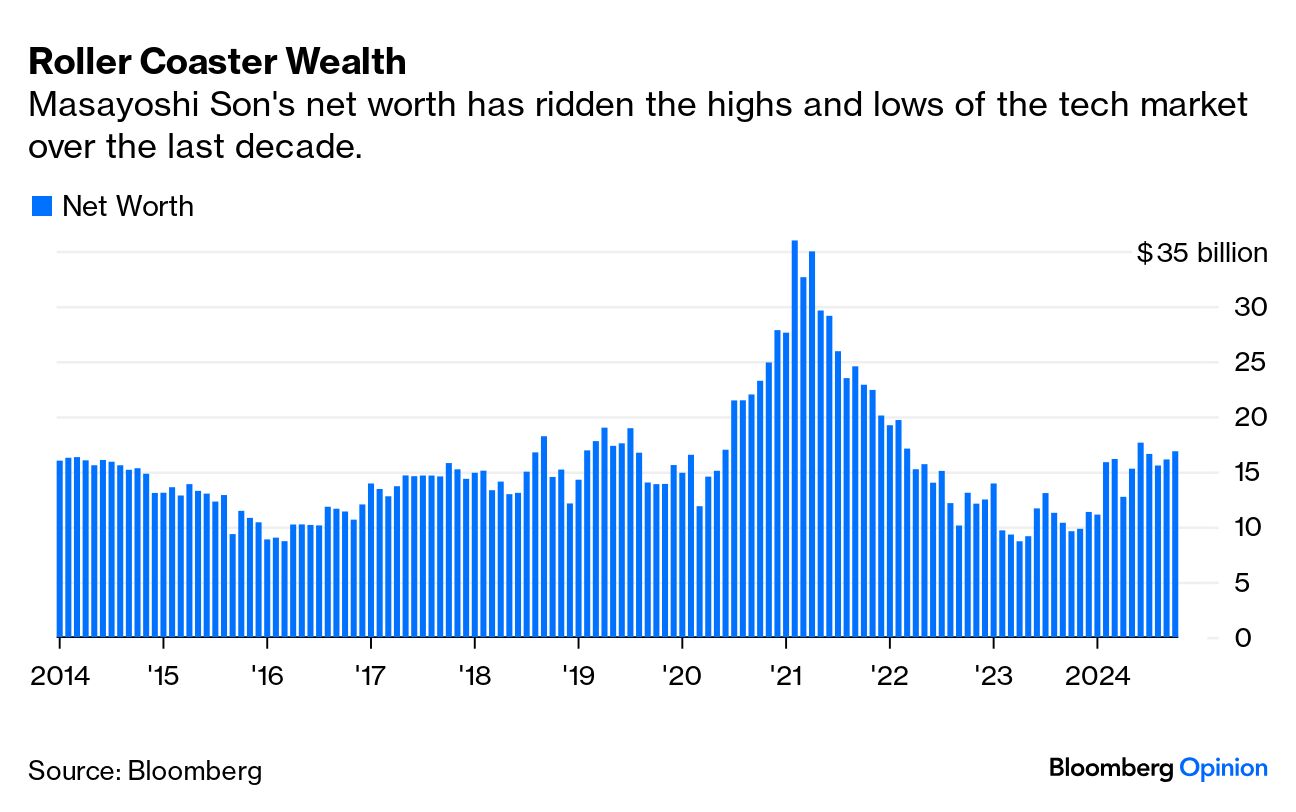

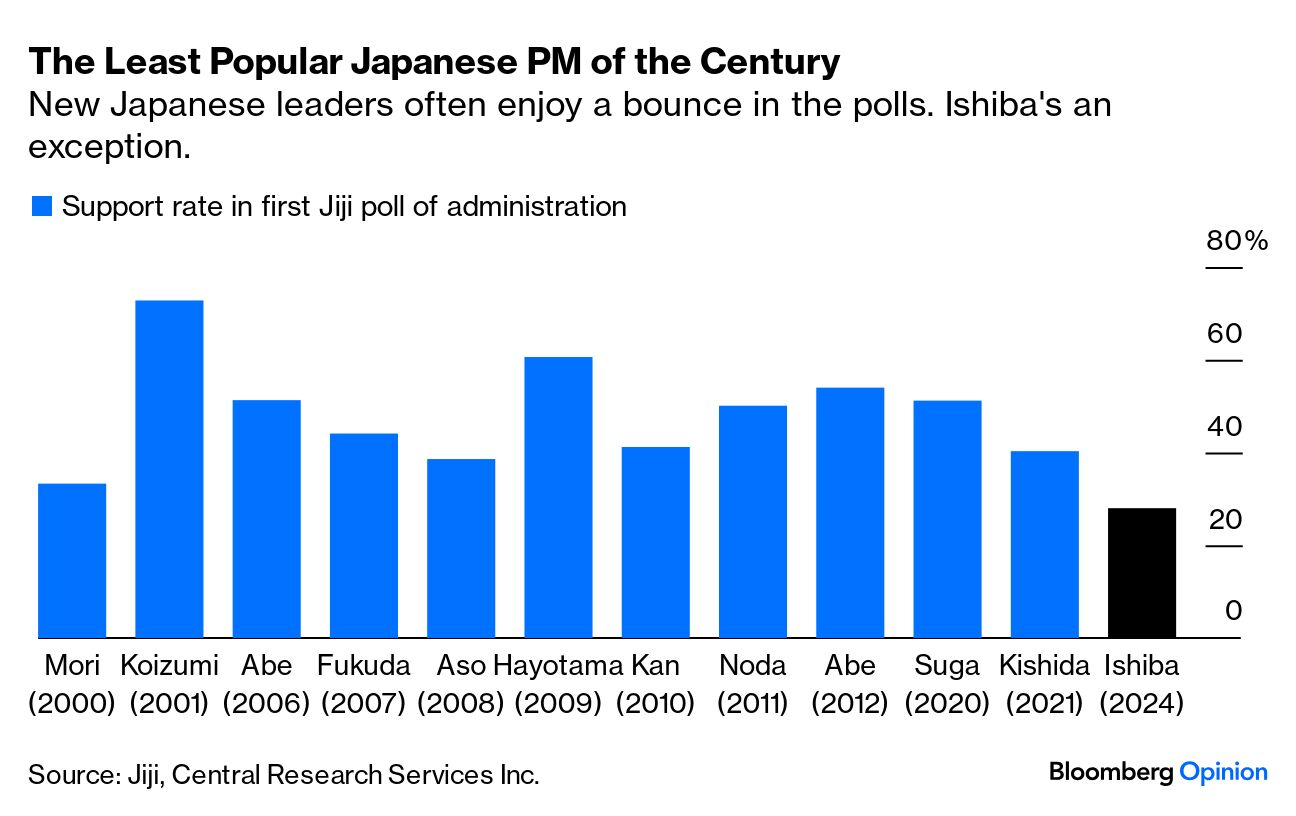

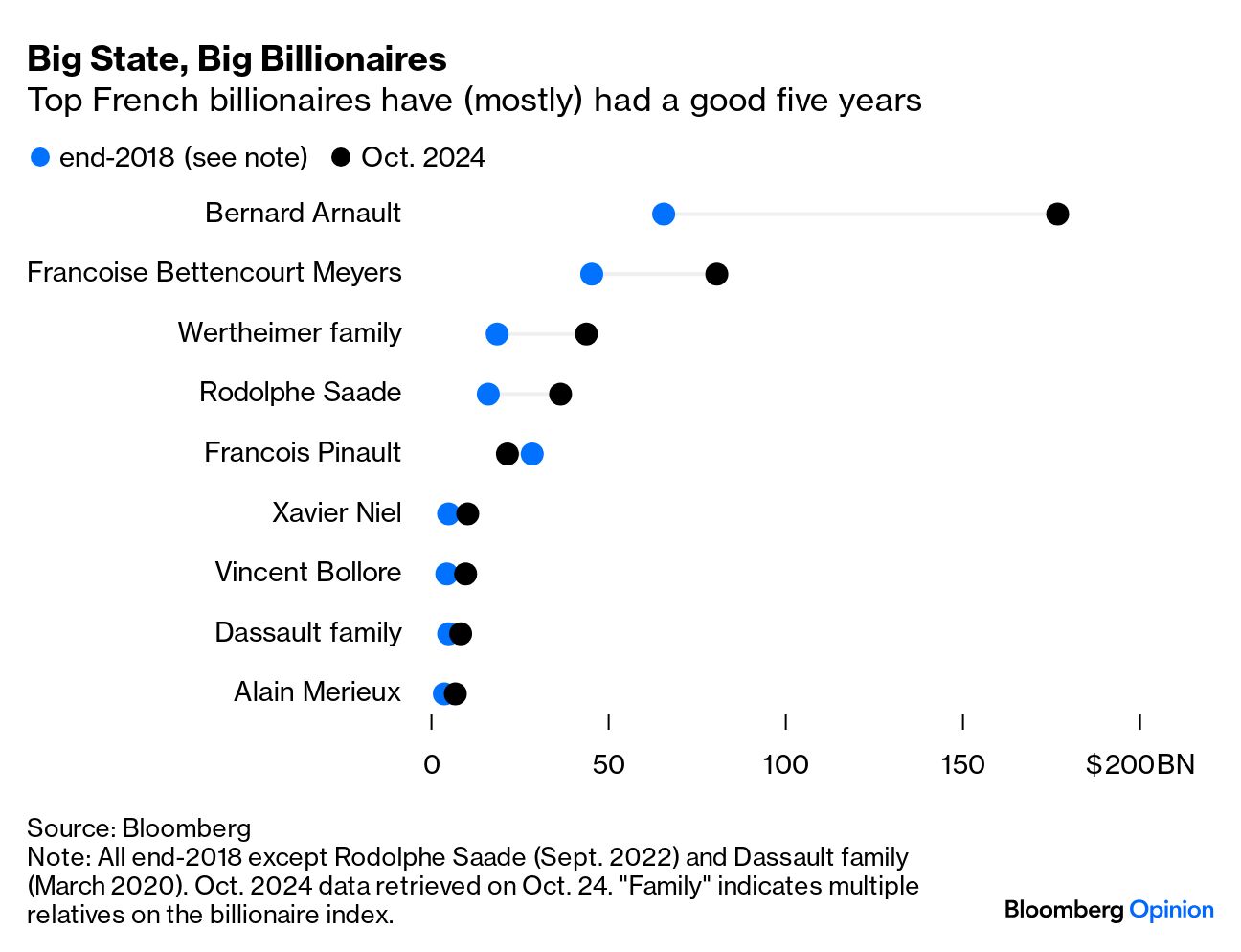

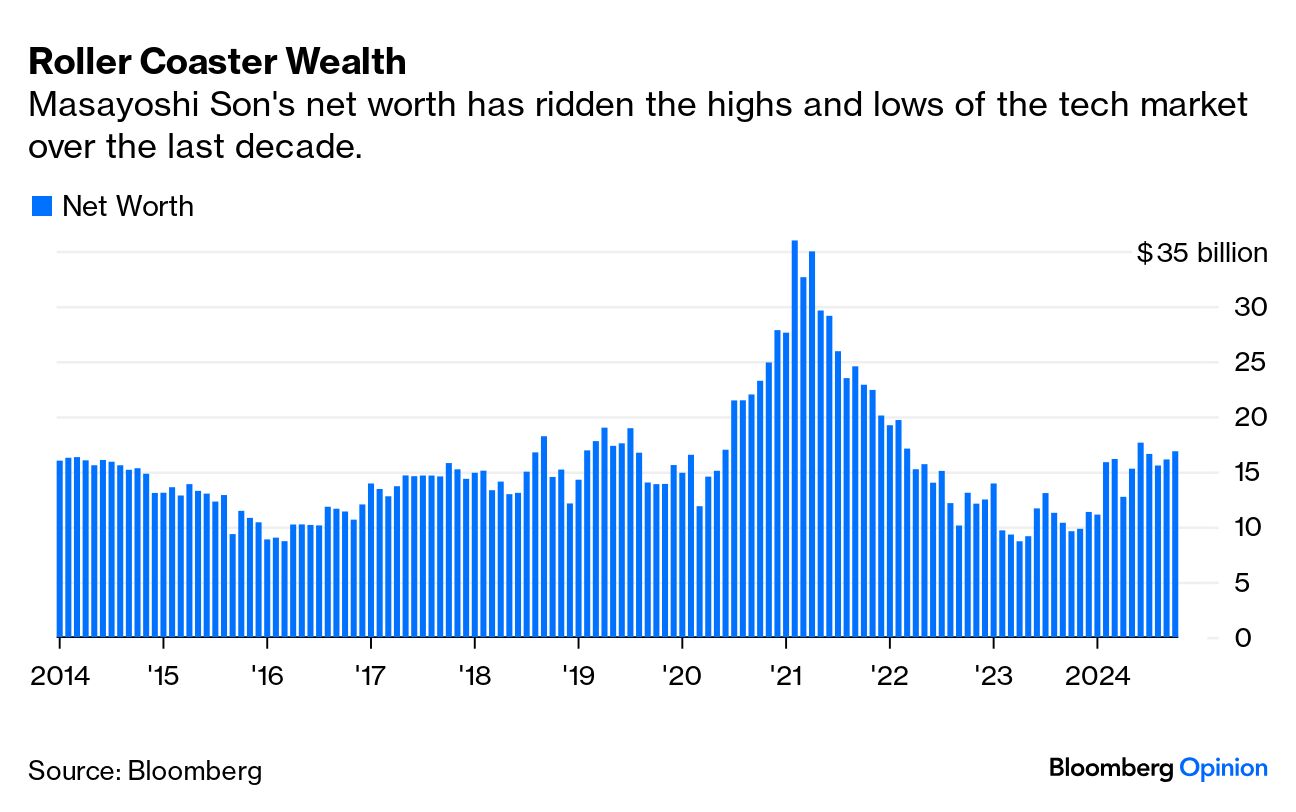

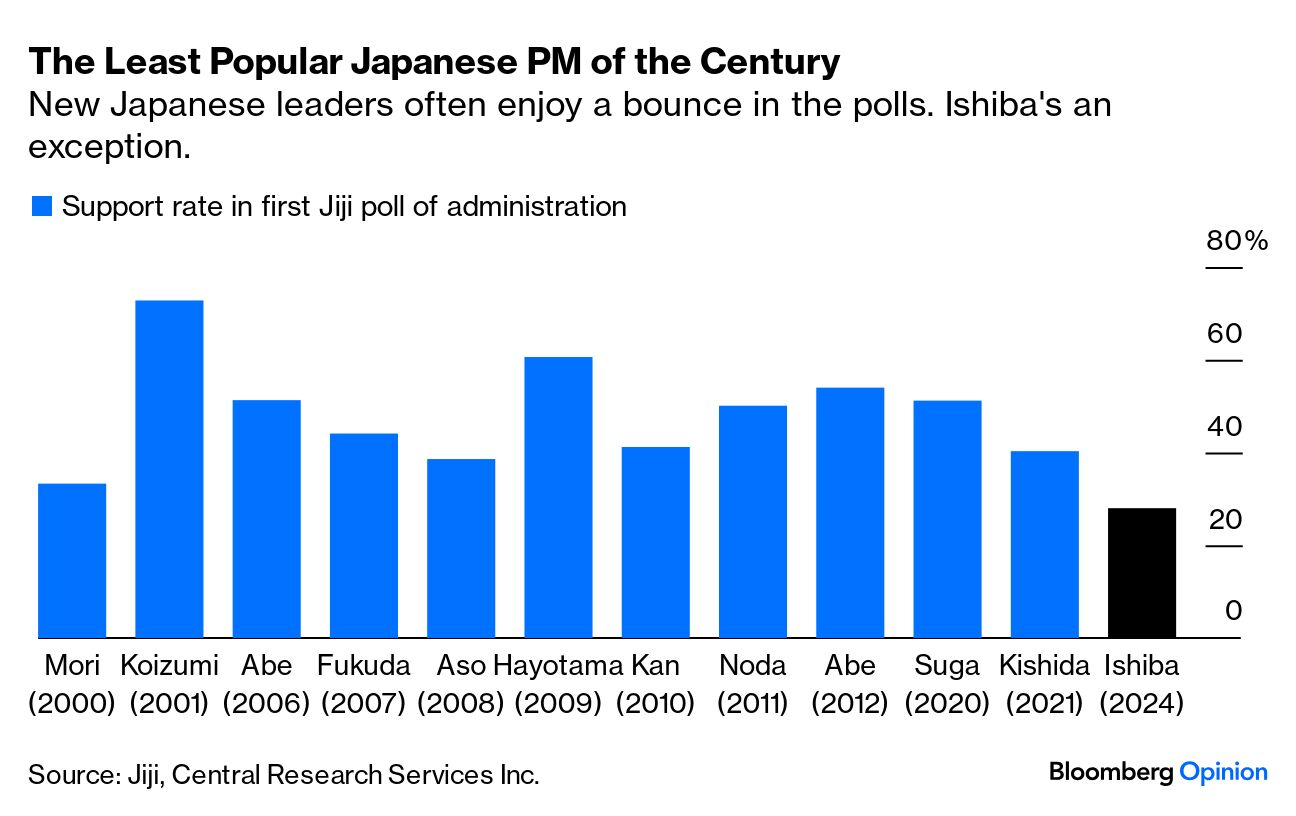

| This is Bloomberg Opinion Today, a geopolitical bric-a-brac of Bloomberg Opinion's opinions. Sign up here. When I wrote about the BRICS summit last year, I got considerable reader backlash for the headline, which called for the group to be scrapped. And so I've kept an open mind about its usefulness since. This week's get-together of the bloc showcased an expanded membership: In addition to Brazil, Russia, India, China and South Africa — which provide the acronym — Iran, Egypt, Ethiopia and the United Arab Emirates have been admitted. I hope no one is trying to come up with a new name to fit in all those new initial vowels. But, to my point, the monthslong walk-up to the meeting in Kazan, Russia, saw some positive developments. India's economy has strengthened, even though Prime Minister Narendra Modi has suffered a couple of political hiccups, as Andy Mukherjee and Mihir Sharma have noted here and here. While China continues to struggle with ramping up growth, Prime Minister Xi Jinping's attempts to seed the economy with stimulus are likely to produce a downpour of benefits in the longer run, says Shuli Ren. There's even a bit of a diplomatic breakthrough between Beijing and New Delhi over their contentious border, as Ruth Pollard notes. Meanwhile, Russia