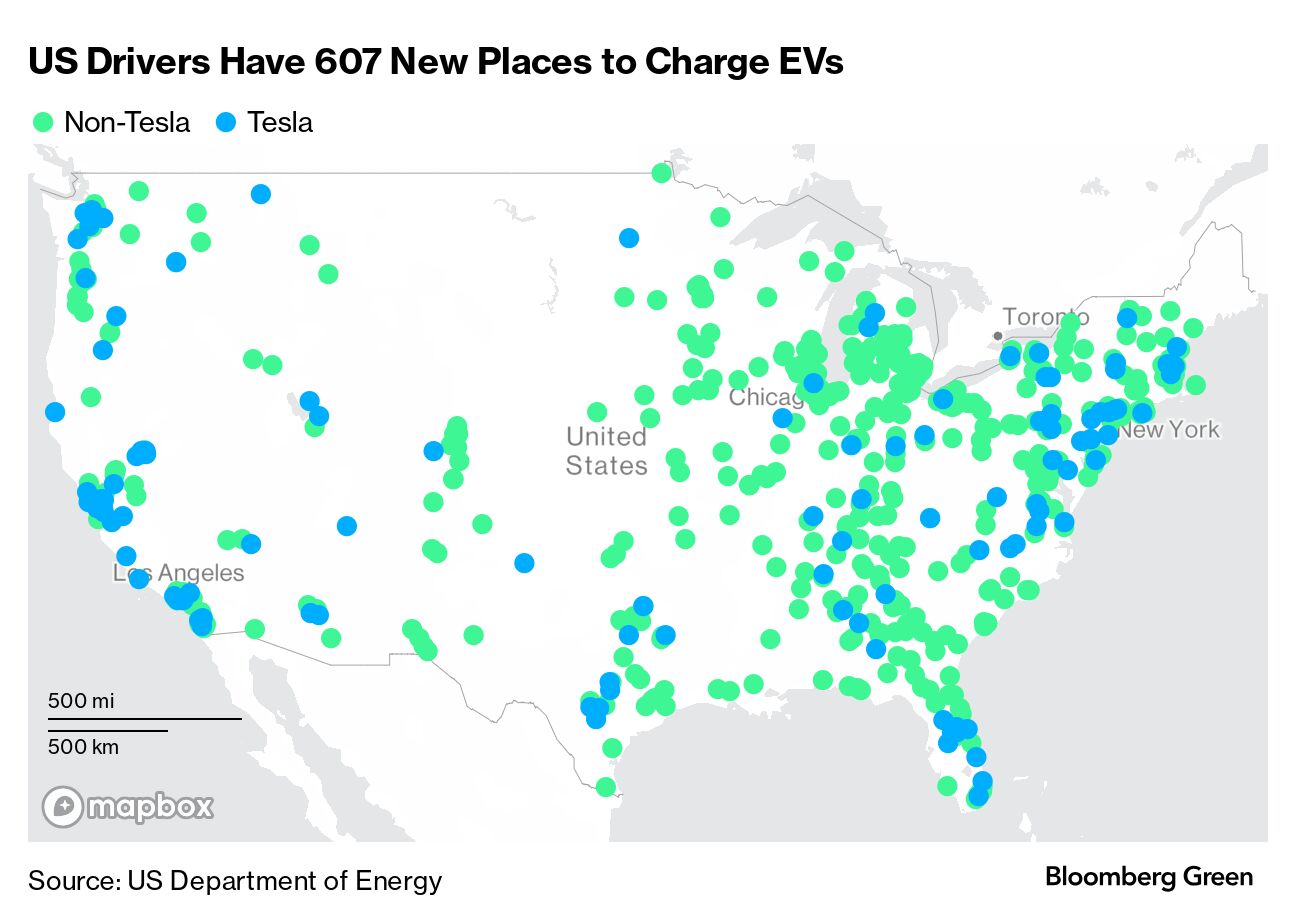

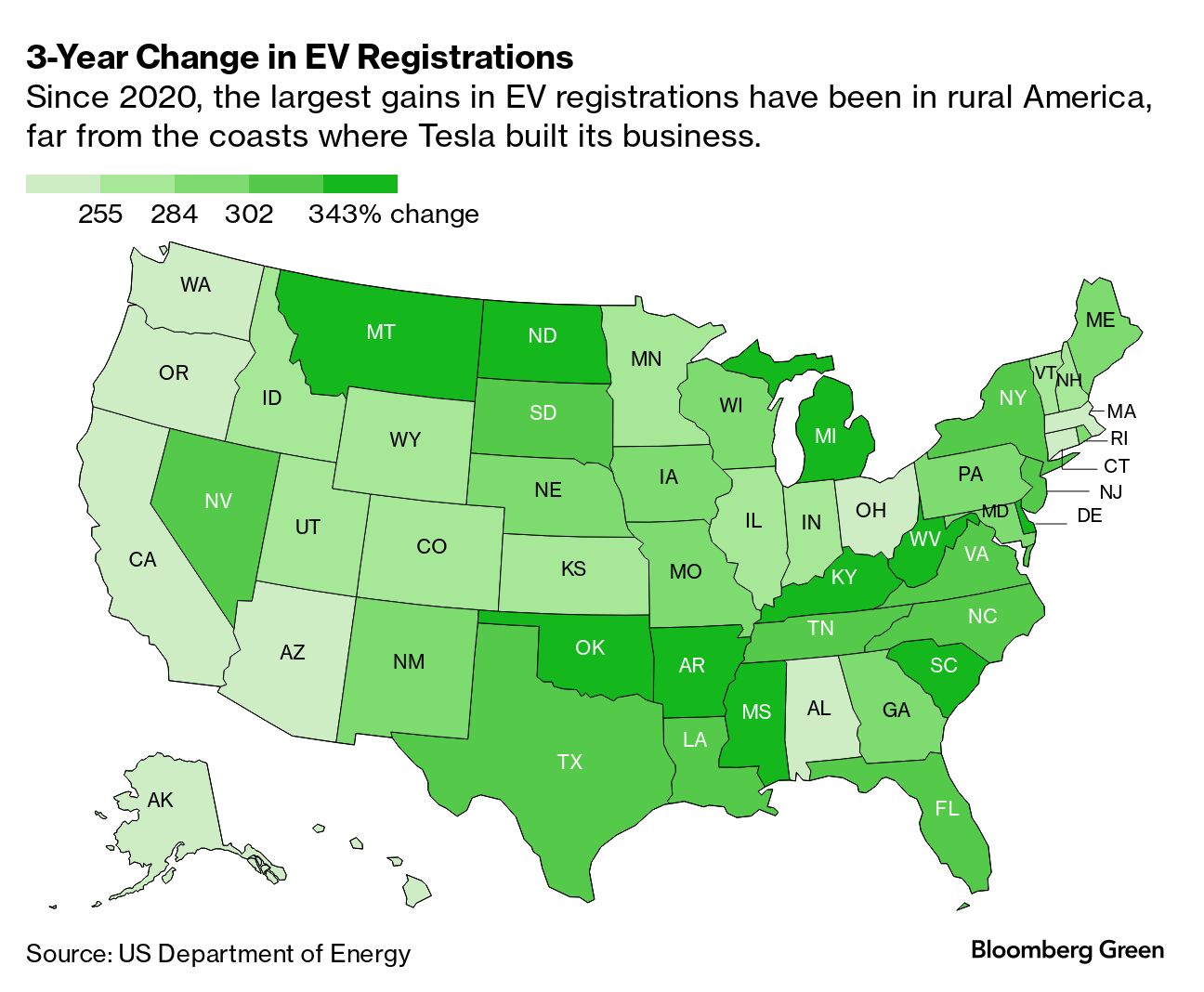

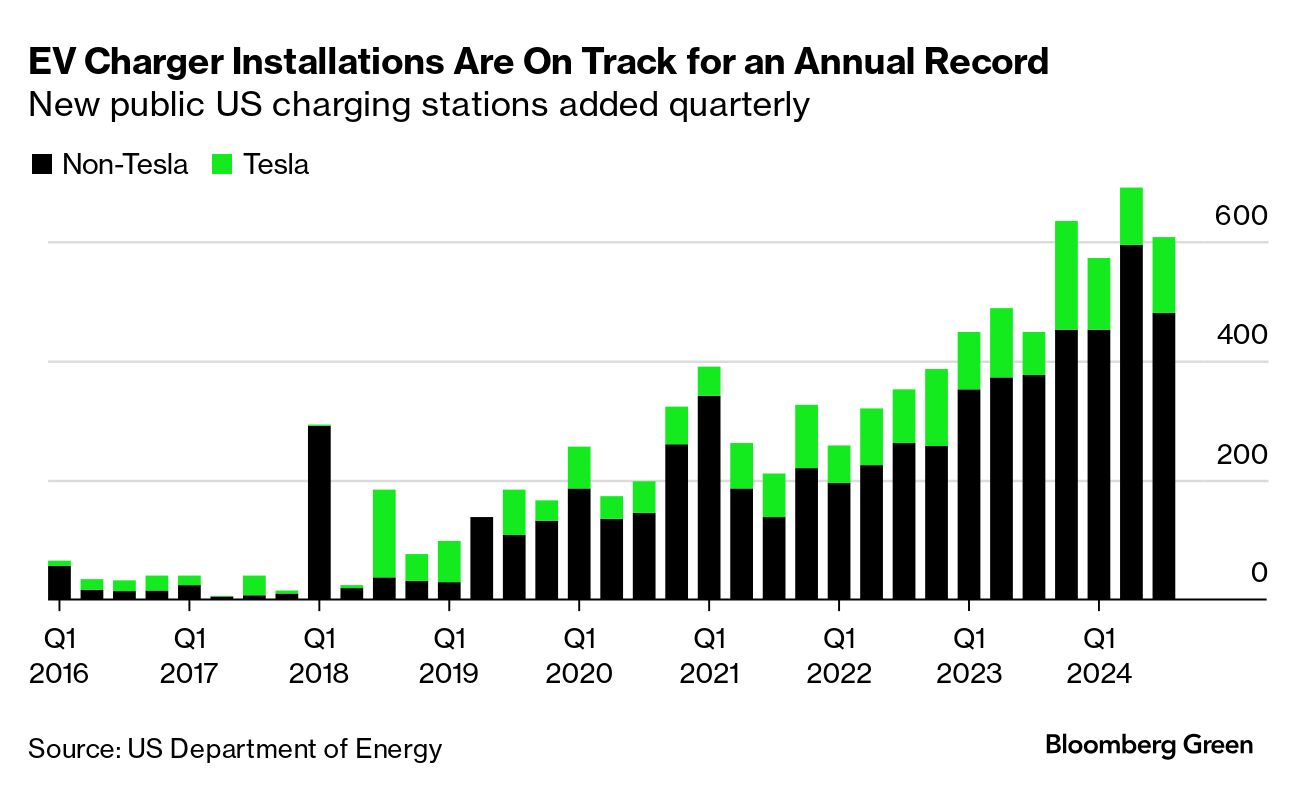

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. As electric-car sales pick up pace far from the US coasts, a wave of new fast-charging stations are coming online from the Rust Belt down to the Deep South. Roughly 600 such stations switched on across the US in the third quarter, a 7% increase from the end of June, according to a Bloomberg Green analysis of Department of Energy data. There are now almost 9,000 public fast-charging sites in the US. For the year to date, the number of fast-charging locations in the US has grown 35% over the year-earlier period. At that rate, stations will number roughly 11,600 by the end of the year — roughly one for every 10 US gas stations. "There are so many new stations going in every quarter," said Erika Myers, executive director of CharIN North America, a Washington DC-based nonprofit focused on improving the charging experience. "It might feel like there isn't much (charging) if you researched this last year, but take another look." The recent charger blitz is a boon particularly for drivers in the US Midwest and South. Between June and October, drivers got 51 new places to quickly top up