from over. — Stephen Mihm A new mineral pact between the US and India misses the point. — Mihir Sharma Giant pandas have returned to DC. Trump talked with Bloomberg News. Molly Baz is back in Times Square. Starbucks is a teen emporium. The date to end all Chicken Shop Dates. Angel numbers are completely made up. Paul Mescal watches your TikToks. A frog that croaks like Star Trek special effects. The King Conker controversy. (h/t Andrea Felsted for last two kickers) Notes: Please send steel nut replicas and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment