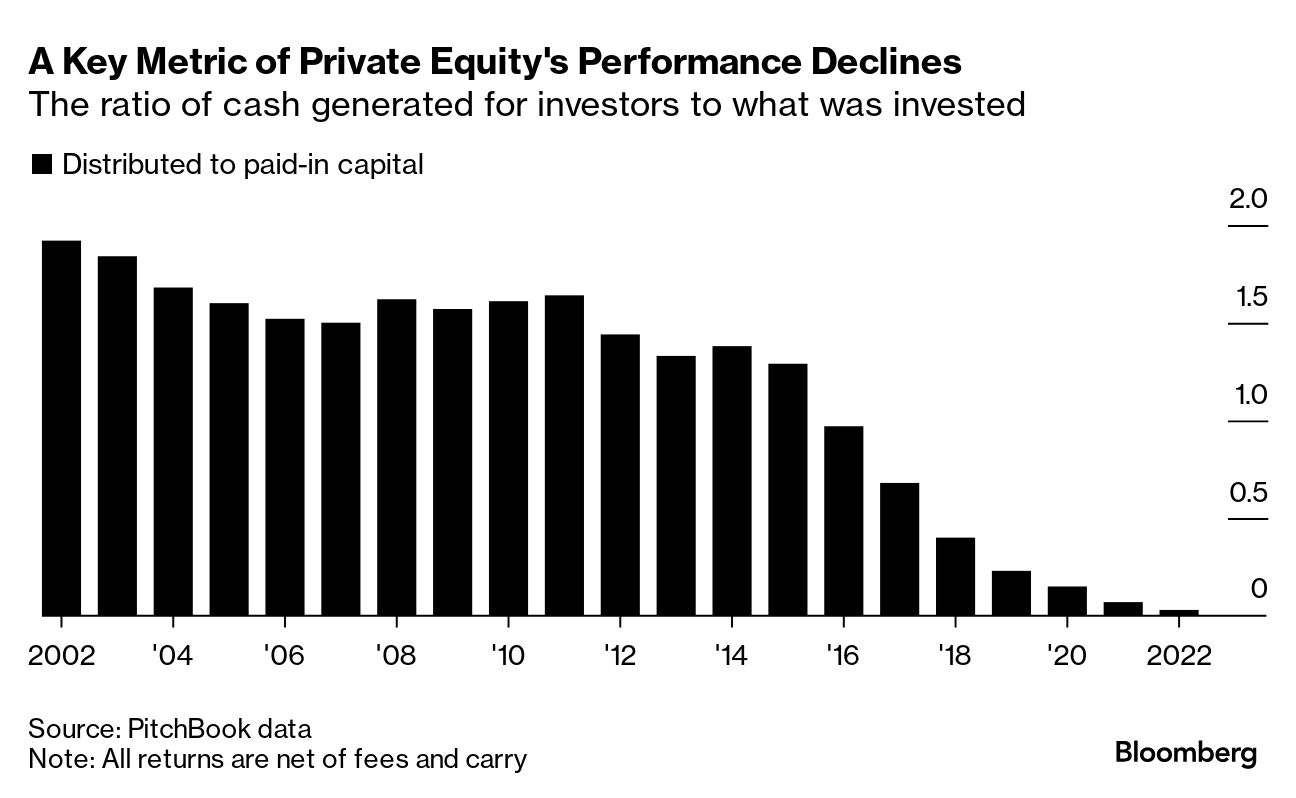

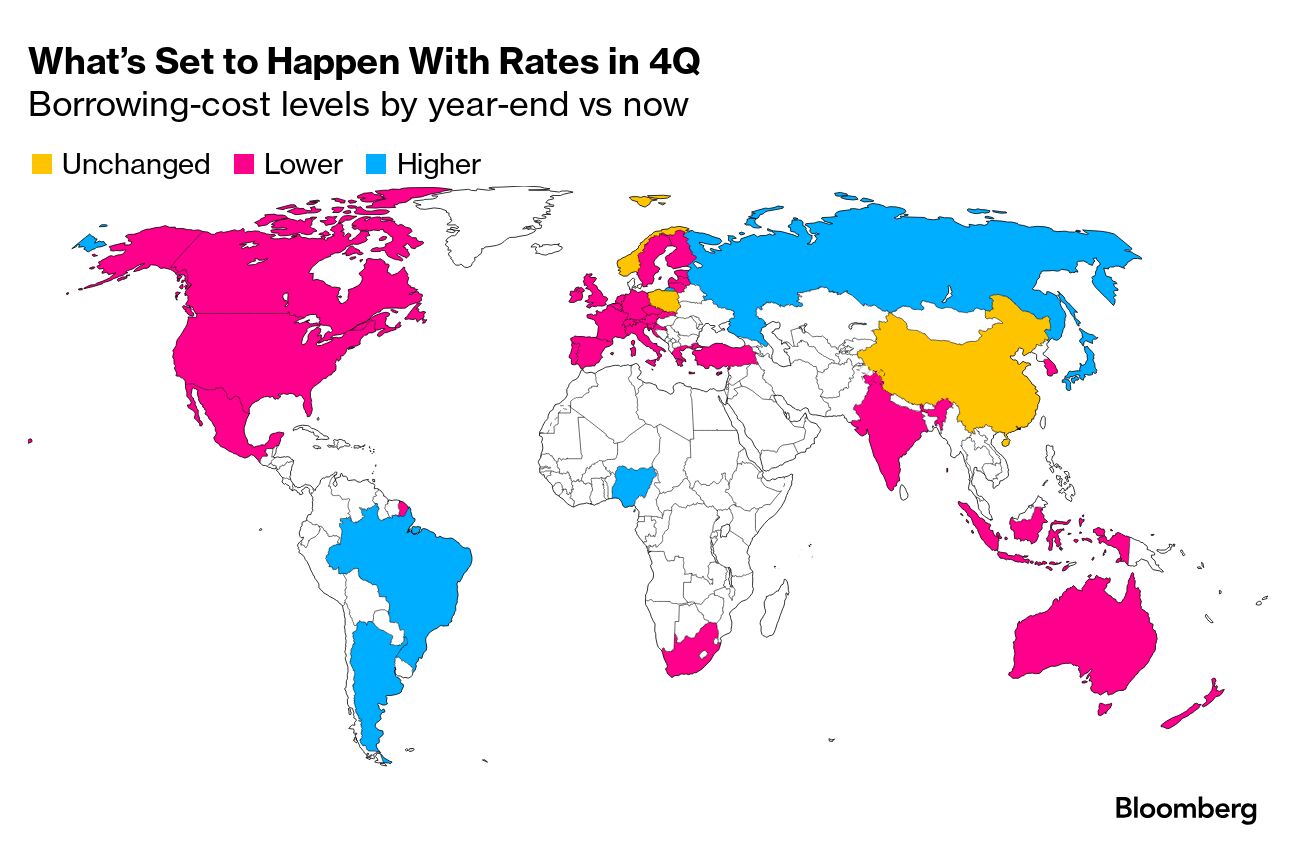

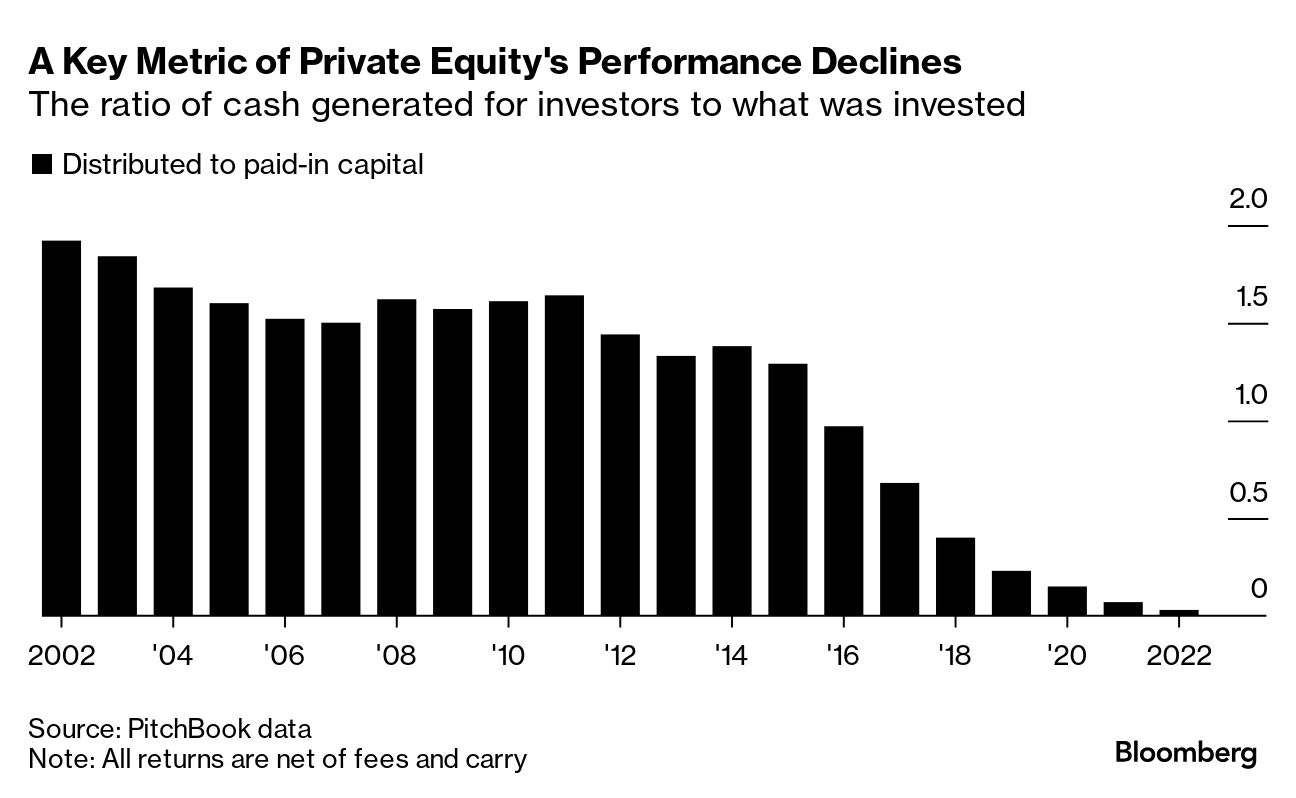

| Dockworkers walked out of every major port on the US East and Gulf coasts for the first time in nearly 50 years, staging a strike that could ripple across the world's largest economy and cause political turmoil just weeks before the presidential election. The 36 affected ports have the combined capacity to handle as much as half of all US trade volumes. The International Longshoremen's Association is seeking higher wages and a rollback of the language on automation in a six-year contract that expired at midnight. Union leader Harold Daggett has for months threatened a strike starting on Oct. 1 if no deal is reached before the deadline. US President Joe Biden, who often touts his pro-union bona fides, has said the dispute is a matter for collective bargaining and that he wouldn't invoke his authority to order dockworkers back to the ports while negotiations continue. —David E. Rovella Iran launched a volley of ballistic missiles at Israel on Tuesday in what Tehran said was retaliation for the killing of Hamas and Hezbollah leaders and an Iranian general. Israel said Iran fired more than 100 missiles, and that while many were intercepted, several hit in the south and central areas of the country. The Iranian response comes in the wake of Israel's opening of a new front in a widening Middle East war. Hundreds have been killed in the recent Israeli bombardment of Lebanon, which has been followed by Israeli soldiers crossing into the south of that country. That incursion comes as more people were killed in Gaza Tuesday, part of a war that's reportedly killed more than 41,000 Palestinians and largely destroyed the Gaza Strip. Next week will be the one-year anniversary of the attack on southern Israel by Hamas and other militant groups in which 1,200 Israelis were killed, triggering the conflict.  