an EV in Michigan, 24 in Ohio, 38 in Florida, 25 in Georgia, 14 in Kentucky and 15 in Alabama. While electric-vehicle sales gains slowed at the start of the year, the pace has picked back up. Drawn in part by a parade of newer, more affordable models, Americans bought 346,309 fully electric vehicles in the third quarter, 11% more than a year ago, according to Cox Automotive. There are now 3.5 million EVs registered in the US, according to federal data, and sales gains have been steepest in rural states like Oklahoma, Arkansas and Montana that largely have steered clear of battery-powered cars until recently. EVgo, which operates about 1,000 fast-charging stations in the US, says the new crop of more affordable vehicles is helping. "What we're seeing on the ground are people buying electric vehicles across the United States," CEO Badar Khan said on an August earnings call. "That just speaks very well to the underlying demand." The third-quarter infrastructure blitz was fueled in part by the Biden administration's National Electric Vehicle Infrastructure (NEVI) Formula program, a $5 billion plan to fill in gaps in the charging map. Though it's still early days, that money switched on nine stations in the third quarter, including the first facilities funded by the program in Rhode Island and Utah. Those figures should increase quickly in coming months; some 29 states have awarded NEVI contracts or signed agreements for another 700 charging stations, according to the government. The invisible hand is plenty strong even absent Beltway sweeteners. North American operators will spend an estimated $6.1 billion on charging infrastructure this year, nearly double their 2023 investment, according to BloombergNEF. That annual spend is expected to double again by 2030. — By Kyle Stock  NTT CEO Akira Shimada, left, and Toyota CEO Koji Sato at a news conference in Tokyo. Photographer: Kiyoshi Ota/Bloomberg Toyota and Nippon Telegraph & Telephone plan to jointly invest ¥500 billion ($3.3 billion) between now and 2030 toward autonomous-driving technology development, executives said in a news briefing on Thursday. The goal is to implement the tech by 2028 and to share it with other companies. The tech would rely on artificial intelligence to operate a network that would help predict and respond to traffic accidents and improve road safety. "Transmitting large amounts of data will be crucial as software-defined vehicles become more common," Toyota CEO Koji Sato said during the briefing in Tokyo. |

No comments:

Post a Comment