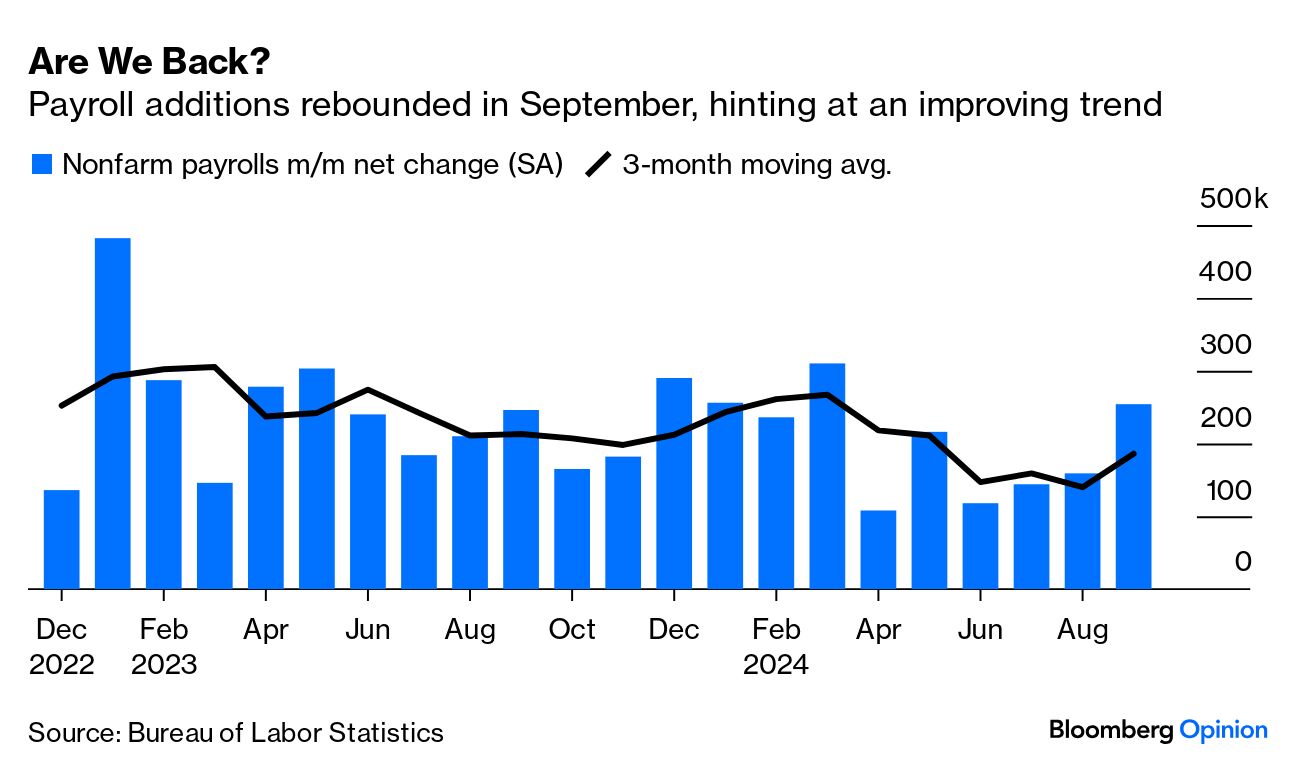

| Data showing the fastest US jobs growth in six months, a surprising drop in unemployment and higher wages sent Treasury yields surging on Friday and had investors furiously reversing course on bets for another half-point interest-rate cut from the Fed as soon as next month. In local markets this morning, New Zealand bonds are outperforming treasuries ahead of Wednesday's Reserve Bank of New Zealand policy decision. It may soon be time to shed our paranoia about the US labor market and concede that the economy is looking fabulous, Jonathan Levin writes for Bloomberg Opinion. Rio Tinto confirmed it has made an approach for a potential acquisition of Arcadium Lithium. The approach was non-binding and there was no certainty any transaction will proceed, Rio said in a statement Monday. Meanwhile, an Arcadium shareholder has written to the board of the US miner urging it not to accept a low takeover offer from Rio. An Australian judge rejected an attempt by social media platform X to wipe a A$610,500 fine levied by a watchdog. On Friday, the court threw out X's petition and ordered Elon Musk's company to pay all proceedings. That ends a lawsuit that arose after Australia's eSafety commissioner fined the platform, saying it didn't adequately respond to queries about efforts to crack down on child-abuse content. New Zealand's government will include 149 projects in a fast-track approvals bill — predominantly in housing, infrastructure, resources and agriculture — in a bid to revive a slowing economy. The legislation is expected to pass before the end of the year. |

No comments:

Post a Comment