Missiles launched from Iran towards Israel as seen from the West Bank city of Nablus on Oct. 1. Photographer: Majdi Mohammed/AP BlackRock Chief Executive Officer Larry Fink said the market is pricing too many interest-rate cuts from the Federal Reserve, given the US economy continues to grow. Money markets imply a one-in-three chance the Fed will deliver another half-point cut in November. But Fink said it's hard for him to see that materializing, as most government policies at the moment are more inflationary than deflationary. "I do believe there's room for easing more, but not as much as the forward curve would indicate," he said. Now that the Fed has joined rich-world peers with its own rate cut, lingering worries about consumer prices are increasingly poised to give way to concerns about growth around the world, according to Bloomberg Economics. Its aggregate gauge of advanced-economy borrowing costs shows a decline of almost 40 basis points between now and the end of the year, and a further drop totaling more than double that amount by the time 2025 is out. But unanswered questions are haunting the outlook, with the US election key among them. Boeing is said to be considering raising at least $10 billion by selling new stock, as the embattled planemaker seeks to replenish cash reserves depleted further by an ongoing strike. Boeing is under pressure to shore up its finances and hold onto its investment-grade credit rating. The company is one step away from dropping into speculative territory, which would further drive up the cost to service its $58 billion debt load. Private equity firms have fallen on hard times. For decades they raised bushels of cash, bought businesses, loaded them with debt, sold them at a profit and persuaded happy investors to do it all over again. All the while, they earned the enmity of the dismissed employees, closed businesses and gutted industries left behind in the rubble. PE, as the asset class is known, grew at breakneck speed, snapping up companies worldwide—from dry-cleaning businesses and pet care companies to private hospitals and school operators. But now, the tables are turning, and private equity is in a funk. Here's why.  Samsung Electronics is firing thousands of its employees across Southeast Asia, Australia and New Zealand, a mass termination that will remove 10% of its workers in those markets. Mass firings are also said to be planned for other overseas subsidiaries and could reach 10% in certain markets. Samsung shares have slid more than 20% this year as the world's largest maker of memory chips and smartphones struggles. It's fallen behind rival SK Hynix in the memory chips used for artificial intelligence, and has made little progress against Taiwan Semiconductor Manufacturing in the production of custom-made chips for outside customers. The South Korean company is not, however, planning dismissals in its home market. When it comes to the US dockworkers strike, union chief Harold Daggett doesn't hide his light under a bushel. Clad in a blue sweatshirt that read "The Docks Are Ours," he relishes the fear he says gripped negotiating rivals when they saw his opposition to automation. "You