appears to have weathered its 2023 October surprise — the Ukrainian counter-offensive — and is getting soldierly help from North Korea. And two months ago, it seemed that the displacement of the US dollar as the dominant global currency — the biggest game-changer for BRICS — was finally starting. One currency hedge fund manager, Marcus Ashworth wrote back in August, predicted a liquidation "avalanche" of up to $1 trillion in US-based assets by Chinese companies that would lead to a 10% gain in China's currency against the buck. Expected interest rate cuts by the US Federal Reserve would also speed up the decline, which was a dramatic 5% in August. By late September, the US dollar index (DXY), which tracks the currency against its major international counterparts, had fallen to about 100.12. A recalibration of foreign exchange would be a positive thing for nearly everyone, Marcus said. "US-domiciled funds may look offshore for diversification as opportunities abroad start to reappear." In anticipation of this paradigm shift, there was talk that BRICS was going to come up with its own form of currency, partly digital, partly gold-based. There was even a name for it: the unit. Instead, in the intervening weeks, the dollar has strengthened. Marcus passed along an analyst note to me that said the "DXY is ramping up, continuously breaking through one resistance level after another. This rally underscores a growing confidence in 'US exceptionalism,' which could gain further traction if [Donald] Trump wins, potentially pushing the index towards 106.5 by year-end." The DXY is currently around 104.5. Last week, Russian President Vladimir Putin, the summit host (and a likely beneficiary of a second Donald Trump term), said there were no immediate plans for any kind of BRICS currency. Who knows? Maybe the North Koreans want to be paid in dollars. So, everyone anticipating a transformative, acronym-led upheaval in global trade and finance status quo, you've got to wait till after the US election. (John Authers, by the way, looks at the markets and election predictions.) In his latest column, Lionel Laurent points out that "new billionaires are accumulating more wealth through inheritance than entrepreneurship. For the first time in 15 years, there are no self-made billionaires under the age of 30." In How to Become a Billionaire, self-made French plutocrat Xavier Niel bewails the nepo-babyhood of the world's upper crust — particularly in France. While Lionel isn't shedding tears over the problems of the top 0.00003%, he says Niel's book is a cogent argument for the need to diversify the ranks of the upwardly mobile. Lionel writes: "Research shows that the children of low-income families are underrepresented among inventors, PhDs and professors, robbing countries of potential scientific discovery and productivity gains; a lack of diversity among innovators influences the products they invent." A couple of statistics jump out about the French moneyed