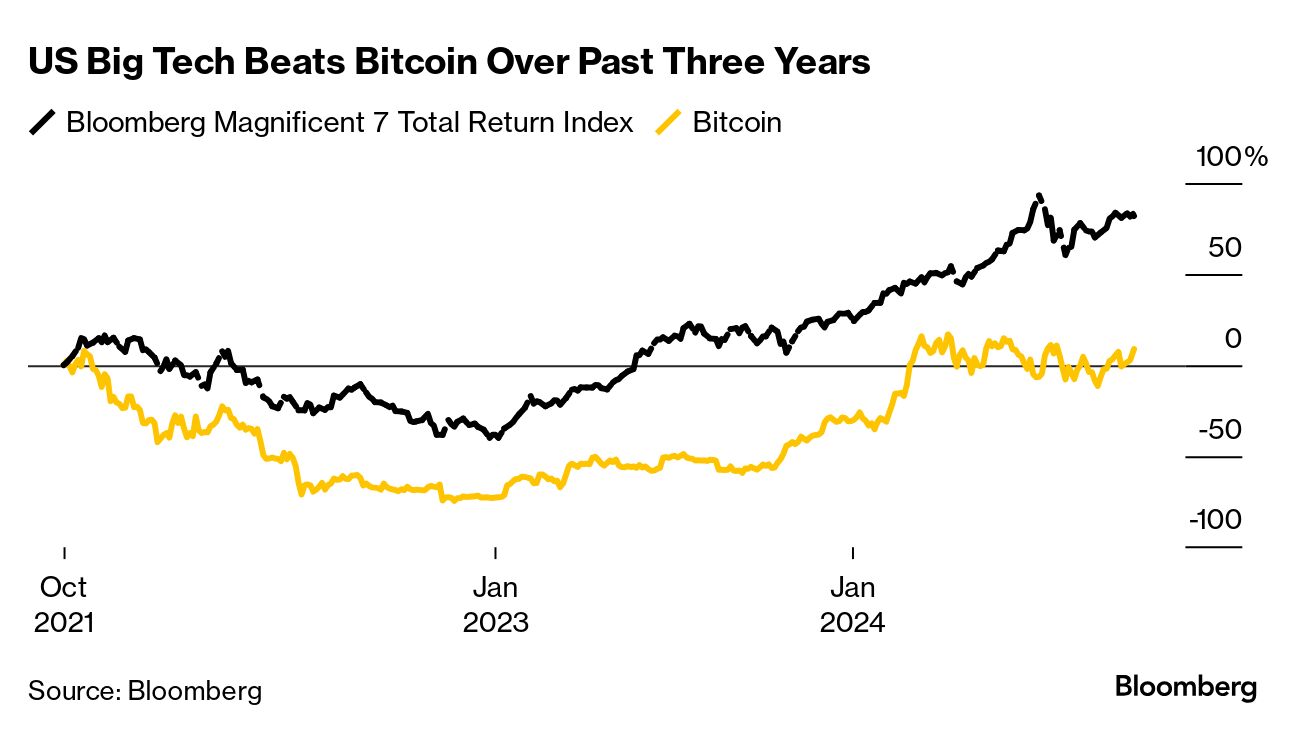

| The notion that few, if any, assets can rival Bitcoin's returns over longer periods of times is axiomatic for the crypto faithful, and the basis for arguments that bouts of intense volatility are therefore tolerable. If the starting point is Bitcoin's origin in 2009, then the gains are indeed mind-boggling. But many crypto investors engaged with digital assets only from the pandemic onwards, so their time-frames are far more truncated. Over such periods, a more nuanced picture emerges about Bitcoin returns. One way to see that is to compare the token with US tech megacaps. For instance, an index of the so-called Magnificent 7 US tech stocks — Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia and Tesla — is up 86% during the past three years, whereas Bitcoin has delivered a paltry 5%. Over that span, measures of the original cryptocurrency's realized volatility were also notably higher than they were for the tech-stock gauge. Of course, past performance can be cut in all sorts of ways, and a snapshot is just that -- a partial picture. But if nothing else, one takeaway is that mainstream assets can provide richer returns than Bitcoin over longer periods, and potentially with reduced stress levels to boot. Right now, the largest digital asset is on a bit of a tear, buoyed by wagers that the US regulatory outlook for crypto will improve after the upcoming presidential election. Part of that momentum stems from Republican nominee Donald Trump's lead in prediction betting markets with three weeks to go to election day, given that he is avowedly pro-crypto. But as the digital-asset echo chamber fills with chants of "buy Bitcoin," it's worth keeping in mind that there have been much less bumpy rides to potentially bigger profits slap bang in the middle of traditional markets. |

No comments:

Post a Comment