guys don't realize it but you're making history," Daggett said to union members early Tuesday outside the Port of New York and New Jersey. "I got strong language that's going to go in the new contract—they're scared." There's little doubt that paralysis at the nation's ports heading into the holidays and a contested presidential election provides him solid leverage against shipping lines and port operators. In Washington, Democrats and Republicans alike are struggling to navigate the political impact. On one hand, supporting a union that's shutting down parts of the economy in a fight for higher wages and job security could alienate voters worried about shortages. On the other hand, intervening to ease the economic pressure—as Biden said he isn't going to do—risks losing crucial blue-collar support in the process.  Harold Daggett, president of the International Longshoremen's Association Photographer: Michael Nagle/Bloomberg Tom Brady's latest record-setting attempt will take place off the field and inside an auction house. On Dec. 10, the seven-time Super Bowl-winning quarterback and now sports broadcaster will sell 47 pieces from his collection of watches and sports memorabilia at Sotheby's New York. The pieces will be sold in a stand-alone evening sale the auction house has named "The GOAT: Watches and Treasures from Tom Brady."  Tom Brady Photographer: Nic Antaya/UFL/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg's flagship briefing in your mailbox daily. Subscribe to the Bloomberg Australia podcast: Host Rebecca Jones and a rotating cast of Bloomberg journalists lift the lid on the biggest business stories shaping the nation. Sign up here. |

No comments:

Post a Comment