class. Says Lionel: "L'Oreal SA heiress Francoise Bettencourt-Meyers is worth around 2.7% of French GDP; LVMH SE boss Bernard Arnault, whose daughter is Niel's partner, is worth around 5%." Here's a chart illustrating how well they are doing: "[Tech investor Masayoshi] Son has been on an AI tear. Last month, he invested $500 million in OpenAI through his Vision Fund, having missed out on the AI company's previous funding rounds. ... He'll have rich pickings, with dozens more generative AI startups struggling to cover the costs of computing power and eager for funding in a business dominated by the tech giants. But Son poses some risk for everyone else in the pond. … Though he's worth about $16 billion, according to the Bloomberg Billionaires Index, Son's career has been nothing short of volatile." — Parmy Olson in "Masayoshi Son Inflates the AI Bubble Even More."  "Japanese Prime Minister Shigeru Ishiba was supposed to be a fresh face. He could quickly end up being a forgotten one. Weeks into his premiership and mere days before a general election [on Oct. 27], red alert signals are sounding in Tokyo's corridors of power. After his surprise victory in last month's leadership race for the ruling Liberal Democratic Party, Ishiba has spectacularly failed to achieve even the 'new manager bounce' in public opinion polls that generally accompanies a change at the top. His Cabinet has been greeted with the lowest support figures of any new prime minister this century. More respondents to a Jiji poll said they disapproved of the premier than supported him." — Gearoid Reidy in "Japan's New Leader Is Scrambling to Stem the Electoral Bleeding."  I wrote a week or so ago about apocalyptic brooding. This week, I pursued the theme with a walk through tunnels in London purpose-built for Armageddon. About 30 meters (100 feet) beneath Holburn — the broad street that runs roughly between St. Paul's Cathedral and Soho — is a 1.7 kilometer (slightly over 1 mile) labyrinth put together at the start of World War II and expanded during the Cold War. In the first conflict, the British capital suffered horribly under the German blitz: 43,000 Londoners perished in the bombings and huge sections of the city were obliterated. The initial batch of tunnels were constructed in 18 months to provide shelter from the bombs. After the Nazis were defeated, the cold war between NATO and the Warsaw Pact then threatened the world with nuclear annihilation — and, as a consequence, Britain dug out broader tunnels to link up secure communications equipment, including the hot line between the White House and the Kremlin. For a brief moment, it was also the location for the bunker of the Ministry of Defense.  Welcome to the London underworld. Photograph by Howard Chua-Eoan/Bloomberg If Australian entrepreneur Angus Murray's dream comes true, these tunnels will become the capital's next big tourist draw, comparable to the London Eye (which has been wheeling around since 2000) and Madame Tussauds' (waxing and not waning for two centuries). I've written about Murray's project before — when it was billed as the James Bond tunnel because it helped inspire Ian Fleming's depiction of Q Branch, the fictional division of the British secret service that provides 007's panoply of gadgets, weapons and cars. But London Tunnels Plc will be much more than an espionage theme park, Murray explained during an hour-long tour of the site. The dark days of the war will be an integral part of the experience. London has no memorial to the 43,000 victims of the blitz. There are plaques and monuments to local victims in Kennington Park, Tottenham and Balham, but nothing dedicated to the entirety of the city's civilian dead. Murray says his tunnels will remedy that. Oscar Wilde said, "Suffering is one very long moment." Nearly a century has passed, but remembrance may still bring healing. How much is that spider in the corner? — Howard Chua-Eoan The banks that need to work harder. — Paul J. Davies The world needs new concrete measures . — Lara Williams The methane bomb all around us. — David Fickling How China can win by losing. — Minxin Pei Europe's bad Russian habit. — Javier Blas What danger lurks in the UK budget? — Marcus Ashworth Oh, the luxury of being spontaneous...  "I love restaurants that make room for walk-in customers." Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send brickbats and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment